[2018] ATP 8

Catchwords:

Decline to make a declaration – board spill – collective action – association – requisition notice – voting intention statement – relevant agreement – control – public interest – concurrent proceedings

Corporations Act 2001 (Cth), sections 203D, 249D, 249P, 602, 606, 611, 657A, 671B

ASIC Regulatory Guide 128: Collective action by investors

Perpetual Custodians Ltd (as custodian for Tamoran Pty Ltd (as trustee for Crivelli)) and Others v IOOF Investment Management Ltd (2013) 304 ALR 436

Auris Minerals Limited [2018] ATP 7, Tap Oil Limited [2017] ATP 23, Regal Resources Limited [2016] ATP 17, Resource Generation Limited [2015] ATP 12, Echo Resources Limited [2015] ATP 8, Regis Resources Limited [2009] ATP 7, GoldLink Growthplus Limited [2007] ATP 23

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| No | No | Yes | No | No | No |

Introduction

- The Panel, Rodd Levy (sitting President), Denise McComish and Bruce McLennan, declined to make a declaration of unacceptable circumstances in relation to the affairs of Caravel Minerals Limited. The application concerned allegations of association between shareholders of Caravel who had requisitioned a general meeting pursuant to s249D1 to replace directors of Caravel and between the requisitioning shareholders and other shareholders. The Panel was not satisfied that there was sufficient material to establish such associations or, if there was an association among some of the requisitioning shareholders, that the circumstances were unacceptable.

- In these reasons, the following definitions apply.

- AFR

- African Energy Resources Limited (ASX code: AFR)

- AFR Australia

- AFR Australia Pty Ltd

- Bridge Street

- Bridge Street Capital Partners Pty Limited

- Bridge Street related

shareholders - the Requisitioning Shareholders that have connections to Bridge Street, namely, Pine Street Pty Ltd and Clarkson's Boathouse Pty Ltd

- Caravel

- Caravel Minerals Limited (ASX code: CVV)

- Confidentiality Agreement

- the confidentiality agreement, dated 30 June 2017, between Caravel and MRG

- Hartree

- Hartree Pty Ltd

- MRG

- Mitchell River Group Pty Ltd

- MRG related shareholders

- the Requisitioning Shareholders that have connections to MRG, namely, Mr Alasdair Cooke, AFR Australia, Glenlaren Pty Ltd, Hartree, Revenge Holdings Pty Ltd, Mr Steven Jackson, Terra Metallica Nominees Pty Ltd and Trepanier Pty Ltd

- Other Shareholders

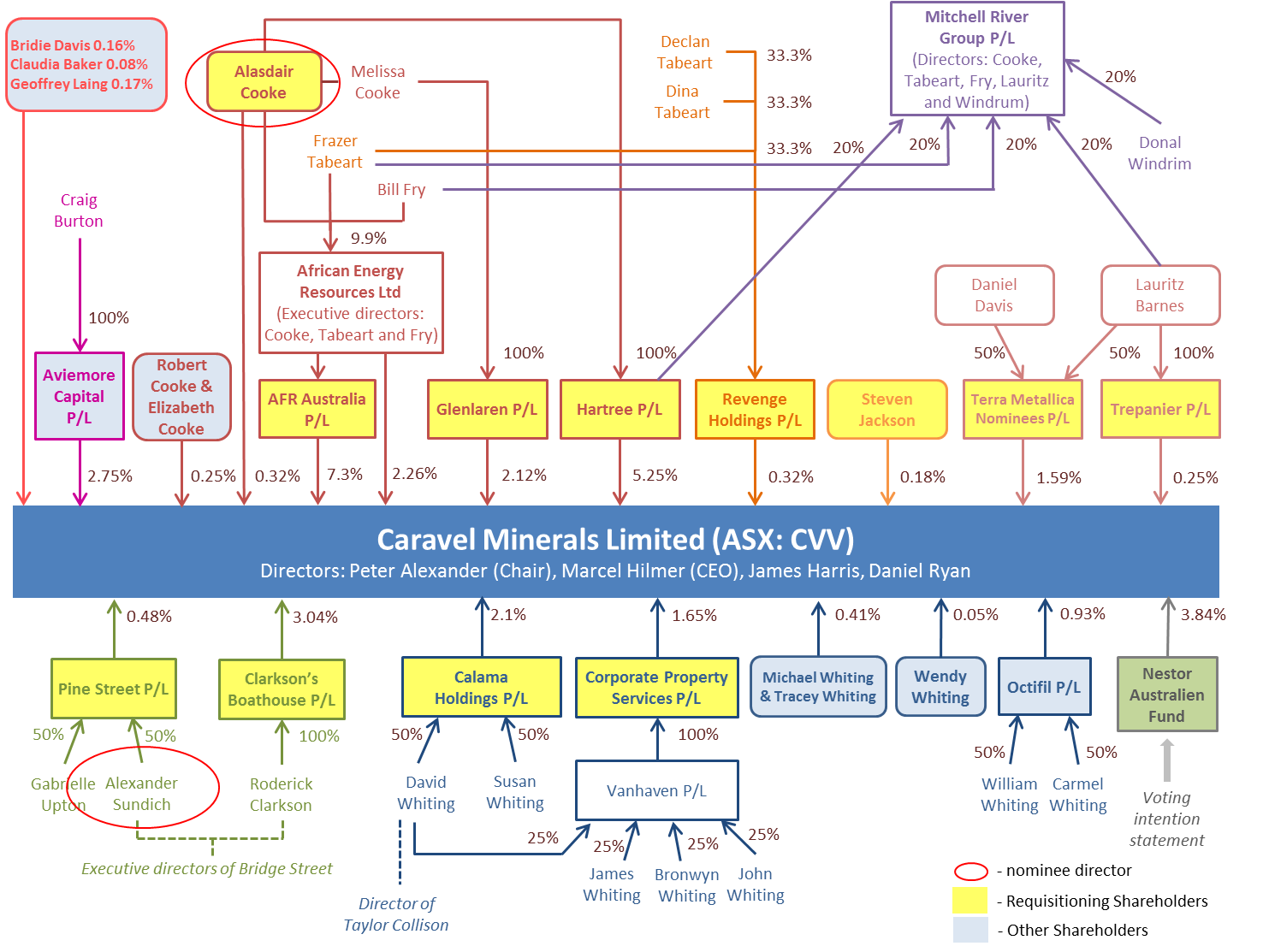

- Ms Bridie Davis, Ms Claudia Baker, Mr Geoffry Laing, Mr Michael Whiting and Mrs Tracey Whiting, Ms Wendy Whiting, Octifil Pty Ltd, Mr Robert Cooke and Mrs Elizabeth Cooke, and Aviemore Capital Pty Ltd (highlighted in blue in the diagram below)

- Requisitioning Shareholders

- Mr Cooke, AFR Australia, Calama Holdings Pty Ltd, Clarkson's Boathouse Pty Ltd, Corporate Property Services Pty Ltd, Glenlaren Pty Ltd, Hartree, Pine Street Pty Ltd, Revenge Holdings Pty Ltd, Mr Jackson, Terra Metallica Nominees Pty Ltd and Trepanier Pty Ltd (highlighted in yellow in the diagram below)

- s249D Notice

- the request for general meeting of shareholders of Caravel pursuant to s249D signed by the Requisitioning Shareholders and received by Caravel on 8 March 2018

- Support Statement

- the statement of support to be distributed to all members pursuant to s249P regarding the resolutions proposed to be moved at the general meeting provided by Mr Cooke to Caravel on 8 March 2018

- Voting Intention Statement

- a notice of voting intention to vote in favour of the resolutions proposed by the Requisitioning Shareholders signed by the Voting Intention Statement Shareholder

- Voting Intention Statement

Shareholder - Nestor Australien Fund (highlighted in green in the diagram below)

- Whiting related shareholders

- the Requisitioning Shareholders that have connections to Mr David Whiting, namely, Calama Holdings Pty Ltd and Corporate Property Services Pty Ltd

Facts

- Caravel is an ASX listed copper, gold and base metals explorer with projects in Western Australia.

- Bridge Street (formerly known as Palladion Partners Pty Ltd) were engaged to act as corporate adviser and communications adviser to Caravel in 2015.

- On 30 June 2017, Caravel and MRG entered into the Confidentiality Agreement in relation to a potential strategic transaction. MRG is an independent mining investment partnership and technical services consultancy. Mr Cooke of MRG was introduced to Caravel by Bridge Street. Bridge Street was introduced to Mr Cooke by Mr David Whiting of Taylor Collison.

- On 7 July 2017, Caravel announced the commencement of an ore sorting study by MRG and a commitment by MRG to subscribe for shares to raise $450,000 to fully fund the study and short-term working capital requirements. The placement was managed by Bridge Street.

- On 13 July 2017, shares representing at that time 8.26% in Caravel were issued to entities nominated by MRG, including some of the Requisitioning Shareholders, as part of the placement.

- On 14 July 2017, Mr Cooke lodged a notice of initial substantial holder in Caravel disclosing aggregate voting power of Mr Cooke and his associates, Hartree and Glenlaren Pty Ltd, of 8.06% in Caravel.

- On 30 August 2017, AFR Australia gave a notice of initial substantial holder in Caravel after acquiring a stake of 7.3% in Caravel in connection with an agreement with a joint venture partner.

- Between 6 and 14 November 2017, Mr Cooke sent several emails to Mr Marcel Hilmer, the chief executive officer of Caravel, with his views on issues relating to Caravel's operations and noting MRG's support for a fund raising through a rights issue. Mr Cooke also attended a meeting with a relevant water authority with Mr Hilmer.

- On 23 November 2017, Mr Cooke wrote to Mr Hilmer seeking a response to Mr Cooke's offer to introduce MSP Engineering Pty Ltd to underwrite a $3 million rights issue and present on MRG's ideas for Caravel to work with MSP Engineering Pty Ltd to fast track Caravel's Calingiri project. In response, Mr Hilmer advised that Caravel had reengaged consultants from its previous scoping study and so did not need a proposal from MRG at that time.

- On 27 November 2017, Caravel announced a rights issue to raise $1.1 million with Bridge Street as lead manager. The prospectus released the next day indicated that parties related to Mr Hilmer, Mr Peter Alexander (the non-executive chairman of Caravel) and Mr Tony Poustie (an executive of Caravel) would jointly underwrite the offer in the amount of $600,000.

- On 28 November 2017, Mr Cooke emailed the board of Caravel noting the need to amend the prospectus to correct an issue with shortfall allocation, his disagreement with Caravel's corporate strategy and requesting one board seat.

- On 1 December 2017, Mr Cooke emailed Mr Alexander raising certain concerns about actions Caravel's executives had taken and asked Mr Alexander to speak to certain Caravel shareholders noting: "Amongst your own shareholder group there are three active groups representing shareholders, Bridgestreet [sic] Capital, Taylor Collison and Schroeder Equities. Each of these account for about 5% of the register. We have been in contact with these groups since our involvement with CVV and we have had past experience raising capital with all of them in other companies over the past 15 years."

- On 4 December 2017, Mr Alexander Sundich, an executive director and owner of Bridge Street, emailed Mr Hilmer noting that his colleague, Mr Roderick Clarkson of Bridge Street, had received feedback from a number of Caravel's large existing shareholders to the effect that they would "welcome the appointment" of Mr Cooke to Caravel's board as a representative of MRG.

- On 6 December 2017, following receiving comments from Bridge Street, Caravel lodged a supplementary prospectus to clarify the shortfall allocation policy in relation to the rights issue, namely, that applicants under the shortfall offer will be given priority before satisfying the underwriters' commitments.

- On 8 December 2017, Mr Sundich noted in an email to Mr Hilmer that Bridge Street had formed the view that Mr Cooke's appointment to the Caravel board would be a positive development.

- Also on that day, without advising Bridge Street, Caravel completed a placement to undisclosed investors to raise $400,000.

- On 11 December 2017, Bridge Street terminated its engagement as lead manager of the rights issue due to Caravel's decision to undertake the $400,000 placement during the rights issue campaign.

- On 15 and 22 December 2017, Caravel's solicitors sent letters to Bridge Street alleging breaches of confidence by Bridge Street.

- On 12 January 2018, the rights issue closed. Thereafter, Caravel resolved that shortfall shares would not be offered to "MRG and its associates" as it was determined that they would have voting power in Caravel exceeding 20% based on the amount of shortfall shares requested.

- Following the allocation of the shortfall shares, the underwriters took up the remaining shares equal to approximately 8.20% of Caravel.

- On 16 January 2018, the Caravel board considered and unanimously rejected Mr Cooke's request for appointment to the board.

- On 25 January 2018, Caravel received from Mr Cooke and Hartree a notice of intention pursuant to s203D to move a resolution at the next general meeting to remove Mr Hilmer as a director.

- On 5 February 2018, Caravel commenced proceedings in the Supreme Court of Western Australia against MRG, Hartree and Mr Cooke in relation to alleged breaches of the Confidentiality Agreement and unusual trading in Caravel shares during the rights issue offer period.

- On 6 February 2018, Caravel's solicitors sent a letter to Mr Cooke alleging that he had made certain defamatory statements and seeking an undertaking that he cease and desist making such statements.

- On 8 March 2018, Caravel received from Mr Cooke the s249D Notice, the Voting Intention Statement and the Support Statement. The s249D Notice called for a general meeting to consider resolutions for the appointment of Mr Cooke and Mr Sundich as directors of Caravel and the removal of three of the four existing directors of Caravel (including Messrs Hilmer and Alexander).

- On 20 March 2018, a substantial shareholder of Caravel sold its entire stake on market, a portion of which was acquired directly by AFR which increased its (and AFR Australia's) relevant interest in Caravel from 7.30% to 9.56%. AFR's board of directors approved the acquisition with Mr Cooke (the executive chairman of AFR) being excused from the discussion and vote having regard to his material personal interest.

- On 22 March 2018, Aviemore Capital Pty Ltd, a company wholly owned by a director of MSP Engineering Pty Ltd, acquired 2.75% of Caravel.

- On 3 April 2018, after making its application to the Panel, Caravel issued the notice of general meeting for the requisitioned meeting. The letter from Mr Alexander accompanying the notice stated that the s249D Notice was valid with respect to the two appointment resolutions only. Accordingly, the notice did not include the three removal resolutions. The notice also did not include the Support Statement. The meeting is scheduled for 7 May 2018.

- Shareholdings in Caravel and various relationships between the parties and other relevant persons are set out in the diagram below.

Application

Declaration sought

- By application dated 23 March 2018, Caravel sought a declaration of unacceptable circumstances. Caravel submitted that:

- the Requisitioning Shareholders (and possibly the Voting Intention Statement Shareholder and the Other Shareholders) were associated and have:

- failed to provide substantial holding disclosures under s671B and

- acquired a relevant interest in Caravel above 20% in breach of s606(1)

- the association between all of the Requisitioning Shareholders was supported by (among other things):

- the conduct of Bridge Street and MRG and their associates during the rights issue, including the alleged sharing of information and support for Mr Cooke's proposals and appointment to the Caravel board

- the alleged unusual trading to keep Caravel's share price low and discourage participation in the rights issue and

- the lodging of the jointly signed s249D Notice which was said to equate to the entering into of a relevant agreement for the purposes of influencing the composition of Caravel's board or the conduct of Caravel's affairs2

- by virtue of signing the Voting Intention Statement in support of the resolutions proposed by the Requisitioning Shareholders, the Voting Intention Statement Shareholder should be deemed an associate of the Requisitioning Shareholders and

- the Other Shareholders should also be deemed associates of the Requisitioning Shareholders by virtue of their personal or professional connections with one or more of the Requisitioning Shareholders.

- the Requisitioning Shareholders (and possibly the Voting Intention Statement Shareholder and the Other Shareholders) were associated and have:

- Caravel submitted the effect of the circumstances was that control of Caravel had been affected otherwise than in an efficient, competitive and informed market and that the alleged associated shareholders had secured a degree of control over Caravel by acquiring an influential block of shares, without making any offer to acquire the remainder of the shares in Caravel.

Interim orders sought

- Caravel sought interim orders restraining the despatch of the notice of meeting in relation to the s249D Notice and preventing the alleged associated shareholders from acquiring, disposing of or voting any Caravel shares pending determination of its application.

- On 26 March 2018, the substantive President decided not to make interim orders. Among other things, the substantive President considered that the circumstances could be adequately remedied by final orders.

- After deciding to conduct proceedings, the sitting Panel also considered the issue (noting that Caravel had issued the notice of meeting in the interim), but for similar reasons to the substantive President, decided not to make interim orders.

Final orders sought

- Caravel sought final orders to the effect that:

- shares of the alleged associated shareholders (or, at a minimum, shares held in excess of 20%) be vested in ASIC for sale to non-associated parties

- the alleged associated shareholders disclose their associated voting power by the provision of substantial holding notices in compliance with s671B and

- the alleged associated shareholders be prohibited from making any further acquisitions of Caravel shares that would result in their combined shareholding exceeding 20%, unless permitted by s611.

Discussion

Decision to conduct proceedings

- The Panel has on a number of occasions considered whether it is the appropriate forum to resolve disputes in the context of a board spill.3

- After considering a string of Panel cases, including those cited in Echo Resources Limited, the Panel in Resource Generation Limited stated at [48]:

In our view, the fact that an application involves a proposal to reconstitute a board of directors does not take it outside the purview of the Panel. If, in the context of issues regarding the composition of a company's board, there is an accumulation or exercise of voting power possibly in contravention of s606, without proper disclosure under Chapter 6C or in otherwise unacceptable circumstances, those issues may be treated as control issues for the purposes of s657A. Here, we considered that there was a sufficient body of material to warrant an investigation as to whether there was an accumulation of voting power by Noble, Altius and/or PIC in contravention of s606 or in the absence of proper disclosure under s671B. We noted that Noble Resources, Shinto and PIC collectively held almost 44% of RES's outstanding shares, while Noble Resources and Shinto collectively held over 23%.

- We considered that there was sufficient material to warrant us making further inquiries as to whether there were any circumstances that constituted or gave rise to a contravention of s606 or s671B or were otherwise unacceptable as a result of associations between the Requisitioning Shareholders or between any of the Requisitioning Shareholders, the Voting Intention Statement Shareholder or any of the Other Shareholders. We noted that the Requisitioning Shareholders collectively held 26.84% in Caravel as at the date of the application, while the Requisitioning Shareholders, the Voting Intention Statement Shareholder and the Other Shareholders collectively held 35.50% as at the date of the application.

Potential association

Section 249D Notice

- ASIC Regulatory Guide 128 at Table 2 states that jointly signing a s249D notice to requisition a general meeting of a company for the purposes of putting forward a resolution relating to the composition of the board or the company's affairs is "likely to be considered entering into a relevant agreement and for these investors to be considered associates. If this is accompanied by an understanding about the exercise of voting rights, it will also result in the acquisition of a relevant interest. We expect that this would be the case in most instances."

- ASIC submitted that here there was a relevant agreement between the Requisitioning Shareholders by virtue of them signing the s249D Notice and noting in support the apparent agreement of the Requisitioning Shareholders with the Support Statement and that it was unnecessary for all of the Requisitioning Shareholders to sign the s249D Notice in order to requisition the meeting.4

- Mr Cooke clearly had sufficient voting power in Caravel to request a general meeting under s249D without involving any other shareholders. However, in order to demonstrate that they were not seen by the Caravel board as "just a small group of dissident shareholders" (as stated by Mr Cooke in correspondence), Mr Cooke sought to show the support of other Caravel shareholders by having them sign the s249D Notice. At one point in time, he expected shareholders representing 35-40% of Caravel would become signatories on the s249D Notice. Mr Cooke was transparent with other Requisitioning Shareholders (and potential requisitioning shareholders) about the potential association issues (including sharing with the Requisitioning Shareholders the advice of his lawyers) but considered that there were valid reasons for collective action involving more than 20% of Caravel's shareholders in this case.5

- It was not clear to us, in the circumstances of this case, that the signing of the s249D Notice alone was sufficient to establish a relevant agreement between the Requisitioning Shareholders. While there was a shared frustration among the Requisitioning Shareholders with the actions of the Caravel board, we are not satisfied that there was necessarily a 'meeting of minds'6 of all who signed the requisition or that it was established that the purpose of all who signed went beyond causing the resolutions to be put to a meeting.

Other material

- Notwithstanding the large volume of material received in response to the brief, we are not satisfied there is sufficient material to establish, even with proper inferences being drawn, an association between (a) all of the Requisitioning Shareholders, (b) any of the Requisitioning Shareholders and the Voting Intention Statement Shareholder or (c) any of the Requisitioning Shareholders and the Other Shareholders, including Aviemore Capital Pty Ltd.

- The Requisitioning Shareholders were comprised of three groups – the Bridge Street related shareholders, the Whiting related shareholders and the MRG related shareholders. All of the Requisitioning Shareholders denied an undisclosed association. We received copies of correspondence between Mr Cooke and representatives of the Bridge Street related shareholders (in particular, Mr Clarkson), the Whiting related shareholders (Mr Whiting) and the Voting Intention Statement Shareholder in relation to the requisition. However, in our view, the materials appear to show that the Bridge Street related shareholders, the Whiting related shareholders and the Voting Intention Statement Shareholder are independent and did not have the necessary 'meeting of minds' with Mr Cooke or any other MRG related shareholder. For example, there were no materials showing that these shareholders had received any drafts of, or signed off on, the Support Statement.7 Further, there was no material put forward to suggest that the Requisitioning Shareholders did not retain their individual rights to vote in any way they so wished on the s249D Notice resolutions.

- In relation to the MRG related shareholders, the materials showed a close working relationship between Messrs Cooke, Frazer Tabeart, Bill Fry, Lauritz Barnes, Daniel Davis and Jackson in relation to the requisition, including drafting, discussing and signing off on the Support Statement. It was not always clear in the correspondence whether these individuals were acting as representatives of MRG or of AFR or in their personal capacities. While Mr Cooke appeared to be the driving force behind the requisition, the material represented the MRG related shareholders as a voting block and implied there being an MRG 'group'. The MRG related shareholders had been building their respective stakes in Caravel since July 2017, including the acquisition by AFR of 3.22% in Caravel after the date of the s249D Notice.

- We consider that further material would be required to establish, in light of the factors above, whether there was an association among the MRG related shareholders. However, after weighing up the considerations below, we are not satisfied that further inquiries are warranted at this time.

- If an association was established only between the MRG related shareholders, the aggregated voting power would be below 20% as at the date of the application. Accordingly, there would be no prospect of a breach of s606. There remains however the question of compliance with the substantial shareholder provisions, which we accept is important to ensure an efficient, competitive and informed market. The accumulation of voting power under 20% without proper disclosure may give rise to unacceptable circumstances under s657A(2)(c).

- In exercising its powers under s657A, the Panel must have regard to the purposes in s602. Section 602 is concerned with the acquisition of control over voting shares. In our experience, the Requisitioning Shareholders' actions are consistent with a desire to change the composition of the Caravel board for corporate governance or other proper purposes and do not suggest an intention to exercise control on an ongoing basis.8 In any event, in this case, the names of the MRG related shareholders (among other shareholders) have been disclosed as Requisitioning Shareholders in the s249D Notice.9 In these circumstances, we are unlikely to make a declaration and orders.

- If it becomes apparent over time that the MRG related shareholders (or any other shareholders), through patterns of behaviour or other material, are acting together in a manner affecting control of Caravel, a new application may be made to the Panel at that time.

- We also considered certain public interest concerns in deciding to decline to make a declaration.10 First, we are concerned that prolonging proceedings to further investigate a potential association among the MRG related shareholders, in circumstances where we consider it unlikely that we would make an order for disclosure, would require Caravel and the other parties to incur further legal costs and diminish Caravel's limited cash reserves.

- Secondly, we considered the relevance of the fact that there is a current proceeding pending before the court. The Panel has stated that it "should not decline to consider an application or make orders merely because the applicant may be concurrently pursuing other avenues of relief in connection with the same circumstances, unless there is a clear overlap in the nature of the proceedings (such as a scheme of arrangement where the court has commenced scrutiny of the scheme)".11 We agree. In this case, on one view, the matters Caravel raised before the court may be thought to overlap with a broader dispute evident in the circumstances before us. The overlap is not extensive and would not normally prevent us considering the matter.12 However, we note that there is no reason why the matters raised (and especially the Chapter 6C matters) cannot be addressed by a court.

- Lastly, it is also relevant to note that the s249D Notice and Caravel's Panel application in response are but two actions in a series of actions between Caravel and one or more of the Requisitioning Shareholders, including (in chronological order):

- Mr Cooke requesting a board seat which was rejected by Caravel

- Caravel lodging a supplementary prospectus in relation to the rights issue in response to concerns raised by Bridge Street regarding the shortfall allocation

- Caravel undertaking a placement during the rights issue campaign without informing Bridge Street and Bridge Street subsequently terminating its engagement

- Caravel deciding to offer no shortfall shares to "MRG and its associates"

- Mr Cooke and Hartree providing a s203D notice to Caravel proposing the removal of Mr Hilmer from the Caravel board

- Caravel commencing litigation against MRG, Hartree and Mr Cooke and threatening Mr Cooke with a further defamation action

- the Requisitioning Shareholders sending the s249D Notice to Caravel and

- Caravel sending a notice of meeting to shareholders that did not include the Support Statement and containing only two of the five resolutions requested by the Requisitioning Shareholders with Caravel. While not the subject of the application, ASIC submitted that "in the absence of justification for withholding resolutions 3, 4 and 5 [ASIC rejected Caravel's reasons for doing so] ASIC considers Caravel should take steps to ensure the additional resolutions are properly put before a general meeting of its members."

- We do not consider it appropriate in these circumstances to unduly interfere (by prolonging these proceedings) with the proper functioning of a statutorily requisitioned meeting and shareholders' opportunity to consider the replacement of the Caravel directors if they see fit.

Decision

- For the reasons above, we declined to make a declaration of unacceptable circumstances. We consider that, on the material before us, it would be contrary to the public interest to make a declaration, and it is not against the public interest to decline to make a declaration. In making our decision, we had regard to the matters in s657A(3).

Orders

- Given that we made no declaration of unacceptable circumstances, we make no final orders, including as to costs.

Rodd Levy

President of the sitting Panel

Decision dated 19 April 2018

Reasons given to parties 1 May 2018

Reasons published 3 May 2018

Advisers

| Party | Advisers |

|---|---|

| Caravel | Steinepreis Paganin |

|

African Energy Resources Limited and AFR Australia Pty Ltd |

DLA Piper Australia |

|

Mr Alasdair Cooke, Hartree Pty Ltd and Glenlaren Pty Ltd |

Tottle Partners |

| Calama Holdings Pty Ltd | Johnson Winter & Slattery |

1 - Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

2 - Referring to Table 2 of ASIC Regulatory Guide 128 which provides that, if two or more shareholders join together for the purposes of a requisitioned meeting, they will likely become "associates" for the purposes of Chapter 6

3 - Including Resource Generation Limited [2015] ATP 12, Echo Resources Limited [2015] ATP 8, Regis Resources Limited [2009] ATP 7 and GoldLink Growthplus Limited [2007] ATP 23

4 - Section 249D(1) requires that the request for a general meeting is made by members with at least 5% of the votes that may be cast at the general meeting

5 - Referring to ASIC Regulatory Guide 128 at [128.49] and [128.50]

6 - See Perpetual Custodians Ltd (as custodian for Tamoran Pty Ltd (as trustee for Crivelli)) and Others v IOOF Investment Management Ltd (2013) 304 ALR 436, [70]-[75]

7 - With the exception of Mr Sundich who, as a nominee director, received and commented on drafts of the Support Statement (copying Mr Clarkson)

8 - See, similarly, Auris Minerals Limited [2018] ATP 7 at [24] and Regis Resources Limited [2009] ATP 7 at [19]. See, by contrast, Resource Generation Limited [2015] ATP 12 at [96]-[98]

9 - While the s249D Notice does not describe any potential association between the MRG related shareholders or the other information required by s671B, other Caravel shareholders have been made aware of the shareholders who have requisitioned the meeting

10 - Section 657A

11 - Regal Resources Limited [2016] ATP 17 at [64]

12 - We note that Caravel submitted that to the extent any orders made by us overlap the orders sought by Caravel from the court, the request for the relevant court orders would be withdrawn by Caravel