[2011] ATP 4

Catchwords:

Association – family – structural links – gift – course of negotiations – unacceptable circumstances – declaration – orders – vesting in Commonwealth – disclosure of association

Corporations Act 2001 (Cth), sections 12, 53, 602, 606, 611, 657D, 671B

Corporations Regulation 1.0.18

ASIC v Fortescue Metals Group Ltd [No 5] [2009] FCA 1586, ASIC v Fortescue Metals Group Ltd [2011] FCAFC 19

Viento Group Limited [2011] ATP 1, Mount Gibson Iron Limited [2008] ATP 4, Dromana Estate Ltd 01R [2006] ATP 8, National Foods Limited 01 [2005] ATP 8

Introduction

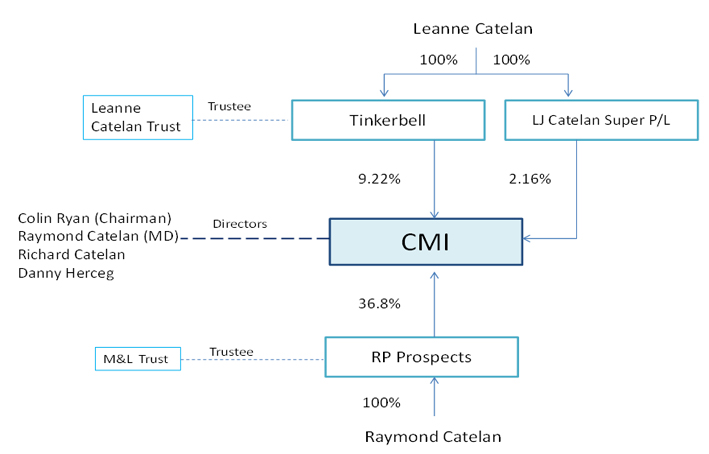

- The Panel, Peter Day, John Keeves (sitting President) and Andrew Sisson, made a declaration of unacceptable circumstances in relation to the affairs of CMI Limited. The Panel found that parties with a relevant interest in 36.8% of CMI were associated with parties that acquired 9.22% of CMI, resulting in the voting power of the associated parties increasing in CMI otherwise than through one of the exceptions in section 611 and in a failure to disclose the association.

- In these reasons, the following definitions apply.

- applicants

- Mr Gerry Pauley and Dr Gordon Elkington

- CMI

- CMI Limited

- Farallon

- Farallon Capital Pty Ltd

- RP Prospects

- RP Prospects Pty Ltd

- Tinkerbell

- Tinkerbell Enterprises Pty Ltd as trustee for Leanne Catelan Trust

Facts

- CMI Limited is an ASX listed company (ASX code: CMI). It has on issue 33,752,634 ordinary shares and 28,005,311 Class A shares.

- Mr Raymond Catelan is the Managing Director of CMI.

- RP Prospects, as trustee for the M&L Trust, has a relevant interest in 36.8% of CMI ordinary shares. RP Prospects is wholly owned by Mr Raymond Catelan.

- Mr Raymond Catelan and Ms Leanne Catelan are identified along with others in the trust deed as beneficiaries of the M&L Trust. The trust is a discretionary trust.

- LJ Catelan Superannuation Fund Pty Ltd, as trustee for the LJ Catelan Superannuation Fund, has a relevant interest in 2.16% of CMI. LJ Catelan Superannuation Fund Pty Ltd is wholly owned by Ms Leanne Catelan.

- Farallon was a shareholder in CMI, holding 3,112,422 of the ordinary shares (9.22%).

- In May 2010, Mr Richard Catelan (a director of CMI) and Mr Greg Nunn of Farallon met and discussed the possible acquisition of Farallon’s shareholding. Mr Catelan regarded the discussion to be personal, for his benefit alone. It appears that the request to purchase the shares came from Mr Richard Catelan. In an email following the meeting Mr Nunn wrote to Mr Catelan:

I have offered my services as a director in attempt (sic) to assist with this work, however my offers have been continually rejected.

Given there is no value I can add, I reluctantly advise I will consider your request to purchase my shares in CMI.

- On 26 May 2010, in an email to Mr Richard Catelan, Farallon put a price of $1.73 per share on its holding against a market price at the time of 62 cents. The price was too high according to Mr Richard Catelan. Mr Richard Catelan mentioned the discussion to Ms Leanne Catelan. Ms Catelan submitted that she first became aware of the opportunity to acquire Farallon’s stake in CMI at this time. The purchase of the shares was not taken further.

- In or around October 2010, Farallon’s shareholding was again raised in discussions between Mr Richard Catelan and Farallon. At this time, a price was not nominated for the shares.

- Mr Richard Catelan also mentioned to Ms Leanne Catelan that Mr Colin Ryan (Chairman of CMI) knew people at Farallon and that “it may be appropriate for an approach to be made via Mr Lindsay Somerville [an adviser to Greg Nunn] and that to do so, Colin Ryan may be able to assist.”

- Mr Richard Catelan suggested to Mr Ryan that he speak with Mr Lindsay Somerville “about Farallon Capital’s attitude to the sale of the CMI shares.” He did this because Mr Ryan and Mr Somerville had a working history and Mr Catelan thought it would be better for them to discuss Farallon’s position regarding the CMI shares.

- Mr Ryan submitted that he contacted Mr Somerville to determine “... what Mr Somerville’s role was.” Mr Somerville was “advising Mr Nunn’s family on managing his business investments and on an ordered (sic) disposal. The Farallon shareholding in CMI was one of the assets to be sold.”

- Mr Somerville said he would arrange for the Farallon equity manager, Mr Daniel McCullough, to contact Mr Ryan, which Mr McCullough did. Mr Ryan submitted that “in a general price discussion, it became clear that he was seeking to achieve a price of not less than 75 cents for the whole parcel… He made it clear that the family’s instructions to him were to sell the entire holding as quickly as possible.”

- Mr Ryan informed Mr Richard Catelan of these discussions.

- Mr McCullough also sent Mr Richard Catelan an email saying “I understand that you have been discussing the purchase of Farallon’s CMI shareholding with our interim CEO, Lindsay Somerville, while I was away on holidays.”

- Mr McCullough indicated that there were other possible purchasers and he would continue negotiating on a ‘first-come, first-served’ basis.

- Mr Richard Catelan was not in a financial position to acquire the shares. He notified Ms Leanne Catelan of his understanding that Farallon would sell its entire CMI shareholding for 75 cents per share and, following this, “took no further active role in the negotiations past this point.”

- Ms Leanne Catelan expressed interest in acquiring the shares, based in part on the involvement of members of her family in the business, “although the main factor influencing Ms Catelan’s interest has been her belief in the strength of the company’s electrical division.”

- Ms Catelan could not afford the shares from her own financial resources, the total cost being $2,334,316.50. She submitted that she “decided to acquire the CMI shares held by [Farallon] prior to approaching her father for any gift to allow her to fund the purchase.”

- On 16 November 2010, Mr Raymond Catelan (Ms Catelan’s father) made a gift of $2,350,000 to Ms Catelan.

- On 19 November 2010, CMI’s annual general meeting was held. Mr Gerry Pauley stood for appointment to the CMI Board. Mr Pauley said, in the Explanatory Memorandum to the Notice of Meeting, “Shareholders other than the largest shareholder should have representation on the [CMI] Board.” Mr Pauley was not elected to the board.

- On learning that Ms Leanne Catelan had decided to acquire Farallon’s shares, Mr Danny Herceg (a director of CMI), while in Brisbane to attend the annual general meeting of CMI, voluntarily contacted Mr McCullough “for the purpose of ensuring appropriate steps were put in place to secure proper completion of that transaction.”

- Mr Herceg submitted that “it is likely that, in the course of discussing what steps would be taken to complete the transaction, I would have told Daniel McCullough that the purchaser would be Tinkerbell Enterprises.” He does not recall being asked by either Mr Richard Catelan or Ms Leanne Catelan to make the call, “but I volunteered to do so on learning that the transaction was to be an off market transfer of shares and without the involvement of any Sharebrokers (at least on Ms Catelan’s behalf).”

- Mr Herceg was not Ms Catelan’s lawyer.

- McInnes Wilson, the lawyers for Ms Catelan, forwarded an off-market transfer form to Gadens Lawyers, acting for Farallon. The transfer was signed by Farallon on 23 November 2010.

- On 24 November 2010, Tinkerbell, as trustee for the Leanne Catelan Trust, lodged a substantial holding notice (dated 23 November 2010) showing the acquisition on 23 November 2010 of 3,112,422 ordinary shares in CMI (9.22%). No associates were listed in the notice.

- Ms Leanne Catelan is the sole director and sole shareholder of Tinkerbell.

- Ms Leanne Catelan and Mr Raymond Catelan are identified along with others in the trust deed as beneficiaries of the Leanne Catelan Trust. The trust is a discretionary trust.

- On 24 November 2010, Farallon, lodged a notice of ceasing to be a substantial holder, reflecting the sale of 3,112,422 ordinary shares in CMI.

- Relevant shareholdings in ordinary CMI shares include the following:

Application

- By application dated 6 January 2011, the applicants sought a declaration of unacceptable circumstances.

- The applicants submitted that “The principal transaction which the applicants wish to have investigated by the Panel is the purchase of 9.22 percent of the ordinary CMI shares by [Tinkerbell] ATF the Leanne Catelan Family Trust (sic) that was announced to the market on 24 November 2010.”

- They also submitted “that the managing director of CMI, Mr Ray Catelan, and his family members have been increasing and are continuing to increase their holdings of shares in the company by a combination of measures which we believe are unacceptable and not in accordance with the letter or spirit of the Eggleston Principles.”

- They also submitted that:

- the acquisitions by each of Mr Danny Herceg and Mr Richard Catelan of 500,000 CMI ordinary shares from RP Prospects (owned by Mr Raymond Catelan) on 19 May 2009 should be investigated

- between 5 June 2009 and 7 July 2009, Mr Raymond Catelan acquired 4.36% of CMI ordinary shares on market in breach s606(1) and

- there had been a sale by Mr Raymond Catelan of 2,069,636 Class A shares to Zazu Holdings Pty Ltd (controlled by Mr Denis Catelan who is Mr Raymond Catelan’s brother) and subsequent re-purchase in 2009, and this was unacceptable.

Final Orders Sought

- The applicants sought final orders, including that:

- various family members and the directors of CMI be declared associates of Mr Raymond Catelan in relation to CMI

- the Leanne Catelan Trust be required to sell so many of the shares “purchased on 24 November 2010” as exceed the ‘creep’ allowance in s611 item 9

- Mr Raymond Catelan be required to sell so many shares as would remedy his acquisitions between 5 June 2009 and 7 July 2009 as per the ‘creep’ allowance in s611 item 9 and

- Mr Herceg and Mr Richard Catelan be required to sell the shares each of them bought from Mr Raymond Catelan in May 2009.

Discussion

Conduct proceedings

- We decided to conduct proceedings in relation to the acquisition of Farallon’s shares.

- We did not conduct proceedings in relation to other transactions referred to in the application. While these transactions may place the application in context, they occurred too long ago. Moreover, the transactions related to relatively small parcels of shares. We do not take these transactions into account in forming our views on the acquisition of Farallon’s shares.

- Relevantly, therefore, the final orders the applicants sought were:

- Ms Leanne Catelan be declared to be an associate of Mr Raymond Catelan in relation to CMI and

- the Leanne Catelan Trust be required to sell so many of the shares as were acquired on 24 November 2010 in excess of the ‘creep’ provisions in s611 item 9.

Preliminary findings

- Having considered the application, submissions and rebuttals, we made preliminary findings and invited comments on them. Our conclusions follow consideration of responses.

- We considered the cumulative effect of the material and drew appropriate inferences. In doing so we had in mind that, while we must be satisfied by logical and probative material, the potential seriousness of a finding of association suggests that “the circumstances appearing from the evidence [must be established to] give rise to a reasonable and definite inference and not merely to conflicting inferences of equal degrees of probability.”1

Association

- Section 12 sets out the tests of association. Two are relevant here:

- Section 12(2)(b) - which provides that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company’s board or conduct of its affairs. This provision treats those who, by arrangement, can control a board or the affairs of the company through the actual owners of shares as the owners; that is “[t]hose who manipulate the strings are to be regarded as the personification of the puppet.” The association cannot be unilateral.

- Section 12(2)(c) - which provides that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company’s affairs. Again, this provision means having an understanding as to some common purpose or object - not simply two persons separately and coincidentally acting in the same manner.2

Personal relationships

- Ms Leanne Catelan is Mr Raymond Catelan’s daughter.

- She resides in a property owned by RPD Qld Pty Ltd, which is ultimately controlled by Mr Raymond Catelan. Ownership of the premises will vest in her if she survives her father. She does not pay rent.

- Ms Catelan is employed by CMI and works for her father. She performs the role of Mr Raymond Catelan’s personal assistant at CMI. Previously, she has worked for her ex-husband and for RP Data Limited, of which Mr Raymond Catelan was managing director. We have no evidence that she has held other jobs.

- Ms Catelan and Mr Raymond Catelan have generally discussed investing in CMI. Mr Catelan submitted “when approached by her, I do offer my general views on share investing and CMI generally to my daughter, Leanne Catelan. We discuss these issues from time to time (perhaps once a month on average).... In relation to CMI, our recent discussions have been about the company’s debt position and conservation of cash.”

- Mr Raymond Catelan submitted “There is no written correspondence between Tinkerbell Enterprises (or its directors or representatives) and me relating to the acquisition of shares in CMI. However, I did prepare a deed of gift when I gifted the funds to Leanne Catelan which I believe she used to acquire the CMI shares.”

- Ms Leanne Catelan submitted that she “and her father, Ray Catelan, also discussed CMI regularly (perhaps once or twice a month on average) and Ms Catelan recalls discussing Mr Nunn’s [principal of Farallon] illness with Mr Catelan, and wondering with her father whether Farallon Capital would be selling its CMI shares as a result. However, Ms Catelan did not discuss the possibility of Tinkerbell Enterprises acquiring the CMI shares with her father until after Ms Catelan had made a decision to acquire the shares.”

- In none of his responses did Mr Raymond Catelan refer specifically to the discussion in which they were “wondering” whether Farallon would be selling its shares. This is a significant omission given it is the very transaction we are enquiring into.

- Ms Leanne Catelan later submitted “All and any discussions Ms Catelan has had with either Ray Catelan or Richard Catelan would have been on an informal, friendly and general basis. Accordingly there are no documents (including email correspondence) evidencing those discussions.... All and any conversations between Ms Catelan and Ray Catelan or Richard Catelan regarding the performance of CMI was always of a general nature.” While discussions about CMI’s performance may have been general, we think that there was a specific discussion about Farallon selling its holding, as Ms Catelan submitted above.

- Ms Leanne Catelan also submitted that she discussed the investment opportunity generally with her cousin, Mr Richard Catelan, and her fiancé.

- She submitted that, when first raised, “the opportunity to buy those shares (or the availability of acquiring shares) was more likely only raised by Richard Catelan in passing.”

- Given the size of the investment for Ms Catelan, how recently it was made, and the number of discussions that took place with many people, we are surprised Ms Catelan has not been more specific. She received a very significant gift to buy the shares, which is documented and dated. This would be a clear point of reference from which to recall other details. In our view it would not be difficult to more precisely recall dates and details of discussions with family members and others, and in particular discussions with her father who gave her the money to buy the shares. We think the responses were vague in circumstances where it is reasonable to expect more detail.

- In our view, the discussions with Mr Raymond Catelan went further than has been disclosed, particularly when we consider also the trusts, the gift and the course of discussions and negotiations. We are being invited to accept that, apart from very general discussions about the performance of CMI, or wondering if Farallon would sell, the first discussion that Ms Leanne Catelan had with Mr Raymond Catelan concerning the acquisition by Tinkerbell was when she asked him for the money. This is despite the possibility of the sale having arisen twice and other directors of CMI having taken part in discussions or negotiations on her behalf. We do not accept that Ms Leanne Catelan had no discussions with Mr Raymond Catelan about the acquisition, particularly because of the funding of it and the discussion above, until she had decided to make the purchase. We do not accept that the only discussions about CMI that she and Mr Raymond Catelan had were of a general nature. We infer that the specific acquisition was discussed, and before Ms Catelan decided to acquire the shares.

- Ms Catelan submitted that she decided to pursue the opportunity to acquire Farallon’s shareholding in CMI without seeking any independent advice in relation to the purchase. Yet the acquisition amounts to a very significant purchase for her. She engaged lawyers to undertake the mechanics of the transfer but nothing else. Mr Herceg, Mr Raymond Catelan’s lawyer and a director of CMI, got involved as a volunteer. This is unusual. Based on our experience, the course of discussions, the negotiations and the way the acquisition occurred are uncommercial in the sense that they are not consistent with the usual practice or what we would expect if the parties had been acting independently and at arm’s length.

- In our view it is significant that she played no part herself in discussions with Farallon and took no independent advice. Moreover, in our view it is significant that her submissions use the passive voice to explain the position, and in particular when describing Mr Ryan’s involvement, which she described as a “nomination”. This grammatical device renders it unclear who involved whom in discussions.

- We infer that Ms Leanne Catelan was not acting independently when it came to her investment in CMI through Tinkerbell.

- We infer that Mr Raymond Catelan had more involvement in relation to the decision to purchase the shares than has been submitted, particularly taking the trusts, the gift and the negotiations into account. He controls 36.8% of CMI. The clear inference that can be drawn, which we draw, is that there is a shared goal or purpose in Ms Leanne Catelan’s acquisition (through Tinkerbell), namely consolidation of control of CMI, particularly having regard to the fact that Mr Raymond Catelan provided the money for the purchase of the Farallon shareholding.

Financial gift

- Ms Leanne Catelan submitted that she lent Tinkerbell the funds and was in a position to do so as a result of a gift from her father, Mr Raymond Catelan. Mr Raymond Catelan submitted that he understood the gift would be used for this purpose. The funds were transferred directly to the account of Tinkerbell.

- Ms Catelan submitted that Mr Raymond Catelan had exhibited an increased generosity to close family members in recent years. Mr Catelan produced other deeds of gift. One showed that he had made a larger gift to his wife than the gift to Ms Leanne Catelan. But the gift to Ms Catelan to purchase the shares was far larger than other gifts provided by Mr Raymond Catelan to either of his daughters in the past. No evidence was produced of other equivalent gifts to Ms Catelan or of equivalent gifts to Mr Raymond Catelan’s other daughter.

- Ms Catelan submitted that she did not discuss the possibility of Tinkerbell acquiring the shares with her father until after she had decided to acquire them. However, she did not have the money to buy the shares and a number of people, including board members of CMI, had been engaged in discussions or negotiations with Farallon. The sequence of events has been disclosed in a vague way. The interdependence of the need for the gift and the timing of the decision to acquire the shares was barely acknowledged. It seems unlikely to us that such efforts to discuss or negotiate the acquisition would be undertaken (and perhaps even an agreement was reached) before Ms Catelan was able to fund the acquisition or could be assured of funding. We consider it unlikely that other discussions did not take place.

- In the circumstances, we do not accept Ms Leanne Catelan’s submission that the decision to acquire the shares was based solely on her own assessment. Nor do we think that the money was not expected to be provided before she decided to acquire the shares. We infer that the decision to acquire Farallon’s shareholding in CMI was not formed by her alone.

- Ms Catelan could not afford the shares. Mr Richard Catelan was “not in a financial position” to acquire the shares. Mr Raymond Catelan gave Ms Leanne Catelan the money for the shares.

- The clear inference that can be drawn, which we draw, is that there is a shared goal or purpose in Tinkerbell’s acquisition, namely consolidation of control of CMI, between Mr Raymond Catelan and Ms Leanne Catelan.

Conduct of negotiations

- The negotiations in relation to Farallon’s CMI shareholding appear to have involved the following elements.

- While it is not at all clear who first approached whom in connection with the acquisition of Farallon's shares, it appears from Mr Nunn’s email of 26 May 2010 that the request to purchase the shares came from Mr Richard Catelan.

- Ms Leanne Catelan submitted that she first became aware of the opportunity to acquire Farallon’s stake in CMI through her cousin, Mr Richard Catelan, in or about June 2010. Ms Catelan submitted that the topic did not generate any particular interest at the time. It is not clear why this conversation occurred because Mr Catelan submitted that the discussions he had with Farallon about the acquisition were personal to him.

- About 4 months later, when the sale of the shares again came up, Mr Richard Catelan again mentioned it to Ms Catelan. He suggested that “it may be appropriate for an approach to be made via Mr Lindsay Somerville [an adviser to Greg Nunn] and that to do so, Colin Ryan may be able to assist.” He suggested to Mr Colin Ryan (Chairman of CMI) that he speak with Mr Somerville “about Farallon Capital’s attitude to the sale of the CMI shares.” It is not clear why Mr Richard Catelan took the running on this. Mr Catelan has also not made clear on whose behalf Mr Ryan was told he would be acting.

- Mr Ryan contacted Mr Lindsay Somerville. Mr Ryan has not made clear for whom he was told he was acting or on whose behalf he believed he was acting.

- Mr Ryan informed Mr Richard Catelan of his discussion and submitted that he had no further involvement. Mr Richard Catelan informed Ms Leanne Catelan of this discussion and submitted that he “took no further active role in the negotiations past this point.” Ms Catelan submitted that she was not involved in discussions with Farallon. It appears that, at this point, no agreement had been reached with Farallon. It is not clear who took the negotiations further.

- Mr Herceg submitted that upon learning that Ms Leanne Catelan had decided to acquire a parcel of shares from Farallon he contacted Mr Daniel McCullough “for the purpose of ensuring appropriate steps were put in place to secure proper completion of that transaction.” Mr Herceg submitted that he volunteered his involvement. It is not clear why Mr Herceg felt the need to volunteer. Given that Ms Leanne Catelan engaged other legal advisers to complete the mechanics, he has not explained his involvement satisfactorily in our view.

- Mr Herceg submitted that “it is likely that, in the course of discussing what steps would be taken to complete the transaction, I would have told Daniel McCullough that the purchaser would be Tinkerbell Enterprises.” Mr Herceg submitted that he could not recall whether it was Mr Richard Catelan or Ms Leanne Catelan who informed him of Ms Leanne Catelan’s decision to buy the shares. If it was Mr Catelan, this is at odds with Mr Catelan’s submission that he took no further active role. We note Ms Catelan’s submission that she “did not, at any time, have any discussions in relation to the acquisition of shares in CMI directly with either Colin Ryan or any representative of Farallon Capital.”

- The negotiations for Tinkerbell’s acquisition were conducted by persons other than Ms Leanne Catelan. Each of Mr Richard Catelan (a director of CMI and Ms Leanne Catelan’s cousin), Mr Colin Ryan (Chairman of CMI) and Mr Danny Herceg (a director of CMI) was involved in discussions concerning the acquisition of Farallon’s shares, or aspects of the negotiation that led to the acquisition of Farallon’s shares. In either case, there was an involvement. We regard this level of involvement as unusual if Ms Leanne Catelan was acting independently, particularly when considered against the fact that she was not involved with Farallon at all herself. We also note that the only director of CMI said not to have been involved was Mr Raymond Catelan, Ms Catelan’s father and the provider of the funds. This, too, is unusual.

- It is significant, in our view, that no one was able or prepared to tell us who spoke to Farallon to actually agree the acquisition of the shares for $0.75 per share.

- Mr Richard Catelan and Mr Ryan did not respond to a question asking this. Mr. Richard Catelan had submitted earlier “I am aware from previous submissions that it has been suggested by Ms Leanne Catelan that I was ‘possibly’ the person who communicated her acceptance of the offer to purchase the CMI shares to Farallon on Ms Catelan’s behalf. This is simply not the case. I had no such part in the negotiations or dealings. Ms Catelan is mistaken in this instance.”

- Mr Herceg submitted in relation to his role that “I am not Ms Catelan’s lawyer and did not at any stage intend to have carriage of the transaction on her behalf.” Nevertheless, he took a role.

- Ms Catelan submitted that she did not at any time have any discussions with any representative of Farallon and “assumes her decision to accept a price of $0.75 a share was likely communicated to Farallon by Richard Catelan....” Mr Richard Catelan submitted that she was mistaken.

- Mr Raymond Catelan submitted that he “was not involved in any discussion in relation to the purchase of shares in CMI from Farallon... other than relating to the gift of funds to her.”

- We do not have the benefit of a response from Farallon as to the conversations, despite specifically inviting submissions from Farallon.

- We are therefore unable to determine conclusively who agreed the transaction. In such a simple transaction this is surprising.

- We are also unable to determine conclusively who agreed the price. Mr Ryan submitted that he conveyed to Mr Richard Catelan that Farallon would not accept less than 75¢ a share, but no one has acknowledged communicating agreement to that price with Farallon. Farallon did not wish to provide a response.

- While we are unable to determine who agreed that transaction or the price, it is clear that it was not Ms Leanne Catelan or she would likely have said so. Instead, she submitted either that Mr Richard Catelan communicated to Farallon (which he denies) or “Ms Catelan understands that Mr Ryan spoke with a representative of Farallon Capital by telephone, initially suggesting a price of $0.70 per share. After some negotiation, in mid-November a price of $0.75 was reached, based on all of the shares being sold.”

- It remains unclear who conducted those negotiations.

- We consider Ms Catelan’s responses to be consistent with the conclusion that she did not alone decide on this investment. Indeed, the evidence suggests that she could not have formed a view about purchasing the shares without some discussion of how to complete the purchase, since she did not have the funds. Yet she submitted that she took no part in such discussions until she approached her father for the money subsequent to deciding to acquire the shares (but not having communicated that decision to Farallon or apparently knowing how or by whom the decision was communicated). This is inherently improbable if Ms Catelan was acting independently.

- Given that she played no role in the negotiations with Farallon, with the denials and in the absence of an explanation as to who formally agreed on behalf of Tinkerbell to acquire the shares, we are left to believe that no one did. Information about the actual agreement is vague to the point of almost being nonexistent.

- Mr Raymond Catelan provided the funds for the acquisition. Presumably instructions about the price and the transaction needed to come from someone other than Ms Catelan or Mr Richard Catelan. Only Mr Raymond Catelan had the money and (at that stage) control of the money.

- Based on our experience, and in the absence of direct evidence, we think the most likely course of negotiation was, and we infer, that it was agreed with Farallon that the shares would be acquired by Catelan interests, although we cannot say who communicated this. Ms Leanne Catelan became the nominated acquirer. We infer that Mr Raymond Catelan had more involvement than was submitted.

- We infer that Mr Richard Catelan and Mr Ryan did not respond to our question on this aspect of the matter because the response would not have been of assistance.

- This was a straightforward transaction, yet the evidence about how it progressed is obscure. This is surprising.

- Moreover, we note that some responses to questions have not been accurate and complete.

- Ms Sharyn Williams, company secretary of CMI, submitted:

CMI and its directors (other than Ray Catelan) have reviewed the attachment to the Takeover Panel’s brief dated 14 January 2011 and consider that there are not any matters identified in that brief in respect of which they have personal knowledge such as to make a submission by them appropriate at this stage. That said, they confirm that the factual background identified in the Takeover Panel’s brief accords with their understanding of the relevant facts and events.

- The brief asked (among other things): “Tinkerbell Enterprises, what discussions were held between you (including any of your directors or representatives) and Farallon Capital (including any of its directors or representatives) in relation to the acquisition of shares in CMI? Please provide us with a copy of all documents evidencing discussions, including email correspondence.” The question was directed to Tinkerbell. The other directors need not have responded. But a response was provided (Mr Richard Catelan also put in a response separately). It was not accurate and complete.

- Mr Richard Catelan and Mr Ryan have since submitted in response to direct questions that they were involved in discussions concerning the acquisition if not actual ‘negotiations’. Each of them has acknowledged agreeing the response above provided by Ms Williams.

- Mr Ryan submitted he “did not regard my conversations with Mr Somerville and Mr McCullough to be facts material to the Panel’s considerations.” He further submitted in response to our preliminary findings, that the conversations he had, and detailed, “did not include discussions with the purchaser of the shares; it was entirely related to the position and intent of Farallon. [The brief] appeared to be directed to the issue of association between CMI shareholders other than Farallon....” He spoke to the seller and to Mr Richard Catelan. We do not accept that his discussion with the ‘sell-side’ is immaterial. While Mr Ryan may not have had any discussion with Ms Leanne Catelan, he did have a discussion or discussions with the ‘buy-side’ when communicating with Mr Richard Catelan and this, too, was not immaterial.

- Mr Richard Catelan submitted that he did not consider he had a role in the October negotiations as his previous discussions (in May or June) with Farallon had been personal to him “albeit that they related to the same parcel of CMI shares.” He submitted in response to our preliminary findings that “At no time did I have contact with any representative of Farallon during or after this negotiation [we think this refers to the October negotiations], nor any of Ms Leanne Catelan’s advisers or legal consult (sic).” He submitted that he could not speculate or comment on a negotiation he had no part in. We do not accept this. He held the opening discussions, took the purchase to Ms Leanne Catelan and spoke to Mr Ryan. As he disclosed this in a submission dated the same day as the CMI submission, it is not clear why he participated in the CMI submission.

- Mr Herceg submitted that all the questions in the brief were expressly directed to Mr Raymond Catelan or Ms Leanne Catelan and the issue appeared to be whether or not they were associates in respect of the acquisition. He submitted “It would be expected that only those two individuals would be able to explain their affairs so far as was relevant for the Panel’s deliberations. I certainly did not feel I had the requisite knowledge of those personal and private matters... At worst, the CMI directors simply (but reasonably, in my opinion) misunderstood the purpose and scope of the Panel’s brief.” We do not accept this. In our view, it should have been sufficiently clear to a person of his expertise and experience that the involvement of others in relation to the discussions and negotiations leading up to the purchase of the shares in question would be relevant to a decision about a potential association.

- In our view, Mr Ryan, Mr Herceg and Mr Richard Catelan initially participated in a submission that was not accurate and complete. It should have been clear to them that we would be interested in the extent of their participation. As noted, Mr Catelan made a separate submission.

- Mr Herceg, when asked whether he was involved in preparing the deed of gift, submitted “I did not have any involvement in preparing a deed of gift referred to in that question” and later, “Although I witnessed the signing by Ray Catelan of the document, I did not assist in the preparation of that document.” Since this, virtually identical deeds of gift have been provided to us carrying “Herceg Lawyers” in the footer. We infer that his precedent was used by Mr Raymond Catelan.

- The lack of accuracy and completeness of CMI’s initial response makes us more prepared to draw the inference that Mr Raymond Catelan was likely involved in the negotiations or purchase beyond merely a gift of the money after Ms Catelan had decided to acquire the shares. We infer that Mr Ryan, Mr Herceg and Mr Richard Catelan did not want aspects of the transaction under investigation disclosed and that Mr Raymond Catelan was involved in the acquisition.

- Ms Catelan also submitted that “Richard Catelan understood that Colin Ryan, the chairman of CMI, knew one of the advisers to Farallon Capital (Mr Lindsay Somerville) from his previous professional dealings as chairman of a major accounting firm and, as a result, Mr Ryan was nominated to contact Farallon Capital and see what Farallon Capital’s asking price was.”

- Mr Ryan submitted that he did not regard himself as “nominated”; nor, he submitted, was he negotiating with Farallon on behalf of anyone. He did, however, find out Farallon’s position and convey to Mr Richard Catelan that Farallon would not accept less than 75¢ a share. Ms Leanne Catelan submitted that she “did not ask Colin Ryan to ascertain Farallon Capital’s sale price for the shares.”

Trusts – cross beneficiaries

- The M&L Trust is a family discretionary trust established by Mr Raymond Catelan. Mr Raymond Catelan has significant powers of appointment and removal of trustees and appointment of beneficiaries. This trust is controlled by Mr Raymond Catelan.

- Ms Leanne Catelan and Mr Raymond Catelan are identified along with others in the trust deed as beneficiaries.

- The Leanne Catelan Trust is a family trust established by Ms Leanne Catelan. Ms Leanne Catelan and Mr Raymond Catelan are identified along with others in the trust deed as beneficiaries. Ms Leanne Catelan submitted the beneficiaries are determined by Tinkerbell from time to time and are selected from family members of hers. Ms Catelan submitted that Mr Raymond Catelan had never received a distribution.

- These arrangements suggest that Ms Leanne Catelan’s investment affairs are not entirely separate from Mr Raymond Catelan’s. This is a structural link between them, in addition to the family relationship and Ms Catelan’s working relationship.

- The Panel has previously concluded that cross beneficiaries under trust arrangements support an inference of association.3 We do so in this case as well.

Conclusion on association

- A relevant agreement must exist for the purpose of controlling or influencing the composition of a company’s board or the conduct of its affairs. Acting in concert must exist in relation to a company’s affairs. ‘Affairs of a company’ are broadly defined and include, among other things, the acquisition and ownership of shares.4 In our view, Mr Raymond Catelan and Ms Leanne Catelan were acting, or proposing to act, in concert in relation to the acquisition of the 9.22% of CMI acquired from Farallon, or they had or proposed to enter a relevant agreement in relation to the acquisition. With the acquisition of a further 9.22%, the holdings, if aggregated, are almost 50%. In the context of control this is a significant acquisition of a substantial interest in CMI.

- The submissions of Ms Leanne Catelan and Mr Raymond Catelan seek to establish that each acts independently of the other in their investment affairs and that their investment affairs are separate. In so far as the evidence in relation to Tinkerbell’s acquisition of Farallon’s CMI shareholding is concerned, we do not accept that. The submissions of others appear to obscure who was involved.

- Aspects of the transaction were not conducted at arm’s length but between family members who were heavily involved in the operations of CMI. Their behaviour was not consistent with the actions of persons acting independently of one another. The transaction was not conducted as one would expect a typical investment portfolio transaction to be conducted.

- We consider it unusual that three other directors of CMI were participants in discussions concerning, or aspects of the negotiations involving, the acquisition of the shares for Ms Leanne Catelan, who was not involved and who is not a director of CMI. Based on our experience, this is uncommercial behaviour (in the sense it is not what we would expect from parties acting independently and at arm’s length).

- We find it unusual that Mr Herceg, who from the evidence of the other deeds of gift has been Mr Raymond Catelan’s solicitor, volunteered to communicate with Farallon. Apparently he did so without instructions from Ms Leanne Catelan. Based on our experience, this is uncommercial behaviour, in the sense mentioned above.

- Also, in our experience, the sequence of events is unusual. Discussions were held, but acknowledgement of there being ‘negotiations’ was not forthcoming. Information about the actual agreement is vague to the point of almost being nonexistent. Communication of the actual agreement decision is vague. And the approach for the funding of the transaction (through the gift) was said to have come after the decision to acquire the shares.

- The Panel said in Dromana Estate Ltd 01R:5

... Issues of association frequently need to be decided on the basis of inferences from partial evidence, patterns of behaviour and a lack of a commercially viable explanation for the impugned circumstances.

- We have drawn inferences from partial evidence, the pattern of behaviour here, uncommercial conduct and inadequate explanations. In our view, the inferences are reasonable and definite and not merely conflicting inferences of equal degrees of probability.

- The Panel also said in Viento Group Ltd,6 relying on Mount Gibson Iron Limited: 7

Circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- We think elements of these circumstances have been established in this case.

- The Catelan family are the major shareholders in CMI. There are structural links in this case including the family links, work relationships and the trusts. The course of negotiations was uncommercial, and the decision to invest such a large gift in one stock is an uncommercial action.

- Considering the whole of the material, based on our expertise and drawing appropriate inferences, we conclude that Ms Leanne Catelan and Mr Raymond Catelan are not acting independently in relation to the investment by Tinkerbell in CMI. Either there was an agreement, arrangement or understanding between them for the purpose of the ownership of the 9.22% parcel of shares in CMI or they were acting in concert in relation to the ownership of that parcel or both. In addition, we have no evidence that their relationship has changed since the time the shares were acquired from Farallon.

- In National Foods, the Panel said:

... Section 12 does not, however, require that the agreement or concerted action relate expressly to shares in any way, or to the exercise of votes attached to shares. Rather, the legislature has decided to aggregate the voting power of people who are cooperating in ways which might be advanced by the use of such power.8

- We infer that Ms Leanne Catelan and Mr Raymond Catelan are associated:

- under s12(2)(b) for the purpose of controlling or influencing the conduct of CMI’s affairs, or

- under s12(2)(c) in relation to the affairs of CMI.

- The voting power in CMI of the associated parties has therefore increased as a result of Tinkerbell’s acquisition other than through one of the exceptions in s611.

- The association was not disclosed to the market.

Decision

Conclusion

- It appears to us that the circumstances are unacceptable. We made a declaration of unacceptable circumstances (Annexure B), having considered that it is not against the public interest to do so and having regard to the matters in s657A(3).

Orders

- Following the declaration, we made final orders (Annexure C). Under s657D the Panel’s power to make orders is very wide. The Panel is empowered to make ‘any order’9 if 4 tests are met:

- It has made a declaration under s657A. This was done on 22 February 2011.

- It must not make an order if it is satisfied that the order would unfairly prejudice any person. We are satisfied that our orders do not unfairly prejudice any person. Our orders involve 2 things –

- divestment of the shares acquired by Tinkerbell on 23 November 2010, which will remedy the unacceptable circumstances and

- disclosure of the association between Ms Leanne Catelan and Mr Raymond Catelan, which will remedy the existence of an uninformed market.

- It gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 21 February 2011. Submissions and rebuttals were received.

- It considers the orders appropriate to either protect the rights and interests of persons (or group) affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. There is no takeover in this case. The orders protect rights and interests by remedying the aggregation of voting power that occurred other than in accordance with chapter 6.

- Tinkerbell submitted that it would always have been entitled to acquire 3% of the issued capital of CMI under item 9. Therefore it should not be required to divest all the shares acquired. This depends on when the parties became associates.

- ASIC disagreed that the parties were entitled to creep. It submitted that the transaction did not comply with paragraph (b) of item 9, which requires that:

(b) as a result of the acquisition, none of the persons referred to in paragraph (a) would have voting power in the company more than 3 percentage points higher than they had 6 months before the acquisition.

- ASIC submitted that, on the basis of the association, the entire 9.22% holding was obtained in contravention of section 606. Moreover, “It appears that Tinkerbell denies the association existed as at 24 May, 2010. ASIC considers that the Creep Exemption could not have been relied upon if there was no association at that date.” Alternatively, if there was an association at that time, ASIC submitted that the market had not been informed of it and relying on item 9 would be contrary to the efficient market principle in section 602(a).

- In our view, the entire parcel was acquired as a single transaction and should be divested.

- However, if Tinkerbell is entitled to creep under item 9, which is for it to determine in the first instance, our orders permit it to acquire shares if the appointed seller decides to sell any shares on market. By allowing an acquisition under the orders, rather than allowing Tinkerbell to retain the shares, ASIC’s concerns are met. This is because the parties are only permitted to acquire what item 9 will allow and the acquisition is then effective from the date it is made.

- Tinkerbell also submitted that it should be able to acquire shares from the appointed seller other than on-market. ASIC disagreed with this also. We agree with ASIC’s submission. In particular, if the associated parties are allowed to participate in the sell down, it may not result in a competitive bargaining process because they can offer any amount for the shares knowing that the associated parties will ultimately have the excess sale price returned to them.

- Tinkerbell also submitted that it should be allowed to acquire additional shares under another exception in section 611. It is too complicated in this case to anticipate the basis on which Tinkerbell might acquire shares other than under item 9, but we would be prepared to consider varying the orders in an appropriate situation.

- Similarly, if the three-month period is not long enough for the appointed seller to dispose of the shares in an orderly manner, we would be prepared to consider varying the orders at the request of ASIC or Tinkerbell.

- The applicants submitted that the appointed seller should not account to Tinkerbell for any net sale proceeds in excess of the original purchase price of the shares. We do not agree. The Panel’s task is to remedy unacceptable circumstances, which the divestment and disclosure will do.

- Post-script - after making the orders Tinkerbell applied for a stay pending a review. The President granted a stay (Annexure D).

John Keeves

President of the sitting Panel

Decision dated 22 February 2011

Reasons published 8 March 2011

| Party | Advisers |

|---|---|

| Tinkerbell | McCullough Robertson |

| CMI | Mallesons Stephen Jaques (at end of proceedings) |

| Mr Colin Ryan | Mallesons Stephen Jaques (at end of proceedings) |

| Mr Danny Herceg | Mallesons Stephen Jaques (at end of proceedings) |

| Mr Raymond Catelan | Not applicable |

| Mr Richard Catelan | Not applicable |

| Mr Gerry Pauley | Not applicable |

| Dr Gordon Elkington | Not applicable |

Annexure A

Australian Securities and

Investments Commission Act (Cth)

Section 201A

Undertaking

CMI Limited

Pursuant to section 201A of the Australian Securities and Investments Commission Act 2001 (Cth), Tinkerbell Enterprises Pty Ltd (Tinkerbell) undertakes to the Takeovers Panel that it will not, at any time prior to the conclusion of the proceedings before the Takeovers Panel in respect of the affairs of CMI, dispose of, transfer or grant a security interest over the 9.22% interest in CMI it acquired from Farallon Capital Pty Limited on 24 November 2010 without first giving the Takeovers Panel 48 hours of its intention to do so.

Signed by James Peterson of McCullough Robertson Lawyers

with the authority, and on behalf, of

Tinkerbell Enterprises Pty Limited

Dated 19 January 2011

Annexure B

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

CMI Limited

- CMI Limited (CMI) is an ASX listed company (ASX code: CMI).

- Mr Raymond Catelan is the Managing Director of CMI.

- Ms Leanne Catelan is Mr Raymond Catelan’s daughter.

- RP Prospects Pty Limited, as trustee for the M&L Trust, has a relevant interest in 36.80% of CMI. Ms Leanne Catelan and Mr Raymond Catelan are identified in the trust deed as beneficiaries of the trust. RP Prospects Pty Ltd is wholly owned by Mr Raymond Catelan.

- On 23 November 2010, Tinkerbell Enterprises Pty Ltd (Tinkerbell), as trustee for the Leanne Catelan Trust, acquired a relevant interest in 9.22% of CMI. Ms Leanne Catelan and Mr Raymond Catelan are identified in the trust deed as beneficiaries of the trust. Tinkerbell is wholly owned by Ms Leanne Catelan.

- The funds for Tinkerbell’s acquisition came from Mr Raymond Catelan. He made a gift of the money to Ms Leanne Catelan.

- The negotiations for Tinkerbell’s acquisition were done by persons other than Ms Leanne Catelan. Each of Mr Richard Catelan (a director of CMI and Ms Leanne Catelan’s cousin), Mr Colin Ryan (Chairman of CMI) and Mr Danny Herceg (a director of CMI) was involved in discussions concerning the acquisition or aspects of the negotiations for the acquisition.

- The Panel considers that Ms Leanne Catelan and Mr Raymond Catelan are associated:

- under section 12(2)(b)10 for the purpose of controlling or influencing the conduct of CMI’s affairs, or

- under section 12(2)(c) in relation to the affairs of CMI.

- The voting power in CMI of the associated parties has increased as a result of Tinkerbell’s acquisition other than through one of the exceptions in section 611.

- A notice of initial substantial holder lodged by Tinkerbell on 24 November 2010 did not disclose the association.

- It appears to the Panel that the circumstances are unacceptable:

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on the control, or potential control, of CMI

- having regard to the purposes of Chapter 6 set out in section 602 and

- because they constitute or give rise to a contravention of sections 606 and 671B.

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of CMI.

Alan Shaw

Counsel

with authority of John Keeves

President of the sitting Panel

Dated 22 February 2011

Annexure C

Corporations Act

Section 657D

Orders

CMI Limited

The Panel made a declaration of unacceptable circumstances on 22 February 2011.

The Panel Orders

Divestment order

- The Sale Shares are vested in the Commonwealth on trust for Tinkerbell.

- ASIC must:

- sell the Sale Shares in accordance with these orders and

- account to Tinkerbell for the proceeds of sale, net of the costs, fees and expenses of the sale and any costs, fees and expenses incurred by ASIC and the Commonwealth (if any).

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller -

- to use the most appropriate sale method to secure the best available sale price for the Sale Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale.

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller’s functions in relation to the disposal of the Sale Shares

- unless the Appointed Seller sells Sale Shares on market, that it obtain from any prospective purchaser of Sale Shares a statutory declaration that the prospective purchaser is not associated with any of the Associated Parties

- that none of the Associated Parties may directly or indirectly purchase any of the Sale Shares, except to the extent that they are allowed to acquire additional shares under item 9(b) of s611 and the Appointed Seller sells those shares on market and

- to dispose all of the Sale Shares within 3 months from the date of its engagement.

- CMI and the Associated Parties must do all things necessary to give effect to these orders, including:

- oing whatever is necessary to ensure that the Commonwealth is registered with title to the Sale Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Sale Shares.

- The Associated Parties must not otherwise dispose of, transfer, charge or vote any Sale Shares (except those acquired on market under paragraph 3(b)(iv)).

- None of the Associated Parties may take into account any relevant interest or voting power that any of them or their respective associates had, or have had, in the Sale Shares when calculating the voting power referred to in Item 9(b) of s611 of the Corporations Act 2001 (Cth), of a person six months before an acquisition exempted under Item 9 of s611. Any Sale Shares acquired on market under paragraph 3(b)(iv) must be taken into account in any subsequent calculation for item 9 purposes, taking the date of acquisition as the date they were acquired on market under paragraph 3(b)(iv).

Substantial holding disclosure order

- The Associated Parties must as soon as practicable give notice of their substantial holding in relation to their voting power in CMI and their association, including disclosing:

- the name of each associate who has a relevant interest in voting shares in CMI

- the nature of their association

- the relevant interest of each associate and

- details of any relevant agreement through which they have a relevant interest in CMI shares.

Interpretation

| Term | Meaning |

|---|---|

| Appointed Seller | An investment bank or stock broker |

| ASIC | Australian Securities and Investments Commission, as agent of the Commonwealth |

| Associated Parties | Ms Leanne Catelan and Mr Raymond Catelan or any of their associates |

| CMI | CMI Limited |

| on market | in the ordinary course of trading on Australian Stock Exchange and not by crossing or special crossing |

| Sale Shares | 3,112,422 shares held by Tinkerbell in CMI |

| Tinkerbell | Tinkerbell Enterprises Pty Ltd as trustee for the Leanne Catelan Trust |

Alan Shaw

Counsel

with authority of John Keeves

President of the sitting Panel

Dated 25 February 2011

Annexure D

Corporations Act

Section 657E

Interim Orders

CMI Limited

- On 22 February 2011, the Panel made a declaration of unacceptable circumstances in relation to the affairs of CMI Limited under section 657A of the Corporations Act 2001 (Cth)

- On 24 February 2011, the Panel received a review application

- On 25 February 2011, the Panel made orders under section 657D of the Corporations Act 2001 (Cth) (Orders)

- On 25 February 2011, the Panel received a request to stay the Orders pending the review.

The President ORDERS:

- That orders 1, 2, 3, 4, 6 and 7 of the Orders are stayed.

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the review proceedings and

- 2 months from the date of these interim orders.

Alan Shaw

Counsel

with authority of Kathleen Farrell

President of the Panel

Dated 25 February 2011

1ASIC v Fortescue Metals Group Ltd [No 5] [2009] FCA 1586 at [82], referred to in ASIC v Fortescue Metals Group Ltd [2011] FCAFC 19 at [78]

2Mount Gibson Iron Limited [2008] ATP 4 at [12], footnotes omitted

3Viento Group Limited [2011] ATP 1

4 Section 53, applied by Corporations Regulation 1.0.18

5 [2006] ATP 8 at [25]

6 [2011] ATP 1 at [120]

7 [2008] ATP 4

8National Foods Limited 01 [2005] ATP 8 at [57]. The Panel also noted that ss12(2)(b) and (c) should not be read unduly widely: [58]

9 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

10 References are to the Corporations Act 2001 (Cth) unless otherwise indicated