[2015] ATP 12

Catchwords:

Board spill - collective action - association - relevant agreement - understanding - acting in concert - voting power - relevant interest - substantial holding notices - media canvassing - declaration - orders

Corporations Act 2001 (Cth), sections 12(2), 64, 249D, 602, 602A, 606, 609(1), 657A, 657C(3), 657D, 671B

Queensland North Australia Pty Ltd v Takeovers Panel [2015] FCAFC 68, Perpetual Custodians Ltd v IOOF Investment Management Ltd; Murray v Perennial Investment Partners Ltd (2012) NSWSC 1318, Flinders Diamonds Ltd v Tiger [2004] SASC 119, Endresz v Whitehouse (1997) 24 ACSR 208, Bank of Western Australia Ltd v Ocean Trawlers Pty Ltd (1995) 16 ACSR 501, J-Corp Pty Ltd v Australian Builders Labourers Federated Union of Workers (1992) 44 IR 264, Elders IXL Ltd v NCSC (1987) VR 1, Adsteam Building Industries Pty Ltd v Queensland Cement and Lime Company Ltd (No 4) (1984) 14 ACLR 456,Tillmanns Butcheries Pty Ltd v Australasian Meat Industry Employee's Union (1979) 42 FLR 331

Panel Guidance Note 4 - Remedies General, ASIC Regulatory Guide 128: Collective action by investors

Procedural Rule 7.1.1.

Echo Resources Limited [2015] ATP 8, Gondwana Resources Limited 02 [2014] ATP 15, Northern Iron Ltd [2014] ATP 11, Avalon Minerals Limited [2013] ATP 11, World Oil Resources Limited [2013] ATP 1, CMI Limited 01R [2011] ATP 5, CMI Limited [2011] ATP 4, Viento Group Limited [2011] ATP 1, Mount Gibson Iron Limited [2008] ATP 4, Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12, Orion Telecommunications Ltd [2006] ATP 23, Rusina Mining NL [2006] ATP 13, Coopers Brewery Limited 03R and 04R [2005] ATP 23 & ATP 24, Austral Coal 03 [2005] ATP 14, Pacific Magnesium Corporation Ltd [2005] ATP 12, Rivkin Financial Services Limited 02 [2005] ATP 1, Rivkin Financial Services Limited 01 [2004] ATP 14, St Barbara Mines 02 [2004] ATP 12, Anzoil NL 01 [2002] ATP 19, Winepros Limited [2002] ATP 18

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | Yes | Yes | Yes | No |

Introduction

- The Panel, Stephanie Charles, David Friedlander and Nora Scheinkestel (sitting President), made a declaration of unacceptable circumstances in relation to the affairs of Resource Generation Limited. The application concerned, among other things, the failure to disclose an alleged association between 3 Resource Generation shareholders 2 of whom were members of a debt club seeking to provide new project financing to the company. One of the shareholders (Altius) had requisitioned a general meeting to change the composition of the Resource Generation board. The Panel considered that 2 of them (Noble and Altius) were associated for the purpose of controlling or influencing the composition of the board of Resource Generation, made a declaration of unacceptable circumstances and ordered disclosure.

- In these reasons, the following definitions apply:

- Altius

- Altius Investment Holdings (Pty) Limited

- BEE or BEE enterprise

- A black economic empowerment enterprise

- Fairy Wing

- Fairy Wing Trading 136 (Pty) Ltd, a BEE enterprise

- Ledjadja

- Ledjadja Coal (Pty) Ltd, owned 74% by RES and 26% by Fairy Wing

- Noble

- Noble Group Limited

- Noble Resources

- Noble Resources International Pte Ltd, a subsidiary of Noble

- PIC

- Public Investment Corporation SOC Limited (on behalf of the Government Employees Pension Fund)

- Project

- Boikarabelo coal project in the Waterberg region of South Africa

- RES

- Resource Generation Limited

- Shinto

- Shinto Torii Inc., a subsidiary of Altius

- In these reasons, references to Altius being an associate include its subsidiary, Shinto, and references to Noble being an associate include its subsidiary, Noble Resources.

Facts

- RES is a company listed on ASX (ASX code: RES) and Johannesburg Stock Exchange (JSE code: RSG). It is a mining exploration and development company, with a project in the Waterberg region of South Africa.

- RES owns a 74% equity interest in Ledjadja which owns the Project. The remaining 26% is owned by Fairy Wing, a BEE enterprise. RES manages Ledjadja and the Project.

- RES has the following substantial holders:

- PIC - 19.49%

- Noble Resources - 13.69% and

- Shinto - 10.69%.

- In January 2013, Noble provided to RES US$20 million short term funding and entered into an export coal off-take agreement with Ledjadja.

- In March 2013, RES was introduced by Noble to Altius as a member of Noble's due diligence team and to Mr Rob Lowe, Chief Executive Officer of Altius and former Director of Africa Commodities Group, the South African joint venture entity between Noble and Altius.

- On 26 March 2013, Noble sought the appointment of a Noble nominee on the RES board but the request was rejected.

- On 2 April 2013, RES established a strategic partnership with Noble which included Noble acquiring a 7.5% interest in RES at 40 cents a share, entering into a US$123 million loan facility with Ledjadja and appointing Noble as supply chain manager and exclusive marketing agent for the Project.

- On 4 June 2013, RES and Noble entered into a further coal offtake contract for the domestic market.

- On 13 June 2013, RES appointed Altius to provide to Ledjadja representation services for the Project in South Africa and to arrange equity investments in RES.

- On 21 June 2013, to assist RES obtain traction on a proposed entitlement offer, Altius committed to take up a number of shares in the entitlement offer or find an investor to do so, subject to several conditions. These included that Noble, as an existing substantial shareholder, increase its shareholding to 9.9% post entitlement and that Altius have the right to nominate at least one member to the board of RES. The right to nominate one director to the board was accepted by RES but never exercised.

- On 28 June 2013, Noble agreed to provide loan funds of US$55.3 million for construction of the rail link for the Project and reduced the US$123 million loan facility by the equivalent amount to US$67.6 million. Noble provided US$20 million to RES under the rail link agreement on 10 March 2014.

- Also on 28 June 2013, RES announced a 1 for 1 pro-rata non-renounceable entitlement offer. The offer closed on 23 July 2013 with acceptances for 16.7% of the shares offered.

- The shortfall was placed on 22 October 2013 with Noble, PIC and Shinto. PIC was introduced to RES by Altius to take up Altius' original commitment. However, given the size of the shortfall, Altius decided to take up some of the remaining shortfall through its subsidiary, Shinto. Shinto funded the acquisition of RES's shares with a loan from Noble, guaranteed by Altius.

- On 2 January 2014, Noble agreed to provide RES a US$65 million loan for site infrastructure and the existing US$67.6 million loan facility was cancelled.

- On 10 March 2014, a 'debt club' was established with the aim of funding the Project. The debt club included Noble, PIC, two banks and a South African development corporation. In an email from Altius to the debt club participants, Mr Lowe stated that the "process will be managed in South Africa by Altius (as shareholder in ResGen and as South African BEE partner of Noble) and Noble (as shareholder in ResGen, as marketing agent for Ledjadja and as participant in the consortium)". Noble submitted that the debt club was not "Noble led or similar" noting that "RES with Altius as its paid representative has coordinated the debt club". Debt club negotiations continued for over a year but RES and the debt club were unable to agree on the terms for financing the Project.

- On 28 May 2014, in the context of debt club discussions, Mr William Randall of Noble asked Mr Paul Jury, Chief Executive Officer of RES, for a board seat for Noble. Mr Jury indicated that such a request would be acceptable once funding was in place.

- On 9 September 2014, RES confirmed in writing to Altius that it would receive a commission of 2% of the funding raised for successful completion of the debt club financing.

- In June 2015, Noble and Altius commenced discussions regarding the performance of the RES board and the direction of the company's management.

- In July 2015, Noble and Altius commenced discussions regarding the composition of the RES board.

- On 21 July 2015, Mr Randall sent by email to RES a letter with the debt club's "final offer". The term sheet was signed by Noble, PIC and one other debt club participant. The financial model submitted with the offer included a contract mining option as an alternative to the owner mining option which RES was pursuing. Noble contended that hiring a third party to perform contract mining for the Project would reduce the initial required capital expenditure.

- On 22 July 2015, RES responded with its preliminary view that it would not sign the term sheet noting that a number of material items had been left open and the conditions precedent were not capable of being satisfied.

- On 31 July 2015, RES's financial advisors wrote to Noble identifying material issues with the term sheet and putting forward an alternative owner-operator mining option for consideration.

- On 3 August 2015, Mr Jury informed Mr Lowe by email that RES was willing to pursue the contract mining option through an open competitive tender process and set forth a timeline that would achieve a result by mid-December 2015. Mr Lowe responded by email on the same day with concerns regarding the timeline and that RES had previously suggested that it would issue a draft contract to Noble's preferred contractor. Discussions regarding the contract mining option occurred during meetings among RES, Noble and Altius during the period from 4 to 7 August 2015.

- On 19 August 2015, RES released an ASX announcement that it was seeking quotes from mining contractors in response to the debt club's requests.

- On 25 August 2015, Altius sent an email to PIC requesting a meeting to discuss Altius' proposal, with the support of Noble, for each of PIC, Noble and Altius to appoint one non-executive director to the RES board.1

- On 8 September 2015, Altius delivered a presentation to PIC regarding a proposal to South Africanise the project and the RES board. Noble was in attendance.

- On 14 September 2015, Mr Lowe sent an email to Mr Jury stating that the project "is reaching a critical juncture" and for this reason both Noble and Altius seek to secure representation on the boards of RES and Ledjadja. The email stated that PIC was supportive of the proposal and that Mr Lowe would be meeting with PIC in the coming week when PIC would advise whether it would also seek to appoint representatives or "simply support the Noble/Altius initiative". The email was 'blind' copied to Noble.

- On 16 September 2015, Mr Lowe sent an email to PIC, at PIC's request and copying Noble, setting out the motivations and timelines for the appointment of representatives from PIC, Noble and Altius to the RES board. Altius also informed PIC that it had appointed Clayton Utz (also Noble's lawyers) to advise on "the appointments, procedures and generally".

- On 17 September 2015, RES received a letter from Noble's lawyers requesting the appointment of Mr Denis Gately and Mr Manish Dahiya (with Mr Randall as his alternate) as additional directors to the RES board.

- On 18 September 2015, RES responded to Noble's lawyers declining to make the appointments referring to the debt club negotiations and stating that the appointment of additional directors by parties with potentially conflicting interests would not be in the interests of the company and its shareholders at that time. RES released Noble's request and RES's response to ASX and JSE. Following receipt of the response, Noble emailed Altius saying "[a]s expected…I think it is now important to send your letter noting the reason why Noble not appropriate".

- On 21 September 2015, RES's lawyers wrote to Noble and Altius, copying PIC and ASIC, stating that in view of the association that appeared to exist between Noble and Altius any collective action in respect of RES contrary to the Corporations Act would be notified to ASIC.

- On 22 September 2015, Altius wrote to RES's lawyers denying any association with Noble. Altius also emailed PIC noting, among other things, that Altius remained committed to secure the appointment of additional directors to the RES board.

- On 29 September 2015, RES received from Altius, on behalf of its subsidiary Shinto, a s249D2 notice dated 28 September 2015 requisitioning a general meeting to consider resolutions to remove all current RES directors and appoint six new directors (including Mr Gately). The meeting was scheduled by RES for 26 November 2015, immediately after its 2015 annual general meeting on the same day.3

- On 1 October 2015, RES wrote to ASIC claiming illegal collective action by Altius, Noble and PIC.

- On 9 October 2015, PIC, Noble and Altius met at PIC's offices and discussed, among other things, Altius' proposals for changes to management if Shinto's resolutions were passed at the requisitioned meeting.

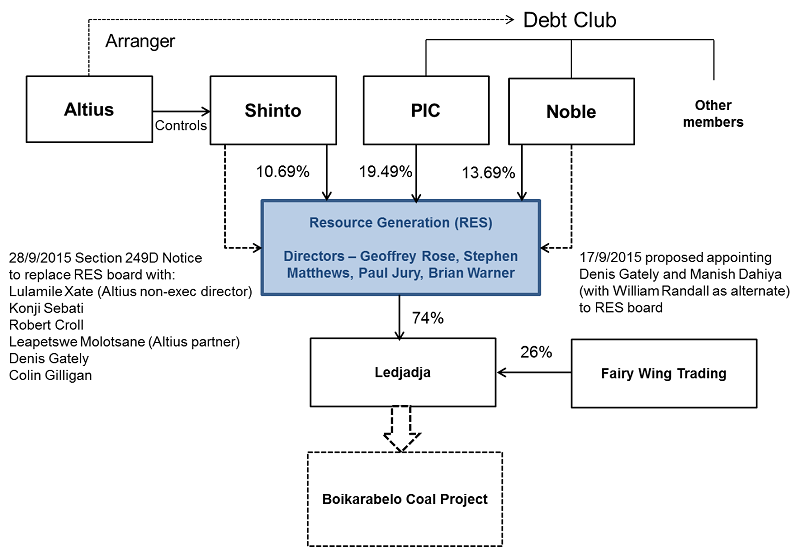

- The structure of holdings of the various parties are shown in the following diagram:

Application

Declaration sought

- By application dated 12 October 2015, RES sought a declaration of unacceptable circumstances. RES submitted that:

- Altius, Noble and PIC were associates under (i) s12(2)(b) because they had entered into a relevant agreement for the purpose of controlling or influencing the composition of RES's board and (ii) s12(2)(c) because they were acting in concert in relation to RES's affairs

- Altius, Noble and PIC had acquired a relevant interest in each other's RES shares by virtue of them entering into a relevant agreement to each vote their shares in favour of the resolutions at the requisitioned meeting and the relevant agreement constituted the entry into a transaction as set out in s64. The acquisition of a relevant interest, and the corresponding increase in each of their voting power above 20%, constituted a breach of s606

- Altius, Noble and PIC had failed to disclose their association or voting power in RES in contravention of s671B(1) and

- Altius, Noble and PIC were attempting to obtain control of RES other than in an efficient, competitive and informed market or in a manner that afforded all shareholders an opportunity to participate in the benefits that would accrue to Altius, Noble and PIC in obtaining that control in contravention of s602.

Interim orders sought

- RES sought interim orders that:

- each of Altius, Noble and PIC disclose details of their association in relation to RES and of their relevant interests in each other's RES shares and

- each of Altius, Noble, PIC and their associates be restrained from exercising votes attaching to their RES shares at the requisitioned meeting or any adjournment of that meeting.

Final orders sought

- RES sought final orders identical to the interim orders.

Discussion

Decision to conduct proceedings

- Before the Panel will conduct proceedings on the issue of association, there must be a sufficient body of material demonstrated by the applicant, together with inferences that might be drawn, to support the Panel finding association.4

- In its preliminary submissions, Noble submitted that the Panel did not get involved in disputes about the composition of a company's board unless they were connected with a control transaction or where shareholders had entered voting arrangements which contravened s606.5 Altius made a similar preliminary submission.

- In Rivkin Financial Services 01,6 the Panel declined to conduct proceedings, considering that there was insufficient evidence to support an inference of association or the accumulation of voting power where there had been acquisitions made by alleged associated parties and changes to the board. The Panel stated that: "the Panel will not generally treat issues about the composition of a company's board as control issues for the purposes of section 657A, unless an accumulation of voting power was involved in contravention of section 606 or without proper disclosure under Chapter 6C". Similarly, in Regis Resources Limited,7 the Panel stated that it "will not treat issues about the composition of a company's board as a control issue for the purposes of s657A unless an accumulation or exercise of voting power occurs in contravention of Chapters 6-6C or in otherwise unacceptable circumstances".

- In Flinders Diamonds Ltd v Tiger,8 the Full Court of the Supreme Court of South Australia found that two shareholders had resolved upon a plan to replace the board - however that of itself was not sufficient to constitute a breach of s606. The breach of s606 arose because one shareholder had also agreed to give the other shareholder an irrevocable proxy. The court said that "[a]lthough voting arrangements for the purpose of achieving a specific goal, such as the reconstruction of the board of directors, are not the kind of arrangements which on their face offend the spirit of Ch 6 of the Corporations Act, they are, however, caught by the width with which the terms in ss 606 and 608 and the definitions of material terms in those provisions are expressed".

- In Echo Resources Limited,9 the Panel considered that there was an insufficient body of material to warrant an investigation into an association relating to a board spill which involved alleged associates holding less than 20%. However, the Panel considered that if there had been sufficient material it would have conducted proceedings and considered the question of jurisdiction.

- In our view, the fact that an application involves a proposal to reconstitute a board of directors does not take it outside the purview of the Panel. If, in the context of issues regarding the composition of a company's board, there is an accumulation or exercise of voting power possibly in contravention of s606, without proper disclosure under Chapter 6C or in otherwise unacceptable circumstances, those issues may be treated as control issues for the purposes of s657A. Here, we considered that there was a sufficient body of material to warrant an investigation as to whether there was an accumulation of voting power by Noble, Altius and/or PIC in contravention of s606 or in the absence of proper disclosure under s671B. We noted that Noble Resources, Shinto and PIC collectively held almost 44% of RES's outstanding shares, while Noble Resources and Shinto collectively held over 23%.

Media canvassing

- In its preliminary submissions, Noble submitted that the application was purely tactical to prevent shareholders of RES from exercising their rights to determine whether to replace directors.

- In this regard, we considered an article appearing in The Australian which contained a number of statements attributable to Mr Jury that may have been in contravention of the media canvassing and confidentiality undertakings given by RES in its Notice of Appearance. The Panel is particularly concerned where applicants make public statements before an application is made that put respondents, then subject to the media canvassing and confidentiality undertakings, at a disadvantage. RES submitted that not all of the statements attributed to Mr Jury were made by him and that the statements were made 5 days before the application was made. We did not consider that the media canvassing in this case was sufficient reason to establish that the application was purely tactical.

Preliminary findings

- Having considered the application, submissions and rebuttals, we made preliminary findings and invited comments on them. Our conclusions follow consideration of responses.

- We considered the cumulative effect of the material and drew appropriate inferences. In doing so we had in mind that we must be satisfied by logical and probative material and the potential seriousness of a finding of association.

- Noble submitted that the Panel's preliminary findings did not provide a nexus between the relevant evidence and its proposed findings and consequently, it was difficult for Noble to determine the matters in respect of which additional submissions should be made. Noble added "that a party should be provided with a reasonable and fair opportunity to provide meaningful comments".

- Whilst we agree that generally parties should be provided with that opportunity, we disagree that there was an insufficient basis here for making meaningful comments. We provided a detailed chronological description of the relevant events we considered had been established and indicated the date (25 August 2015) at which we were minded to find that the association first arose. The parties were free to dispute any of the events, including those events on and after 25 August 2015, or identify other events or facts that would have negated such a finding. Indeed, Noble and each of the other parties provided detailed submissions and rebuttals in relation to the preliminary findings.

- In proceeding this way we were mindful of the limited time available before the requisitioned meeting.

Association

- Section 12 sets out the tests for association as applied to Chapter 6. There are two relevant tests here:

- s12(2)(b) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of a company's board or conduct of its affairs and

- s12(2)(c) - which provides, in essence, that B is an associate of A if (and only if) B is a person with whom A is acting or proposing to act in concert in relation to the company's affairs.

- A relevant agreement is an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal and

- whether written or oral or partly written and partly oral and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights.10

- As the Panel in CMI Limited 01R11 said, the cases make it clear that there is significant overlap between the concepts of "relevant agreement" and "acting in concert" in s12.

- An understanding means an understanding - "plainly a word of wide import"12 - as to some common purpose or object in relation to the company in question. Here, the company in question is RES. We accept the submission of Noble that:

The association provisions of the Corporations Act recognise that to establish an association there must be at least an understanding between the parties as to their common purpose of object (a mere coincidence of separate acts is insufficient), some knowing conduct as the result of communications between them, contemporaneity and community of purpose, and the understanding between the parties as to the common purpose or object must be consensual.13

- In Mount Gibson Iron Limited,14 the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- As the Panel in Winepros Limited15said, often establishing an association requires the Panel "to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association".

- ASIC RG 128 deals with collective action by investors wishing to cooperate in relation to their investments and aims to promote investor engagement on corporate governance issues. It recognises a difference between, on the one hand, investors expressing views and promoting appropriate discipline in decision-making and, on the other hand, investors taking control of decision-making.16

- In encouraging proper corporate governance, which objective the Panel supports, the regulatory guide nevertheless notes that there are requirements to be met, particularly in relation to making sure that shareholders and directors are given enough information to enable them to assess the merits of any proposal.17 Thus, it states:

Investors concerned about common issues may become 'associates' or be regarded as having entered into a 'relevant agreement' for the purposes of the takeover or substantial holding provisions. This is because these provisions are not only concerned with the power of individual investors in relation to the voting and disposal of shares in companies or interests in managed investment schemes, but also the aggregated voting power of groups of investors who are either related or associated with each other in relation to some aspect of the entity's affairs.18

- Table 1 of RG 128 identifies conduct unlikely to constitute acting as associates or entering a relevant agreement, including "discussing and exchanging views on a resolution to be voted on at a meeting." However, it adds:

If the conduct extends to the formulation of joint proposals to be pursued together or there is an understanding that the investors will act or vote in a particular way, then concerns may arise.

- Table 2 of RG 128 identifies conduct more likely to constitute acting as associates or entering a relevant agreement, including "[i]nvestors formulating joint proposals relating to board appointments or a strategic issue."

- We agree that investors should be free to discuss and exchange views in the context of promoting good corporate governance but note ASIC's concerns. It is important but may not always be easy to recognise the line between conduct that is unlikely to constitute acting as associates or entering a relevant agreement and conduct that is likely to do so.

Association between Noble and Altius

- We consider Noble and Altius are associated for the purpose of controlling or influencing the composition of the board of RES. In arriving at this finding, we took into account, among other matters, the structural links, common investments and common dealings between the parties and their shared goals, collaborative conduct and common knowledge.

Structural links, common investments and common dealings

- Altius was introduced to RES by Noble in 2013 as part of its due diligence team. Noble had a pre-existing joint venture company with Altius called Africa Commodities Group (ACG), a South African entity owned 60% by Noble and 40% by Altius. Mr Lowe was a former director of ACG and Mr Lulamile Xate (one of Altius' director nominees for the RES board) is currently a director of ACG. ACG was formed as a strategic partnership providing Noble with a Level 1 BEE partner, Altius, for South African investments. The company has been dormant since 2012. In the email from Mr Lowe to debt club participants on 10 March 2014, Altius was described "as shareholder in ResGen and as South African BEE partner of Noble".

- Altius' original commitment to invest in RES included conditions that Noble increase its shareholding in RES to 9.9% post RES's 2013 entitlement offer and Altius have the right to nominate at least one member to the board of RES. In the context of seeking commitments for the entitlement offer, Mr Randall wrote to RES stating that the three letters from strategic partners (which were for commitments to the offer) were submitted on the basis that the loan term sheet between Noble and RES for rail (see paragraph 14 above) would be signed off and the terms and conditions of the Altius commitment letter would be accepted. The email further stated that "[a]ll submissions are interlinked in respect of funding timing, however does not form an association (in any way shape or form for avoidance of doubt)".

- Noble provided the funding for Shinto to acquire its RES shares, with a guarantee from Altius regarding the funds. Altius submitted that RES was fully aware of the loan and guarantee and saw copies of each without raising objection. RES acknowledged that it was aware of the loan and submitted that this was not "unusual in the BEE South African context where foreign partners are continually providing funds to the BEE partner".

- From March 2014, when Altius was hired by RES to secure debt funding for the Project, Noble and Altius had been working closely together in relation to the debt club. They shared a common goal in wanting the RES board to proceed with the debt club's most recent funding proposal. For Altius, as debt arranger, this included a financial interest in securing its commission from RES.

- These matters support our finding of an association based on the shared purpose, collaborative conduct and common knowledge of Noble and Altius on and from 25 August 2015.

No uncommercial conduct

- We agree with Noble's submission that there is no evidence of Noble or Altius engaging in uncommercial behaviour in relation to RES. However, absence of uncommercial conduct does not necessarily contradict a finding of association.

Shared purpose, collaborative conduct and common knowledge

- Altius submitted that ongoing discussions began from about June 2015 up to and including 18 September 2015 between Altius and Mr Randall and Mr Greg Hunter of Noble regarding two issues related to the performance of the RES board and the direction of the company's management. The first was the remoteness of the existing directors because they are based in Australia. The second was frustration that the board lacked initiative in finding solutions to fund the Project (primarily reducing the capital expenditure required for the Project).

- Altius also submitted that ongoing discussions began from about July 2015 between Altius and Mr Randall and Mr Hunter of Noble regarding the composition of the board of RES. Altius submitted that it concluded that the board should be changed to include representation from Noble and Altius (and possibly PIC) for the reasons described in the preceding paragraph and a general loss of trust towards RES and its management.

- At this stage, these discussions show only an exchange of views, without the formulation of a joint proposal or understanding to act or vote in a particular way indicative of an association.

- On 25 August 2015, Altius sent an email to Mr Mandla Mapondera of PIC requesting a meeting to discuss and secure PIC's support to Altius' proposal for each of PIC, Noble and Altius to appoint one non-executive director to the RES board. In the email, Mr Lowe set out the percentage ownership of each of Noble, Altius and PIC. Following the percentages, the email read (in part):

…With the support of Noble, Altius would like to table resolutions at the next ResGen AGM, due in October, under which each of PIC, Noble and Altius would appoint one non executive director to the board of ResGen. A part of the mandate of our nominees would be to ensure transformation of the executive

Altius has consulted with its stakeholders and outside parties…and we have identified the individual that we would wish to nominate. Noble is engaged in a similar process

I would like to come and see you in order to discuss this proposal…Greg Hunter from Noble will accompany me

- Noble stated that it did not know why the voting percentages were outlined or why Mr Hunter was copied on the email, although it suspected it was because the discussions of debt club members and Altius in prior months included discussions to "South Africanise" the Project.

- The meeting with PIC took place on 8 September 2015 with Mr Lowe, Mr Xate and Mr Leapetswe Molotsane from Altius, Mr Hunter from Noble and Mr Mapondera, Mr Fedelis Madavo and Mr Zack Leguma from PIC in attendance. At the meeting, Altius delivered a PowerPoint presentation which included slides or statements regarding:

- the debt funding having been hampered by, among other things, "absentee ownership and management"

- Altius' proposal to "South Africanize the project" with meaningful South African ownership

- Noble, Altius and PIC holding a "voting block" of 47.77% (assuming that Altius' stake increased to 14.59% on the basis that it would purchase a block of shares that had come on the market) and

- a "New South African Board" with PIC to be invited to nominate two directors, Altius to nominate one director and Noble to nominate one director.

- Altius submitted that the presentation slides used "shorthand expressions" that favoured "brevity over accuracy" and that the "expressions used in the presentation should be viewed in this context, noting also that it is not a 'legal' document". It also submitted that the use of the words "voting block" was intended to convey Altius' expectation of support from Noble and PIC and should not be interpreted as a 'relevant agreement' with regards to the votes of Noble and PIC in relation to resolutions to spill the board. It also noted that, at that time, Altius expected RES to respond constructively to its proposals and there was no anticipation that Altius would requisition a meeting to spill the board.

- Noble submitted, among other things, that Mr Hunter attended the meeting in an operational capacity and had no authority to determine or approve Noble appointees to boards, he had not seen, discussed or agreed the content of the presentation with Altius and it did not reflect any understanding by Noble with respect to shareholding or voting matters.

- We indicated in our preliminary findings that we were prepared to infer that Mr Hunter did not object to the positions stated in Altius' presentation or otherwise indicate that the proposal was still subject to approval by Noble. In response, Altius submitted that it was not appropriate to make that inference from Mr Hunter's silence and it should not be incumbent on business people to object to statements made in a PowerPoint presentation for fear that a tribunal will regard their silence as approval of statements made in the presentation. We agree that the document was not a 'legal' document and the circumstances of the meeting might make it hard to object. However, Mr Hunter's presence and seeming acquiescence at the meeting was part of a pattern of conduct that we consider relevant.

- On 14 September 2015, approximately one week after the meeting with PIC, Mr Lowe sent an email to Mr Jury stating that the Project "is reaching a critical juncture" and for this reason both Noble and Altius seek to secure representation on the boards of RES and Ledjadja. The email stated that PIC was supportive of the proposal and that Mr Lowe would be meeting with PIC in the coming week when PIC would advise whether it would also seek to appoint representatives or "simply support the Noble/Altius initiative". Altius blind copied Noble on the email. Altius submitted that Noble was blind copied because Noble was coordinating arrangements with a third party contractor referred to in the email.

- On 15 September 2015, Mr Lowe asked Mr Leguma of PIC at a meeting they were both attending whether PIC had made up its mind regarding board representation. Mr Leguma said PIC was still considering its options internally and he asked Mr Lowe to send him Altius' motivations and timelines. The following day, Mr Lowe emailed PIC, copying Mr Hunter, with the motivations and timelines for the appointment of representatives from PIC, Noble and Altius to the RES board. Mr Lowe stated that "I should make it clear that our intention is to supplement the board and not to replace it". The email also informed PIC that Altius had appointed Clayton Utz to advise on "the appointments, procedures and generally". Mr Lowe stated that he was "happy to share the advice we receive from Clayton with the PIC".

- On 17 September 2015, Noble's lawyers sent a letter to RES requesting the appointment of Mr Gately and Mr Dahiya (with Mr Randall as his alternate). RES submitted, as evidence of an association, that the same language "the project is reaching a critical juncture in relation to debt funding and construction" was used in this letter and Altius' 14 September 2015 email. We draw no inference from this.

- On 18 September 2015, after receiving RES's rejection (which RES publicly released), Mr Randall emailed Mr Lowe saying "[a]s expected…I think it is now important to send your letter noting the reason why Noble not appropriate". Following that email, there were two separate conversations that day among representatives of Noble, Altius and Clayton Utz in relation to which both Noble and Altius claimed legal professional privilege. After the second conversation, Mr Randall wrote to Mr Lowe saying "we will be removing you from emails". Noble submitted that the purpose of this email was "to confirm Noble's view that Altius and Noble were to proceed independently with respect of the appointment of directors to the Board of RES". We think it indicates that the paper trail was being 'managed'.

- Altius submitted that it separately engaged Clayton Utz and that it was not a joint engagement on behalf of Noble and Altius, although we note that the same legal personnel at Clayton Utz were used by both Noble and Altius. We consider the fact that Altius used the same lawyers in connection with appointments to the RES board as a relevant circumstance.19

- Shortly after Mr Randall's email regarding removing Mr Lowe from emails, on 18 September 2015, Mr Lowe wrote to PIC requesting a meeting stating: "I am sure that you are aware of recent developments with regard to the ResGen board. Altius has considered internally and we have resolved the appropriate way forward from our perspective". Mr Leguma of PIC responded that it was preferable to wait for Mr Madavo to be available. Mr Lowe responded on 21 September 2015 stating that he would send an email summary of the Altius position determined at a board meeting Friday "so at least you are aware where we are coming from and how we would like to see this unfortunate development resolved". Mr Lowe sent that email to PIC the next day.

- On 21 September 2015, Noble and Altius had received a letter from RES's lawyers, copying PIC and ASIC, alleging an association between Noble and Altius.

- On 22 September 2015, Altius wrote to RES's lawyers denying any association with Noble.

- On 28 September 2015, Shinto requisitioned a general meeting to replace the RES board. RES submitted, as evidence of an association, the fact that Mr Gately was nominated by both Noble in its letter of 17 September 2015 and Shinto in its requisition notice. We do not draw any inference specifically from this fact.

- On 9 October 2015, six days after Altius sent the s249D requisition to RES, Mr Mapondera of PIC, Mr Hunter of Noble and Mr Xate and Mr Lowe (via telephone) of Altius had a meeting at PIC's offices. According to PIC, among other things discussed at the meeting, PIC wanted to know if Altius had candidates in mind for changes to management. Two people were mentioned by Altius - Mr Hunter and Mr Colin Gilligan (one of Altius' director nominees) - and PIC asked to receive a copy of their CVs. PIC submitted that it had not closely followed Altius' requisition of meeting and remained neutral on the matter. Noble submitted that Mr Hunter did not know beforehand that Altius was going to put his name forward and there was no arrangement between Noble and Altius in this regard.

- Table 2 of RG 128 provides that unacceptable circumstances may arise where there is a proposal to replace directors with new directors who are aligned with the requisitioning shareholders. Nothing came to our attention that a majority of the proposed directors were not independent, but we were curious that the shareholders were talking about management changes if the board spill was successful. That would be a matter for an independent board. Moreover, we consider Mr Hunter's presence at the 9 October 2015 meeting continued a pattern of conduct between Noble and Altius.

- Altius submitted that an agreement, arrangement or understanding must involve more than a plan and it must contemplate the method by which the plan may be carried into effect. While Noble and Altius were each proposing to appoint additional directors, Altius submitted that there was no understanding as to what that board composition would ultimately be. Altius further submitted that if the Panel did find that Altius' discussions with Noble and PIC were sufficient to constitute a relevant agreement for the purpose of controlling or influencing the composition of the RES board, any such relevant agreement ceased to exist when Altius requisitioned the meeting.

- Noble submitted that the evidence did not support the drawing of an inference as broad as an association in relation to the composition of the board because, prior to Altius requisitioning the meeting, the interactions between Noble and Altius related to the separate appointment of additional directors. Noble also submitted the requisitioning of the meeting was a unilateral action by Altius and referred, among other things, to Mr Lowe's email on 28 September 2015 forwarding a copy of the notice of requisitioned meeting to Noble in which Mr Lowe stated that he "hope[s] that [Altius] will be able to rely on Noble support in relation to [Altius'] objectives".

- On the evidence, we consider that the 25 August 2015 email from Altius to PIC, copying Noble, which referred to Altius' proposal with Noble's support that each of PIC, Noble and Altius appoint one non-executive director to the RES board, was clear evidence that the discussions between Noble and Altius had moved from being a concurrence of views to being a joint proposal to change the composition of the RES board. Both parties appeared to be frustrated dealing with the current board in relation to advancing the debt club's funding proposal and that frustration coalesced into wanting a change. While Noble and Altius may have taken different actions in pursuit of their shared goal, they nonetheless in our view had an understanding as to a common purpose being to change the composition of the RES board.

- As noted, parties can hold as many discussions as they want. They can be like-minded without necessarily creating an association. But Noble and Altius went beyond discussion. They went beyond even a discussion with an expectation that the other would act in a certain way.20 Their actions fitted the example extracted from Table 2 of RG 128 in paragraph 65 above. They formulated a proposal that involved "at least an understanding between the parties as to a common purpose or object",21 namely a joint proposal for controlling or influencing the composition of the board of RES.

- We consider the conduct of Noble and Altius between 25 August and 9 October 2015 supports the finding that Noble and Altius are associated. In connection with their shared goal to change the composition of the RES board, Noble and Altius acted together in seeking PIC's support for their proposal and represented to PIC that they were acting together. Noble and Altius kept each other updated on discussions and events in relation to matters related to the composition of the RES board, including copying each other on correspondence and attending meetings together. We are not persuaded that the different actions taken by Noble and Altius - the various separate requests for board representation and the requisition of meeting - establish that there is no association or that any association was severed. After having their requests for board representation rebuffed, the requisition of a meeting was a logical next step. The common knowledge of relevant facts between Noble and Altius, particularly by the coordination of correspondence on 18 September 2015, provides a strong indication of a common purpose leading to an association.

Relevant interest

- Having found an association between Noble and Altius, we considered whether Noble and Altius acquired a relevant interest in each other's RES shares by virtue of them entering into a relevant agreement to each vote their shares in favour of the resolutions at the requisitioned meeting.

- RES submitted that the evidence upon which the Panel was minded to find an association established a voting agreement.

- In addition, RES provided a statutory declaration from Mr Jury describing a phone conversation he had with Mr Randall on 30 July 2015. According to Mr Jury, Mr Randall indicated, among other things, that RES's approach to coal mining "was not the way forward" and that he had "the numbers in his pocket to make it happen". Mr Jury understood this to mean that Mr Randall had the votes of Noble, Altius and PIC (and possibly others) to remove the current RES board and appoint a more compliant board which would accept the contract mining option. Noble submitted that Mr Randall did not recall making the "in his pocket" statement or talking to Mr Jury on that day. We do not have enough evidence to prefer one view over another.

- Association is not a contravention of the Act,22 but may lead to a contravention, for example, of the substantial holder provisions by reason of the aggregation of relevant interests.23 It does not always follow that there will be a contravention of s606. Thus RG 128 notes that:

The takeover prohibition does not prohibit collective action occurring when:

(d) despite the aggregate voting power of the investors being more than 20%, no transaction in relation to securities has been entered into, and no legal or equitable interest in securities has been acquired, that increases a person's relevant interest (even if one or more of the investors have otherwise become associates).24

- Chapter 6 does not prohibit shareholders acting together for a proper corporate governance purpose; provided they do not come to an agreement, arrangement or understanding in relation to voting that would contravene s606, and provided also that the substantial holder provisions are complied with if necessary. As explained by the Full Court of the Supreme Court of South Australia in Flinders Diamonds:25

It is not unlawful for shareholders to discuss the merits of the board or individual members of the board or a change in the composition of the board. Nor is it unlawful for shareholders to seek to persuade other shareholders to the view that the composition of the board should change or to solicit support for a particular resolution.

The provisions of Chapter 6 of the Corporations Act are not intended to render directors of a company immune from the legitimate scrutiny of and control by shareholders. Directors are not immune from replacement by the vote of shareholders. Instead, the intent is that, if shareholders wish to change the composition of the Board, they should not reach secret understandings or arrangements as to voting. In that respect, it is to be remembered that s 609(5) of the Corporations Act provides that the granting of proxies to another to vote at one meeting does not result in the proxy holder having a relevant interest prescribed by s 606.

In short, incumbent directors are not entitled to be placed in some kind of cocoon, immune from having to face a group of hostile shareholders, nor should remedies available to a court necessarily enable incumbent directors to acquire or retain control of the company indefinitely.

- RES submitted that it would be illogical for the Panel to infer that Noble and Altius had a relevant agreement for the purpose of influencing the composition of RES's board but not a relevant agreement as to the voting of their RES shares at the requisitioned meeting. The resolutions to be voted on at the requisitioned meeting, RES submitted, were directed precisely at the composition of the board.

- We do not think there has been a contravention of s606 here. Unlike Flinders Diamonds,26 we consider there is insufficient evidence to find that Noble or Altius had a voting agreement in relation to their RES shares. In most cases, parties forming a proposal for controlling or influencing the composition of a board will also enter into a voting agreement. It is, as RES submitted, a logical corollary of a shared goal such as board composition that the agreement, arrangement or understanding would extend also to seeing it implemented. It would not seem to us to require very much evidence to establish that the agreement, arrangement or understanding went as far as a voting agreement, and indeed it might be a relatively easy inference to draw from surrounding circumstances. However, we have the unusual case before us. The evidence is not sufficient in our view to permit the taking of the next step.

- In our view, as ASIC RG 128 seeks to establish, collective action is to be encouraged for proper corporate governance purposes. The Panel does not seek to limit the ability of major security holders to exercise voting power in whatever way they choose. It is only, for example, when collective action binds them to other major holders by virtue of a relevant agreement, or where there are further accumulations of securities, that unacceptable circumstances are likely to occur.

- On the evidence available to us in this matter, the proposal for controlling or influencing the composition of the board of RES involved, at least in the end, replacing the existing board. A majority of the appointees proposed for the board, it appeared, were independent of Noble and Altius. Save for non-disclosure of the association, this would be an example of the type of collective action that would be unlikely to give rise to unacceptable circumstances.

- This case illustrates a wider point in the context of debt clubs and other debt "work-outs". The relationship between debt and equity providers can become blurred when members of the club and their associates hold in excess of 20% of the underlying equity and/or when they seek support from other security holders. In our view, it is up to the individual debt providers to ensure that their communications and actions do not overstep the mark.

Association among Noble, Altius and PIC

- RES submitted that Noble and PIC had a common goal as members of the debt club, a goal which Altius shared as arranger, as all had a financial interest in RES agreeing terms with the debt club. The concurrence of views regarding funding solutions for RES is not sufficient for us to infer an association.

- RES submitted that, in light of subsequent circumstances, significance should be given to Noble's cover letter dated 21 July 2015 containing a "final" offer letter from the debt club to RES with a deadline for responding to the offer. It submitted that the reference to a "final" offer was the start of a planned course of action leading to the requisitioned meeting and it could reasonably be inferred by PIC signing the term sheet that PIC would play its part in the agreed course of action. In our view, there is no evidence to link PIC's signing of the term sheet to a plan to change the composition of the RES board.

- RES also submitted that an inference could be drawn of the existence of a voting agreement that involved PIC by virtue of the "in his pocket" statement, the "voting block" slide, and the statement in Mr Lowe's 14 September 2015 email that PIC was "supportive" of Altius' proposal. In our view these support an association between Noble and Altius but do not go as far, we think, as incorporating PIC in the association. As we say elsewhere, Noble and Altius tried to incorporate PIC into their agreement, arrangement or understanding, but we do not think they were successful. In short, in our view, there is no evidence of consensus on the part of PIC to infer a voting agreement with Noble and Altius.

- RES further submitted that when Noble and Altius spoke to PIC about important decisions relating to the Project and RES, those discussions occurred with Dr Daniel Matjila, PIC's Chief Executive Officer, not other PIC officers. Accordingly, RES submitted, any voting arrangement among Noble, Altius and PIC would have been made at the senior management level only and that no correspondence or meetings with Dr Matjila were disclosed by the other parties. RES relied on the close relationship at the senior management level to submit that, among other things, the "voting block" statement in Altius' presentation to PIC was not a proposal but a pre-existing position that the PIC officers who attended the meeting may not have been aware of. PIC submitted that the idea of "a 'secret' relationship and plan developed over a number of years between Mr Lowe, Mr Randall and an invisible man who was nowhere to be seen is, with respect, not a sound basis for the Panel to make a serious finding". The absence of evidence of Dr Matjila's involvement does not mean that he was involved as RES suggests. There is no evidence of any agreement or understanding at the senior management level for us to infer that PIC was associated.

- Finally, RES submitted that the sharing of legal advice with PIC raised an inference that Noble, Altius and PIC were acting together on the subject matter of the advice. In this regard, reference was made to the email from Altius to PIC on 22 September 2015, stating that Altius remained committed to securing the appointment of additional directors to the RES board, in which two sentences were redacted. Altius submitted that the redacted text was provided to PIC pursuant to common interest privilege on the basis that, as fellow shareholders, Altius and PIC had a common interest in the legal advice sought in relation to the allegations of RES in its letter of 21 September 2015 that Altius was associated with Noble. We consider the claim of common interest privilege over the legal advice shared with PIC a relevant circumstance in finding an association, however, on all the material, we are not satisfied that PIC is associated, or has a voting agreement, with either or both of Noble or Altius.

- PIC may have shared a common goal with Noble and Altius in relation to the debt club. The evidence even of this is equivocal. Certainly, there is not sufficient evidence that PIC was acting together with Noble and Altius in seeking to change the composition of the RES board. The evidence shows that, both before and after Altius requisitioned the meeting, Noble and Altius had been actively pursuing PIC's support for their proposal. A week after Altius' presentation to PIC on 8 September 2015, PIC submitted that Mr Leguma told Mr Lowe that he had not spoken to Mr Madavo about PIC's position on nominating directors to RES's board and would pass on his request for an update. Similarly, after the 9 October 2015 meeting, PIC submitted that it remained neutral on how it would vote on the resolutions put forward by Altius.

Facility agreement

- The facility agreement by which Noble funded Shinto's purchase of RES shares contained an undertaking from Shinto that it would not sell any assets except in accordance with certain exceptions, including arm's length sales in the ordinary course of Shinto's business.27 Noble submitted that this undertaking did not create any relevant interest for Noble in Shinto's shares in RES because of the exception to the undertaking on the basis that Shinto's sole business was the acquisition holding and disposal of shares or, in the alternative, the loan itself was a money lending and financial accommodation transaction to which the exception in s609(1) applied.

- ASIC submitted, among other things, that the money lending and financial accommodation transaction exception in s609(1) was only available where the person whose property is subject to the security interest was not an associate of the person who takes or acquires the security interest. It submitted that regardless of whether the exception applied at the time Noble and Shinto entered into the facility agreement, that exception would have ceased to be available on 25 August 2015 (being the date the Panel was minded to infer an association). On that basis, ASIC submitted that Noble would have obtained a relevant interest in Shinto's shares in RES on that date.

- Noble submitted that there was no logical basis for the proposition that there may be a contravention of s606 as a consequence of events which might subsequently occur if, at the time when the relevant transaction was entered into and the relevant interest would otherwise have been acquired, an exception was available to the parties. Noble offered to waive the negative undertaking contained in the facility agreement if the Panel was minded to infer a relevant interest on this basis.

- The facility agreement was not germane to the association in this case, so we did not investigate ASIC's technical point.

Application timing

- Under s657C(3), an application for a declaration must be made "within 2 months after the circumstances have occurred" or such longer period determined by the Panel.

- The applicant presented a significant amount of background material dating back to early 2013 as part of its application.

- Once we were minded to find that an association existed between Noble and Altius, we considered when that association first existed. In our view, the association arose by 25 August 2015 being the day that there was clear evidence that Noble and Altius planned to present their proposal to change the composition of the RES board to PIC.

- Based on our preliminary findings, we asked the parties to comment on whether the application would be out of time and whether we should extend time for making the application if we were to find an association prior to 25 August 2015.

- RES submitted that the voting agreement that formed the basis for the acquisition of a relevant interest was one in respect of the specific resolutions to be put to the requisitioned meeting and therefore could only take effect when the general meeting was requisitioned by Altius on 28 September 2015. On this basis, RES submitted that the application was made within the required 2 month period. We did not need to decide this because there was in our view insufficient evidence of a voting agreement.

- In respect of association, RES submitted that if the initial finding of association was more than 2 months before the application was made, the Panel could rely on the fact that the circumstances were continuing. We cannot, for the reason below. Alternatively, to the extent a time extension was required, RES requested a time extension on the basis that it was not aware of what Noble and Altius were planning in respect of board changes until 14 September 2015.

- Altius submitted that RES could not rely on the circumstances being 'continuing' because in Queensland North Australia Pty Ltd v Takeovers Panel,28 the Full Federal Court held that "[t]he time limits set by ss 657B and 657C(3) cannot be extended by relying on the ongoing effects of the circumstances found to exist or to have existed". The law is that circumstances occur at a particular time, but are not ongoing generally.

- Altius further submitted that RES's application was out of time because, if RES's evidence were to be accepted, RES formed the view that shareholders holding close to 50% of the votes of RES might be acting in concert at the time of the "in his pocket" statement on 30 July 2015. Even assuming that statement was made by Mr Randall, we were not prepared to infer that there was an association between Noble and other shareholders then.

- Noble submitted that it could not meaningfully comment on the timing issue because the Panel had not specified any earlier dates on which it was minded to infer circumstances of association and the reasons for any prospective extension.

- PIC submitted that the Panel should decline to extend time stating that the "essential matters" (quoting Austral Coal 0329) supporting RES's case cannot have only first come to light in the 2 month period preceding RES's application because, in seeking to prove its case, RES had sought to rely on documents and conversations dating back to 2013.

- In our view, the association arose by 25 August 2015 and therefore, we do not need to consider whether to extend the time for making the application or seek further submissions based on an earlier date.

Contravention

- We consider that since 25 August 2015 Noble and Altius:

- have a relevant agreement for the purpose of controlling or influencing the composition of the board of RES and are associated with each other under s12(2)(b) or

- are acting in concert in relation to the affairs of RES, for the purpose of controlling or influencing the composition of the RES board, and are associated with each other under s12(2)(c).

- As a result of the association between Noble and Altius, the voting power of each of Noble and Altius in RES shares aggregates to 24.38%.

- No change in substantial holding notice was lodged by Noble or Altius disclosing their association. We consider that the failure of each of Noble and Altius to disclose their association in a substantial holding notice constitutes or gives rise to a contravention of s671B. As a result of the failure to disclose their association, RES shareholders were not aware that Noble and Altius are associates for the purpose of controlling or influencing the composition of the RES board ahead of the requisitioned meeting.

Decision

Declaration

- It appears to us that the circumstances are unacceptable:

- having regard to the purposes of Chapter 6 set out in s602 or

- because they constitute or give rise to a contravention of s671B.

- Accordingly, we made the declaration set out in Annexure A and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure B. Under s657D the Panel's power to make orders is very wide. The Panel is empowered to make 'any order'30 if 4 tests are met:

- it has made a declaration under s657A. This was done on 18 November 2015.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. We are satisfied that our orders do not unfairly prejudice any person. They go no further than remedying the undisclosed association that we found by requiring disclosure.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 11 November 2015. RES, Noble, Altius and ASIC made submissions and rebuttals.

- it considers the orders appropriate (in this case) to protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons. The orders do this by requiring Noble and Altius to disclose their association in substantial holder notices (in a form acceptable to the Panel) and to disclose their association in any communication in respect of the requisitioned meeting with RES shareholders or in the media.

- Altius offered to undertake to disclose an association with Noble in relation to the composition of the board of RES in a substantial holder notice, albeit maintaining that it was not an associate of Noble. Noble was prepared to offer a similar undertaking.

- We appreciate the offers by Altius and Noble but did not pursue them. While the Panel generally encourages undertakings, in this case the undertakings were offered at a point in the proceedings where no advantage could be gained from a cost or time point of view.31

- Altius submitted in the alternative that an order requiring it and Noble to disclose their association in substantial holder notices was unnecessary given that the Panel's decision would be communicated via its website and the ASX; which would bring the matter to the attention of RES shareholders ahead of the requisitioned meeting.

- ASIC submitted that it was important that Altius and Noble lodge a substantial holder notice "to ensure that investors receive the level and standard of information they are entitled to under the Corporations Act 2001 (Act) in relation to the identity, interests and dealings of persons who may be in a position to influence or control the destiny of RES". We agree. The substantial holder provisions promote an efficient, competitive and informed market and compliance with them is important.32 Moreover, market participants looking into RES would expect to find information that shareholders holding 13.69% and 10.69% respectively are associated in substantial holder notices rather than in the Panel's reasons.

- ASIC and RES submitted that Noble and Altius should be required to disclose their association in any communication to RES shareholders or in the press in respect of the meeting requisitioned by Shinto.

- Altius and Noble submitted that this further disclosure was not necessary given that the Panel's decision (and, if ordered, the substantial holder notices) would be disclosed to the market. Altius further submitted that such an order would be "a disproportionate response to the unacceptable circumstances". We do not agree with these submissions. RES shareholders had only a short time in which to consider the further disclosure in relation to Noble's and Altius' association before the extraordinary general meeting. During that time, Noble and Altius were free to canvass shareholders.33 Noble and Altius should disclose their association in any communication by them with other shareholders or the press.

- RES submitted that the Panel should make an order restricting Altius' and Noble's votes. The Panel made voting restriction orders in Orion Telecommunications Ltd34 and Avalon Minerals Limited.35 RES submitted that, while the Panel found that the associates in those cases had made acquisitions that contravened s606 after the relevant associations had been formed, the Panel in each case vested any shares acquired in breach of s606 with ASIC and made additional orders restricting the votes of the relevant associates over 20%.

- Noble submitted that the circumstances in Orion and Avalon "were so disparate from those of the present that the Panel's orders in those cases cannot be fairly transposed to the present". We agree that those cases are different. In Orion, there were common directorships, a pattern of acquisitions by the associated parties over time and the associated parties had "formed an understanding that they would use their combined voting power (if necessary) for the purpose of influencing the composition of Orion's board and the conduct of Orion's affairs".36 In Avalon, the associated parties had an understanding amounting to a relevant agreement, or were acting in concert, to increase their interest in Avalon driven by restrictions on one associate's ability to acquire shares in his own name.37

- The fact that we did not find a voting agreement between Noble and Altius supports not making a voting restriction in this case.

- ASIC submitted that "the exercise of any future creep entitlement without account being taken of the delay in Noble and Altius disclosing the association would be problematic and the Panel may wish to consider this in formulating its orders". We consider that the creep exception in item 9 of s611, or more particularly the limitation on the ability to creep, applies to Altius' and Noble's combined holding until the time that it is clear that they are no longer associates (if applicable).38

Costs

- RES did not apply for costs.

- Altius submitted that a cost order should be made against RES, "specifically in relation to the wasted time and expense incurred by Altius in responding to RES' continued assertion of Altius' association with PIC following the Panel's communication of its Preliminary Findings". Altius also submitted that RES did not present a case of "reasonable merit in a businesslike way"39 in relation to a possible association between PIC and either or both of Altius and Noble after our preliminary findings were given.

- We make no order for costs.

Nora Scheinkestel

President of the sitting Panel

Decision dated 18 November 2015

Reasons published 9 December 2015

Advisers

| Party | Advisers |

|---|---|

| Altius | Norton Rose Fulbright Australia |

| Noble | Clayton Utz |

| PIC | Herbert Smith Freehills |

| RES | Jones Day |

Annexure A

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Resource Generation Limited

Circumstances

- Resource Generation Limited (RES) is a company listed on ASX (ASX code: RES) and JSE (JSE code: RSG).

- RES's substantial holders include:

- Noble Resources International Pte Ltd, a subsidiary of Noble Group Limited (together, Noble) - 13.69% and

- Shinto Torii Inc. (Shinto), a subsidiary of Altius Investment Holdings (Pty) Limited (together, Altius) - 10.69%.

- Altius has previously described itself as Noble's South African black empowerment enterprise (or 'BEE') partner. Noble and Altius are 60:40 joint venture partners in Africa Commodities Group.

- Noble provided the funding for Shinto to buy its RES shares, with a guarantee from Altius regarding the funds.

- On 10 March 2014, a debt club was established with the aim of funding RES's Boikarabelo coal project in the Waterberg region of South Africa. The process was to be managed by Noble and Altius. The debt club included Noble, Public Investment Corporation SOC Limited (PIC), a holder of 19.49% of RES, and two banks. Debt club negotiations continued for over a year but RES and the debt club were unable to agree on the terms for financing the project.

- From about July 2015, Noble and Altius began to have discussions regarding the composition of the board of RES.

- On 25 August 2015, Altius sent an email describing a proposal by Altius "[w]ith the support of Noble…to table resolutions at the next ResGen AGM, due in October, under which each of PIC, Noble and Altius would appoint one non executive director to the board of ResGen" and requesting a meeting with PIC to discuss and secure PIC's support to the proposal. That meeting occurred on 8 September 2015. Altius, with Noble representatives in attendance, delivered a presentation to PIC which described, among other things, Altius' proposal to "South Africanize the project", the "voting block" of Noble, Altius and PIC and a "New South African Board" with PIC to be invited to nominate two directors and Noble and Altius to nominate one director each.

- On 14 September 2015, RES received an email from Altius requesting board representation for Altius and Noble.

- On 17 September 2015, Noble wrote to RES requesting the appointment of two additional directors. RES declined to make these appointments referring to the debt club negotiations and stating that the appointment of additional directors by parties with potentially conflicting interests would not be in the interests of the company and its shareholders at that time.

- Upon receiving RES's response, Noble emailed Altius saying "[a]s expected…I think it is now important to send your letter noting the reason why Noble not appropriate".

- On 28 September 2015, RES received a letter from Altius containing a notice from Shinto requisitioning a general meeting pursuant to section 249D40, to remove and replace the current four directors with six new directors.

- On 9 October 2015, Noble, Altius and PIC met and discussed, among other things, what candidates Altius had in mind for changes to management if Shinto was successful with its section 249D requisition.

- The Panel considers that since 25 August 2015 Noble and Altius:

- have a relevant agreement for the purpose of controlling or influencing the composition of the board of RES and are associated with each other under section 12(2)(b) or

- are acting in concert in relation to the affairs of RES, for the purpose of controlling or influencing the composition of the RES board, and are associated with each other under section 12(2)(c).

- As a result of the association between Noble and Altius, the voting power of each of Noble and Altius in RES shares has increased to 24.38%.

- No change in substantial holding notice has been lodged by Noble or Altius disclosing their association. The Panel considers that the failure of each of Noble and Altius to disclose their association in a substantial holding notice constitutes or gives rise to a contravention of section 671B. As a result of the failure to disclose their association, RES shareholders are not aware that Noble and Altius are associates for the purpose of controlling or influencing the composition of the RES board ahead of the requisitioned meeting.

- It appears to the Panel that the circumstances are unacceptable:

- having regard to the purposes of Chapter 6 set out in section 602 or

- because they constitute or give rise to a contravention of section 671B.

- The Panel considers that it is not against the public interest to make a declaration of unacceptable circumstances. It has had regard to the matters in section 657A(3).

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of RES.

Alan Shaw

Counsel

with authority of Nora Scheinkestel

President of the sitting Panel

Dated 18 November 2015

Annexure B

Corporations Act

Section 657D

Orders

Resource Generation Limited

The Panel made a declaration of unacceptable circumstances on 18 November 2015.

The Panel ORDERS

- By no later than 10.00am (Melbourne time) on Friday, 20 November 2015, each of the Associated Parties must provide to RES and the ASX a notice in the form of ASIC Form 604 "Notice of change of interests of substantial holder", in a form acceptable to the Panel, disclosing:

- all the information required by a Form 604 in respect of each of the Associated Parties and their respective associates and

- the existence and nature of the association between the Associated Parties.

- Each Associated Party must disclose the association between the Associated Parties in any communication by the Associated Party with RES shareholders or the media in respect of the requisitioned meeting.

- In this order the following terms apply:

- Altius

- Altius Investment Holdings (Pty) Limited and its subsidiary Shinto Torii Inc.

- Associated Parties

- Noble and Altius

- Noble

- Noble Group Limited and its subsidiary Noble Resources International Pte Ltd

- Requisitioned meeting

- The general meeting of shareholders of RES requisitioned by Shinto Torii Inc. pursuant to section 249D of the Corporations Act 2001 (Cth) on 28 September 2015

- RES

- Resource Generation Limited

Alan Shaw

Counsel

with authority of Nora Scheinkestel

President of the sitting Panel

Dated 18 November 2015

1 See paragraphs 77 and 96 for the significance of this email

2 References are to the Corporations Act 2001 (Cth) unless otherwise indicated

3 The meeting was held as scheduled. All of Shinto's resolutions were passed.

4 Mount Gibson Iron Limited [2008] ATP 4 at [15]. See also Regis Resources Ltd [2009] ATP 7, Boulder Steel Limited [2008] ATP 24, BigAir Group Limited [2008] ATP 12 and Rusina Mining NL [2006] ATP 13

5 Quoting Echo Resources Limited [2015] ATP 8, Regis Resources Limited [2009] ATP 7, BigAir Group Limited [2008] ATP 12, Pacific Magnesium Corporation Ltd [2005] ATP 12 and St Barbara Mines 02 [2004] ATP 12

6 [2004] ATP 14 at [26]

7 [2009] ATP 7 at [19]

8 [2004] SASC 119 at [71]

9 [2015] ATP 8

10 Section 9

11 [2011] ATP 5 at [33]-[34]

12 Adsteam Building Industries Pty Ltd v The Queensland Cement and Lime Company Ltd (No 4) (1984) 14 ACLR 456 at 459

13 Citing Perpetual Custodians Ltd v IOOF Investment Management Ltd; Murray v Perennial Investment Partners Ltd (2012) NSWSC 1318; Bank of Western Australia Ltd v Ocean Trawlers Pty Ltd (1995) 16 ACSR 501; J-Corp Pty Ltd v Australian Builders Labourers Federated Union of Workers (1992) 44 IR 264; Adsteam Building Industries Pty Ltd v Queensland Cement and Lime Company Ltd (No 4) (1984) 14 ACLR 456

14 [2008] ATP 4. These factors have been applied in several Panel decisions including Viento Group Limited [2011] ATP 1, CMI Limited [2011] ATP 4 and World Oil Resources Limited [2013] ATP 1

15 [2002] ATP 18 at [27]

16 RG 128 at [128.3]

17 By analogy with the principle in s602(b)(iii) for the acquisition of a substantial interest. Note, however s602A

18 RG 128 at [128.7]

19 See World Oil Resources Limited [2013] ATP 1 at [188(b)] and Gondwana Resources Limited 02 [2014] ATP 15 at [47]

20 A relevant agreement cannot be a unilateral act: Elders IXL Ltd v NCSC (1987) VR 1; Endresz v Whitehouse (1997) 24 ACSR 208; 15 ACLC 936; Tillmanns Butcheries Pty Ltd v Australasian Meat Industry Employee's Union (1979) 42 FLR 331

21 Adsteam Building Industries Pty Ltd v Queensland Cement and Lime Company Ltd (No 4) 14 ACLR 456 at 459; cited in Bank of Western Australia v Ocean Trawlers Pty Ltd (1995) 16 ACSR 501, per Owen J referring to s15(1)(a). See also Anzoil NL 01 [2002] ATP 19 at [52]

22 Rivkin Financial Services Limited 02 [2005] ATP 1

23 Coopers Brewery Limited 03R and 04R [2005] ATP 23 & ATP 24: Association is the basis for aggregating relevant interests held by different people to determine voting power

24 RG 128 at [128.39(d)]

25 Flinders Diamonds Ltd v Tiger International Resources Inc & Ors [2004] SASC 119 at [72]-[74]

26 [2004] SASC 119 at [71], referred to in BigAir Group Limited [2008] ATP 12 at [21]-[22]

27 The facility agreement also contained an upside sharing arrangement upon the repayment of the loan

28 [2015] FCAFC 68 at [73]

29 [2005] ATP 14

30 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

31 See Guidance Note 4 - Remedies General at fn 8 and Procedural Rule 7.1.1. at note 1

32 Northern Iron Ltd [2014] ATP 11 at [53]

33 We do not consider that their confidentiality and media canvassing undertakings stop them from contacting shareholders to vote in favour of some or all of the resolutions in the requisitioned meeting, see Annexure A of the Panel's Procedural Rules

34 [2006] ATP 23

35 [2013] ATP 11

36 [2006] ATP 23 at [114(b)]