[2016] ATP 4

Catchwords:

Declaration – orders – unlisted company – shareholder intention statements – undervalue statements – independent expert's report – VWAP – disclosure – supplementary target's statement – letter to shareholders – definitive feasibility study – consent

Corporations Act 2001 (Cth), sections 602, 638, 640, 643, 644, 657A, 657C, 657D, 674

Guidance Note 4 Remedies General – Guidance Note 18 Takeover Documents – Guidance Note 22 Recommendations and Undervalue Statements – Guidance Note 23 Shareholder intention statements – ASIC Regulatory Guide 25 Takeovers: False and misleading statements

Tully Sugar Limited 01R [2010] ATP 1 – Tully Sugar Limited [2009] ATP 26 – Programmed Maintenance Services Limited 02 [2008] ATP 9 – Universal Resources Limited [2005] ATP 6 – General Property Trust [2004] ATP 30 – Sirtex Medical Limited [2003] ATP 22 – Goodman Fielder Ltd 02 [2003] ATP 5 – Brickworks Ltd 01 [2000] ATP 6

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | Yes | Yes | Yes | No |

- The Panel, Richard Hunt (sitting President), Andrew Lumsden and Karen Phin, made a declaration of unacceptable circumstances in relation to the affairs of Gulf Alumina Limited. The application concerned an off-market scrip takeover offer by Metro Mining Limited for Gulf. The Panel considered that a letter to shareholders from Gulf and Gulf's target statement contained insufficient and misleading information regarding (among other things) the value of Gulf and shareholder intention statements. The Panel ordered corrective disclosure.

- In these reasons, the following definitions apply.

- February letter

- Letter from Gulf to its shareholders dated 12 February 2016

- December letter

- Letter from Gulf to its shareholders dated 3 December 2015

- DFS

- Definitive feasibility study

- Gulf

- Gulf Alumina Limited

- Metro

- Metro Mining Limited

- Metro offer

- The off-market scrip takeover offer by Metro for Gulf at 3.3 Metro shares for every 1 Gulf share

- Nanshan

- Shandong Nanshan Aluminium Co. Ltd

Facts

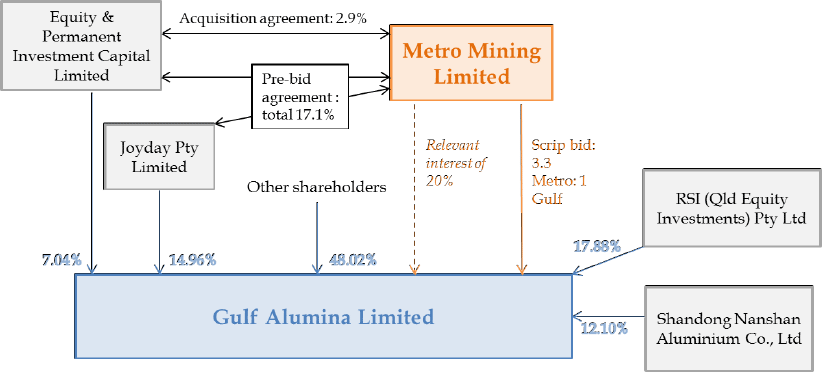

- Gulf is an unlisted company with over 50 members. Metro is an ASX listed company (ASX code: MMI). Metro has a relevant interest in 20% of Gulf's shares due to pre-bid acceptance agreements with two Gulf shareholders.

- On 2 December 2015, Metro announced an off-market scrip takeover offer for all the shares in Gulf at 3.3 Metro shares for every 1 Gulf share (implied value of $0.215 per Gulf share). If 100% of Gulf shareholders accept the offer, they will own 44% of the combined group.

- On 3 December 2015, Gulf sent the December letter to its shareholders which stated, among other things, that:

- the Metro offer "materially undervalues [the Skardon River Bauxite Project] as well as the prospective value of Gulf's other bauxite rich tenements expected to be developed…"

- "Metro's unsolicited approach fails to recognise the key value differentials between the two projects and should be rejected" and

- "we have a near final DFS with substantially larger NPV (c $500m) than Metro's".

- On 10 December 2015, Metro lodged its bidder's statement.

- On 6 January 2016, Gulf issued its target's statement, recommending that shareholders reject the Metro offer. The target's statement disclosed the following shareholder intention statement:

Fifteen of Gulf's Shareholders holding in aggregate 70.6% of Gulf's Shares have stated that it is their current intention not to accept the Offer. Unless Non-participating Gulf Shareholders change their intentions, the Offer will not succeed.

Each of the Non-participating Gulf Shareholders informed Gulf by letters dated between the dates of 15 December 2015 and 3 January 2016 that it had no current intention of accepting the Takeover Offer from Metro Mining Limited...

The statements by Non-participating Gulf Shareholders are as to current intentions and are not binding on them. However, as at the date of this Target Statement, Gulf is not aware that any Non-participating Gulf Shareholder has changed its intention.

- On 12 February 2016, Gulf sent the February letter to its shareholders disclosing, among other things, that Gulf had completed its final DFS in December 2015 and the latest project net present value had improved by $62m over the interim DFS.

- The diagram below shows the relevant structure:

Application

- By application dated 15 February 2016, Metro sought a declaration of unacceptable circumstances.1 Metro submitted that Gulf had contravened section 6382 because Gulf had:

- provided inadequate information supporting the rejection of the Metro offer as undervaluing Gulf

- disclosed shareholder intention statements that were misleading

- provided inadequate information supporting statements about Gulf's near term funding options and

- made statements that were incorrect or misleading concerning:

- environmental impact statement approval and mine construction timeframes

- Gulf's infrastructure

- the renewal of Gulf's mining leases

- Gulf's off-take heads of agreement with Nanshan

- the mining potential of Gulf's Skardon River north tenement

- Gulf's definitive feasibility study and

- Gulf's convertible notes.

- Metro submitted that:

- the effect of the circumstances was that Gulf had not provided its shareholders with sufficient information to enable them to assess the merits of the Metro offer, contrary to the principle in s602(b)(iii) and

- this effect was exacerbated by the fact that Gulf is an unlisted public company and not subject to the continuous disclosure regime under the Corporations Act.3

Final orders sought

- Metro sought final orders that:

- Gulf prepare and lodge a supplementary target's statement correcting the information deficiencies in a form approved by the Panel (which annexes a copy or includes a summary of Gulf's DFS)

- Gulf appoint an independent expert (to be determined by the Panel) to prepare a report that states whether, in the expert's opinion, the Metro offer is fair and reasonable and

- Gulf prepare and lodge a supplementary target's statement annexing the independent expert's report and addressing the disclosure required under s638(3).

Preliminary submissions

- Gulf made preliminary submissions to the effect that:

- it had engaged with Metro to negotiate commercial terms on which to proceed. Metro applied to the Panel before any outcome was evident and

- the Panel should not conduct proceedings as it was prepared to issue a supplementary target's statement and take reasonable steps to seek to resolve differences between it and Metro. It was willing to provide an undertaking to this effect and requested Metro do the same.

Discussion

- We have considered all the submissions and rebuttals from parties, but in relation to the issues in this section, address specifically only those we consider necessary to explain our reasoning.

Undervalue statements

- Metro submitted that the statements made in the December letter (see paragraph 5) were undervalue statements within the meaning of Guidance Note 22 – Recommendations and Undervalue Statements and the Gulf directors had not provided the bases for them in the December letter or the target's statement.

- We agree that the statements are undervalue statements.4 Guidance Note 22 provides that if a target's directors make a recommendation, and it includes (expressly or by implication) an undervalue statement, then they should either make their reasons for the recommendation clear or, if more work is needed to finalise the reasons, they should clearly state that the reasons for the recommendation will be disclosed later (but no later than the issue of the target's statement).5

- Gulf submitted that the undervalue statements were based on Gulf's near final DFS,6 which demonstrated a substantially larger NPV for Gulf of around $500m, compared to the NPV for Metro's project of $235m. Gulf submitted that it was not legally required to procure an independent expert's report and that "Gulf Shareholders should base their decision whether or not to accept the offer on the relative merits of the projects rather than on their respective value".

- ASIC submitted that it was only rarely that a target board could justify an undervalue statement based solely on qualitative factors, which may include "where the offer price is less than an alternative offer for the target, or is at a discount to the target's current market price". ASIC submitted that those circumstances do not appear to be applicable here.

- We consider that Gulf did not provide, in either the December letter or target's statement "clearly disclosed reasons, which are soundly based and reasonable"7 for the undervalue statements. Gulf provided draft disclosure which stated that shareholders should ignore, and Gulf directors were no longer relying on, the December letter. We accept this retraction.

- However, the target's statement contained insufficient information regarding the comparative value of Gulf as a standalone entity and the Metro offer, and the bases on which the directors recommended that shareholders reject the Metro offer. We think this needs to be addressed.

- Metro submitted that "[i]n our experience, there has been no better case for the Panel to require the appointment of an independent expert and, if not in these circumstances, it is difficult to envisage a situation when the Panel might exercise such a power".

- ASIC submitted that "an assessment of the value of bid consideration and the value of target shares is information that all investors and their advisers reasonably expect will be provided to them by the Target" under s638. We agree. This is consistent with Guidance Note 22, which states that regardless "of whether a recommendation is made, directors must provide shareholders with some guidance as to the value of the target".8

- However when an undervalue statement is made, more is required. The Panel in Goodman Fielder Ltd 02 considered that "[w]hether or not an independent expert is retained, ASIC policy and contemporary standards require the basis of a valuation or forecast to be set out, sufficiently to allow an assessment of its reliability".9

- Gulf is not required under s640 to obtain an independent expert's report; nor is the target board beholden to the bidder.10 Gulf must nevertheless provide sufficient information for its shareholders to determine whether to accept the Metro offer. We therefore invited Gulf to choose between either:

- providing a comparative value of Gulf as a stand-alone entity on the one hand and Metro offer on the other hand (being, a consideration of Gulf as 44% of the merged entity) or

- obtaining an independent expert's report. Gulf chose to do this.

- Gulf also stated in the December letter that it had a "near final DFS with substantially larger NPV (c $500m) than Metro's". Metro submitted that, while it was not market practice for a listed company, Gulf should release its full DFS because (among other reasons) Gulf was an unlisted company, had not obtained an independent expert's report and had not provided any other probative measures of value.

- Gulf provided a summary of its final DFS in a draft supplementary target's statement. In our view the summary was insufficient. We required Gulf to provide further disclosure of its DFS, in content and form, sufficient to allow a direct comparison to the Metro DFS (provided in the bidder's statement and in a market announcement by Metro dated 5 November 2015). When Gulf provided the further disclosure, we considered whether the capital expenditure assumptions and the expertise and experience of the personnel who compiled the DFS was sufficiently disclosed. Had Gulf not opted to obtain an expert's report we would have required additional disclosure of this as well.

Shareholder intention statements

- Metro submitted that the intention statement referred to in paragraph 7 was "liable to mislead or deceive a reader given it ha[d] been expressed as a 'current' intention'" and was inconsistent with Guidance Note 23 Shareholder intention statements.11

- ASIC submitted that, while the statement was expressed as the present intention of the shareholders involved, the shareholders were reserving their rights by reason of the qualification that the statement was not binding on them and suggesting that they could change their minds. ASIC submitted therefore that "there does not appear to be a departure from the policy underlying GN 23".

- By the time of submissions on the brief, Gulf submitted that the non-participating shareholders had "further reiterated their intentions in more definite terms, by way of letters to Gulf's board between 17 February 2016 and 24 February 2016…" It provided the following disclosure in a draft supplementary target's statement:

Fifteen of Gulf's Shareholders holding in aggregate 71.0% of Gulf's Shares have now advised…that they will not accept the [Metro offer]. [One of the non-participating shareholders] stated that nor will it accept any revised offer from Metro unless that offer is an improved offer, with all other fourteen shareholders stating nor will they accept any improved offer from Metro Mining Limited other than a substantially improved offer, taking account of whether it has been recommended to Gulf shareholders unanimously by the Gulf Board, and the reasons for that recommendation.

- As to this, ASIC submitted that the subsequent intention statement was "vague and unclear to the extent that they refer to a 'substantially improved offer'". We agree, but think that this can be the separately considered, should the situation arise that the shareholders do not accept an improved offer.12 It is also unclear in the draft supplementary target's statement whether the subsequent statement is an expression of current intention.

- Gulf offered not to refer to the subsequent intention statement and revert back to the earlier intention statement. We do not see how Gulf can revert to the earlier intention statement. It is a statement by the non-participating shareholders and would have to be changed by them.13 We require Gulf to retract the earlier intention statement and disclose the subsequent intention statement.

- Metro submitted that the original shareholder intention statement failed to disclose the number of shares and percentage holding of the each of the shareholders. We consider that, consistent with GN 23,14 it is necessary for the market to know the holding (in number and percentage of total Gulf shares) and the relevant relationships (e.g. director, associate of director, etc.) of the non-participating shareholders. Gulf provided further disclosure of these matters.

Convertible notes and the value of Metro's offer

- The bidder's statement said that the Metro offer was a "43% premium to the equity conversion price of Gulf's convertible loan note, which converted into Gulf Shares in July 2015, of $0.15 per Gulf Share" based on "the volume weighted average price (VWAP) of Metro shares for the five day trading period before the date of this Bidder's Statement". In response, Gulf stated in its target statement that the "convertible notes were purchased by a party on an arm's length basis for the equivalent price of $0.2756 per share (including transaction costs) and not $0.15 as claimed by Metro." This was given as one of the reasons for the Gulf directors recommending shareholders reject the Metro offer.

- Metro submitted that Gulf's use of the convertible notes transaction to value Gulf's shares was unreasonable because:

- it related to a transfer of convertible notes and there was insufficient public material to determine the terms of the notes and how they differ from ordinary shares

- the disclosure was insufficient to allow shareholders to make an informed decision about whether the convertible notes transaction was a reasonable measure of the value of Gulf's shares and

- the most recent transaction was in fact the purchase of 2,500,000 shares by Metro on 30 November 2015.

- On further inquiry, Gulf submitted that it was not involved in the subsequent "negotiation of the convertible note sale and purchase transaction." We consider that it was misleading for Gulf's target statement to refer to the convertible note sale as 'arm's length' when Gulf was not involved in the transaction. Gulf agreed to retract this statement.

- We also looked at whether Metro's use of a 5 day VWAP was appropriate given Metro's shares are thinly traded.15 Metro submitted that the 5 day VWAP it had used (calculated using the VWAP of Metro shares for the 5 trading days before lodgement of its bidder's statement) was lower than 5, 10, 30, 90 and 180 VWAP's based on the day that the bidder's statement was dispatched. We decided not to pursue the issue further.

Agreement with Nanshan

- Metro submitted that the disclosure in the target's statement regarding the off-take arrangements with Nanshan gave rise to an inference that the arrangements were binding. For example, Gulf stated "[t]he Bidder's Statement states Gulf does not have off-take arrangements with customers while Metro has an MOU for its product. Gulf shareholders would be aware of the long term arrangement Gulf has with Nanshan, not only by taking a cornerstone shareholding in Gulf soon after inception, but also through the offtake Heads of Agreement (HoA) in relation to product offtaking and funding for the Skardon River project signed in May 2008".

- Gulf clarified that the arrangements were non-binding. We require Gulf to remove references to arrangements with Nanshan being 'legally binding' in the draft supplementary target's statement.

Skardon River north tenement

- The target statement said that Gulf would "…endeavour to increase the Skardon River mine life by mining its Skardon River North tenement (across the river) and adjoining tenements". Metro submitted that the statements regarding the potential for additional mining of this tenement were unsubstantiated, not reasonably based and, therefore, misleading as they implied that resources existed.

- Gulf submitted that it had "never claimed that the Skardon River north tenement has value" but only that it intended to explore and develop its other tenements.

- We think the statements go to value. Gulf represented that mining its north tenement would increase the Skardon River mine life, which would presumably increase the value of the Skardon River mine. We require that Gulf clarify whether the north tenement had been valued, what value Gulf's directors had attributed to it and the reasonable basis for such value. Gulf submitted that there had been no valuation on the north tenement, and agreed to retract the statement and make a positive statement that the north tenement had not been valued.

Environmental Impact Statement

- Metro submitted that the target's statement provided misleading information about the progress of Gulf's environmental impact statement, including that the Gulf project would receive approval in April 2016 and construction would commence in May 2016. Metro submitted that, using statutory timeframes16 and assuming that Gulf had submitted its supplementary environmental impact statement at the end of January 2016, the best case scenario would be late August 2016 for construction. Gulf submitted that it had a positive working relationship with the relevant regulator and was aiming to reduce the statutory timeframes by approximately 20 business days.

- Gulf agreed to provide disclosure to update the environmental impact statement timetable.

Other issues

- In relation to issues relating to Gulf's infrastructure and mining leases, we did not consider the issues to be material. It is open to the parties to put forward their own position through supplementary disclosure.

Extension of Time

- Section 657C(3)(a) provides that a Panel application can only be made within 2 months after the circumstances have occurred. As the application was made more than 2 months after the December letter, we requested submissions on whether, if we found unacceptable circumstances relating to the December letter, we should extend time under s657C(3)(b). Following submissions we extend the time to make the application.

Decision

Declaration

- It appears to us that the circumstances are unacceptable:

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- the control, or potential control, of Gulf or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Gulf and

- having regard to the purposes of Chapter 6 set out in section 602 and

- because they constituted or constitute a contravention of a provision of Chapters 6 and 6B.

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- Accordingly, we made the declaration set out in Annexure A and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure B. Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make 'any order'17 if 4 tests are met:

- it has made a declaration under s657A. This was done on 11 March 2016.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. We are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 7 March 2016. Each party made submissions and rebuttals.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. The orders do this by requiring corrective disclosure to ensure that shareholders are able to assess the value of their Gulf shares against the Metro offer, including by Gulf providing either a comparative value between Gulf's shares and the Metro offer or obtaining an independent expert's report, and by Gulf retracting misleading statements made in the target's statement.

- Gulf submitted that it will obtain an independent expert's report and requested that we order Metro to provide its DFS, pre-feasibility study and the information required by the independent expert, to the independent expert. Metro had already agreed to provide the documents to the expert. It is in Metro's interests to ensure the expert has the necessary information to provide an accurate opinion of the offer. We do not consider it necessary to make an order.

Variation of orders

- Gulf requested an extension of time to provide corrective disclosure from 6 days to 8 days. We granted the extension (see Annexure C).

Costs

- We indicated to the parties that we were not minded to make an order for costs, but may revisit a costs order depending on how efficiently the additional disclosure issues are resolved. Metro submitted this was a reasonable position to adopt.

- The supplementary target's statement was settled without unreasonable delays. We do not need to revisit the question of costs.

Other matters

Metro announcement dated 15 March 2016

- On 15 March 2016, Metro made an announcement titled 'Takeovers Panel Update' on ASX. Among other things, the announcement stated the following:

- "Given Metro's offer is now UNCONDITIONAL, Gulf shareholders can accept the offer with certainty and enjoy the benefits of being a Metro shareholder relative to remaining a Gulf shareholder, which, as demonstrated by Panel's decision and the further information required by the Panel, has significant risks."

- "As such, Metro urges Gulf shareholders to ACCEPT the offer without delay so the benefits of combining Metro's and Gulf's adjacent and highly complementary bauxite assets in the one entity under the stewardship of Metro's proven board and management team can be realised."

- The announcement also inaccurately summarised our declaration and orders and the accompanying media release.

- The announcement encouraged Gulf shareholders to accept the offer despite our orders for corrective disclosure and the anticipated release of the independent expert's report. We required Metro to make a corrective announcement and, because the announcement had been reported in various media, provide relevant journalists with a copy, which Metro did. We consider that the announcement was inappropriate, and misrepresented what the Panel's decision demonstrated.

Richard Hunt

President of the sitting Panel

Decision dated 11 March 2016

Reasons published 15 March 2016

Post script

- On 23 March 2016, Metro announced a variation to the offer consideration.18 On 24 March 2016, Gulf applied to vary the Panel's orders.

- We made a variation (see Annexure D) to change the definition of 'Metro offer' and allow for any variations in consideration.

- On 7 April 2016, Gulf applied to vary the Panel's orders to give the independent expert more time to complete its report. We made a variation (see Annexure E) to:

- Require Gulf to issue and dispatch a copy of its supplementary target's statements, including a copy of the independent expert's report, by no later than 9 May 2016

- Order that as soon as practicable after 12 April 2016, Metro extend the offer period in relation to the Gulf offer in accordance with the Corporations Act to close on a date not earlier than 7pm (Melbourne time) on 19 May 2016. This order gives Gulf shareholders time after release of the independent expert's report to consider whether to accept Metro's bid.

- Order that, until Gulf issues the supplementary target's statement with the independent expert's report, Gulf must not issue shares, or grant an option over its shares, or agree to make such an issue or grant such an option,19 unless it receives Panel consent. We made this order to mitigate any disadvantage to Metro in the delay in obtaining the independent expert's report and extending the bid.

Advisers

| Party | Advisers |

|---|---|

| Gulf Alumina Limited | Macpherson Kelley |

| Metro Mining Limited | McCullough Robertson Lawyers |

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Gulf Alumina Limited

Circumstances

- Gulf Alumina Limited (Gulf) is an unlisted public company with more than 50 members.

- On 2 December 2015, Metro Mining Limited, an ASX listed company (ASX code: MMI), announced an off-market scrip takeover offer for all the shares in Gulf at 3.3 Metro shares for every 1 Gulf share (Metro offer).

- On 3 December 2015, Gulf sent a letter to its shareholders regarding the Metro offer that contained an unsubstantiated value statement.

- On 6 January 2016, Gulf lodged its target's statement, recommending shareholders reject the Metro offer.

- The target's statement contains insufficient or misleading information regarding:

- the comparative value of Gulf as a standalone entity and the Metro offer, and the bases on which the directors recommend that shareholders reject the Metro offer

- shareholder intentions not to accept the Metro offer

- Gulf's definitive feasibility study

- whether convertible notes used to value Gulf's ordinary shares were properly described as having been transferred on an 'arm's length' basis

- the status and terms of a Heads of Agreement arrangement described as an offtake agreement and

- the value of Gulf's Skardon River North tenement.

- By reason of the information deficiencies identified in paragraph 5:

- Gulf shareholders have not been given enough information to enable them to assess the merits of the Metro offer and

- the acquisition of control over voting shares in Gulf is not taking place in an efficient, competitive and informed market.

- It appears to the Panel that the circumstances are unacceptable:

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- the control, or potential control, of Gulf or

- the acquisition, or proposed acquisition, by a person of a substantial interest in Gulf and

- having regard to the purposes of Chapter 6 set out in section 602 of the Corporations Act 2001 (Cth) (Act) and

- because they constituted or constitute a contravention of a provision of Chapters 6 and 6B of the Act.

- having regard to the effect that the Panel is satisfied the circumstances have had, are having, will have or are likely to have on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Gulf.

Alan Shaw

Counsel

with authority of Richard Hunt

President of the sitting Panel

Dated 11 March 2016

Annexure B

Corporations Act

Section 657D

Orders

Gulf Alumina Limited

The Panel made a declaration of unacceptable circumstances on 11 March 2016.

The Panel Orders

Value disclosure or independent expert's report

- Unless Gulf proposes to obtain an independent expert's report providing an opinion for shareholders on whether the Metro offer is fair and reasonable, Gulf must include in the supplementary target's statement referred to in order 3:

- the comparative value of Gulf as a stand-alone entity on the one hand and the Metro offer on the other hand (that is, including Gulf as 44% of the merged entity) broadly consistent with ASIC's Regulatory Guide 111 Content of expert reports

- a clear explanation of the bases on which the directors have made their recommendation and

- in the DFS:

- a breakdown of the 'Other Infrastructure and contingency' item in the Capital Expenditure table on page 11 and

- disclosure regarding the expertise and experience of the management personnel who compiled the DFS.

- If the directors opt for obtaining an independent expert's report, Gulf must:

- instruct an independent expert within 5 business days of the date of this order and further instruct the expert to report within 4 weeks of the date it is given instructions

- promptly provide such information and assistance as is reasonably required by the expert

- in the supplementary target's statement referred to in order 3 disclose the fact of engagement of an independent expert together with a statement about when that report is expected to be received and a statement that it will be sent to each shareholder to whom offers have been made and

- as soon as practicable after receiving the report issue a supplementary target's statement including the report and send a copy to each shareholder to whom offers have been made.

Corrective disclosure

- Gulf must within 6 business days of the date of this order issue, in a form approved by the Panel, a supplementary target's statement that includes the information in the draft first supplementary target's statement (as amended) provided in response to the Panel's supplementary brief, subject to the following:

- shareholder intention statement disclosure

- disclosure of the statements provided by the non-participating Gulf shareholders between 17 February 2016 and 24 February 2016

- disclosure of the relationship each non-participating Gulf shareholder has with Gulf, if any (e.g. director, associate of a director, related party) and

- clear and prominent retraction of the statements provided by the non-participating Gulf Shareholders between 15 December 2015 and 3 January 2016

- retraction of previous statements

- clear and prominent retraction on page 1 of the supplementary target's statement of the value statement made in the letter to shareholders dated 3 December 2015, and a statement that Gulf directors are not relying on such value statements and

- where retracted information is discussed (e.g. sections 5, 7 and 8 of the draft supplementary target's statement provided), adding "Retraction of…" in the section heading

- corrected statements

- in section 2, removal of the statement in paragraph 1 that the directors' recommendation in the target's statement was "based on the respective merits of Gulf's Project and Metro's Project as set out in the Target's Statement"

- in section 2, paragraph 3, removal of "For this reason also"

- in section 4.5, omission of paragraph 1 and removal of "legally binding" from the second paragraph and

- in section 5, state "…Target's Statement

andas corrected by this First Supplementary Target's Statement along with any further Supplementary Bidder's Statement or Supplementary Target's Statement" and

- a general statement at the beginning of the supplementary target's statement that the corrective disclosure was required by the Panel.

- shareholder intention statement disclosure

Interpretation

In these orders the following definitions apply:

- DFS

- Definitive feasibility study

- Gulf

- Gulf Alumina Limited

- Metro

- Metro Mining Limited

- Metro offer

- The off-market scrip takeover offer by Metro for Gulf at 3.3 Metro shares for every 1 Gulf share

- Non-participating Gulf shareholders

- Shareholders who stated that they intend not to accept the Metro takeover offer

Alan Shaw

Counsel

with authority of Richard Hunt

President of the sitting Panel

Dated 11 March 2016

Annexure C

Corporations Act

Section 657D(3)

Variation of Orders

Gulf Alumina Limited

Pursuant to section 657D(3) of the Corporations Act 2001 (Cth)

The Panel Orders

The final orders made on 11 March 2016 are varied by deleting '6 business days' and substituting '8 business days' in order 3.

Alan Shaw

Counsel

with authority of Richard Hunt

President of the sitting Panel

Dated 21 March 2016

Annexure D

Corporations Act

Section 657D(3)

Variation of Orders

Gulf Alumina Limited

Pursuant to section 657D(3) of the Corporations Act 2001 (Cth)

The Panel Orders

The final orders made on 11 March 2016, as varied on 21 March 2016, are further varied by adding ", or as varied from time to time" in the definition of 'Metro offer'.

Alan Shaw

Counsel

with authority of Richard Hunt

President of the sitting Panel

Dated 1 April 2016

Annexure E

Corporations Act

Section 657D(3)

Variation of Orders

Gulf Alumina Limited

Pursuant to section 657D(3) of the Corporations Act 2001 (Cth)

The Panel Orders

The final orders made on 11 March 2016, as varied on 21 March 2016 and 1 April 2016, are further varied by:

- Replacing the words "as soon as practicable after receiving the report" with "by no later than 9 May 2016" in paragraph 2(d).

- Inserting the following additional orders after paragraph 3:

"4. As soon as practicable, Metro extend the offer period in relation to the Metro offer in accordance with the Corporations Act to close on a date not earlier than 7pm (Melbourne time) on 19 May 2016.

"5. Gulf must not issue shares, or grant an option over its shares, or agree to make such an issue or grant such an option (except where it issues shares on the exercise of any option on issue as disclosed in the first supplementary target's statement), unless it receives Panel consent. This order 5 ceases when Gulf issues the supplementary target's statement, including the independent expert's report, pursuant to paragraph 2(d)."

Alan Shaw

Counsel

with authority of Richard Hunt

President of the sitting Panel

Dated 12 April 2016

1 On 15 February 2016, Metro requested the February letter be considered part of the application

2 References are to the Corporations Act 2001 (Cth) unless otherwise indicated

3 Metro made a submission outside the brief process that it had become aware that Gulf was seeking to raise capital and sought interim orders, or an undertaking from Gulf, to mitigate the effects of this. We considered that the issues raised were not matters under the current application and Metro could make a further application to the Panel if it wished

4Guidance Note 22 – Recommendations and Undervalue Statements at [6] defines an undervalue statement as "a statement, or other representation, that says, or implies, that the value of an offer under a bid is less than the value of the securities in the target the subject of the offer"

5Guidance Note 22 – Recommendations and Undervalue Statements, at [8]

6 Prior to its finalisation, as disclosed in the February letter

7Guidance Note 22 – Recommendations and Undervalue Statements, at [15]

8Guidance Note 22 – Recommendations and Undervalue Statements, at [18]. See also Tully Sugar Limited [2009] ATP 26 at [26], Tully Sugar 01R [2010] ATP 1

9Goodman Fielder Ltd 02 [2003] ATP 5 at [70]

10 see Sirtex Medical Limited [2003] ATP 22 at [66]

11GN 23 – Shareholder intention statements at [8(a)]

12 See ASIC Regulatory Guide 25 Takeovers: False and misleading statements

13 ASIC submitted that Gulf's directors appeared to have been significantly involved in procuring the shareholder intention statements which may have resulted in Gulf obtaining a relevant interest in the shareholders' shares or an association between Gulf and those shareholders. We leave this issue to ASIC if it wishes to make further enquiries

14 Guidance Note 23 – Shareholder intention statements at [11]

15 see General Property Trust [2004] ATP 30 and Guidance Note 18 – Takeover documents at [25]-[26]

16 Under the Environmental Protection Act 1994 (Qld)

17 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

18 To increase the bid consideration to 3.5 Metro shares for every 1 Gulf share conditional on Metro having a relevant interest of 50% in Gulf by or before the end of the offer period and "there being no change to Gulf's capital structure other than as a result of the exercise of options already on issue". ASIC refused to receive or register Metro's notice of variation. Metro stated its intention to improve its offer (subject to the above conditions) in its second supplementary bidder's statement dated 6 April 2016

19 except where it issues shares on the exercise of any option on issue as disclosed in the first supplementary target's statement