[2018] ATP 22

Catchwords:

Tracing notices – failure to disclose – identity of substantial holders – substantial holdings – indirect self-acquisition – efficient, competitive and informed market – declaration – orders – extension of time – standing

Corporations Act 2001 (Cth), sections 12, 259D, 606, 608, 657D, 657EA and 672A, Administrative Appeals Tribunal Act 1975 (Cth), section 43(1), Administrative Decisions (Judicial Review) Act 1977 (Cth), section 5, and Judiciary Act 1903 (Cth), section 39B

Corporations Regulations 2001 (Cth), regulation 6.10.01

Shi v Migration Agents Registration Authority [2008] HCA 31; (2008) 235 CLR 286, ASIC v Yandal Gold Pty Ltd (1999) 32 ACSR 317

Guidance Note 2: Reviewing Decisions, Guidance Note 4: Remedies General, Procedural Rules 3.3.1, 3.3.2

Tribune Resources Ltd [2018] ATP 18, AMP Shopping Centre Trust 02 [2003] ATP 24

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| Yes | No | Yes | N/A | Yes | No |

Introduction

- The Panel, Karen Evans-Cullen, Ron Malek (sitting President) and Denise McComish, affirmed with minor variations the final orders made by the initial Panel1 in relation to the affairs of Tribune Resources Limited. The review application related only to the initial Panel's final orders. No party sought a review of the initial Panel's declaration of unacceptable circumstances.

- In these reasons, the following definitions apply.

- Declaration

- the Declaration made by the initial Panel on 14 September 2018 (Annexure A)

- Hedley

- R Hedley Pty Ltd

- Lake Grace

- Lake Grace Exploration Pty Ltd

- Nimby WA

- Nimby WA Pty Ltd

- Northwest

- Northwest Capital Pty Ltd

- Original Orders

- the final orders made by the initial Panel on 26 October 2018

- Rand

- Rand Mining Ltd (ASX: RND)

- Relevant Parties

- Tribune, Mr Anthony Billis, Ms Phanatchakorn Wichaikul, Ms Buasong Wichaikul, SGL, SGPL, Trans Global, Rand, Nimby WA, Lake Grace and Northwest

- Resource Capital

- Resource Capital Ltd (a company incorporated in the Seychelles)

- SGL

- Sierra Gold Ltd (a company incorporated in the Seychelles)

- SGPL

- Sierra Gold Pty Ltd

- Trans Global

- Trans Global Capital Ltd (a company incorporated in the Seychelles)

- Tribune

- Tribune Resources Ltd (ASX: TBR)

Facts

- The facts are as set out in the initial Panel's Declaration and reasons.2 We adopt them, as supplemented below, as our findings of fact. Briefly:

- The market has not been informed, and continues not to be informed, of persons with relevant interest in shares held by Tribune's three largest shareholders, namely, SGL, Trans Global and Rand (which Tribune controls).3

- Tracing notice responses by SGL, SGPL, Trans Global and Rand were incorrect.

- On the basis of the submissions made to the initial Panel by Tribune, SGL, SGPL, Trans Global and Rand, there have been numerous contraventions of the substantial holder provisions in relation to Tribune shares, including by:

- Mr Billis, who has voting power of 60.49% in Tribune

- Tribune, which has a relevant interest of 26.32% in its own shares4 and

- Ms Phanatchakorn Wichaikul, as a result of her association with Mr Billis.

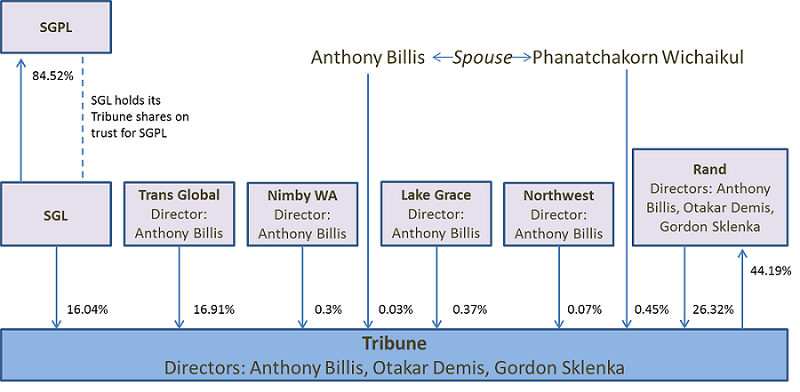

- Shareholdings and relevant relationships between relevant Tribune shareholders are shown in the following diagram:

Application

- By application dated 30 October 2018, Rand sought a review of the Original Orders. Rand described the central component of its application as being that the Original Orders "are prejudicial to Rand by failing to adequately protect Rand from the potentially severe financial effects on Rand resulting from the divestment orders". In particular, Rand considered the divestment orders should:

- allow for a disposal of Tribune shares by in-specie distribution to Rand shareholders (other than the Relevant Parties and their associates)

- permit Relevant Parties to purchase Sale Shares provided such purchase is not in breach of the takeovers provisions and

- provide greater protection for Rand regarding the risk of a potential material decrease in the Tribune share price.

Interim orders

- Rand sought interim orders staying Original Orders 1 to 4, to allow the Panel to conduct the review requested by its application. The President of the Panel made interim orders staying Original Orders 1 to 45 until the earliest of further order of the Panel, determination of the proceedings or 2 months from the date of the interim orders.6

Discussion

Conducting proceedings

- We decided to conduct proceedings, indicating that we would consider the application on the merits on a 'de novo' basis, and specifically invited submissions and rebuttals on:

- whether there are orders that would be more appropriate than the Original Orders to protect rights or interests affected by the circumstances declared to be unacceptable

- whether the Original Orders (or changes contemplated by the application or submissions) unfairly prejudice Rand or any other person

- whether the requirements of s259D are relevant to the Panel's decision and

- other matters we should consider.

Materials considered

- In deciding this matter, we have been provided with, and have considered, the following:

- all material before the initial Panel7

- the initial Panel's reasons for decision and

- all submissions and material provided to us in the review.

- We will address specifically only what is necessary to explain our findings on material questions of fact, the material on which they are based, and our reasons.

Decisions subject to review

- No-one sought a review of the Declaration.8 It follows that the Declaration, and the circumstances it declared unacceptable, are the starting point for this review, which confers on us "[i]n conducting the review, … the same power to make … an order under section 657D" as the initial Panel.9

- Mr Billis and Trans Global submitted that the Original Orders were not a "global decision to make the orders as a package", but rather "each order" was a separate and reviewable decision. They submitted that Rand's application had a narrow compass, concerned only with the "decisions" in certain paragraphs of Order 3 and Order 5, and we had no jurisdiction to reconsider the Original Orders "at large".10 The boundaries of our jurisdiction are set by reference to the decision subject to review,11 but we do not otherwise agree with these submissions. In our view, the initial Panel's decision to make the Original Orders was one decision, the terms of which were divided into numbered paragraphs and sub-paragraphs to assist the reader. We note, for example, that Order 3 cannot be read without reference to the definitions in Order 18, including that of "Sale Shares" (which refers to Order 11, which in turn refers to Orders 8, 2 to 7 and 14). Even if we are wrong, we think that Rand's application clearly sought review of all of the Original Orders,12 even though the "grounds" discussed in the application (which, in this case,13 were not required to be set out14) addressed only some of the Original Orders.

More appropriate orders?

- Hedley submitted that the "secret control position and the illegal cross shareholding" of the Relevant Parties had prevented other shareholders participating in the potential control premium that might otherwise have been available. Hedley submitted that, to protect the rights or interests of those shareholders, the Panel should order further divestment to reduce Mr Billis' voting power in Tribune to either 20% or 5%.

- Tribune submitted that expanding the divestment orders was not appropriate as:

- no breach of s606 had been found and disclosure was the appropriate remedy for non-disclosure

- Hedley's application to the initial Panel sought corrective disclosure rather than divestment, and Hedley's later submissions seeking divestment had an inappropriately punitive purpose and

- it would amplify the depressive effects of the divestment orders on Tribune's share price.

- Mr Billis and Trans Global submitted that the Original Orders, and in particular the voting restrictions in Orders 12 and 13, go beyond what is necessary to protect rights or interests affected by the unacceptable circumstances.

- We accept that the application to the initial Panel sought orders requiring corrective disclosure and only sought divestment if there was a failure to provide that corrective disclosure. That may be explained, in part at least, by Hedley's comment in the application that:

…the Applicant considers there are a number of circumstances which suggest that breaches of section 606 of the Act have occurred and which are likely to lead to a separate application to the Takeovers Panel. However, until such time as the tracing notice and substantial holding requirements of the Act have been complied with, it is not possible to confirm several key facts pertaining to those breaches.

- The initial Panel noted this reference to a possible further application when it decided to make a declaration without making further enquiries into potential s606 breaches.15 That, combined with the lengthy period over which the failure to disclose has occurred, inevitably makes it more difficult to determine what groups of persons have been affected, and in what way, and be satisfied that further divestment, as proposed by Hedley, will appropriately protect the rights or interests affected. Ultimately, we were not persuaded that further divestment orders are appropriate.

Existing divestment orders

- The position is different with respect to the provision in the Original Orders for divestment of Rand's holding in Tribune and any shares vested in accordance with Order 11. In each case, those orders would in our view address clear and ongoing effects on the rights or interests of persons affected by unacceptable circumstances identified in the Declaration.

- In the case of Rand's holding in Tribune, the divestment orders will address current and long standing uncertainty as to the effects of s259D, including as to whether those shares have been (or might be) voted and whether (and if so when) Rand might cease to hold them.

- In the case of any shares vested in accordance with Order 11, the divestment orders would address the effects of any ongoing lack of disclosure due to Relevant Parties failing to comply with Order 8.

- We considered the arguments put in favour of allowing an in-specie distribution by Rand of its Tribune shares (other than to Relevant Parties), but were not persuaded that any potential benefits justified the additional complexity, uncertainty and delay involved.

- We considered the arguments put in favour of allowing Relevant Parties to purchase Sale Shares if permitted to do so under the takeovers provisions. Among other things, that would permit Relevant Parties to acquire Sale Shares by making a takeover bid and increase their control in a potentially opportunistic way. The voting power they have obtained without disclosure16 would allow them to prevent any other person acquiring control, which may discourage other persons17 from seeking to acquire Sale Shares. We consider, drawing on our experience, that such an order would likely result in the Relevant Parties benefitting from the unacceptable circumstances at the expense of other Tribune shareholders. In our view, that would not provide, at least in the current circumstances, appropriate protection of the rights or interests of other Tribune shareholders that have been affected by the unacceptable circumstances. It is open to parties to seek a variation of the Orders under s657D(3) if circumstances change.18

- We note that the Orders do not prevent Relevant Parties making a takeover bid for Tribune once all Sale Shares have been sold by the Appointed Seller and do not prevent purchasers of Sale Shares selling into any such bid.19 If so, any such takeover bid will at least occur after the Sale Shares have been sold in a market where potential acquirers have the benefit of the Relevant Parties' corrective disclosure and have less reason to fear being compulsorily acquired.

- We considered all other submissions relating to the divestment orders in the Original Orders but, with one exception, we were not satisfied that any change was appropriate. The exception concerns the requirement in Order 3(b)(vii) for the Appointed Seller to:

… notify ASIC as soon as reasonable practicable if (without being obliged to do so) it forms the view that disposing of any or all of the Sale Shares within 6 months from the date of its engagement would likely result in a material decrease in the Tribune share price.

- Rand submitted that Order 3(b)(vii) is flawed and uncertain in several respects and does not provide it with sufficient protection against the potential prejudice of a material decrease in the Tribune share price.

- ASIC submitted that Order 3(b)(vii) should instead be deleted on the basis that it is unnecessary and may delay sale of the Sale Shares or complicate appointment of an Appointed Seller.

- There will always be some risk that the price at which shares vested in ASIC are sold will be prejudicial to the shareholder. That risk is mitigated in part in this case by the instruction given to the Appointed Seller under Order 3(b)(i), the extended time for disposal of 6 months, and the provision for the Panel to give a further extension under Order 3(b)(vi). In our view, Order 3(b)(vii) is not likely to further mitigate that risk for Rand and the uncertainty of its terms may limit the effectiveness of the divestment orders in protecting rights or interests of other Tribune shareholders. Accordingly, we do not think it appropriate to include Order 3(b)(vii) and consider that the Original Orders should be varied to delete it.

Clarification of the meaning of "Sale Shares"

- Tribune submitted that it was not sufficiently clear that shares would cease to be "Sale Shares" once sold by the Appointed Seller, such that Relevant Parties (including Tribune) may be prevented from acquiring Tribune shares in perpetuity. We do not read the Original Orders in that way, but are happy to vary Order 17 and the definition of "Sale Shares" for the avoidance of doubt.

Voting restrictions

- Mr Billis and Trans Global submitted that the voting restrictions imposed by Orders 12 and 13 go beyond what is reasonably necessary to remedy the unacceptable circumstances and are unfairly prejudicial to Relevant Parties. They submitted that, as at 1 December 1998, interests associated with Mr Billis had "lawfully acquired" voting power of 30.43%, which it would be unfairly prejudicial to restrict to the extent provided in Orders 12 and 13. They also submitted that Order 13 is discriminatory, as it only applies to the voting rights of each Relevant Party, and that Orders 12 and 13 could have the unintended effect of facilitating a change of control of Tribune.

- The Declaration identifies a very significant discrepancy between the level of voting power of the Relevant Parties and the level of voting power that has been disclosed in accordance with Chapter 6C. The initial Panel indicated that Orders 12 and 13 sought to give the market a period to digest the disclosure required by Order 8.20 In explaining its choice of a month as the appropriate period, the initial Panel noted the potential for a meeting to replace the board to be convened or requisitioned while the voting restrictions remain in place.21

- In our view, restricting voting rights that have not been properly disclosed in accordance with Chapter 6C is appropriate. It protects the interests of minority shareholders whose voting rights will have been adversely affected by the failure to comply with Chapter 6C. It is also consistent with the purposes in s602(a) and (b). However, we think it appropriate also to take account of the potential for such restrictions to disrupt the governance and proper operation of the company. Balancing those factors is difficult, especially in a case such as this where the failure to disclose is so significant. In our view, a period of one month strikes an appropriate balance.

- We are also satisfied that it is appropriate to make the adjustment effected by Order 13 to take account of ASIC not voting the shares vested in it. We think it is appropriate to apply this adjustment only to Relevant Parties given their involvement in the unacceptable circumstances and the fact that other small shareholders are less likely to vote their shares.

Unfair prejudice

- We do not believe that the Original Orders, or our changes to them, will unfairly prejudice any person. We accept that the Original Orders and our changes may be prejudicial to Relevant Parties or some of them. However, we do not consider that such prejudice is "unfair" having regard to the involvement of Relevant Parties (or some of them) in the circumstances declared to be unacceptable in the Declaration.22 We think that the adverse effect of the orders on other persons, if any, will not be sufficiently significant to be "unfair". Also, we do not consider that there are any alternative orders that would achieve a better balance in protecting rights or interests affected by the unacceptable circumstances yet be less prejudicial to Relevant Parties or any other person.

Relevance of s259D

- Tribune submitted that the requirements of s259D are not a matter within our jurisdiction. We accept that it is not our role to enforce s259D, and only a court can conclusively determine whether it has been contravened. In this case, the initial Panel referred in the Declaration to effects of s259D23 that were not contested. In these circumstances we consider that s259D, its effects and its underlying policy are all relevant matters for us to take into account.

Cost orders?

- ASIC submitted that it should receive "compensation" (as opposed to a costs order) for its oversight of the drafting of substantial holder notices required by Orders 8 and 9. We assume that orders of that kind could in an appropriate case be made under our power to make "ancillary or consequential orders" under s657D(2). However we are not satisfied that this is an appropriate case.

- Hedley sought orders that the Relevant Parties pay its costs. Mr Billis and Trans Global sought orders that Hedley pay their costs incurred in rebutting Hedley's submissions.

- We were not satisfied that the conduct of any party in these proceedings warranted an award of costs, given the Panel's policy on cost orders.24

Decision

Orders

- We made an order varying the Original Orders as set out in Annexure B. The only substantive changes we made were:

- to delete Order 3(b)(vii)

- to confirm (in Order 17) that Orders 5, 6 and 13 have no application to Relevant Parties once all Relevant Parties have complied with Order 8 and

- to confirm that "Sale Shares" (defined in Order 18) cease to be Sale Shares once sold in accordance with Orders 1 to 7.

- We otherwise affirmed the Original Orders as the orders we consider the correct or preferable orders to make, given the circumstances declared unacceptable in the Declaration.

- The Panel is empowered to make 'any order'25 if 4 tests are met:

- it has made a declaration under s657A. The initial Panel did so on 14 September 2018.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons above, we are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. We did so on 9 and 19 November 2018.

- it considers the orders appropriate to protect either the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons. For reasons similar to those of the initial Panel,26 we are satisfied that the circumstances declared unacceptable in the Declaration have affected (or will, or are likely to, affect):

- the rights or interests of other Tribune shareholders and

- the rights or interests of other market participants,

Ron Malek

President of the sitting Panel

Declaration dated 14 September 2018

Orders dated 21 November 2018

Reasons given to parties 6 December 2018

Reasons published 7 December 2018

| Party | Advisers |

|---|---|

| Hedley | DLA Piper Australia |

| Mr Billis and Trans Global | SBA Law |

| Rand | Baker McKenzie |

| Tribune | Quinn Emanuel Urquhart & Sullivan |

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Tribune Resources Limited

Circumstances

- Tribune Resources Limited (Tribune) is a company listed on the Australian Securities Exchange (ASX Code: TBR). Tribune's directors are Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka.

- Tribune has the following major shareholders:

- Sierra Gold Ltd (SGL – a company incorporated in the Seychelles), with a relevant interest of 16.04% in Tribune.

- Trans Global Capital Ltd (Trans Global – a company incorporated in the Seychelles), with a relevant interest of approximately 16.91% in Tribune.

- Rand Mining Limited (Rand – an ASX listed company, ASX Code: RND) with a relevant interest of approximately 26.32% in Tribune.

SGL

- SGL lodged a substantial holder notice on 10 November 2009 in relation to its shareholding in Tribune. It did not disclose any other person who had a relevant interest in those shares.

- On 19 June 2018, SGL replied to a beneficial ownership notice issued by ASIC under s672A(1) of the Corporations Act 2001 (Cth) (Act) disclosing, among other things, that:

- SGL holds its Tribune shares on trust for Sierra Gold Pty Ltd (ACN 009 138 783).

- The shareholders of Sierra Gold Pty Ltd, including SGL, have a relevant interest in SGL's Tribune shares "by virtue of their shareholding in Sierra Gold Pty Ltd and as a result of the Shares being held on trust for Sierra Gold Pty Ltd".

- To the best of SGL's knowledge and recollection all instructions given to SGL in respect of the acquisition or disposal of its Tribune shares, the exercise of any voting or other rights attached to those shares or any other matter relating to those shares, "at all or any time during the period that SGL has been the registered legal owner of the Shares, has been given to SGL by the shareholders...of Sierra Gold Pty Ltd in accordance with the terms of Sierra Gold Pty Ltd's constitution".27

- SGL and Sierra Gold Pty Ltd submitted to the Panel that SGL holds its 80.95% shareholding in Sierra Gold Pty Ltd as nominee and bare trustee for Mr Billis, accordingly Mr Billis has a relevant interest in SGL's 16.04% interest in Tribune and, to the extent that SGL and Sierra Gold Pty Ltd are aware, none of the other shareholders in Sierra Gold Pty Ltd nor the sole director of Sierra Gold Pty Ltd have a relevant interest in those shares. SGL and Sierra Gold Pty Ltd submitted that Mr Billis is the sole director of SGL.

- SGL and Sierra Gold Pty Ltd submitted that Ms Phanatchakorn Wichaikul "is the registered holder and beneficial owner of all the share capital of SGL". SGL and Sierra Gold Pty Ltd submitted in effect that SGL's substantial holder notice referred to in paragraph 3 and SGL's tracing notice response referred to in paragraph 428 contained inaccurate or deficient disclosure. Ms Phanatchakorn Wichaikul is Mr Billis's wife.

- Mr Billis is a party to these proceedings and did not rebut any of the submissions made by SGL and Sierra Gold Pty Ltd.

Trans Global

- Trans Global lodged a substantial holder notice on 9 April 2009 in relation to its shareholding in Tribune. It did not disclose any other person who had a relevant interest in those shares.

- On 6 July 2018, Trans Global replied to a beneficial ownership notice issued by ASIC under s672A(1) of the Act disclosing, among other things, that Ms Phanatchakorn Wichaikul has a relevant interest in Trans Global's shareholding in Tribune and Mr Billis is a director of Trans Global.

- Trans Global and Mr Billis submitted to the Panel that:

- Trans Global holds 4,454,000 Tribune shares "as nominee or bare trustee" for Mr Billis and holds 4,000,000 Tribune shares "as nominee or bare trustee" for Ms Buasong Wichaikul

- Mr Billis has a relevant interest in the Tribune shares held by Trans Global because Mr Billis is the sole director of Trans Global and "therefore has the power to exercise, or control the exercise, of the right to vote attached to the shares in Tribune held in the name of" Trans Global "and the power to dispose of, or control the exercise of a power to dispose of, those shares"

- Ms Buasong Wichaikul has a relevant interest in 4,000,000 of the 8,454,000 shares in Tribune held by Trans Global and

- Trans Global's tracing notice response inaccurately disclosed that Ms Phanatchakorn Wichaikul had a relevant interest in Trans Global's shareholding in Tribune.

- Trans Global's Register of Members and Share Ledger states that:

- Ms Phanatchakorn Wichaikul is Trans Global's sole shareholder and

- Mr Billis was the sole shareholder in Trans Global between 18 September 2009 and 20 May 2010. On 20 May 2010 he sold his shareholding to Ms Phanatchakorn Wichaikul for US$100.

Rand

- Rand's board is identical to Tribune's board, comprising Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka.

- On or about 27 January 2010, Tribune increased its voting power in Rand Mining Limited from 20.51% to 43.85%. As a result s259D(1) of the Act applied requiring within 12 months from that time that either Rand cease to hold Tribune shares or Tribune cease to control Rand, unless ASIC provided an extension of time. Subsection 259D(3) of the Act also applied, and continues to apply, prohibiting Rand from exercising voting rights to its Tribune shares while Tribune controls Rand.

- On 24 December 2010, Tribune applied to ASIC for an extension of time under s259D(1). ASIC subsequently informed Tribune that it would not give an extension. Rand continues to be controlled by Tribune and holds Tribune shares.

- On 3 July 2018, Rand replied to a beneficial ownership notice issued by ASIC under s672A(1) of the Act disclosing, among other things, that each of Messrs Anthony Billis, Otakar Demis and Gordon Alfred Sklenka has a relevant interest in Rand's Tribune shares "by virtue of their position as directors of Rand". In a submission to the Panel, Rand submitted that its directors "do not in fact have a relevant interest in Rand's shares in Tribune as disclosed in Rand's tracing notice response".

Resource Capital Limited

- On 23 December 2010, Rand entered into an Option and Access Agreement with Resource Capital Limited and Iron Resources Limited. Pursuant to the Option and Access Agreement, Resource Capital Limited granted Rand the option to acquire all the issued shares in Iron Resources Limited. If Rand exercised the option, a share purchase agreement (attached to the Option and Access Agreement) would have full force and effect, which involved (among other things) Rand paying Resource Capital Limited a deposit of 8,000,000 Tribune shares (approximately 16% of the Tribune shares on issue).

- In a submission to the Panel, Rand submitted that Resource Capital Limited had a relevant interest in 8,000,000 Tribune shares by virtue of Resource Capital Limited being a party to the Option and Access Agreement. Resource Capital Limited has not lodged a substantial holder notice disclosing its interest in Tribune. Rand has informed the Panel that it wishes to terminate the Option and Access Agreement.

- The Option and Access Agreement was signed by Mr Billis as a director of Resource Capital Limited and Iron Resources Limited and by Ms Phanatchakorn Wichaikul as "Secretary/Director" of Resource Capital Limited and Iron Resources Limited. Resource Capital Limited's response dated 26 June 2018 to a beneficial ownership notice issued by ASIC under s672A(1) of the Act discloses that Mr Billis is a director of Resource Capital Limited.

- In Tribune's application to ASIC dated 24 December 2010 (referred to in paragraph 14), Tribune stated that Rand had informed it that:

- Mr Billis was one of the two directors of Iron Resources Limited and

- The directors of Resource Capital Limited were Mr Billis and Ms Phanatchakorn Wichaikul.

Association between Mr Billis and Ms Phanatchakorn Wichaikul

- The Panel considers that Mr Billis and Ms Phanatchakorn Wichaikul both now and since at least 20 May 2010:

- have a relevant agreement for the purpose of controlling or influencing the composition of the board of Tribune or the conduct of Tribune's affairs and are associated with each other under section 12(2)(b) or

- acted in concert in relation to the affairs of Tribune and are associated with each other under section 12(2)(c).

- The factors that support the inference that Mr Billis and Ms Phanatchakorn Wichaikul are associates include:

- their relationship as husband and wife

- Mr Billis being the sole director of SGL, Trans Global and Lake Grace Exploration Pty Ltd and Ms Phanatchakorn Wichaikul being the sole shareholder of those companies

- the involvement of Mr Billis and Ms Phanatchakorn Wichaikul in Resource Capital Limited and Iron Resources Limited (see paragraph 18) and

- The uncommercial nature of the sale of Mr Billis's interest in Trans Global on 20 May 2010 for US$100.

Conclusion

- The market has not been informed, and continues not to be informed, of persons who have a relevant interest in shares held by the three largest shareholders of Tribune.

- Tracing notice responses by SGL, Sierra Gold Pty Ltd, Trans Global and Rand contain material that, in the submissions made by those parties to the Panel, were and are false.

- If the material provided to the Panel in the submissions by Tribune, SGL, Sierra Gold Pty Ltd, Trans Global and Rand is accurate, there have been numerous contraventions of the substantial holder provisions in relation to Tribune shares, including by:

- Mr Billis, at least in relation to Tribune shares held by himself (0.03%), Ms Phanatchakorn Wichaikul (0.45%), SGL (16.04%), Trans Global (16.91%), Rand (26.32%)29, Nimby WA Pty Ltd (0.3%), Lake Grace Exploration Pty Ltd (0.37%) and Northwest Capital Pty Ltd (0.07%) – meaning that he has voting power of 60.49% in Tribune

- Tribune, in relation to having an interest in its own shares by operation of s608(3)(a) and (b) of the Act as a result of Tribune controlling Rand and Tribune holding voting power in over 20% in Rand and

- Ms Phanatchakorn Wichaikul as a result of her association with Mr Billis.

Effect

- It appears to the Panel that:

- the acquisition of control over voting shares in Tribune and Rand has not taken, and continues not to take, place in an efficient, competitive and informed market

- the holders of Tribune and Rand shares and the market in general has not known, and continues not to know, the identity of persons who acquired a substantial interest in Tribune and Rand and

- the above effects in relation to Tribune are magnified by Rand being prohibited from voting its 26.32% interest in Tribune by virtue of s259D(3) of the Act.

Conclusion

- It appears to the Panel that the circumstances are unacceptable circumstances:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have:

- on the control, or potential control, of Tribune

- on the acquisition, or proposed acquisition, by a person of a substantial interest in Tribune or

- as a consequence of (i) and (ii), on the control or potential control of Rand

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602 of the Act

- in the further alternative, because they constituted, constitute, will constitute or are likely to constitute a contravention of a provision of Chapter 6C of the Act or gave or give rise to, or will or are likely to give rise to, a contravention of a provision of Chapter 6C of the Act.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Tribune.

Bruce Dyer

Counsel

with authority of Christian Johnston

President of the sitting Panel

Dated14 September 2018

Annexure B

Corporations Act

Sections 657EA AND 657D

Orders

Tribune Resources Limited

The Panel in Tribune Resources Limited made a declaration of unacceptable circumstances on 14 September 2018 and final orders on 26 October 2018.

The final orders made on 26 October 2018 are varied to read as follows.

The Panel Orders

Divestment Orders

- The Sale Shares are vested in the Commonwealth on trust for Rand.

- ASIC must:

- sell the Sale Shares in accordance with these orders and

- account to Rand for the proceeds of sale, net of the costs, fees and expenses of the sale and any costs, fees and expenses incurred by ASIC and the Commonwealth (if any).

- ASIC must:

- retain an Appointed Seller to conduct the sale and

- instruct the Appointed Seller:

- to use the most appropriate sale method to secure the best available sale price for the Sale Shares that is reasonably available at that time in the context of complying with these orders, including the stipulated timeframe for the sale and the requirement that none of the Relevant Parties or their respective associates may acquire, directly or indirectly, any of the Sale Shares

- to provide to ASIC a statutory declaration that, having made proper inquiries, the Appointed Seller is not aware of any interest, past, present, or prospective which could conflict with the proper performance of the Appointed Seller's functions in relation to the disposal of the Sale Shares

- unless the Appointed Seller sells Sale Shares on market, that it obtain from any prospective purchaser of Sale Shares a statutory declaration including:

- a statement that the prospective purchaser is not associated with any of the Relevant Parties

- details of all historical relationships or connections (if any) between the prospective purchaser and any Relevant Party and

- details of all communications, agreements, arrangements or understandings (if any) between the prospective purchaser and any Relevant Party in the 12 months prior to the date of the statutory declaration

- to provide ASIC with a copy of each statutory declaration obtained under paragraph 3(b)(iii) within 2 business days of receipt and not sell any Sale Shares to a prospective purchaser until 2 business days after providing ASIC with a copy of the statutory declaration from the prospective purchaser

- unless the Appointed Seller sells Sale Shares on market, not to sell any Sale Shares to a prospective purchaser:

- who is a Relevant Party

- who does not provide a statutory declaration containing the statement and information required by paragraph 3(b)(iii) or

- in circumstances where ASIC has informed the Appointed Seller that it has reason to believe or suspect, drawing inferences where necessary, that the prospective purchaser may be an associate of a Relevant Party, unless ASIC has subsequently advised the Appointed Seller that it has formed the view that, on the basis of the information available, it is not likely that the prospective purchaser is an associate of a Relevant Party and

- to dispose of all of the Sale Shares within 6 months from the date of its engagement or a longer period approved by the Panel.

- The Company and the Relevant Parties must do all things necessary to give effect to these orders, including:

- doing whatever is necessary to ensure that the Commonwealth is registered with title to the Sale Shares in the form approved by ASIC and

- until the Commonwealth is registered, complying with any request by ASIC in relation to the Sale Shares.

- None of the Relevant Parties or their respective associates may, directly or indirectly, acquire any of the Sale Shares (including, in the case of the Company, under a buy-back).

- The Relevant Parties must not otherwise dispose of, transfer, charge or vote any Sale Shares.

- Nothing in these orders obliges ASIC or the Commonwealth to:

- invest, or ensure interest accrues on, any money held in trust under these orders or

- exercise any rights (including voting rights) attaching to, or arising as a result of holding, the Sale Shares.

Corrective disclosure orders

- Each Relevant Party must as soon as reasonably practicable and in any event within 2 months of the date of these orders:

- give the Company a substantial holder notice (Notice) detailing all acquisitions made, or disposals of, relevant interests in Company shares (to the extent known by the Relevant Party after making reasonable enquiries or to the extent that ASIC has otherwise indicated it is satisfied that disclosure will not be necessary having regard to the historical nature of the acquisitions and/or disposals) in a form acceptable to ASIC and containing any additional information reasonably required by ASIC within 14 days of receiving the draft required by Order 9 or

- satisfy ASIC that the market is adequately informed of the information that would otherwise be included in the Notice.

- Each Relevant Party must as soon as practicable, and in any event within 14 days of the date of these orders, provide ASIC with a draft Notice. One Notice may be provided for multiple Relevant Parties if acceptable to ASIC.

- The Company must publish a Notice on its ASX Announcements Platform within 2 business days of receiving the Notice.

- If a Relevant Party does not comply with Order 8 within 2 months of the date of these orders, the Company shares held by that Relevant Party are vested in the Commonwealth on trust for the Relevant Party. Orders 2 to 7 and 14 will then apply to those shares as if they are 'Sale Shares' and Order 2(b) will then apply as if the reference to 'Rand' is replaced with the name of the Relevant Party.

Voting restrictions

- A Relevant Party must not exercise, and the Company must disregard, any voting rights in respect of the Company shares held by that Relevant Party and must not dispose of, transfer, charge or otherwise deal with any Company shares held by that Relevant Party until the date that is 1 month after the Relevant Party has complied with Order 8 (Initial Restriction Period).

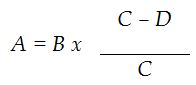

- After the Initial Restriction Period, a Relevant Party (not including Rand) may only exercise, and the Company may only take into account, voting rights in respect of such number of Company shares calculated in accordance with the following formula:

Where:

- is the number of Company shares in respect of which voting rights may be exercised and taken into account under this Order 13 by the Relevant Party

- is the number of Company shares held by the Relevant Party

- is the total number of Company shares on issue

- is the total number of Company shares that are vested in ASIC under Orders 1 and 11 and have not been sold by the Appointed Seller

Creep

- No Relevant Party may take into account any relevant interest or voting power that they or their associates had, or have had, in:

- the Sale Shares and

- until six months after the Relevant Party has complied with Order 8, any other Company shares,

Timing

- Orders 1 to 4 come into effect three business days after the date of these orders.

- All other orders took effect on 26 October 2018.

- For the avoidance of doubt, Orders 5, 6 and 13 have no application to Relevant Parties once all Relevant Parties have complied with Order 8 and the Appointed Seller has sold all of the Sale Shares.

Interpretation

- In these orders the following terms apply.

- Appointed Seller

- an investment bank or stock broker

- ASIC

- Australian Securities and Investments Commission, as agent of the Commonwealth

- Company or Tribune

- Tribune Resources Limited

- Company shares

- Ordinary shares in the issued capital of the Company

- date of the orders

- 26 October 2018 or in relation to a specific order, the business day after any stay of that order is lifted

- Notice

- the notice described in Order 8(a)

- on market

- in the ordinary course of trading on Australian Securities Exchange and not by crossing or special crossing

- Rand

- Rand Mining Limited

- Relevant Parties

- Company, Mr Anthony Billis, Ms Phanatchakorn Wichaikul, Ms Buasong Wichaikul, Sierra Gold Ltd, Sierra Gold Pty Ltd, Trans Global Capital Ltd, Rand, Nimby WA Pty Ltd, Lake Grace Exploration Pty Ltd and Northwest Capital Pty Ltd

- Sale Shares

- 12,025,519 Company shares held by Rand (comprising Rand's holding in Tribune less 1,135,000 Tribune shares acquired by Rand on or about 2 and 10 January 2014) and any Company shares vested in accordance with Order 11 (for the avoidance of doubt, Sale Shares cease to be Sale Shares once sold in accordance with Orders 1 to 7)

Allan Bulman

Director

with authority of Ron Malek

President of the sitting Panel

Dated 21 November 2018

1 - All references to the initial Panel are to the Panel in Tribune Resources Ltd [2018] ATP 18

2 - Tribune Resources Ltd [2018] ATP 18 at [3]-[8 ], [16]-[21] and [24]-[74]

3 - See the diagram in paragraph 4

4 - by operation of s608(3)(a) and (b) and Tribune's control of Rand and voting power above 20% in Rand

5 - given these orders were likely to take effect before the appointment of a review Panel

6 - See TP 18/74.The interim orders ceased to have effect on 21 November 2018

7 - That is, material before the initial Panel when it made the Original Orders. On 22 November 2018 (after we had decided this matter) we were informed that Mr Billis, Trans Global, SGPL and SGL had applied under s5 of the Administrative Decisions (Judicial Review) Act 1977 (Cth) and s39B of the Judiciary Act 1903 (Cth) for declarations and orders in relation to the initial Panel's decision to make Orders 12 and 13 of the Original Orders. No party sought to make us aware of that application before we made our decision and we were not aware of it.

8 - Rand's application stated "to avoid any doubt" that it did not seek a review of the Declaration

9 - s657EA(4)

10 - Mr Billis and Trans Global nevertheless made submissions in response to our brief (reserving their rights and without making any admission that we had jurisdiction to consider other orders)

11 - Compare, with respect to s43(1) of the Administrative Appeals Tribunal Act 1975: Shi v Migration Agents Registration Authority [2008] HCA 31; (2008) 235 CLR 286 at [133] (Kiefel J)

12 - The details of the application described it as made "pursuant to section 657EA of the Corporations Act for review of the Orders" and "Orders" was defined in the introduction as "the Orders made by the Panel on 26 October 2018". As it happens, for reasons explained below, the only changes to the Original Orders we considered appropriate were the deletion of Order 3(b)(vii) (which Mr Billis and Trans Global accepted was open to us) and consequential or clarifying changes to Orders 16, 17 and 18

13 - Given that the President's consent under s657EA(2) was not required: Guidance Note 2, footnote 28, Procedural Rule 3.3.2

14 - Procedural Rule 3.1.1(a). The short 2 business days' time limit under s657EA(3) and Corporations Regulation 6.10.01 means a review application will often need to be made (as in this case) before the initial panel has given reasons for the decision, making grounds more difficult to formulate. Of course, applicants will often wish to express preliminary grounds regardless, in order to encourage the review panel to conduct proceedings

15 - Tribune Resources Ltd [2018] ATP 18 at [60]

16 - as described in the Declaration

17 - who could reasonably expect that the Relevant Parties would receive sufficient acceptances to compulsorily acquire the minority, or at least delist Tribune

18 - For example, if a bidder (not associated with any Relevant Party) made a takeover bid before the Sale Shares are sold, it may be arguable that allowing a Relevant Party to counterbid (subject to appropriate conditions) could benefit and better protect minority shareholders' rights or interests

19 - Order 14 should not prevent this as the bidder will be able to rely on items 1 or 2 of s611 and will not need to rely on item 9 of s611. See also paragraph 27 below regarding clarification of the meaning of "Sale Shares"

20 - Tribune Resources Ltd [2018] ATP 18 at [108]

21 - Tribune Resources Ltd [2018] ATP 18, footnote 42

22 - See ASIC v Yandal Gold Pty Ltd (1999) 32 ACSR 317 at [140]-[153]; AMP Shopping Centre Trust 02 [2003] ATP 24 at [54]-[59]

23 - Presumably treating this as "relevant" under s657A(3)(b)

24 - See Guidance Note 4: Remedies General at [24] to [37]

25 - Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

26 - subject to, and as supplemented by, our additional reasons above

27 - On 5 July 2018, a shareholder in Sierra Gold Pty Ltd (Henley Point Pty Ltd) replied to a beneficial ownership notice under s672A(1) of the Corporations Act, issued by ASIC, disclosing, among other things, that the shareholders in Sierra Gold Pty Ltd provide the directors of SGL with instructions relating to SGL's Tribune shares

28 - And Sierra Gold Pty Ltd's response to a tracing notice dated 11 July 2018

29 - as a result of his relevant interest in Tribune and the operation of s608(3)(a) and (b) of the Act