[2009] ATP 9

Catchwords:

Review application - reverse takeover bid - lock-up device - fiduciary out - new bid condition - auction for control - announcement of bid - bid conditions - association - effect on control - acquisition of a substantial interest - efficient, competitive and informed market - equal opportunity to share in benefits - evidence - scrip offer - declaration of unacceptable circumstances - orders

Corporations Act 2001 (Cth), sections 12, 602, 611 (item 4), 629, 631, 657A, 657D, 657EA

Guidance Note 7 Lock-up Devices, Guidance Note 4 Remedies General

Gloucester Coal Limited 01 [2009] ATP 6, Magna Pacific Holdings Ltd 02 [2007] ATP 3, Queensland Cotton Holdings Limited [2007] ATP 5, Consolidated Minerals Ltd 03 [2007] ATP 25, Village Roadshow Limited 03 [2004] ATP 22, Village Roadshow Limited 02 [2004] ATP 12, Azumah Resources Limited [2006] ATP 3, National Foods Limited [2005] ATP 8, LV Living Limited [2005] ATP 5

Introduction

- The review Panel, Michael Ashforth, Geoff Brunsdon and Alison Lansley (sitting president) made a declaration of unacceptable circumstances in relation to the affairs of Gloucester. The review Panel considered that there was insufficient evidence of a control block to conclude that the Merger amounted to a change of control of Gloucester giving rise to unacceptable circumstances or had an effect on control to warrant a shareholder vote. But, contrary to the principles in ss602(a) and (c), the Merger had an effect on control in that it acted as a lock-up device of Gloucester by preventing other control transactions. The Panel ordered that the Merger be subject to a "fiduciary out".

- In these reasons, the following definitions apply.

- Term

- Meaning

- AMCI

- AMCI International AG

- AMCI Group

- AMCI, its subsidiary AMCI Investments Pty Ltd, Hans Mende, Fritz Kundrun, Kirsten Investments II LLC, Markus Investments II LLC and Nicola Investments LLC

- FRC

- FRC Whitehaven Holdings BV

- Gloucester

- Gloucester Coal Limited

- Merger

- Proposed takeover bid by Gloucester for Whitehaven at 1 share for every 2.45 Whitehaven shares announced on 20 February 2009

- MIA

- Merger Implementation Agreement dated 19 February 2009 between Gloucester and Whitehaven

- Noble

- Noble Group Limited

- Noble bid

- Proposed cash bid at $4.85 per share for all the shares in Gloucester announced on 27 February 2009

- Whitehaven

- Whitehaven Coal Limited

- In these proceedings, the review Panel:

- directed that the review applications received from Whitehaven and Gloucester are related and be considered in the same proceeding under ASIC regulation 16

- adopted the Panel's published procedural rules and

- consented to the parties being represented by their commercial lawyers.

Facts

- The following facts are in addition to the facts as set out in the reasons for the initial Panel's decision in Gloucester Coal Limited 01.1

- On 21 March 2009 the pre-bid acceptance deeds between Gloucester and each of FRC, AMCI, HFTT Pty Ltd and Ranamok Pty Ltd lapsed in accordance with their terms. Under those deeds, 19.9% of Whitehaven shares would have been tendered into the Gloucester bid.

- The initial Panel's reasons stated that approximately 74% of the shares in Whitehaven were represented by Whitehaven directors or their associates. On 25 March 2009 Whitehaven lodged with ASX a notice correcting the public statements on which the initial Panel's statement was based. The notice specified that collectively the directors and their associates have a relevant interest in 33.67%, not 74%, of Whitehaven shares.

- The difference between the 74% and 33.67% was explained by Whitehaven as follows:

- 32.3% of Whitehaven's share capital held by FRC was incorrectly stated to be connected to Mr Krueger, who does not have a relevant interest in FRC's Whitehaven shares and is not an associate2 of FRC and

- 8% of Whitehaven's share capital held by Fritz Kundrun (as trustee of the Kundrun Family Trust), Kirsten Investments II LLC, Markus Investments II LC and Nicola Investments II LLC was incorrectly stated to be associated with Mr Mende, who does not have a relevant interest in those shares and is not an associate of Mr Kundrun.

- On 25 March 2009 Whitehaven also lodged with ASX an Appendix 3X (Initial Director's Interest Notice) and Appendix 3Y (Change of Director's Interest Notice)3 amending the original versions of those notices referred to in the initial Panel's reasons. The amended Appendix 3X showed that Mr Krueger neither held, nor had a relevant interest in, any Whitehaven shares. The amended Appendix 3Y showed that 5,660,377 Whitehaven shares had been transferred from the Mende Family Trust, reducing Mr Mende's relevant interest to 75,379,833 Whitehaven shares.

- On 1 April 2009, Whitehaven advised that it had received a letter from AMCI offering to undertake not to vote 1.13% of the shares it will hold in the post-Merger Gloucester for six months after the Merger.4

- Similarly, on 1 April 2009, Whitehaven provided a letter from Hans Mende, a director of Whitehaven, undertaking that he would not nominate for a position on the merged entity board at the time of the Merger or for 12 months thereafter. Whitehaven also advised that it would invite Gloucester to nominate an independent director, which would have the effect of equal Gloucester and Whitehaven representation on the merged entity's board.

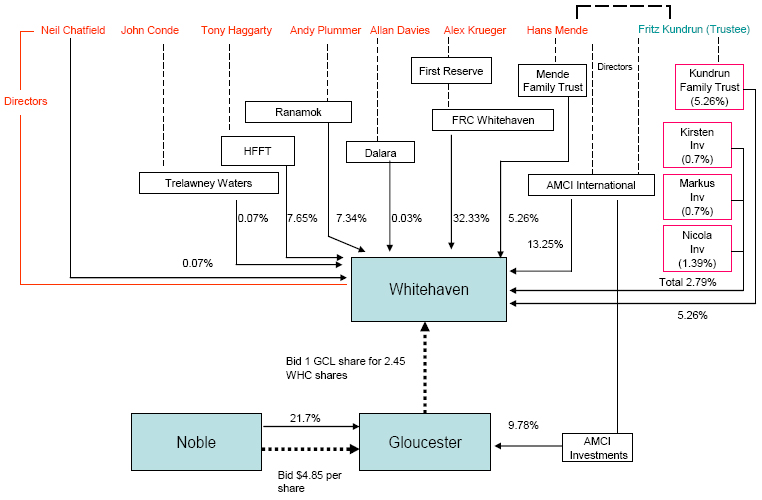

- The following diagram represents the competing proposals for Gloucester and the various interests in Whitehaven.

Application

- By applications dated 19 March 2009 Whitehaven and Gloucester sought a review of the Panel's decision in Gloucester Coal Limited 01. Gloucester's review application stated that it supported Whitehaven's application. It did not specify additional review grounds.

- The Panel consented to FRC, AMCI and AMCI Investments Pty Ltd becoming parties.

- Whitehaven sought a review on the following grounds (among others):

- there were errors in the findings of fact by the initial Panel regarding association and whether there would be a change of control of Gloucester based on the dilution of Gloucester's shareholders

- treating the inability or unwillingness of Noble to bid for the post–Merger Gloucester as evidence that the Merger is 'anti-competitive' reads the principle in s602(a) too narrowly

- it would not be in the public interest to uphold the initial Panel's decision, which was inconsistent with s611 item 4 and would encourage bids being made that were subject to the Panel taking some action to stymie competing transactions and destroy the 'first mover' advantage

- the initial Panel's orders unfairly prejudiced Whitehaven and

- new information had come to light.

Discussion

- The review proceeding is a de novo consideration. We have considered the matter on the information now available and exercised our own discretion.

- We have been provided with:

- the initial application, interim order, preliminary submissions, brief, orders brief, and all submissions and rebuttals for the initial Panel and

- the decision media release, decision email, declaration of unacceptable circumstances, orders and the reasons of the initial Panel.

- As part of these proceedings we obtained the following additional materials:

- the review applications (as amended)

- further statements provided by both parties in relation to the applications and

- submissions and rebuttals to our brief, supplementary brief and orders brief.

Initial Panel's Reasons

- The initial Panel made its declaration on the following bases:

- Gloucester shareholders were denied an opportunity to consider the merits of the Merger and

- in the alternative, Gloucester shareholders were denied the opportunity to consider the Noble bid or any other control transaction for Gloucester,

both being transactions that would have an effect on the control of, or the acquisition of a substantial interest in, Gloucester.

- We think that the material calls for consideration of these two questions. We take each in turn.

Opportunity to consider merits of change of control

- The initial Panel considered that the structure of the Merger, with Gloucester as the bidder, was "at the expense of Gloucester shareholders' right to consider a proposal that affects control of their company."5

- In reaching that conclusion, the initial Panel had before it many public statements concerning directors and their associates collectively controlling 74% of Whitehaven's shares. Thus, Whitehaven directors and their associates would control an approximately 51% stake in the post-Merger Gloucester. We think the initial Panel took the view that the circumstances before it were sufficient to give rise to an effect on control of such a nature and scale that a vote of Gloucester shareholders was required. In the absence of association, we were less satisfied. In any event, the circumstances before us are different in that Whitehaven publicly amended the many references it had previously made to the relevant interests of its directors and their associates. We reviewed the facts behind the amended statements and asked further questions. We conclude that, on the evidence provided, the effect on control is not of such a nature and scale as to require a shareholder vote, unless it appears that some of the shareholders are associated.

- We note the ASIC submission, and its acceptance by the initial Panel, that implicit in the wording of s602(b) is that proposals involving control transactions should be considered by shareholders of the relevant company (ie, by voting or acceptance).6 We agree, where the effect is of sufficient nature and scale.

- In form, Gloucester is making a takeover bid for Whitehaven, as a result of which existing Whitehaven shareholders will acquire shares in Gloucester. In our view, s611 item 4 reflects a policy that there may be an acquisition of a relevant interest above 20% as a result of the acceptance of a takeover. However, this exception from the prohibition in s606 has limits. It is not the purpose of item 4 to allow reverse takeovers (or, indeed, any acquisition) to occur without regard to the principles in s602. As the initial Panel said:

"Section 657A empowers the Panel to consider whether a transaction that has an effect on the control of a company, or on the acquisition of a substantial interest in a company, is unacceptable having regard to the policy of Chapter 6, even if it does not breach any provision of Chapter 6."7

- Acceptance of Gloucester's offer by FRC will result in it acquiring a relevant interest in 21.68% of Gloucester shares. We do not think a shareholding of 21.68% in the post-Merger Gloucester is enough in these circumstances to amount to a change of control, or an effect on control such as to give rise to unacceptable circumstances. Potentially one other "shareholding" (AMCI Group) will have voting power of between 17 and 21% in the post-Merger Gloucester (depending on association of persons connected with that Group – see below). Thus there would be (potentially) two shareholdings above 20%. We also do not think that this alone is sufficient in this case to give rise to a change of or effect on control.

- We note Noble's existing 21.7% holding in Gloucester will be diluted to approximately 7%. While we do not accept the submission that the substitution of one holding for another cannot be a change of control or an effect on control, we do not regard this dilution as bringing about such a change or an effect as to give rise to unacceptable circumstances.

- ASIC RG 60 deals with schemes of arrangement. At [60.15] ASIC says:

"ASIC considers that a scheme of arrangement which produces a reverse takeover effect is often likely to raise issues of concern, especially where the shareholders of the 'offeror' company (ie the company whose shares are offered as consideration) will not be given the opportunity to ratify the proposal. ASIC encourages a person proposing such a scheme to consult with ASIC very early in the planning stage. A reverse takeover is likely if:

- the market capitalisation of the 'target' is larger than that of the 'offeror';

- a shareholder of the 'target' is likely to be the largest shareholder of the enlarged 'offeror'; or

- the relative shareholdings of members of the 'offeror' are likely to be materially affected by the scheme."

- ASIC submitted that its concerns from a Chapter 6 perspective primarily arise where a reverse takeover has an effect on control or results in control of the bidder passing to a person and the person's associates. It submitted that the acquisition of 20% (or more) generally provided a good guide as to when control of a company had passed.

- We do not understand ASIC to be saying that every acquisition of a relevant interest above 20% in a scrip takeover requires shareholder approval, as s611 item 4 clearly permits such a situation. The test then is whether it is unacceptable. To say otherwise does not sufficiently acknowledge the operation of s611 item 4 in our opinion. While Village Roadshow 038 recognised that the exceptions in s611 are not an absolute protection against a finding of unacceptable circumstances, Village Roadshow 029 made it clear that the Panel gives full weight to an express exception created by Parliament. That Panel said "… the exception itself gives effect to part of a legislative scheme, and its intended operation must be seen in that context."10

- We also agree that there may be cases in which a holding just over 20% establishes a change of control. But it does not, in our view, follow axiomatically that such a holding will establish a change of control. And whether such a holding has an effect on control giving rise to unacceptable circumstances will depend on the circumstances.

- In this matter, if FRC and AMCI Group are associates, voting power up to approximately 42% would be aggregated in the post-Merger Gloucester.11 This would be enough, with the other factors in this matter, in our view, to amount to a change of control or an effect on control that would give rise to unacceptable circumstances. Accordingly, we carefully considered the question of association.

Association

- Broadly, two or more persons are associates if:

- there is (or is proposed) an agreement, arrangement or understanding between them (whether formal or informal, written or oral, and whether or not legally binding) for controlling or influencing the composition of the entity's board or the conduct of the entity's affairs or

- they are acting, or proposing to act, in concert in relation to the entity's affairs.12

- It is not sufficient that two persons separately and coincidentally act in the same manner.13 However, there may be a concurrence of time, character, direction and result which leads to the inference that the separate acts were the outcome of an association.

- We sought submissions from the parties on various relationships between Whitehaven shareholders that may give rise to an association under s12. Information was first sought from the parties in the brief. After consideration of the submissions and rebuttals we were considering finding associations between FRC and AMCI Group on the one hand, and between Mr Mende and persons connected with the AMCI Group14 on the other hand. We then issued a supplementary brief which outlined this possibility and invited further submissions.

FRC and AMCI Group

- Both FRC and AMCI submitted that they were not associates under s12.

- FRC submitted that First Reserve's15 investment and divestment decisions were made by its investment committee of 13 managing directors,16 having regard to the fiduciary duties of First Reserve as a fund manager and the investment criteria of the relevant fund. FRC also submitted that it invested in Whitehaven some years after AMCI (buying its interest from AMCI); that FRC and AMCI made different decisions in respect of participation in the Whitehaven placement; and that where the parties have invested alongside each other, the exit decisions have been made at different times and in different circumstances.

- AMCI submitted that it made decisions about its Whitehaven investment independently of FRC and was not influenced by FRC in this process. It submitted that its decisions in relation to Whitehaven were made by Fritz Kundrun and Hans Mende as AMCI directors and their decision-making did not include consultation with FRC or its representatives. It also submitted that it pursued its own interests and did not make investment decisions to suit FRC's objectives.

- On the material before us we are not satisfied that FRC and AMCI are associates under s12 in respect of their shareholdings in Whitehaven. There is no further evidence that would lead to a conclusion that they were, or would become, associates in relation to their potential holdings in the post-Merger Gloucester.

AMCI Group

- It was conceded that Mr Mende has a relevant interest in AMCI's 13.25% of Whitehaven and the Mende Family Trust's 5.26% of Whitehaven (totalling 18.51%). What was disputed was whether he also has a relevant interest or voting power in:

- 5.26% held or controlled by Fritz Kundrun as trustee of the Kundrun Family Trust

- 0.7% held or controlled by Kirsten Investments II LLC

- 0.7% held or controlled by Markus Investments II LLC and

- 1.39% held or controlled by Nicola Investments II LLC.

- Whitehaven submitted that there was no association such as to give Mr Mende voting power over 20%. AMCI did not address the question.

- As we are of the view that association between FRC and AMCI is not established, we do not find it necessary to draw a conclusion on the relationships between persons connected with the AMCI Group.

- Therefore we are not satisfied on this basis of a change of control of Gloucester or an effect on control that gives rise to unacceptable circumstances. If we cannot establish an association, we must remain open to the possibility that in fact the separate holdings will act as countervailing interests rather than as a block.

Opportunity to consider Noble bid or other control transaction

- The initial Panel's second basis for unacceptable circumstances was that the Merger structure prevented an auction for control of the pre-Merger Gloucester. We agree, but our reasoning differs.

- The Merger was structured as a takeover of the larger Whitehaven by the smaller Gloucester. Whitehaven and Gloucester had agreed that, for a number of reasons, this reverse takeover structure was the more appropriate method to effect the Merger.

- Gloucester submitted that the Merger was structured as a takeover of Whitehaven by Gloucester because (among other reasons):

- it minimised completion risk and offered deal certainty. Whitehaven's directors and their associates, and FRC, had indicated that they would accept the Merger in the absence of a superior proposal for Whitehaven. Although the public statements regarding the directors and their associates collectively representing 74% of Whitehaven have been retracted, the parties have confirmed that they remain committed to the transaction.17 This level of commitment largely fulfills the Merger's 80% minimum acceptance condition, which was otherwise not waivable without the consent of Whitehaven. Moreover, Noble holds a 21.67% stake in Gloucester and had advised Gloucester that it intended to continue to use the 3% creep rule to increase its influence over Gloucester. The structure of the Merger meant that Noble could not use its stake in Gloucester to block the bid

- it was an agreed deal. Gloucester's directors "had formed the view that [the Merger] was in the interests of Gloucester shareholders" and regarded it as "essential that Gloucester accommodated Whitehaven's request that the deal be structured as an acquisition of Whitehaven by Gloucester" and

- it provided Whitehaven shareholders with the opportunity to obtain CGT roll over relief and gave accounting treatment advantages.

- These factors and the market capitalisation of Whitehaven (2.3 times that of Gloucester) lead us to the conclusion that this reverse takeover is, in substance, a merger where both parties are in play.

Restrictive arrangement

- Guidance Note 7 says:

"The term 'lock-up device' refers to different types of restrictive arrangements entered into between bidders and targets (or other parties) to encourage or facilitate a takeover bid…."18

- The principles regarding lock-up arrangements apply to any arrangement that has the effect of fettering the actions of a target, a bidder or a substantial shareholder.19 We are of the view that factors present in the Merger amount to a lock-up device. The commitments of Whitehaven's directors and FRC to the Merger, the MIA and the announced bid terms combine to give rise to a restrictive arrangement between Gloucester and Whitehaven.

- The MIA between Gloucester and Whitehaven included terms to the following effect:

- Gloucester and Whitehaven were to release an agreed bid announcement. This was done on 20 February 2009.

- Exclusivity provisions, including a 'No Talk' provision. In substance, this was that each party must not (among other things) participate in discussions or negotiations in relation to a third party proposal, unless:

- it was unsolicited

- not to do so would reasonably be likely to involve a breach of directors' duties and

- before any binding third party arrangement was entered into, the other party was given the opportunity to match the terms.

- The MIA appeared to be consistent with the policy in Guidance Note 7 to the extent that it contained reciprocal 'No Talk' fiduciary outs for Gloucester and Whitehaven.

- However, it included the form of bid announcement that Gloucester was to make. By making the agreed bid announcement, as required by the MIA, Gloucester became bound by s631 to proceed with its bid on terms not substantially less favourable than those announced.20

- The agreed bid announcement is inconsistent with the MIA as it does not provide a "fiduciary out" for Gloucester (ie, no condition that the bid is subject to a superior proposal for Gloucester). The effect is that the fiduciary out for Gloucester in the MIA has no operation or no effective operation. This makes it, in substance although not form, inconsistent with the Panel's policy, which says:

"The Panel regards it as essential that a no-talk agreement contain an appropriate 'fiduciary exception', allowing directors to respond positively to any better proposal if they form the view that to do so would be in the best interests of target shareholders."21

- We are of the view that the agreed bid announcement requires rectification.

- The result of the Gloucester bid as announced is that the Gloucester board is unable to consider alternative proposals for the pre-Merger Gloucester and is unable to recommend such proposals to its shareholders to consider.

- The Panel is primarily concerned with whether the overall effect of a lock-up arrangement is contrary to the policy in s602(a). The two criteria applied are:

- whether the arrangement has a significant deterrent impact on competition for control or on current or potential counter-proposals. This focuses on the effect on potential bidders and

- whether the arrangement has a substantial coercive effect on target shareholders when they are assessing the proposal or any current or potential counter-proposals. This focuses on the effect on shareholders.

- As Guidance Note 7 says:

"Arrangements which have the effect or likely effect of impeding the willingness of current or potential buyers or bidders to advance their proposal or the ability of sellers or shareholders to consider and accept or respond to current or potential alternative proposals have the effect of undermining the competitiveness and efficiency of the market for control of the relevant company and generally. This is true, even if the arrangements affect only one of those classes of people."22

- The Panel is also concerned with whether the overall effect of a lock-up arrangement is contrary to the policy in s602(c). If the arrangement has the effect of excluding potential bidders for the bidder itself (in a reverse takeover), the bidder's shareholders are denied an opportunity. This is all the more acute because those shareholders do not even have such benefits as may exist by reason of the first bid – they will receive no control premium for their shares and are likely to suffer dilution with a control premium passing to the 'target's' shareholders.

- As the bid for Whitehaven must proceed, any bidder for Gloucester can only bid for the post-Merger entity. This combined with the MIA prevents the Gloucester board from engaging with current or potential counter-proposals for Gloucester; so, for example, the current bid by Noble cannot be considered, potentially depriving shareholders of a reasonable and equal opportunity to participate in the benefits of that proposal (or any other).

- We are of the view that the circumstances relating to the Merger have the effect of 'locking-up' Gloucester contrary to the policy in s602, and agree with the initial Panel that "the Merger prevents an auction for control of Gloucester."23

- This approach is consistent in our view with the Panel's treatment of 'No Talk' clauses where the Panel has sought to restore the intended effect of the clauses by ordering amendments to the wording24 or sought to clarify the interpretation of a clause so that it would not be read as strictly as it appeared to be written because that would rob the clause of efficacy.25

- Accordingly, in this matter the lock-up gives rise to unacceptable circumstances because, in our view:

- it prevents the acquisition of control over Gloucester shares taking place in an efficient, competitive and informed market by preventing bids for the pre-Merger Gloucester, including the Noble bid and

- it prevents the Gloucester board from considering a superior proposal for Gloucester (whether the Noble bid or otherwise, as they consider appropriate). Therefore Gloucester shareholders do not all have a reasonable and equal opportunity to participate in the benefits accruing to Gloucester shareholders through an alternative proposal.26

- We agree with the initial Panel27 that what is relevant is the effect on the acquisition of control over shares in Gloucester in its current form, not the post-Merger Gloucester.

- We do not think that this means every bid must include a condition that there is no superior proposal made or announced for the bidder itself. We also do not think that such a condition is a necessary part of all reverse takeover bids, although it is more likely to be appropriate for a reverse takeover than an ordinary takeover. Gloucester's bid, a reverse takeover, has unique features. The lack of an effective 'fiduciary out' in these circumstances, in our opinion, gives rise to unacceptable circumstances.

Orders

Power to make orders

- Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make any order28 if 4 tests are met:

- it has made a declaration under s657A. This was done on 29 April 2009

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons below, we do not think our orders unfairly prejudice any person

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 17 April 2009 and

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. For the reasons below, we think our orders protect rights and allow the takeover to proceed as it should have.

- The initial Panel ordered that Gloucester seek shareholder approval of its bid for Whitehaven and that Whitehaven's directors, their associates and any party to the pre-bid acceptance deeds not vote. Such an order suits a finding of a change of control of Gloucester in unacceptable circumstances. We have made different orders, on different findings, to the effect that it be open to Gloucester's independent directors to decide whether a superior proposal for Gloucester warrants the company letting its bid for Whitehaven lapse. Consistent with the Panel's policy on lock-up devices, we think Gloucester's board should be free to engage with potential bidders. The Panel's lock-up policy does not insist on shareholders approving an alternate proposal; it concerns itself with unlocking a lock-up. Our orders suit an effect, or potential effect, on control by reason of a lock-up.

Unfair prejudice

- Whitehaven submitted that the orders of the initial Panel unfairly prejudiced it, as a collateral party to an application in relation to the affairs of Gloucester (not it), by interfering with its contractual rights. We did not need to consider this, although were inclined not to agree.

- In any event, we proposed different orders. By creating a landscape in which competition for control of Gloucester can be encouraged, we think no party is unfairly prejudiced.

- Our orders give proper effect to a transaction entered into between Gloucester and Whitehaven, which they were entitled to enter (subject to satisfying the Panel's policy on lock-up devices). The orders allow Gloucester's independent directors, in the exercise of their fiduciary duties, to prefer whatever deal is more in the interests of Gloucester's shareholders. Noble's bid may or may not satisfy Gloucester's independent directors of this, but negotiations can now be undertaken as a result of the Panel's orders. This is a matter for the parties.

- It does not, in our opinion, unfairly prejudice Noble that it must take Gloucester as it finds it at the time it bids, provided it has the ability to persuade Gloucester's independent directors (by increasing its bid price or otherwise) as above.

- Given our conclusion that the Merger does not result in an unacceptable change of control, Gloucester's shareholders must accept that the board may undertake a transaction such as the bid for Whitehaven. It does not, in our opinion, unfairly prejudice them, provided that the board (through the independent directors) can also consider alternative proposals that are more in their interests.

Protect rights

- Noble submitted that the proposed orders did not redress the unacceptable circumstances. It submitted that the orders do not protect the rights and interests of Gloucester shareholders (or allow the bid to proceed as it should have), but "hand control of the decision as to whether Gloucester shareholders should have the opportunity to consider the Noble Bid or any other bid to the Gloucester directors, the very people who structured the Gloucester Bid such that it improperly prevented an auction for control of Gloucester in the first place … ."

- We do not agree. By enabling the Gloucester board to consider the Noble offer, and other potential offers, in our opinion the rights and interests of Gloucester's shareholders are protected. That is a primary responsibility of the directors. The orders enable the independent directors of Gloucester to consider the Noble proposal, or any other proposal. If they consider it to be a superior proposal, the orders allow the opportunity for Gloucester shareholders to participate in any benefits accruing from that proposal. They also protect the interests of any potential bidder for Gloucester, including Noble, by opening that window of opportunity.

Bid proceed as it should have

- In our opinion the orders also allow the Merger to proceed as it would have if the circumstances had not occurred.

- Noble submitted that the proposed orders create a role of "gatekeeper" and hand that role to the Gloucester directors. Any prior transaction which involves a fiduciary out (which the Panel accepts may legitimately occur – hence Guidance Note 7) does exactly that. We do not have information to suggest that the independent directors of Gloucester will act otherwise than properly in the performance of their fiduciary duties. It is not a question of gatekeeping because Noble approached Gloucester after it had entered another transaction.

Conclusion on orders

- We accept that it is consistent with the intention of the parties for there to be a condition in the bid, given the fiduciary outs in the MIA. We consider this order the most appropriate remedy to the unacceptable circumstances. We also believe that such an order is consistent with the Panel's policy on lock-up devices as it removes the anti-competitive effect, enabling Gloucester to consider the Noble bid or any alternative proposal for Gloucester.

- We are of the view that, in these circumstances, the insertion of a condition into the bid to give effect to a fiduciary out in the MIA does not cause Gloucester to breach section 629. Similar to the assessment of a material adverse change, the assessment of a superior proposal is not solely within the opinion, belief, state of mind or control of the bidder.

- In any event, we would accept in these circumstances ASIC's submission that Panel orders can require a person to do something contrary to a relevant provision in Chapter 6.29 We note ASIC's later submission that the Panel would need to weigh the "possible benefits of the condition against the uncertainty created by imposing a condition that turns on the bidder's opinion and the fact the proposed condition arguably raises concerns of the type that section 629 seeks to address." We do not, however, believe that such a concern is warranted in the circumstances as our orders do not allow Gloucester to withdraw from its bid freely. Rather, it may only withdraw if certain events happen, such as a superior third party proposal being made or announced.

- We also consider that, if the independent directors of Gloucester, in the exercise of their duties, form the view that the proposed Noble bid (or as may be increased) is a superior proposal for Gloucester, Noble is not to rely on the Merger condition in its bid. The reason is that a basis of Noble's application was that Gloucester shareholders were not being given an opportunity to participate in the benefits under the Noble offer.

Declaration

- It appears to us that the circumstances are unacceptable having regard to:

- the effect that we are satisfied the circumstances have had, are having, will have or are likely to have on:

- the control, or potential control, of Gloucester

- the acquisition, or proposed acquisition, of a substantial interest in Gloucester and

- the purposes of Chapter 6 as set out in s602.

- the effect that we are satisfied the circumstances have had, are having, will have or are likely to have on:

- We think it is not against the public interest to make a declaration of unacceptable circumstances. We had regard to the matters in s657A(3).

- A copy of the declaration is Annexure A.

Orders

- Following the declaration, we made final orders on 29 April 2009.

- The final orders are Annexure B.

- We did not make any costs orders.

Alison Lansley

President of the Sitting Panel

Decision dated 29 April 2009

Reasons published 7 May 2009

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Gloucester Coal Limited 01R

The Takeovers Panel revokes the declaration made on 17 March 2009 in relation to the affairs of Gloucester Coal Limited (Gloucester) and substitutes this declaration.

Circumstances

- On 20 February 2009, Gloucester announced a bid for Whitehaven Coal Limited (Whitehaven) offering 1 Gloucester share for every 2.45 Whitehaven shares (Merger). At the time, the market capitalisation of Whitehaven was approximately 2.3 times that of Gloucester.

- Gloucester and Whitehaven entered a Merger Implementation Agreement (MIA). The MIA included the following terms:

- Gloucester and Whitehaven release an agreed bid announcement

- exclusivity provisions including a 'No Talk' provision. In substance, this was that each party must not (among other things) participate in discussions or negotiations in relation to a third party proposal, unless:

- it was unsolicited

- not to do so would reasonably be likely to involve a breach of directors' duties and

- before any binding arrangement is entered, the other party is given an opportunity to match the terms.

- The Merger was structured as a takeover of Whitehaven by Gloucester because (among other reasons):

- it offered deal certainty. Noble Group Limited (Noble) could not use its 21.7% shareholding in Gloucester to block the bid

- it minimised completion risk. The directors of Whitehaven and their associates, and FRC Whitehaven Holdings BV, indicated that they would accept the Merger in the absence of a superior proposal for Whitehaven. This largely fulfills the Merger's 80% minimum acceptance condition

- it offered capital gains tax and accounting treatment advantages and

- Whitehaven requested it and this made the Merger an agreed deal.

- On 27 February 2009, Noble announced a bid for Gloucester of $4.85 cash per share, subject only to the Merger not proceeding and prescribed occurrences.

- While the MIA included a fiduciary carve out for Gloucester from the 'No Talk' provision, the announcement of the bid did not include a condition that the bid was subject to no superior proposal emerging for Gloucester.

- As a consequence:

- the fiduciary carve-out in the MIA has limited or no effective operation

- the Gloucester board is unable to consider the Noble bid or any alternative proposal for Gloucester in its pre-Merger form

- by reason of (b), there is no prospect of Gloucester shareholders having an opportunity to participate in any benefits accruing through the Noble bid or any other alternative proposal for Gloucester

- the acquisition of control over voting shares, and therefore the potential control of, or the acquisition of a substantial interest in Gloucester, will not take place in an efficient, competitive and informed market.

- It appears to the Panel that the circumstances are unacceptable having regard to:

- the effect that the Panel is satisfied that the circumstances have had, are having, will have or are likely to have on:

- the control, or potential control, of Gloucester

- the acquisition, or potential acquisition, by a person of a substantial interest in Gloucester and

- the purposes of Chapter 6 of the Act set out in s602.

- the effect that the Panel is satisfied that the circumstances have had, are having, will have or are likely to have on:

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3) of the Act.

Declaration

Under section 657A of the Act, the Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of Gloucester.

Alan Shaw

Counsel

with authority of Alison Lansley

President of the Sitting Panel

Dated 29 April 2009

Annexure B

Corporations Act

Section 657D

Orders

Gloucester Coal Limited 01R

Pursuant To

- A declaration of unacceptable circumstances in relation to the affairs of Gloucester Coal Limited (Gloucester) on 29 April 2009 and

- Section 657D of the Corporations Act 2001 (Cth)

The Panel Orders

The orders made on 20 March 2009 are revoked and the following substituted:

Amended bid terms

- Gloucester's bid for Whitehaven Coal Limited (Whitehaven) announced on 20 February 2009 be subject to a condition to the effect that no superior proposal for Gloucester is made or announced.

In this condition, a proposal is a superior proposal if:

- the independent directors of Gloucester form the opinion, reasonably formed in good faith and for a proper purpose based on their fiduciary duties, that it is more in the interests of Gloucester's shareholders than Gloucester's bid for Whitehaven and

- it is conditional on Gloucester's bid for Whitehaven not proceeding or otherwise lapsing or being withdrawn.

- The condition in paragraph 1 is not waivable for 21 days after the first offer under Gloucester's bid for Whitehaven is made. If, within that time, a superior proposal (as defined in order 1) has been made or announced then it cannot be waived at all unless that superior proposal lapses or does not otherwise proceed.

Amended Merger Implementation Agreement

- The Merger Implementation Agreement between Gloucester and Whitehaven dated 19 February 2009 be amended by inserting the following clauses:

- at the end of clause 5.4 - "Nothing in this clause 5.4 requires either Gloucester or Whitehaven to take, or refrain from taking, any action if to do so would be inconsistent with any order of the Takeovers Panel."

- at the end of clause 7.2(b) - "(3) waive the condition in paragraph 3(j) of Schedule 2 before the earliest time permitted under any order of the Takeovers Panel."

- at the end of clause 7.2(c) – "(3) paragraph 3(j) of Schedule 2 being waived."

- after clause 6.8 - "6.9 Gloucester is not liable to Whitehaven for any breach of this agreement that is a direct or indirect result of compliance with any order of the Takeovers Panel."

- at the end of schedule 2, item 3 –

"No superior proposal for Gloucester

(j) Before the end of the Offer Period no superior proposal for Gloucester is made or announced.

In this condition, a proposal is a superior proposal if:(i) the independent directors of Gloucester form the opinion, reasonably formed in good faith and for a proper purpose based on their fiduciary duties, that it is more in the interests of Gloucester's shareholders than Gloucester's bid for Whitehaven and

(ii) it is conditional on Gloucester's bid for Whitehaven not proceeding or otherwise lapsing or being withdrawn."

Noble condition

- If the independent directors of Gloucester, in the exercise of their duties, form the view, and announce, that the proposed Noble bid (or as may be increased) is a superior proposal for Gloucester, and that its bid for Whitehaven will not proceed, Noble:

- is not to rely on the condition referred to in paragraph 1 of attachment 1 to its announcement dated 27 February 2009 and

- must free its bid of that condition.

Announcement

- Gloucester must:

- announce to ASX and

- include in its bidder's statement

the amendment required to the terms of its announced bid.

Consideration of proposal

- The independent directors of Gloucester must consider any proposal made or announced as soon as practicable.

Alan Shaw

Counsel

with authority of Alison Lansley

President of the Sitting Panel

Dated 29 April 2009

* Cited as Gloucester Coal Limited 01R

1 [2009] ATP 6

2 References to the term "associate" have the meaning given by s12 unless specified otherwise

3 See ASX Listing Rule 3.19A

4 According to Whitehaven's submission, the amount by which the combined holding of merged entity shares held by AMCI and its subsidiary AMCI Investments Pty Ltd, Hans Mende, Fritz Kundrun, Kirsten Investments II LLC, Markus Investments II LLC and Nicola Investments LLC exceeds 19.9%

5 Gloucester Coal Limited 01 [2009] ATP 6 at [25]

6 Gloucester Coal Limited 01 [2009] ATP 6 at [27]

7 Gloucester Coal Limited 01 [2009] ATP 6 at [30]

8 Village Roadshow Limited 03 [2004] ATP 22 at [53]-[54]

9 Village Roadshow Limited 02 [2004] ATP 12 at [53]

10 Village Roadshow Limited 02 [2004] ATP 12 at [54]

11 This assumed association within the AMCI Group would result in the aggregate voting power of Mr Mende being approximately 21.03%

12 The panel has recognised on many occasions that, while the definition casts the net widely (having regard to the broad definition of what is an entity's affairs in s53), the limbs are to be read in the context of the policy of Chapter 6, which is principally concerned with the accumulation and exercise of voting power. See, for example, Azumah Resources Limited [2006] ATP 34 at 60, National Foods Limited [2005] ATP 8 at [57]-[58] and LV Living Limited [2005] ATP 5 at [77].

13 Adsteam Building Industries Pty Limited v Queensland Cement and Lime Co Limited (No 5) [1985] 1 Qd R 11.

14 Hans Mende, Fritz Kundrun as trustee of the Kundrun Family Trust, two companies ultimately controlled by a limited partnership in which Mr Mende's children have a 99% interest (Kirsten Investments II LLC and Markus Investments II LLC) and a company ultimately controlled by a limited partnership in which one of Mr Kundrun's children has a 99% interest (Nicola Investments II LLC)

15 First Reserve Corporation, the ultimate holding entity of FRC

16 Mr Krueger is one of the 13

17 Whitehaven's correcting ASX announcement on 25 March 2009 (released after Gloucester's initial submissions) informed the market that 32.3% of the Whitehaven share capital owned by FRC had been incorrectly associated with Mr Krueger, a director of Whitehaven and Mr Krueger had no relevant interest in Whitehaven shares held by FRC. FRC submitted that it still intended to accept the Gloucester bid in the absence of a superior proposal. Similarly, the 25 March 2009 ASX announcement by Whitehaven said that an approximately 8% interest held by Mr Kundrun, Kirsten Investments II LLC, Markus Investments II LLC and Nicola Investments LLC had been incorrectly attributed to Mr Mende, a director of Whitehaven. No submissions were made as to whether this 8% would accept the Gloucester bid. However, Whitehaven submitted that, at the time the Merger was announced, Whitehaven was advised that Mr Kundrun supported the Merger and this remained its understanding.

18 Overview, paragraph 2

19 GN 7 at [7.1]

20 A failure to do so is a strict liability offence under s631(1A)

21 GN 7 at [7.31]

22 GN 7 at [7.11]

23 Gloucester Coal Limited 01 [2009] ATP 6 at [35]

24 Magna Pacific Holdings Ltd 02 [2007] ATP 3

25 Queensland Cotton Holdings Limited 02 [2007] ATP 5

26 Also considered by the initial Panel: Gloucester Coal Limited 01 [2009] ATP 6 at [34]

27 Gloucester Coal Limited 01 [2009] ATP 6 at [38]

28 Including a remedial order but not an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

29 And see Guidance Note 4, paragraph 14 and s657D(2)