[2016] ATP 3

Catchwords:

Declaration – orders – unlisted company – bidder's statement – supplementary bidder's statement – disclosure – misleading statements – collateral benefits – equal opportunity – funding arrangements – altered funding arrangements – private equity – passive investors – intentions – dispatch of documents – withdrawal rights – confidentiality – media canvassing – Panel procedures

Corporations Act 2001 (Cth), sections 602, 623(1), 633, 636(1)(a), 636(1)(c), 636(1)(f), 636(1)(m), 641(6), 650D(1), 651A, 657A, 657D, 670A, 671(B)(4), 1041H

ASIC Regulations 2001, regulations 16(2)(c), 20

Cooperatives Act 1997 (Qld)

Savage Resources Ltd v Pasminco Investments Pty Ltd [1998] 30 ACSR 1, Sagasco Amadeus Pty Ltd v Magellan Petroleum Australia Ltd [1993] HCA 14

Panel Guidance Note 4 – Remedies General, Panel Guidance Note 14 – Funding Arrangements, Panel Guidance Note 18 – Takeover Documents, Panel Guidance Note 19 – Insider Participation in Control Transactions, Panel Guidance Note 21 – Collateral Benefits, ASIC Regulatory Guide 9 – Takeover Bids

Affinity Education Group Limited [2015] ATP 9, Mungana Goldmines Limited 01R [2015] ATP 7, Richfield International Limited [2015] ATP 4, Northern Iron Ltd [2014] ATP 11, Minemakers Limited [2012] ATP 8, BC Iron Limited [2011] ATP 6, Brockman Resources Limited [2011] ATP 3, Multiplex Prime Property Fund 03R [2009] ATP 23, MYOB Limited [2008] ATP 27, Tower Software Engineering Pty Ltd 01 [2006] ATP 20, Citect Corporation Limited [2006] ATP 6, Breakfree Limited 04(R) [2003] ATP 42, Austar United Communications Limited [2003] ATP 16

Procedural Rules 1.1.1, 2.3.1, 3.1.1(c), 10.2.1

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | Yes | Yes | Yes | Yes | No |

Introduction

- The Panel, Rod Halstead, Peter Hay (sitting President) and Sarah Rennie, made a declaration of unacceptable circumstances in relation to the affairs of Brisbane Markets Limited. The application concerned an off-market takeover bid by Produce Markets Queensland Pty Ltd for Brisbane Markets. The Panel considered that the bidder's statement and supplementary bidder's statements contained information deficiencies and potentially misleading statements. The Panel declared the circumstances unacceptable and ordered the dispatch of a supplementary bidder's statement in a form approved by the Panel, withdrawal rights for accepting shareholders and orders relating to dispatch.

- In these reasons, the following definitions apply:

- BML

- Brisbane Markets Limited1

- Brismark

- The Queensland Chamber of Fruit and Vegetables Industries Co-Operative Limited

- Brismark Rules

- Rules of The Queensland Chamber of Fruit & Vegetable Industries Co-operative Limited

- Offer

- the off-market takeover bid for BML by PMQ at $3.50 cash per share

- PMQ

- Produce Markets Queensland Pty Ltd, a wholly owned subsidiary of VGI2

- Pre-Bid Deed

- Pre-bid Deed dated 9 November 2015 between S & D and PMQ

- S & D

- S & D George Investments Pty Limited

- VGI

- VGI Partners Pty Ltd

Facts

- BML is an unlisted company with more than 50 shareholders. It owns and manages the Brisbane Markets site at Rocklea, Queensland.

- BML has two classes of shares consisting of approximately 42.5 million ordinary shares and four industry shares. The industry shares have no right to participate in capital or profits of the company but provide special rights in relation to the governance of BML, primarily the right to appoint directors and veto resolutions at general meetings.

- Brismark holds 33.89% of the ordinary shares and the four industry shares in BML. Brismark is a trading cooperative established pursuant to the Cooperatives Act 1997 (Qld). Brismark's internal affairs are governed by the Cooperatives Act and the Brismark Rules. All of its members are required to operate as wholesalers of fruit and vegetables at the premises of BML.

- On 9 November 2015, PMQ entered into the Pre-Bid Deed with S & D. Simon George is one of the two directors of S & D and the holder of 50% of the shares in S & D. Mr George was a director of BML until 13 November 2015 and, through a separate entity, has a shareholding in Brismark.

- On 12 November 2015, PMQ lodged a bidder's statement with ASIC in relation to an off market bid for the shares in BML for $3.50 cash per share. It subsequently lodged supplementary bidder's statements on 18 December 2015 and 23 December 2015.

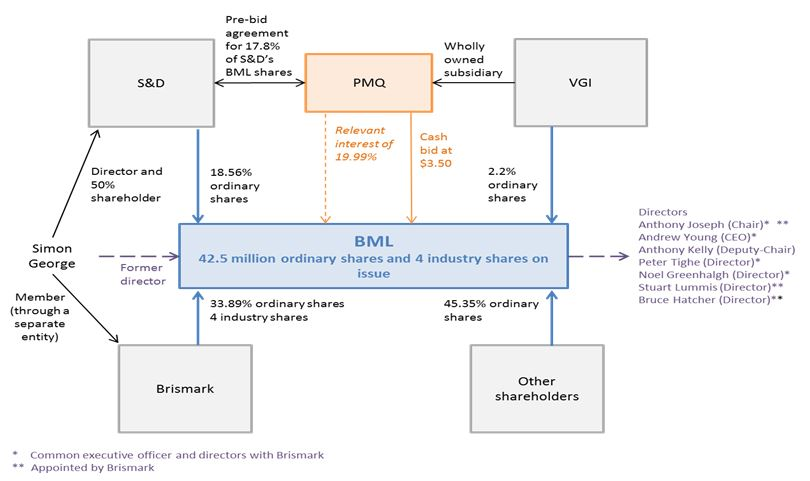

- In the bidder's statement, PMQ disclosed that it had a relevant interest in approximately 19.99% of the ordinary shares of BML, comprising approximately 2.20% held by funds managed by VGI and a relevant interest in 17.80% through the Pre-Bid Deed.

- PMQ made statements to the effect that "[i]f Brismark accepted the Offer in respect of its entire stake in Brisbane Markets and the entire proceeds from this were distributed equally amongst Brismark Members, each Brismark Member would receive a payment of $950,264" (an Equal Distribution Statement) in several sections in the bidder's statement, in a presentation attached to the bidder's statement and in the second supplementary bidder's statement.3

- The Offer was conditional upon, among other things, the special rights attaching to the industry shares being varied such that they were effectively converted into, and had identical rights to, the ordinary shares, or the industry shares being otherwise cancelled (the Industry Shares Condition).

- On 5 December 2015, an article in the Courier Mail included statements that "Brismark's 52 members are being offered about $1 million each for their holding in Brismark" and that Mr Douglas Tynan (Executive Director of VGI) "already got 23 positive responses from Brismark Members to support the takeover and only needs 39 of the 52 to push ahead with obtaining Brismark's 33 per cent stake".

- On 2 January 2016, an article in the Courier Mail (together with the 5 December 2015 article, the Courier Mail articles) included a statement that "Brismark's 50 odd-member traders are being offered $1,000,000 each for their individual holding by VGI. That cash sweetener is believed to have attracted several traders to VGI's side".

- The structure of holdings of the various parties are shown below:

Application

Declaration sought

- By application dated 6 January 2016, as rewritten, BML sought a declaration of unacceptable circumstances. BML submitted (among other things) that:

- matters described in the bidder's statement and supplementary bidder's statements were misleading and deceptive in breach of s670A4 and breached s636(1)(m) including:

- the description of the Pre-Bid Deed

- the nature of the relationship and cooperation between Mr George and S & D, on the one hand, and PMQ and VGI, on the other hand

- the Equal Distribution Statement and the description of the process to achieve the equal distribution among Brismark members (the Equal Distribution Process) and

- the description of the process to achieve the Industry Shares Condition (the Industry Shares Variation Process)

- PMQ's description of its arrangements for funding the bid breached s636(1)(f), in particular, it failed to identify the persons who were to provide, directly or indirectly, the cash consideration for the bid

- PMQ had offered certain rights to S & D under the Pre-Bid Deed which were collateral benefits not offered to other BML shareholders in breach of s623(1) or the equality principle set out in s602(c) and

- PMQ had failed to correct the Courier Mail articles that omitted material information and contained statements that were misleading and deceptive, in breach of s1041H, concerning the ability of Brismark to accept the Offer and deal with the proceeds of any sale of its BML shares.

- matters described in the bidder's statement and supplementary bidder's statements were misleading and deceptive in breach of s670A4 and breached s636(1)(m) including:

- BML submitted that the effect of the circumstances was that:

- BML shareholders were not being given an equal opportunity to participate in benefits that were accruing to one BML shareholder, S & D and

- PMQ was seeking to acquire control over voting shares in BML other than in an efficient, competitive and informed market and without BML shareholders being given enough information to enable them to assess the merits of the Offer.

Interim orders sought

- BML sought interim orders to the effect that:

- PMQ be ordered to produce specified documents and

- until a determination by the Panel or the making of further orders, PMQ be restrained from dispatching any supplementary bidder's statement and PMQ and S & D be restrained from undertaking any actions in respect of the Pre-Bid Deed.

- PMQ provided an undertaking (see Annexure A) to the effect that, until the conclusion of the Panel's deliberations on the application, it would not process any acceptances that it received from BML shareholders, lodge any further supplementary bidder's statement and take any action under the Pre-Bid Deed. On this basis, we did not make interim orders.

- A request for documents is generally not a matter for an interim order.5 Applicants may suggest documents that may be relevant to the proceedings which the Panel can consider in the process of seeking submissions to a brief.

Final orders sought

- BML sought final orders, including orders to the effect that:

- the Pre-Bid Deed be cancelled

- PMQ lodge with ASIC a supplementary bidder's statement containing corrective statements and disclosing the information sought in the application in a form approved by the Panel

- any BML shareholders who have accepted the Offer be entitled to withdraw their acceptances and

- PMQ publish corrective statements in respect of the Courier Mail articles.

Length of the application

- The application substantially exceeded the 10 page limit required by the Procedural Rules.6 No explanation was given and no request to exceed the limit was made. The "Overview" section of the application was 24 pages and included submissions that were incorporated by reference into the "Details" section of the application. We considered that limiting the "Details" section to 10 pages in these circumstances was not in compliance with Procedural Rule 10.2.1.7 The "Overview" section is meant only to summarise the application. As the Panel noted in Brockman: "[i]t is usually the case that brevity serves parties better."8

- We required the applicant to rewrite the application. Having decided to conduct proceedings, we did not issue a brief until BML submitted a revised application. We noted the timing obligation in regulation 20 of the ASIC Regulations 2001, however until it was clear what was to be deleted, we considered that the most efficient course was to wait until the application had been rewritten. One claim, in respect of an escalator in the Pre-Bid Deed, was in fact deleted.

Conflict

- After deciding to conduct proceedings, and following receipt of submissions on the brief, an initial sitting Panel member considered that he could not continue as a member of the sitting Panel due to a potential conflict of interest becoming known and the sitting Panel was reconstituted as specified in paragraph 1. No delay resulted from the reconstitution of the Panel.

Discussion

- We have considered all the submissions and rebuttals from parties, but address specifically only those we consider necessary to explain our reasoning.

Decision to conduct proceedings

- PMQ made a preliminary submission that the Panel should not conduct proceedings and offered undertakings to correct aspects of the claimed disclosure deficiencies.

- ASIC made a preliminary submission that the Panel should conduct proceedings, being particularly concerned that the identity of bid funders had not been disclosed.

- We initially decided to conduct proceedings on the Pre-Bid Deed, the Industry Shares Variation Process and PMQ's funding arrangements.

- Following parties' submissions on the brief, we decided to conduct proceedings also on the Equal Distribution Statement and Equal Distribution Process raised in the application.

- ASIC separately raised an issue, arising out of an investor presentation that was used to seek funding for the bid, regarding the non-disclosure of PMQ's intentions in relation to the future gearing of BML if PMQ gained less than 100% control of BML. The issue was a disclosure issue in the bidder's statement similar in nature to other issues in the application and arose out of information provided in relation to other issues in the application. We considered that the scope of the application allowed us to consider the issue and we were in a position to inquire into and consider it as part of our proceedings fairly and reasonably and in a timely manner.9 In the circumstances of this case, we considered that this was logically connected to the factual matters and other issues raised in the application and decided to conduct proceedings also on this.10

Pre-Bid Deed

- The Pre-Bid Deed provided that S & D:

- will sell approximately 8.9% of BML shares (Tranche A shares) at the cash price of $3.50 per share to PMQ upon the conditions of the takeover offer being satisfied or waived

- grants a call option exercisable within two years of the date of the Pre-Bid Deed entitling PMQ to acquire up to approximately 8.9% of BML shares (Tranche B shares) if an alternative offer is announced or proposed for the greater of the cash price of $3.50 per share and the alternative offer price and S & D gives PMQ written notice that it intends to accept the alternative offer and

- from the date that is two years after the date of the Pre-Bid Deed, will not dispose of any Tranche B shares to a third party without first offering those shares to PMQ at the third party offer price.

- The Pre-Bid Deed contained a sunset clause whereby it will terminate if the conditions to the takeover are not satisfied or waived within 12 months of the date of the Pre-Bid Deed. It also provided that S & D could not give PMQ notice of an alternative offer until 12 months after the date of the Pre-Bid Deed unless the Tranche A shares had been transferred to PMQ.

- BML submitted that PMQ's description of the Pre-Bid Deed in the bidder's statement was misleading, in particular because it represented that the call option and the right of first refusal each terminated on 9 November 2017, when in fact the right of first refusal did not come into effect until 9 November 2017, and remained in effect, subject to rights of termination, "for as long as the Shareholder is the registered holder of any Tranche B Shares". We agree with BML's reading of the Pre-Bid Deed. In its preliminary submissions, PMQ submitted that it was not previously aware of this error and undertook to make corrective disclosure.

- BML further submitted that it was material for BML shareholders and other potential bidders to know that, subject to the takeover bid becoming unconditional by 9 November 2016 and any rights that PMQ may have to terminate the Pre-Bid Deed, the effect of the right of first refusal was that PMQ had perpetual control over the Tranche B shares and therefore, a perpetual blocking stake of up to 19.99%.

- ASIC submitted that the right of first refusal should be disclosed clearly by PMQ, and should include the date from which the restriction on disposal of the Tranche B shares would apply, that the restriction applied for so long as S & D owned any of the Tranche B shares, that all rights and obligations under the Pre-Bid Deed would be of no force and effect unless all of the conditions of the takeover bid were satisfied or waived, and the circumstances in which the agreement may be terminated. It also submitted that, while the requirements of Chapter 6C do not apply to an unlisted entity, "having regard to the analogous policy objectives underlying s671B(4) and the requirements of s636(1)(i) and (m)", if a copy of the deed was not made available to BML shareholders, care had to be taken to ensure that all material terms were disclosed. This was particularly the case here it submitted because the deed may be relevant in any contest for control of BML (or maintenance of control by PMQ if its bid is successful) for many years after the date of the deed.

- We consider that the bidder's statement does not adequately disclose the terms of the Pre-Bid Deed in breach of s636(1)(m).11 VGI agreed to provide in a supplementary bidder's statement a copy of the Pre-Bid Deed and a summary of its terms, including the points raised by ASIC. We do not consider any 'commentary' of the type proposed by BML (that the right of first refusal provides PMQ with a perpetual blocking stake) is necessary.

Collateral Benefit and Equality Principle

Benefit in respect of Tranche B shares

- BML submitted that PMQ was in breach of s623(1) because PMQ had offered S & D an opportunity to sell the Tranche B shares, through the call option and the right of first refusal, which were benefits not offered to other BML shareholders, in order to induce S & D to accept the bid. Alternatively, BML submitted that if the Panel concluded that PMQ was not in breach of s623(1) because benefit was not given, offered to be given or agreed to be given during the offer period, it was open to the Panel to find that the arrangement constituted unacceptable circumstances because it was contrary to the equality principle in s602(c). BML referred to Guidance Note 21 – Collateral Benefits which provides that the Panel "starts from the idea that unacceptable circumstances will be likely to exist whenever a bidder provides a security holder something of value which it does not offer to other security holders".12

- PMQ submitted that the call option and right of first refusal did not confer a benefit on S & D but, to the contrary, were a detriment to S & D because it was unable to sell its Tranche B shares without prior notification to PMQ. Further, the call option and right of first refusal were exercisable at PMQ's discretion and therefore any benefit flowed to PMQ. Even if there was a benefit to S & D, PMQ submitted that, among other things, any higher price paid to S & D would already have been offered to S & D under the alternative offer or third party offer so it would not be receiving a benefit it did not already have and that would not be a benefit likely to induce it to accept PMQ's bid.

- ASIC similarly submitted that, subject to a concern it had about timing of the option exercise (see paragraph 39), it did not consider any benefits identified by BML gave rise to a breach of s623(1) either because they were not benefits "given" to S & D13 or the benefit, if it were to be given, would only be given if the option was exercised.

- We do not consider that a benefit has accrued to S & D in respect of the Tranche B shares as a result of entering into the Pre-Bid Deed primarily for the reasons submitted by PMQ and ASIC.

- ASIC queried whether PMQ could exercise the call option if there was an alternative offer during the offer period given s623(1). It submitted that "[d]oing so will involve PMQ exercising its right to purchase the securities (and thereby giving a cash benefit) other than under the bid, at a price either equal to (in the event PMQ increases the bid consideration price first), or higher than, the bid price, on unconditional terms". It submitted that it was very difficult for a bidder to make acquisitions during the bid period outside a bid other than via an on-market purchase.14 Accordingly, ASIC submitted that PMQ should disclose either how it can exercise the call option in such circumstances or state that it would refrain from exercising the call option during the offer period.

- In our view, nothing turns on ASIC's concern in this case. PMQ agreed to make a statement that it will not exercise the call option if it would breach s623(1). We do not therefore need to decide whether the call option can be exercised during the offer period. If PMQ breaches s623(1) when it exercises the call option, this would be a circumstance to be considered in light of all the factors at the time.

Benefit in respect of Tranche A shares

- In respect of the Tranche A shares, ASIC submitted that the Pre-Bid Deed provided for settlement on the sale of the Tranche A shares seven days after the bid became unconditional while payment under the bid would not be received until up to one month after the conditions were satisfied or waived. In other words, if the bid becomes unconditional, there could be a difference in payment being received of approximately 3 weeks. The Pre-Bid Deed is different to a pre-bid purchase where the shares are acquired prior to the offer period. Thus, ASIC submitted that, to the extent the early settlement terms may be considered a benefit likely to induce S & D to dispose of its shares to PMQ, the benefit may be given during the offer period in contravention of s623(1). Nevertheless ASIC submitted that, on balance, it considered the preferable view was that mere early settlement of the Tranche A shares would not, of itself, constitute a prohibited benefit under s623(1).15

- We do not consider that this circumstance has an effect giving rise to unacceptable circumstances in this case.

Equal Distribution Statement and Equal Distribution Process

- In section 11 of the bidder's statement, PMQ made the statement that "[i]f Brismark accepted the Offer in respect of its entire stake in Brisbane Markets and the entire proceeds from this were distributed equally amongst Brismark Members, each Brismark Member would receive a payment of $950,264". Statements of similar effect were included in other sections of the bidder's statement, in a presentation attached to the bidder's statement and in the second supplementary bidder's statement. In these reasons, we refer to any statement to this effect as the Equal Distribution Statement.

- Section 11 of the bidder's statement, as supplemented by the second supplementary bidder's statement, also described a process that would need to be undertaken by Brismark members for Brismark to accept the Offer in respect of its entire stake in BML and make equal distributions to all Brismark members in order to give effect to the Equal Distribution Statement. In these reasons, we refer to this process as the Equal Distribution Process.

- The Brismark Rules provided that "[p]art of the surplus arising in a year from the business of Brismark, or any part of the reserves may be paid to a Member by way of rebate based on the business done by the Member with Brismark as determined by the Board". The Equal Distribution Process proposed by PMQ involved Brismark members passing a special resolution to amend this rule to provide that the surplus (or reserve) could be paid by way of a rebate equally among members or based on business done by members. No submissions identified any other provision of the Brismark Rules or Cooperatives Act that could be relied upon for distributions to Brismark members.

- BML submitted that the Equal Distribution Statement and the description of the Equal Distribution Process in the bidder's statement, as supplemented by the second supplementary bidder's statement, were misleading and deceptive for a number of reasons including that:

- it was unlikely that the proceeds of any sale of Brismark's BML shares would be a "surplus" for purposes of the Brismark Rules or the Cooperatives Act and, therefore, a separate procedure would be required to distribute the proceeds to Brismark members, "if in fact such a distribution is possible at all"

- if such proceeds were a "surplus", the combined effect of certain sections of the Cooperatives Act was that Brismark could not amend the Brismark Rules to pay a rebate out of the surplus equally among its members because Brismark could only pay a rebate out of the surplus on the basis of the business done by each member with Brismark and

- while PMQ had acknowledged in the second supplementary bidder's statement that any proceeds received by Brismark members may be reduced by tax or the repayment of debt, PMQ had not explicitly stated that it was unlikely that Brismark members would receive $969,31316 after taking into account those reductions.

- PMQ submitted that any confusion about the process by which the proceeds from the sale of Brismark's BML shares could be distributed to Brismark members had been adequately addressed by the second supplementary bidder's statement. Further, the sale of Brismark's BML shares was not a condition of the bid and therefore was not material to BML shareholders. Notwithstanding its submissions, and while it denied breaching s636(1)(m), PMQ offered to retract the Equal Distribution Statement and its explanation of the Equal Distribution Process.

- BML submitted that the Equal Distribution Statement was "intrinsically bound up" with achieving the Industry Shares Condition. This was because Brismark would only agree to a variation of the industry shares in the context of selling its BML ordinary shares and the Equal Distribution Statement was made to encourage Brismark members to apply pressure to Brismark to accept the Offer for its ordinary shares.

- Brismark submitted (separately from BML) that the matters were intrinsically related and that it was aware from speaking to its members that the promise of $1 million to each Brismark member was extremely influential, particularly for smaller operators in the markets. Brismark provided an opinion of counsel to the effect that it was not possible for the Brismark Rules to be amended to enable any "surplus" arising from the sale of Brismark's BML shares to be distributed equally among Brismark members.

- We decided to ask parties in a supplementary brief whether the Equal Distribution Statement was misleading and whether disclosure of the Equal Distribution Process was necessary to enable BML shareholders to assess the merits of the bid. We also asked whether it was impossible for the proceeds to be distributed equally among Brismark members and, if not, what BML shareholders and Brismark members should be told regarding the process for achieving equal distribution.

- BML submitted that it had not reached any definitive conclusions regarding the possibility of equal distribution beyond determining what it described in paragraph 46.

- ASIC submitted that the Equal Distribution Statement referenced a future matter and accordingly required a reasonable basis.17 It submitted that there would be matters in respect of which PMQ would need to have certainty in order to have a reasonable basis to make a statement outlining to the nearest dollar the amount that would be received by Brismark members on any distribution. Among other things, ASIC queried whether there was certainty in this case given the tax that may be payable by Brismark and PMQ's statement that it could not make an assessment as to whether any amount may be "surplus".

- PMQ submitted that the Equal Distribution Statement was not misleading and it had a reasonable basis for making the statement following a close review of the Cooperatives Act, the Brismark Rules and discussions with the Registrar of Cooperatives. It submitted that a distribution would be legally possible if the Registrar approved the proposed amendment to the Brismark Rules.18

- We consider the Equal Distribution Statement to be potentially misleading because:

- it is unlikely the dollar amount disclosed by PMQ is accurate (given, for instance, deduction for taxes) and

- it is unlikely PMQ could calculate the amount each Brismark member would receive (given the uncertainty regarding distribution of the proceeds among Brismark members).

- For this reason, we consider that the Equal Distribution Statement should be retracted.

- ASIC submitted that, had PMQ not made the Equal Distribution Statement, the Equal Distribution Process may not have been a matter requiring disclosure. We agree. On this basis, we accepted the retraction offered by PMQ of the disclosure relating to the Equal Distribution Process.

Industry Shares Variation Process

- In section 10 of the bidder's statement the bidder described the process for varying the special rights of the industry shares in order to satisfy the Industry Shares Condition. The process was that members of Brismark would need to pass a special resolution to permit the disposal of the industry shares and shareholders of BML would need to pass a special resolution to amend BML's constitution to vary the rights attaching to the industry shares. PMQ attached to the bidder's statement blank requisitions of meetings of shareholders of each of Brismark and BML. In these reasons, we refer to this process as the Industry Shares Variation Process.

- In our brief, we asked questions relating to the steps which needed to be undertaken to satisfy the Industry Shares Condition in order to determine whether the existing disclosure was accurate and whether the steps were achievable. Our concerns regarding the description of the Industry Shares Variation Process in the bidder's statement included whether disclosure was required as to the following matters raised in BML's application:

- the need for a special postal ballot of Brismark members (which required a three-quarters majority), in addition to the passing of a special resolution at a general meeting of Brismark members (which required a two-thirds majority)

- the need for disclosure statements or expert reports in connection with a meeting of Brismark members and

- the recovery of costs from Brismark members if a special postal ballot was unsuccessful.

- PMQ submitted that it was prepared to provide corrective disclosure to address our concerns regarding the Industry Shares Variation Process and provided draft corrective disclosure.

- BML also raised a number of technical issues with PMQ's draft corrective disclosure and sought disclosure of further details. The corrective disclosure proposed by PMQ is not in our opinion misleading, and balancing the provision of additional detail for technical precision and the reduced comprehensibility by the inclusion of those details, we do not require the additional details.19 If BML wants to disclose further details it is free to do so.

Funding Arrangements

- In section 5 of the bidder's statement PMQ described that the bid would be funded through a combination of equity funding from funds under management of VGI and a number of selected VGI clients who had entered into binding equity commitment letters with PMQ.

- In section 1 of the first supplementary bidder's statement, without reference to the previous disclosure in the bidder's statement, PMQ stated that it would fund the total consideration from funds held in bank accounts controlled by VGI. It also stated that, following completion of the Offer, funds of a number of selected VGI clients (who may comprise individuals, family offices and endowment funds) and VGI shareholders would be used to repay the funds drawn by PMQ from VGI.

- BML submitted that neither the bidder's statement nor the first supplementary bidder's statement complied with s636(1)(f) because:

- the cash amount held by PMQ for payment of the bid consideration was not disclosed

- the identities of PMQ's investors who were to provide, directly or indirectly, the cash consideration were not disclosed and

- the details of the arrangements under which the cash consideration would be provided by PMQ's investors were vague and contradictory as between the bidder's statement and the first supplementary bidder's statement.

- BML also submitted that the failure to identify PMQ's investors and associated arrangements was contrary to the principles in s602(a) and s602(b)(iii).

Source of VGI's funds

- Guidance Note 14 – Funding Arrangements provides that a bidder should consider making disclosure in relation to "establishing that its funder has the necessary financial resources".20

- We consider PMQ's funding disclosure in the bidder's statement and first supplementary bidder's statement to be deficient because it failed to establish adequately that VGI has the necessary financial resources to provide the funding. We require corrective disclosure that describes the source of the funds in VGI's bank accounts and VGI's capacity to use those funds for the purposes of paying the bid consideration given the investment mandate of each of its existing Investment Funds from where the consideration was being sourced.

Repayment of VGI funding by PMQ

- PMQ provided a copy of the commitment deed between VGI and PMQ pursuant to which VGI would fund the Offer. ASIC submitted that the commitment deed described the funding as an investment (although the deed was silent on the nature of the investment) and did not provide for repayment of the funds (although the first supplementary bidder's statement contemplated that PMQ would repay the funds with investor monies).

- BML submitted that it was relevant for any BML shareholder who rejected the Offer and remained a shareholder to determine the likelihood of PMQ repaying VGI because it could have an adverse impact on the value of BML shares or assets (for example, if PMQ had to liquidate its investment in BML to repay VGI).

- Guidance Note 14 provides that if the funder is a group member it is appropriate to disclose the terms of the intra-group arrangements.21 We were concerned with the lack of disclosure regarding the repayment of VGI by PMQ and the nature of those arrangements.

- PMQ proposed corrective disclosure to the effect that it would replace the commitment deed with a loan deed. PMQ also provided us with a copy of the final loan deed. We require corrective disclosure that describes the terms of the loan deed, including the repayment terms.

Replacement funding by VGI investors

- The remaining issues for funding were whether there were indirect funders of PMQ's bid whose identities should have been disclosed, and documentation of the revised funding arrangements.

- As noted, PMQ's funding arrangements changed between the lodgement of the bidder's statement and the first supplementary bidder's statement.

- PMQ provided copies of the original equity commitment letters with investors referred to in the bidder's statement (with the names of the investors redacted – see paragraphs 95 to 98). However, ASIC submitted (based on documentation it had received from PMQ including a September 2015 investor presentation, investor update and email correspondence) that there appeared to be side arrangements not incorporated in the equity commitment letters showing that it was VGI's intention that the investors would receive BML shares in consideration for their investment. ASIC submitted that such arrangements would necessitate disclosure of the identity of the investors and the arrangements, and that such persons would generally be associates of PMQ. We agree with ASIC and, had the arrangements remained, we would have required disclosure.

- A further submission by ASIC was made to the effect that, even where the controller of the bid vehicle was a private equity manager, the disclosure requirements in s636 should be assessed against the totality of the arrangements and relationships, and disclosure of investors' identities may be required even though those investors might be considered 'passive' or the entity they were taking an equity interest in was controlled by another person. It noted that there was no general carve out from ss636(1)(f) for 'passive' investors.

- BML submitted that, regardless of whether a bidder was a private equity fund or other financial sponsor, funding disclosure should not deviate from the requirements of s636(1)(a), (f) and (m) and s602(b)(i).

- We agree with ASIC that in certain circumstances (for example, the circumstances described in paragraph 73) disclosure of the identity of investors providing equity funding for a bid may be required even though those investors might be considered 'passive' investors.

- PMQ submitted that its funding arrangements contemplated that the investors (consisting of both existing VGI clients and VGI shareholders) would be unitholders in one or more unit trusts which would invest in PMQ following completion of the bid. The trustees would be wholly owned subsidiaries of VGI. PMQ submitted that the units issued to the investors would have no voting or other rights in respect of how the assets of the fund would be managed and no control over PMQ, the BML shareholding or the operation of BML.

- Based on the proposed new fund structure, for the investors that are not VGI shareholders, we do not view it as necessary to disclose their identity.22 We do, however, require disclosure that clearly states that previous descriptions of PMQ's funding arrangements have been replaced and a full description of the new funds through which the investment is to be made, including the structure of each fund, the name and ownership of each of the trustee and the manager of each fund, the nature and rights of the investors in each fund and the terms of the investment, the number of investors in each fund and the arrangements between each fund and VGI or PMQ.

- A distinction is necessary for those investors that are VGI shareholders. These investors have influence over the conduct of the Offer, PMQ and the new funds as a result of being associated with or controlled by directors of PMQ and VGI or shareholders of VGI. We require PMQ to identify these investors.

- As for documentation, PMQ submitted that under its revised funding structure the nature of the interests that the investors would hold in PMQ and the rights attaching to those interests had not been documented. BML submitted, and we noted, that there was also no documentation that terminated the original arrangements, including the equity commitment letters.

- We share the concerns of BML (and ASIC) that the lack of documentation creates uncertainty. PMQ offered to accelerate the process of putting the documentation in place to establish the new funding arrangements, but ultimately indicated that it would take several weeks to complete.

- Because the existing equity commitment letters gave some of the investors rights of influence over the bid terms and those letters were yet to be varied or replaced, we require PMQ to disclose that the investors will have no influence (themselves or by associates) over the conduct of the bid, the ongoing operation of PMQ or any funds established by VGI, or to provide adequate disclosure of the nature and circumstances of any influence, together with the identities of such investors.

Disclosure of the original funding arrangements

- ASIC submitted that the obligation on PMQ to comply with s636(1)(f) applied at the time of lodgement and service (see s633) and dispatch (see s670A) of the bidder's statement and that a bidder should not be permitted to avoid a disclosure obligation by making subsequent structural changes.

- While ASIC rightly submitted that the Panel frequently seeks to ensure shareholders receive historical disclosures to ensure that the integrity of the takeover process is not undermined,23 in this case we are of the view that describing the historical funding structure in the detail ASIC sought (which included identities) would not be helpful for BML shareholders and may be confusing. We also recognise that a bidder may alter its funding arrangements after it bids and we consider the corrective disclosure sufficiently enables the assessment of the altered funding arrangements.24

Disclosure of PMQ's intention on future gearing

- Upon a review of documents produced to ASIC under notice, ASIC submitted that PMQ may have failed to provide full disclosure under s636(1)(c) of its intentions in relation to the future leverage of BML if PMQ obtains less than 100% control of BML. ASIC referred to a slide in the September 2015 investor presentation that indicated an apparent intention of PMQ to move to a higher level of debt (to that reported at 30 June 2015 of $92 million) which would be used for paying a capital return to investors, repayment of existing debt, transactions costs and working capital.

- PMQ submitted that the investor presentation was a "preliminary document" which included some initial discussion of debt level scenarios but did not represent its intentions at the time. PMQ also submitted that it had not formed any intention with respect to debt levels because it did not have access to due diligence materials in order to conduct proper financial analysis.

- ASIC submitted that PMQ's inability to conduct proper financial analysis did not apply the right test of when an intention must be disclosed. It submitted that "[a]n intention is no less an intention merely because it is contingent or subject to review". Given that the investor presentation was used to seek funding from its existing clients, ASIC submitted that it was appropriate for the Panel to infer that PMQ's intentions were to increase the leverage of BML and, on this basis, PMQ should disclose when its intention changed and why.

- We do not have sufficient evidence from which to infer that PMQ had, or has, the intention to re-leverage BML. However, we are concerned that the statement that PMQ is highly confident that it will be able to refinance existing debt at attractive rates if a change of control provision is triggered, leaves investors with an impression that BML's gearing is going to stay the same when PMQ says that no decision has been made. We require PMQ to provide adequate disclosure of its intentions in respect of the future gearing of BML in the event PMQ obtains less than 100% control of BML or to state that no intention regarding gearing has been formed and why.

Other Issues

Relationship and cooperation with Mr George and S & D

- BML submitted that Mr George was an insider, and potentially a participating insider, for the purposes of paragraphs 10 and 12 of Guidance Note 19 – Insider Participation in Control Transactions, in respect of the takeover bid. It submitted that disclosure of the relationship between Mr George and S & D, on the one hand, and PMQ and VGI, on the other hand, was material to other BML shareholders deciding whether or not to accept the Offer because it would inform them of any benefits that Mr George or S & D would receive over them, any material information that PMQ has that they do not have and anything that may deter other potential bidders for BML.

- PMQ made preliminary submissions that BML's allegations that Mr George had provided confidential information to PMQ or VGI or that there was a higher degree of cooperation between Mr George and PMQ than had been disclosed were "mere conjecture". PMQ also confirmed that Mr George was not an investor supporting PMQ's bid and did not otherwise have any ownership or economic benefit in PMQ or VGI.

- We received no submissions from Mr George or S & D, despite Mr George becoming a party.

- There is insufficient evidence to warrant questioning the relationship of Mr George with the bidder in the takeover bid. We decline to conduct on this issue.

Correction of Courier Mail articles

- BML submitted that the Courier Mail articles (see paragraphs 11 and 12) effectively picking up the Equal Distribution Statement were intended, among other things, to mislead members of Brismark into believing that they would receive approximately $1 million each if Brismark accepted the Offer. It submitted that PMQ had, since the date of the target's statement, access to reliable information regarding the ability of Brismark to distribute equally the proceeds of any sale of its BML shareholding and accordingly, had an obligation to correct the misinformation in the Courier Mail articles which it had not done.

- Having found the Equal Distribution Statement to be potentially misleading (see paragraph 54) and having required the bidder to lodge a supplementary bidder's statement containing a retraction of the statement, we consider that the retraction in a formal takeover document to be sent to all BML shareholders and Brismark members is sufficient to correct any prior media articles disclosing the Equal Distribution Statement. We also consider that, following the publication of these reasons, these articles can be addressed by BML or Brismark directly to the extent they believe they are still an issue.

Request for confidential treatment

- In response to our brief, PMQ requested under Procedural Rule 2.3.1 to withhold from the other parties the identity of any person other than VGI who had provided funds to VGI bank accounts and the identity of each investor and any relevant document that disclosed the identity of any investor. PMQ submitted that the identity of the investors was commercially sensitive information and any disclosure would adversely impact the ability of VGI to attract new sources of funds in the future.25 PMQ also submitted that there was an issue of procedural fairness in requiring the disclosure of the identity of the investors to BML and Brismark prior to the Panel's determination on the issue of whether the identity of the investors should be disclosed in connection with its funding arrangements. PMQ proposed to provide the confidential information to the Panel, but not the other parties.

- We sought submissions on PMQ's request from the other parties. ASIC submitted that, instead of withholding relevant documents, the documents could be redacted in a way that did not reveal the identity of investors, noting however that this may result in ASIC providing less information to the Panel than it otherwise would.

- BML submitted that "for procedural fairness reasons the Panel does not make use of information or documents in relation to which other parties do not have an opportunity to comment".26 Rather, it submitted that the documents in question could be sent to the Panel executive who could advise the Panel of their nature, but not their actual content, in order to decide the application in respect of confidentiality and to the extent any documents are withheld, then the Panel should not allow any submissions from PMQ or VGI in reliance on the withheld information. We are not attracted to the complexity of BML's proposal or the jeopardy in which it puts PMQ.

- We decided to accept documents on a redacted basis. PMQ was requested to provide the redacted documents to all parties (including the Panel). While the redaction potentially reduced our ability to draw conclusions on the application, it gave the applicant the procedural fairness it demanded.

Media Canvassing

- During the proceedings we received a submission from the lawyers for PMQ that a bulletin issued by BML to market tenants (many of whom are BML shareholders and Brismark members) primarily dealing with an issue regarding rents in the Brisbane Markets precinct may breach the media canvassing undertaking BML provided in its notice of appearance.

- We indicated to BML that we were concerned that the bulletin may be in contravention of BML's media canvassing and confidentiality undertakings, in particular the statement "[f]urther to the article in the Courier Mail on 2 January 2016, VGI are continuing to promulgate incorrect information in relation to warehouse rental rates to support their hostile takeover bid" and statements of similar effect. We also indicated our concern with the bulletin from an information in takeover documents perspective. Guidance Note 18 – Takeover Documents requires the same standard of care and same standard of disclosure to be applied to any takeover documents sent to offeree shareholders as is applied to the formal bidder's and target's statements.27 We asked BML for submissions, including why the statements did not contravene, or offend the spirit of, the media canvassing undertakings.

- In connection with BML's response, we accepted an undertaking from BML and Brismark that they would liaise with the Panel before communicating with tenants or other stakeholders regarding any issue raised in the context of the takeover bid that the Panel may reasonably consider relevant to the takeover bid until the Panel publishes its reasons. BML and Brismark also reaffirmed adherence to the media canvassing and confidentiality undertakings.

Decision

Declaration

- It appears to us that the circumstances are unacceptable:

- having regard to the effect that we are satisfied the circumstances have had, are having, will have or are likely to have on:

- the control, or potential control, of Brisbane Markets or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Brisbane Markets and

- having regard to the purposes of Chapter 6 set out in section 602 or

- because they constituted or constitute a contravention of a provision of Chapter 6 of the Act.28

- having regard to the effect that we are satisfied the circumstances have had, are having, will have or are likely to have on:

- Accordingly, we made the declaration set out in Annexure B and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure C that PMQ dispatch a supplementary bidder's statement in a form approved by the Panel, that PMQ provide BML shareholders who have accepted the Offer with a withdrawal right, and that Brismark distribute to its members a copy of the supplementary bidder's statement with a cover letter provided by PMQ (in a form approved by the Panel).

- Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make 'any order'29 if 4 tests are met:

- it has made a declaration under s657A. This was done on 9 February 2016.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons below, we are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 2 February 2016. Each party30 made submissions and rebuttals.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. The orders do this by requiring further disclosure to address the inadequacies in disclosure and to retract the potentially misleading statements in the bidder's statement and supplementary bidder's statements and a withdrawal right, so that the takeover will proceed as it would have if the circumstances had not occurred.

- BML submitted in effect that the language of the proposed retraction should be unequivocal and unqualified. In order to mitigate the prejudicial and adverse effects of what it viewed as a weak retraction, BML submitted that the language of the retraction should be strengthened and it needed to be repeated in every place it appeared in the bidder's statement and further communicated by a half page advertisement in the Courier Mail. In our view, a newspaper advertisement is unnecessary particularly where the supplementary bidder's statement is to be mailed to all BML shareholders and Brismark members. Further, we believe the language of the retraction is appropriate. Following the publication of these reasons, if BML and Brismark wish to say more, they will be free to do so.

- In addition, BML submitted that we should consider a further order requiring PMQ and VGI not to make any subsequent bid with a condition or requirement similar to the Equal Distribution Statement or Industry Shares Condition without first obtaining approval from the Registrar of Cooperatives. We view such an order as unnecessary.

- PMQ submitted that we should not make a declaration and orders. It offered to provide an undertaking to issue the supplementary bidder's statement containing corrective disclosure to the satisfaction of the Panel and to extend the offer period by more than one month, triggering withdrawal rights for accepting shareholders under s650D(1). PMQ submitted that there was no practical or enforcement advantage to making the declaration and orders.

- BML and ASIC submitted that we should make a declaration and orders. BML submitted that the Panel's decision in Northern Iron Ltd,31 where the Panel was minded to make a declaration of unacceptable circumstances notwithstanding that the substantial shareholder had offered corrective disclosure, was apposite.

- We agree. In Northern Iron, the Panel provided that:

"There has been a long period of non-disclosure, there have been breaches of the Act, there have been a number of iterations of substantial holder notices with steadily increasing (but still incomplete) amounts of information, and complete disclosure has not yet been made… In our view, a declaration of unacceptable circumstances is justified and necessary. Moreover, should it become apparent that the information now proposed to be disclosed is also incomplete, orders can be varied if a declaration has been made."

- While PMQ and VGI have been generally cooperative throughout the proceedings, there have been multiple iterations of the proposed supplementary bidder's statement with increasing amounts of information and at the time of our decision to make a declaration of unacceptable circumstances, the disclosure was still incomplete. Given the fact that the new funding arrangements are yet to be documented and the deadline for making a declaration without a court-ordered extension was, at the time, fast approaching, there is practical advantage for us in making the declaration and orders. For one thing, we can vary orders if the original orders do not satisfactorily address our concerns. An undertaking, on the other hand, cannot be varied unless the person giving the undertaking agrees to do so.

Costs

- BML sought a costs order.

- The Panel's approach to costs orders is to allow a party to make, or resist, an application once without exposure to a costs order, provided it presents a case of reasonable merit in a businesslike way.32

- Here, we indicated to the parties that we were not minded to make an order for costs, but may revisit a costs order depending on how efficiently the additional disclosure issues are resolved.

- The supplementary bidder's statement was settled without a number of further rounds of amendments. Accordingly, we do not revisit the question of costs.33

Peter Hay

President of the sitting Panel

Decision dated 9 February 2016

Reasons published 9 March 2016

Advisers

| Party | Advisers |

|---|---|

| Brisbane Markets Limited and | HopgoodGanim Lawyers Morgans Corporate Limited |

| The Queensland Chamber of Fruit and Vegetables Industries Co-Operative Limited | HopgoodGanim Lawyers |

| VGI Partners Pty Ltd and Produce Markets Queensland Pty Ltd | Gilbert & Tobin |

| Simon George | Mullins Lawyers |

Annexure A

Australian Securities and Investments Commission Act (Cth) 2001

Section 201A

Undertaking

Brisbane Markets Limited

Pursuant to section 201A of the Australian Securities and Investments Commission Act 2001 (Cth), Produce Markets Queensland Pty Ltd (PMQ) undertakes to the Panel that, until the conclusion of the Panel's deliberations on the application of BML dated 6 January 2016, PMQ will not do any of the following:

- Process any acceptances that it receives from BML shareholders under the offer described in the bidder's statement dated 12 November 2015.

- Lodge any further supplementary bidder's statement.

- Take any action under the pre-bid deed dated 9 November 2015 entered into by PMQ and S & D George Investments Pty Limited.

PMQ further undertakes that, at the conclusion of the Panel's deliberations, it will confirm in writing to the Panel that it has satisfied its obligations under this undertaking.

Signed by David F. Jones of Produce Markets Queensland Pty Ltd, 39 Phillip Street, Sydney New South Wales 2000, with the authority of Produce Markets Queensland Pty Ltd

Dated 13th January 2016

Annexure B

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Brisbane Markets Limited

Circumstances

- Brisbane Markets Limited (Brisbane Markets) is an unlisted company with more than 50 members. Brisbane Markets' issued capital consists of 42,500,000 ordinary shares and 4 industry shares.

- The Queensland Chamber of Fruit and Vegetable Industries Co-operative Limited (Brismark) has a relevant interest in 33.89% of Brisbane Markets and holds all 4 Brisbane Markets industry shares.

- On 9 November 2015, Produce Markets Queensland Pty Ltd (PMQ), a wholly-owned subsidiary of VGI Partners Pty Ltd (VGI), entered into a pre-bid deed (pre-bid deed) with S & D George Investments Pty Ltd.

- On 12 November 2015, PMQ lodged a bidder's statement with ASIC in relation to an off market bid for the shares in Brisbane Markets for $3.50 per share. It subsequently lodged supplementary bidder's statements on 18 December 2015 and 23 December 2015.

- The bidder's statement and supplementary bidder's statements contain information deficiencies, in that in aggregate they:

- do not adequately disclose:

- the terms of the pre-bid deed and PMQ's ability to exercise certain rights under the pre-bid deed

- the process by which rights under the industry shares may be varied

- PMQ's funding arrangements for its bid and

- PMQ's intentions in relation to Brisbane Markets' future gearing in the event that PMQ obtained less than 100% control of Brisbane Markets and

- potentially mislead Brisbane Markets' shareholders about the bid proceeds that could be distributed to Brismark members if Brismark accepts the bid.

- do not adequately disclose:

- By reason of the information deficiencies, Brisbane Markets' shareholders:

- have not been given enough information to enable them to assess the merits of PMQ's bid and

- are required to make decisions whether to hold their shares or accept the offer on the basis of inadequate information, causing the market for control in Brisbane Markets not to be efficient, competitive and informed.

- It appears to the Panel that the circumstances are unacceptable:

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- the control, or potential control, of Brisbane Markets or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Brisbane Markets and

- having regard to the purposes of Chapter 6 set out in section 602 of the Corporations Act 2001 (Cth) (Act) or

- because they constituted or constitute a contravention of a provision of Chapter 6 of the Act.

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Brisbane Markets.

Alan Shaw

Counsel

with authority of Peter Hay

President of the sitting Panel

Dated 9 February 2016

Annexure C

Corporations Act

Section 657D

Orders

Brisbane Markets Limited

The Panel made a declaration of unacceptable circumstances on 9 February 2016.

The Panel Orders

- Produce Markets Queensland Pty Ltd (PMQ) must issue a third supplementary bidder's statement in relation to its bid for Brisbane Markets Limited (BML), in a form approved by the Panel, that includes the following changes to the draft provided to the Panel on or about 4 February 2016:

- adequate disclosure that PMQ will not exercise the call option, pursuant to a pre-bid deed between PMQ and S & D George Investments Pty Ltd dated 9 November 2016, if its exercise would contravene, or would give rise to a contravention of, s623(1) of the Corporations Act 2001 (Cth)

- adequate disclosure that PMQ needs either the written consent or a separate resolution of The Queensland Chamber of Fruit and Vegetable Industries Co-operative Limited (Brismark) to give effect to the variation of the special rights of the industry shares

- either a statement that investors who have signed equity commitment letters have no influence (themselves or by associates) over the conduct of the bid or the ongoing operation of PMQ or any funds established by VGI Partners Pty Ltd (VGI), or adequate disclosure of the nature and circumstances of any influence together with the identities of such investors

- clarification that the statement "each Investor will be a passive investor in each of the New Funds and will have no control over Produce Markets Queensland or its decisions with respect to how it manages its shareholding in Brisbane Markets or in relation to any of the business operations of Brisbane Markets Limited" may not apply to the VGI shareholders, or entities associated with VGI shareholders, who are also investors, naming those investors

- adequate disclosure of PMQ's intentions in respect of the future gearing of BML in the event PMQ obtained less than 100% control of BML or that no intention regarding gearing has been formed and why and

- amendments to reflect adequately the withdrawal rights referred to in order 3.

- PMQ must dispatch the third supplementary bidder's statement by express post to everyone to whom offers were made and any other BML shareholder.

- PMQ must:

- give each BML accepting shareholder (being one who has accepted PMQ's offer in the period from the opening of the offer until the date 5 business days after dispatch of the third supplementary bidder's statement) a right to withdraw its acceptance for a period of 15 business days from the date the third supplementary bidder's statement is dispatched by PMQ

- inform each BML accepting shareholder of the right to withdraw, and give them a Form for exercise of that right, each in a form approved by the Panel and

- do all things reasonably required to give effect to a withdrawal.

- On the same day that the third supplementary bidder's statement is dispatched by PMQ, PMQ must provide Brismark with sufficient copies of:

- the third supplementary bidder's statement and

- a cover letter which explains why Brismark members are receiving the third supplementary bidder's statement

each in a form approved by the Panel.

- Within 2 business days of receipt of the third supplementary bidder's statement and cover letter referred to in order 4, Brismark must:

- dispatch the documents to its members by express post, with no other documents to accompany them and

- advise PMQ that it has completed dispatch in accordance with these orders.

Alan Shaw

Counsel

with authority of Peter Hay

President of the sitting Panel

Dated 10 February 2016

1 Unless otherwise noted, BML and Brismark made joint submissions

2 PMQ and VGI made joint submissions

3 The amount increased from $950,264 in the bidder's statement to $969,313 in the second supplementary bidder's statement because the number of members of Brismark changed from 53 to 52 members

4 References are to the Corporations Act 2001 (Cth) unless otherwise indicated

5 The purpose of an interim order is to prevent unacceptable circumstances from happening, continuing or getting worse while the proceedings are conducted, to preserve the status quo until proceedings are completed or to ensure that the Panel's power to fashion the most appropriate remedy in the circumstances is not forestalled by intervening events. See Guidance Note 4 – Remedies General at [10]

6 Procedural rule 3.1.1(c) requires an application not to exceed 10 A4 pages in 12 point for the details of the application

7 Procedural rule 10.2.1 requires the rules to be interpreted according to their spirit, by looking beyond form to substance and in a way that best promotes the objectives in rule 1.1.1

8Brockman Resources Limited [2011] ATP 3 at [131]

9 ASIC Regulations 2001, regulation 16(2)(c)

10 See Breakfree Limited 04(R) [2003] ATP 42 at [47]: "…we consider that the Panel is entirely justified in considering all the factual matters and other issues that are raised by the application and all facts and issues that are logically connected with those factual matters and other issues". Also see discussion in Mungana Goldmines Limited 01R [2015] ATP 7 at [29] – [49]

11BC Iron Limited [2011] ATP 6 at [30]

12 Guidance Note 21 – Collateral Benefits at [5]

13 Quoting Savage Resources Ltd v Pasminco Investments Pty Ltd [1998] 30 ACSR 1 at [18] which considered that the right to retain shares or sell into a rival offer may not be a benefit given by the holder in contravention of s623(1)

14 Referring to Note 2 to s651A(1) which states that "[t]he effect of s623 is that a purchase outside the bid has to be made through an on-market transaction" and the exception for purchases on-market in ASIC Regulatory Guide 9 – Takeover Bids at [200] which states that "…the competitive market process should afford holders equal access and opportunity to participate in any benefits, and limit the risk that the bidder is able to selectively direct the benefits flowing from its purchases to particular target holders: see also item 2 of s611. Accordingly, the definition of 'on-market' generally excludes transactions that are prearranged between the parties (including special crossings)'". In this regard, ASIC acknowledged that it would have been possible for the call option to be structured as a pre-bid acceptance agreement whereby S&D agreed to accept the bid if the bid was increased to the alternative offer price

15 Referring to Sagasco Amadeus Pty Ltd v Magellan Petroleum Australia Ltd [1993] HCA 14 and inter alia the fact that it appeared any early payment for the Tranche A shares would correspond with early settlement. ASIC did however note that the matter is not necessarily free from doubt given changes to the law since Magellan. See also Citect Corporation Limited [2006] ATP 6 at [56]-[58]

16 See footnote 3

17 Section 670A(2)

18 Relying on section 101(8) of the Cooperatives Act which provides that the rules of a cooperative may "contain other provisions not inconsistent with the Act"

19 See Guidance Note 18 – Takeover Documents at [10-11]: "[a]ccessibility is enhanced by providing key information to the audiences in an effective manner"

20 Guidance Note 14 – Funding Arrangements at [21(a)]. See Tower Software Engineering Pty Ltd 01 [2006] ATP 20 at [53]-[64]

21 Guidance Note 14 – Funding Arrangements at [21(b)]

22 See MYOB Limited [2008] ATP 27 at [11(b)] and Austar United Communications Limited [2003] ATP 16 at [33-38]

23 Referring to Affinity Education Group Limited [2015] ATP 9 at [185-186] and Richfield International Limited [2015] ATP 4 at [121], although there may be a distinction drawn in that those cases involved disclosure of relevant interests

24 See Guidance Note 14 – Funding Arrangements at [6] which provides that, at the time of the alteration, it is appropriate to assess whether the altered funding is in place, or there is a reasonable basis for the bidder to expect that it will be in place, and whether it materially adversely affects target shareholders and the market for target (and bidder) shares

25 Each equity commitment letter provided that the letter not be disclosed subject to certain exceptions including disclosure in the bidder's statement (provided the investor was not named) and if required by law

26 Citing Austar United Communications Limited [2003] ATP 16 at [55] and Multiplex Prime Property Fund 03R [2009] ATP 23 at [8].

27 See Guidance Note 18 – Takeover Documents at [40]-[42]

28 Each of (a), (b) and (c) are found in the alternative

29 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

30 Other than Mr George

31 [2014] ATP 11 at [45]-[46]

32 Guidance Note 4 – Remedies General at [28(d)]

33 In contrast see Minemakers Limited [2012] ATP 8 at [71]-[77]