[2008] ATP 24

Catchwords:

Association - appointment and removal of directors – association – requisition of meeting – decline to commence proceedings

Boulder Steel Limited – Falaknaz Holding LLC – Mr AbdulRahman Falaknaz – Capital Trust Holding AG – Mr Mohammad Al Ali

Corporations Act 2001 (Cth) sections 12(2), 249D, 602, 606, 657A, 657C, 657E, 671B

Introduction

- The Panel, Byron Koster, Alice McCleary and Simon Mordant (sitting President), declined to conduct proceedings on an application concerning an alleged association between two shareholders regarding a change to the composition of the board of Boulder and disclosure issues concerning those shareholdings.

- In these reasons the following definitions apply:

- Term

- Meaning

- Boulder

- Boulder Steel Limited

- Falak Holding

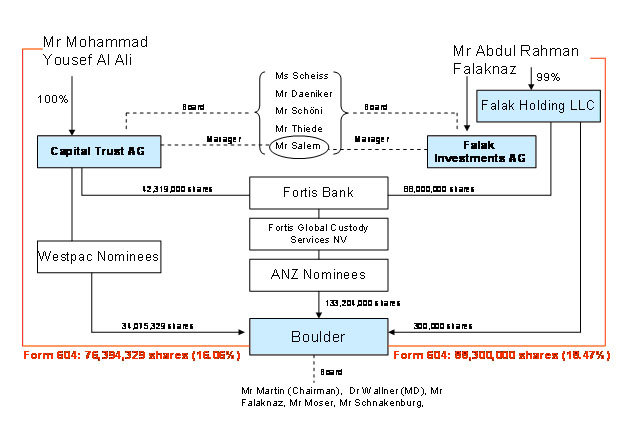

- Falak Holding LLC, 99% owned by Mr Falaknaz

- Capital Trust

- Capital Trust Holding AG, 100% owned by Mr Al Ali

- ANZ Nominees

- ANZ Nominees Limited

- Westpac Nominees

- Westpac Custodian Nominees Limited

- Westpac Parcel

- 34,075,329 shares in Boulder held by Westpac Nominees for interests associated with Mr Al Ali

Discussion

Facts

- Boulder is listed on ASX (ASX code: BGD). Mr Falaknaz is a director of Boulder.

- Various relationships between the parties are described in the following diagram:

- In May 2006, Boulder shareholders approved the issue of 85,000,000 shares each to Falak Holding and Mr Al Ali (representing 18.83% of the issued capital in Boulder at that time). In the explanatory memorandum for the resolutions under Listing Rule 7.1, Boulder stated:

"Based on the information available to the Company, including inquiries made by the Company of the two investors, the Company considers that the two investors are not associates within the meaning of the Corporations Act."

- In December 2006, Capital Trust sold 6,000,000 shares, 3,000,000 of them to Falak Holding. Falak Holding then had an 18.52% holding in the issued capital in Boulder.

- According to a substantial holder notice lodged by DLA Phillips Fox on 1 July 2008, Mr Al Ali was the beneficial holder of 76,394,329 Boulder shares, representing 16.06% of the issued capital in Boulder. The notice stated that ANZ Nominees was the registered holder of 42,319,000 shares, and Westpac Nominees was the registered holder of 34,075,329 shares.

- According to a substantial holder notice lodged by DLA Phillips Fox on 1 July 2008, Mr Falaknaz was the beneficial holder of 88,300,000 Boulder shares, representing 18.47% of the issued capital in Boulder. The notice stated that ANZ Nominees was the registered holder of 88,000,000 shares, and Falak Holding was the registered holder of 300,000 shares.

- Falak Investments AG (a company associated with Mr Falaknaz who owns 99% of Falak Holdings) and Capital Trust share common offices, a common board and a common manager, Mr Hany Salem.

- On 3 June 2008, at a Boulder board meeting according to (unsigned) minutes provided with the Application, Mr Falaknaz conveyed concerns of Mr Al Ali in relation to the management and direction of Boulder and passed on his requests for certain projects to be dropped and others started. Mr Falaknaz stated that Mr Al Ali would requisition an extraordinary general meeting of the company if his requests were not complied with, and further stated that "he himself would vote with Mr Al Ali in an EGM".

- On 8 August 2008, ANZ Nominees (on behalf of Falak Holding) requisitioned an EGM of Boulder seeking to remove the Managing Director and Chief Executive Officer, Dr Peter Wallner, from the board and appoint Mr Theofanis Katapodis as a director.

- In September 2008, Boulder issued tracing notices1 , including to Fortis Bank. The responses revealed, among other things, that Westpac Nominees is not a registered holder of any Boulder shares.

- At the date of the application, Fortis Bank had only responded to the tracing notice by saying that it did not directly hold voting shares in Boulder, and "We cannot provide you with any information on interest [sic] of our clients. This information can only be given via Belgian regulator, CBFA".

- On 9 September, Mr Hany Salem, acting on behalf of Mr Falaknaz, allegedly met with some German shareholders and told them that if they voted in support of Falak Holding 's resolution at the EGM, Mr Falaknaz would show his appreciation by arranging for the conversion, exchange or purchase of options held by those shareholders. Mr Salem is alleged to have indicated that such a deal could not be done through Mr Falaknaz but would have to be done through a 'financing bank'. Mr Salem denies making the invitation.

- On 19 September, Boulder 's lawyers wrote to Mr Al Ali 's lawyers alleging that Mr Al Ali had contravened s671B(1) by failing to lodge a substantial holder notice recording the disposal of the Westpac Parcel some time after 1 July 2008. Mr Al Ali 's lawyers responded that Mr Al Ali had not disposed of the Westpac Parcel, but that the nominee through which the shares were held had changed.

- On 2 October Fortis Bank responded to the tracing notice identifying that 86.050,000 shares were held for the benefit of Mr Falaknaz and 43,000,000 shares were held for the benefit of Mr Al Ali. No issue was taken with the slight discrepancy with the numbers.

Application

- Boulder applied on 30 September 2008 for a declaration and orders, submitting that:

- Fortis Bank, a beneficial holder of Boulder shares, had contravened s672B(1) by failing to respond to a tracing notice. Boulder withdrew (with consent) this part of its application and amended the orders it sought following Fortis ' response to the notice.

- Mr Al Ali or Capital Trust had contravened s671B(1) by failing to lodge a substantial holder notice recording the disposal of the Westpac Parcel some time after 1 July 2008

- Mr Al Ali and Mr Falaknaz are associates and contravened s671B(1) by failing to lodge a substantial holder notice which notified Boulder that since at least 3 June 2008 they had been associates and

- Mr Falaknaz contravened s606(4) by inviting an offer to sell shares in Boulder which, if accepted, would cause a contravention of s606(1).

Interim Orders

- Interim orders (concerning voting at the EGM on 8 October) were only sought in the event that there was insufficient time for the Panel to consider the matter before the EGM. They became unnecessary.

Final Orders

- Boulder sought the following final orders:

- Mr Falaknaz and Mr Al Ali or their companies must not exercise any voting rights at general meetings of Boulder prior to 3 January 2010 in respect of more than 13.52% and 6.48% respectively of Boulder shares on issue2 and

- Mr Falaknaz and Mr Al Ali or their companies be restrained from acquiring a relevant interest in any further Boulder shares if such acquisitions would result in voting power that exceeds the voting restrictions in (a).

Decision

- The Panel declined to conduct proceedings in relation to each of the remaining matters raised in the application.

Failure of Mr Al Ali to disclose disposal of the Westpac Parcel

- The Panel was not satisfied, based on the information provided, that there was any reasonable prospect of a declaration of unacceptable circumstances in relation to this issue. The fact that Westpac Nominees is no longer the registered holder of the Westpac Parcel is not conclusive evidence that the Westpac Parcel was disposed of by Mr Al Ali, and indeed Mr Al Ali 's solicitors restated in a preliminary submission to the Panel that he had not disposed of the shares but had changed nominees.

Association between Mr Falaknaz and Mr Al Ali

- It is not the role of the Panel to undertake investigations without first being provided with substantive allegations and reasons for, or evidence supporting, those allegations.3 Issues of association are notoriously difficult for outsiders to prove,4 but the Panel has repeatedly stated that its starting point is that it is for an applicant to demonstrate a sufficient body of material to satisfy the Panel that association can be established (albeit perhaps with inferences being drawn).5 The Panel considers that there was not a sufficient body of information provided to warrant it undertaking proceedings to establish whether there was an association between Mr Falaknaz and Mr Al Ali and their interests.

- Boulder, at the time of the placement, investigated and satisfied itself that Mr Al Ali and Mr Falaknaz were not associated. It now alleges that they are associated in connection with the removal of Dr Wallner. Of course an association may arise for this purpose, but in the present application a lot of the material that the applicant sought to rely on was historical, which it had previously itself been satisfied about.

- The Panel regarded the remaining material as equivocal at best. The minutes of the Boulder board meeting reflect a surprising level of knowledge in Mr Al Ali about the business operations of Boulder given that he is not on the Board, but they may only show that he and Mr Falaknaz are of a like mind. As previously laid down by the Panel, we would not regard as associates shareholders who are of a like mind concerning a proposal (such as with respect to the composition of a board), unless it is likely (by probative material or likely inferences) that there is a relevant agreement or they were acting in concert.6

Breach of s606(4) by Mr Falaknaz

- The Panel was not satisfied, based on the information provided, that there was any prospect of a declaration of unacceptable circumstances in relation to this issue. To contravene s606(4), Mr Falaknaz must have made an invitation to the shareholders to make an offer which, if accepted, would cause his holding in Boulder to exceed 20% or otherwise contravene s606(1) or (2).

- It was not clear to the Panel that:

- Mr Falaknaz 's holding would necessarily increase to a holding in excess of 20% if the alleged invitations were acted upon

- there was an invitation (there is conflicting information about whether the invitation was in fact made) or

- if there was an invitation, it was necessarily of the type caught by the prohibition in s606(4). The application only alleged that Mr Falaknaz would arrange for the conversion, exchange or purchase of options held by the shareholders. For example, he may only acquire options that give rise to no increase in voting power.

- Further, the potential breach of s606(1) or (2) relies on an association that has Mr Falaknaz's voting power at more than 20% when the invitation was issued. The Panel has decided that there is not enough information to conduct proceedings in respect of the association allegation.

No reasonable prospect of a declaration

- Accordingly, the Panel decided not to conduct proceedings in relation to the application under Regulation 20 of the ASIC Regulations.

Orders

- As the Panel has made no declaration of unacceptable circumstances, it makes no orders.

Simon Mordant

President of the Sitting Panel

Decision dated 3 October 2008

Reasons published 7 October 2008

1 Section 672A of the Corporations Act. All references are to the Corporations Act unless otherwise indicated.

2 Subject to additional shares acquired by Mr Falaknaz interests at a rate of up to 2%, or by Mr Al Ali interests at a rate of 1% every 6 months, or any shares acquired by either under a takeover bid or scheme of arrangement.

3 Rusina Mining NL [2006] ATP 13.

4 Dromana Estate Limited 01R [2006] ATP 8.

5 Mt Gibson Iron Ltd [2008] ATP 4 and BigAir Group Limited [2008] ATP 12.

6 BigAir Group Limited [2008] ATP 12.