[2019] ATP 1

Catchwords:

Declaration – orders – bidder’s statement – target’s statement – independent expert’s report – lock-up – cancelling acceptances – supplementary disclosure

Corporations Act 2001 (Cth), sections 602, 631, 636, 638, 650D, 650E

ASIC Regulations, Regulation 16

Pancontinental v Goldfields (1995) 16 ACSR 463

Guidance Note 5: Specific remedies – Information deficiencies, Guidance Note 7: Lock-up devices

Benjamin Hornigold Limited and Henry Morgan Limited [2018] ATP 23, Molopo Energy Limited 01 & 02 [2017] ATP 10, The President’s Club Limited 02 [2016] ATP 1, Sydney Gas Limited 01 [2006] ATP 9, Austral Coal Limited 03 [2005] ATP 14, Village Roadshow Limited 03 [2004] ATP 22

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| Yes | No | Yes | Yes | Yes | No |

Introduction

- The Panel, Yasmin Allen, James Dickson (sitting President) and Bruce McLennan, made a declaration of unacceptable circumstances in relation to the affairs of Benjamin Hornigold Limited and a declaration of unacceptable circumstances in relation to the affairs of Henry Morgan Limited. The applications concerned concurrent non-inter-conditional scrip takeover bids made by John Bridgeman Limited for each of Benjamin Hornigold and Henry Morgan. The Panel declared the circumstances unacceptable because (among other things) shareholders had not been given sufficient information to assess the bids, John Bridgeman, Benjamin Hornigold and Henry Morgan failed to adequately advise shareholders in relation to the bids, and certain transactions between John Bridgeman, Benjamin Hornigold and another entity operated as a lock-up device in relation to the bid for Benjamin Hornigold. The Panel made orders, which included cancelling acceptances, requiring repayment of a $4.5 million loan from Benjamin Hornigold to John Bridgeman and further disclosure.

- In these reasons, the following definitions apply.

- Applicants

- Jonathan Allan Dixon, Ms Wendy Lynn Cowan, Mrs Susan Jean Dixon ATF Dixon Super Fund, GM Enterprises Australia Pty Ltd ATF GTM Super Fund and Inspired Asset Management Pty Ltd

- BHD

- Benjamin Hornigold Limited (ASX: BHD)

- BRL

- Bartholomew Roberts Pty Limited

- Bidder’s Statements

- The bidder’s statements for JBL’s off-market scrip bids for BHD and HML lodged on 31 October 2018

- HML

- Henry Morgan Limited (ASX: HML)

- JBFG

- JB Financial Group Pty Ltd

- JBFG Loan Extension

- has the meaning given in paragraph 45(b)

- JBFG Offer

- has the meaning given in paragraph 41

- JBL

- John Bridgeman Limited (NSX: JBL)

- JBL Loan Extension

- has the meaning given in paragraph 46

- JB Trading

- JB Trading House Pty Ltd

- Loan Conversion

- has the meaning given in paragraph 45(a)

- Supplementary Bidder’s

Statements - The supplementary bidder’s statements for JBL’s off-market scrip bids for BHD and HML lodged on 22 November 2018

- Target’s Statements

- The target’s statements lodged by each of BHD and HML on 6 December 2018

- Voting Director

- has the meaning given in paragraph 19

Facts

- BHD and HML are ASX listed investment companies. Trading in BHD and HML shares is suspended.

- JBL is listed on the NSX and is the investment manager for BHD and HML under investment management agreements.

- On 10 September 2018, JBL announced its intention to make scrip off-market takeover bids to acquire:

- all of the issued shares and options in BHD that it did not currently own and

- all the issued shares of HML that it did not currently own.

- JBL’s bids for BHD and HML were not inter-conditional. Each bid was initially subject to a waivable 50.1% minimum acceptance condition.

- On 31 October 2018, JBL lodged Bidder’s Statements in relation to its bids for BHD and HML. On 9 November 2018, JBL announced that it had completed dispatch of its Bidder’s Statements. At the time of dispatch, JBL had voting power of 0.19% in BHD and 11.07% in HML.

- On 22 November 2018, JBL:

- following discussions with ASIC, lodged Supplementary Bidder’s Statements in relation to its bids for BHD and HML and

- extended the offer period for its bids for BHD and HML to 14 January 2019.1 The extension of the offer periods triggered a right of withdrawal for BHD and HML shareholders who had accepted the bid before the date of the Supplementary Bidder’s Statements under ss650D(1)(a)(ii) and 650E2.

- On 6 December 2018, BHD and HML lodged their respective Target’s Statements. Each Target’s Statement:

- contained an independent expert’s report concluding that the relevant bid is not fair but reasonable and

- included a statement that the Voting Directors recommend that shareholders accept the bid in the absence of a superior proposal.

- On 24 December 2018, JBL announced that it had obtained shareholder approval for its bids for BHD and HML to proceed and declared both bids free of conditions.

Applications

- By applications dated 28 December 2018, the Applicants sought declarations of unacceptable circumstances in relation to the affairs of each of BHD and HML. The Applicants submitted that:

- the bids were not able to take place in an efficient, competitive and informed market

- the Bidder’s Statements and Target's Statements breached ss636 and 638 and frustrated s602

- the structure of the bids acted to frustrate the policy of Chapter 6

- there was no reasonable basis for the recommendations by the Voting Directors (of each of BHD and HML) and

- the circumstances surrounding each bid had "the effect of being coercive beyond the normal incidence of a change of ownership".

Interim orders sought

- The Applicants sought interim orders prohibiting JBL receiving and/or processing further acceptances under the bids until the applications were determined by the Panel.

- On 31 December 2018, the Panel made interim orders set out in Annexure A that JBL and all officers, agents or persons acting on its behalf must not take any further steps to process any acceptances received under each bid until the earliest of further order of the Panel, determination of the Panel proceedings or 2 months from the date of the interim orders.

Final orders sought

- The Applicants sought final orders:

- preventing JBL from proceeding with the bids

- requiring JBL to withdraw the bids and

- preventing JBL from making or announcing any other bid for BHD and HML for at least 4 months and unless and until (i) JBL has obtained all necessary shareholder approvals in respect of the bids and (ii) ASIC has accepted lodgment of new bidder’s statements.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning.

- JBL made a preliminary submission. It submitted (among other things) that the Applicants had not made their application in a timely manner and all information relevant to JBL’s bids for BHD and HML had been disclosed in the Bidder’s Statements and Supplementary Bidder’s Statements, “the latter of which was settled in consultation with ASIC”. BHD and HML made similar submissions in a combined preliminary submission. They also submitted that one of the Applicants and other HML shareholders were involved in a dispute with HML in relation to exercise of HML options.

- ASIC also made a preliminary submission, stating that it was “open to, and appropriate for, the Panel to conduct proceedings”. ASIC submitted that it had concerns in relation to the Loan Conversion (the conversion of a $4.5 million receivable into a loan by BHD to JBL after announcement of the JBL’s bid for BHD3), including whether “it may be akin to a lock up device”.

- On reading the material we were concerned about (among other things) the Loan Conversion and whether BHD and HML shareholder had sufficient information regarding the relationships and relevant transactions involving JBL, BHD, HML, JB Financial and other related parties. We decided to conduct proceedings and hear the applications together pursuant to Regulation 16 of the ASIC Regulations 2001 (Cth).

Lack of adequate advice to shareholders

- On 5 September 2018, after receiving confidential non-binding letters of intent from JBL in relation to the bids, BHD and HML’s boards each appointed a sub-committee of ‘voting directors’ to consider JBL’s bid (Voting Directors). The board sub-committees each subsequently approved entering into a bid implementation agreement with JBL.

- On 10 September 2018, JBL announced its intention to make the bids. The announcement stated, in relation to the HML offer:

“If appropriate, following their consideration of HML’s due diligence in relation to the HML Offer and their assessment of the independent expert report to be commissioned by them to consider the fairness and reasonableness of the offer, the HML independent directors have undertaken to recommend the HML Offer to HML shareholders in the absence of a superior proposal.”

And in relation to BHD offer:

“Following their due diligence in respect of the BHD Offer, and the advice of an independent expert engaged by them to consider the fairness and reasonableness of the BHD Offer, the independent directors have undertaken to recommend the BHD Offer to BHD shareholders in the absence of a superior proposal.”

- The announcement also included a statement (towards the end) that BHD and HML shareholders should carefully consider the Target’s Statements before deciding whether to accept the bids. The statement in relation to BHD above could be read by BHD shareholders as stating that the independent directors4 had finalised their due diligence, received advice from their independent expert and had undertaken to recommend JBL’s bid. We think it is possible that, in light of subsequent communications to BHD shareholders, some shareholders may have drawn that conclusion.5

- In the bid implementation agreements, each of BHD and HML represented that their respective Voting Directors would unanimously recommend the bids in the absence of a superior proposal and subject to consideration of due diligence, matters detailed in any independent expert’s report and the assessment of the bid by the expert. They also agreed to early dispatch of JBL’s bidder’s statements.

- Each bid implementation agreement also provided that parties would use best endeavours to comply with a timetable which included dispatch of the Target’s Statements and independent expert’s reports at the same time as the bidder’s statement. This did not ultimately occur.

- On 31 October 2018, JBL lodged its Bidder’s Statements. The Bidder’s Statement for BHD stated on the first page:

“BHD’S VOTING DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU ACCEPT THIS OFFER IN THE ABSENCE OF A SUPERIOR PROPOSAL”

The Bidder’s Statement for HML stated on the first page:

“HML’S VOTING DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU ACCEPT THIS OFFER IN THE ABSENCE OF A SUPERIOR PROPOSAL”

- The statements referred to in paragraph 24 were repeated throughout JBL’s Bidder’s Statements. We initially assumed that BHD and HML had not commented on the Bidder’s Statements because we were not provided with any documents suggesting otherwise. BHD and HML later provided material showing that they had asked JBL to amend these statements prior to lodgement to reflect the conditionality of the recommendation. JBL did not make the requested amendments.6 It would appear that BHD and HML had no control over this. They had agreed to early dispatch of the Bidder’s Statements without the ability to ensure that any disclosure concerns in relation to the Bidder’s Statements could be addressed.

- On 9 November 2018, JBL announced that it had completed dispatch of its bidder’s statement for both BHD and HML. At the time of dispatch, JBL had voting power of 0.19% in BHD and 11.07% in HML respectively. Despite being aware of the misrepresentations in the Bidder’s Statements about the conditionality of the director recommendation, BHD and HML failed to alert their respective shareholders of their concerns regarding JBL’s Bidder’s Statements at that time.

- On 9 November 2018, JBL released an announcement “clarifying” (but not retracting) the statements referred to in paragraph 24 stating “these statements must be read in the context of JBL’s announcement of 10 September 2018 and other information provided in the Bidder’s Statements despatched by JBL”.7 JBL did not retract the statements referred to in paragraph 24 until 22 November 2018 when it released its Supplementary Bidder’s Statements. The Supplementary Bidder’s Statements did not provide shareholders with an explanation as to why ASIC had asked JBL to retract the statements. By this point JBL’s voting power in BHD and HML had increased to 40.69% and 57.02% respectively. We consider that a substantial number of BHD and HML shareholders had accepted the bid after receiving the Bidder’s Statements with incorrect and misleading descriptions of the recommendations of the Voting Directors of each company.

- On 26 November 2018, the same day that BHD and HML were required to lodge and dispatch their respective Target’s Statements, the Panel affirmed earlier decisions of ASIC to refuse relief to BHD and HML to either (a) extend time for the dispatch of their Target’s Statements or (b) permit them to lodge incomplete Target’s Statements.8

- On 27 November 2018, the Voting Directors of BHD and HML, in separate announcements, recommended to their shareholders for the first time that they take no action in relation to the JBL bids prior to considering the Target's Statements and independent expert’s reports. This announcement was released a few days after shareholders were offered withdrawal rights.

- BHD and HML released their Target’s Statements and independent expert’s reports on 6 December 2018, past the statutory deadline in contravention of items 11 and 12 of s631(1) of the Act. As noted above, the independent expert concluded that each offer was not fair but reasonable. The sensitivity analysis in the independent expert’s reports stated if JBL obtained only 50% ownership in both companies as compared to 100% ownership, the value of the BHD offer would fall from $0.49 to $0.31 and the value of the HML offer would fall from $0.72 to $0.45. The independent expert did not opine on the value of the bids if JBL obtained less than 50% in either company, but it is reasonable to assume it would be less.

- The Panel has previously stated that it prefers information to be provided to target shareholders “in fewer, more comprehensive (and comprehensible) documents”.9 We recognise that it is not uncommon for a bidder’s statement and a target’s statement in a recommended bid to be dispatched separately. However, in light of these bids being made by the manager of both targets and the complexities involved in assessing the value of concurrent scrip bids which are not inter-conditional, it was highly desirable in this case to dispatch these documents together so shareholders would be given all relevant information before they could accept the bid. This was originally contemplated in the bid implementation agreements and it was entirely within the control of JBL, BHD and HML to progress the disclosure documents before announcing the bids.

- The failure to dispatch the Bidder’s Statement, Target’s Statement and independent expert’s report for each bid together meant that a significant number of shareholders accepted the relevant bid in circumstances where shareholders:

- had not received any clear and prominent advice from BHD and HML (as applicable) to wait for the target’s statement and independent expert’s report before accepting the bid and

- had not been advised that the Voting Directors recommendation was subject to due diligence, matters detailed in any independent expert’s report and the assessment of the bid by the independent expert.

- This lack of information was material, particularly in light of the subsequent analysis of the independent expert in relation to both bids. The independent expert concluded that each bid was not fair but reasonable and assessed the value of both bids to be materially lower if JBL obtained only 50% ownership of BHD and HML compared to 100% ownership. In addition a key reason for the expert concluding that each bid was reasonable was the large number of acceptances JBL had already received under the bid. These conclusions highlight that it was absolutely vital for BHD and HML to advise their respective shareholders to wait until they had received the independent expert’s report.

- We conclude that BHD and HML shareholders were denied sufficient time and information to assess the merits of JBL's bids and did not have the benefit of appropriate and sufficiently timely advice in relation to JBL’s bids. Given JBL’s role as manager of BHD and HML, we would expect BHD and HML to have taken necessary steps to ensure this, including by negotiating protections in the bid implementation agreements and providing prompt advice to shareholders throughout the bid period.

- We were minded to make a finding that the Voting Directors of BHD and HML had not acted sufficiently independently of JBL in relation to the bids. The fact that BHD and HML responded to JBL’s bids in an almost identical way added to our concerns on this issue. We gave the Voting Directors an opportunity to make submissions on this and received responses to the effect that the directors were aware of their obligations as directors, had acted independently and had not been influenced by JBL. The Voting Directors of HML also submitted that “the target as a JBL managed entity had little control over the timing of supply of information required for the preparation of its Target’s Statement. This included the timing of the supply and the content of information requested by, and provided to, HML’s independent expert for its use in the preparation of the Independent Expert’s Report”. We found this submission concerning as it suggested that although the Voting Directors may have exercised independent judgement, JBL maintained control over the bid process. Ultimately we decided it was not necessary to determine whether the Voting Directors of BHD and HML were truly independent of JBL because the Panel’s primary concern is with the effects of actions on market participants.

- We are not just concerned about the process here but also disclosure more generally, which is discussed further below.

Inadequate disclosure of material information about the merged group

- The Applicants submitted in their applications that the disclosure provided by JBL failed to provide a clear and intelligible explanation of, among other things, (i) structural links between JBL, BHD, HML, JBFG, BRL and other entities which form the merged group, (ii) the terms, conditions and risks associated with the JBFG Offer, and (iii) JBL’s financial status and the implications of that status for the merged group.

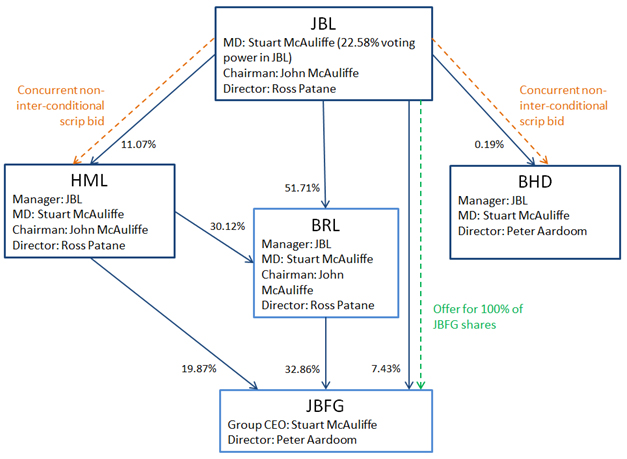

- The chart below shows the relevant structural links and relationships identified by the Applicants as at the date of the application (excluding the loans between these companies discussed further below).

- JBL is the investment manager for BHD, HML and BRL under investment management agreements. JBL, HML and BHD have the same two company secretaries.

- Mr Stuart McAuliffe has provided a $2.5 million facility to JBL, of which JBL has drawn down $1 million.

- On 4 January 2018, JBL announced that it had made an offer to all shareholders in JBFG to acquire their shares for shares and options in JBL, subject to conditions (JBFG Offer). Offers are still open but not all conditions have been fulfilled.

- On 6 June 2018, BHD announced that its board had approved in principle entering into an exclusive trading arrangement with JB Trading (a subsidiary of JBFG), with JB Trading issuing to BHD a $13.5 million convertible note as consideration for entering into the exclusive trading arrangement (JB Trading Transaction).

- On 30 June 2018, JBL issued a tax invoice to BHD of $4,169,237 (excluding GST), which included performance fees, based on the impact on net tangible assets of the issue of convertible notes under the JB Trading transaction. Fees of $4,553,773 were paid by BHD to JBL before the date of the invoice. The JB Trading transaction was ultimately terminated10 and the fees paid became refundable.11

- On 3 August 2018, following discussions with ASX, JBL shares held by BHD were bought back by JBL for approximately $1.1 million and JBL shares held by HML were bought back by JBL for approximately $2.8 million. On 8 August 2018, BHD and HML each made unsecured loans to JBL for a term of one year at 11.5% interest for $1,134,000 and $2,411,000 respectively.

- On 17 September 2018, after the bids were announced, BHD’s board agreed to:

- convert the receivable referred to in paragraph 43 into an unsecured loan of up to $4.5 million at an interest rate of 11.50% per annum repayable within 18 months (Loan Conversion) and

- amend the terms of a $2.3 million convertible loan to JBFG, including extending the expiry date from 10 September 2018 to 11 March 2020 (JBFG Loan Extension).

- On 16 October 2018, the board of BHD agreed to extend its loan to JBL referred to in paragraph 44 by a further six months (JBL Loan Extension).12

- On 22 October 2018, JBL released its audited financial statements for the year ended 30 June 2018. On 2 November 2018, JBL released JBFG’s audited financial statements for the year ended 30 June 2018. KPMG was auditor of both companies at the time and in its audit report for each company stated that certain conditions “indicate a material uncertainty exists that may cast significant doubt on the Group’s ability to continue as a going concern and, therefore, whether it will realise its assets and discharge its liabilities in the normal course of business, and at the amounts stated in the Financial Report”.

- The Bidder’s Statements did not disclose the above relationships and transactions despite JBL, as investment manager of BHD and HML, having access to all material information about these matters. The Bidder’s Statements also did not disclose the status of the JBFG Offer or the material uncertainty identified by KPMG in relation to JBL’s and JBFG’s abilities to continue as a going concern.

- JBL submitted that “[r]elevant information regarding transactions and business relationships are disclosed, inter alia, in various relevant and publicly available documents on the NSX Market announcements platform” and in the 30 June 2018 annual reports of each of JBL, BHD, HML and JBFG. The Bidder’s Statements referred shareholders to the financial information in the BHD and HML annual reports in the context of valuing the offer consideration, and generally to JBL’s NSX announcements.

- ASIC submitted that “all information concerning the relationships and associations between, and relevant interests and cross holdings of, entities and key employees within the group (including where those relationships extend to subsidiaries of JB Financial), needs to be disclosed in a centralized location in the relevant documents in a clear and concise manner.”

- We agree. In the context of a recommended scrip bid, shareholders should be presented with sufficient and timely information about the merged group to enable them to assess whether they should accept the bid and invest in the merged group. This was particularly important in the circumstances of JBL’s bids because it would be difficult for shareholders to assess the value of the bids due to the concurrent, non-inter-conditional transaction structure. Shareholders should not have to piece together from multiple sources a complex structure of transactions and relationships relating to a corporate group and the financial position of members of that group.13

- The Applicants also submitted that shareholders have not been provided with sufficient information regarding the risks surrounding scenarios in which JBL acquires less than 50.1% ownership of HML and/or BHD. JBL submitted that highlighting this risk “is misplaced in circumstances where it has exceeded the minimum acceptance condition for the HML bid and reasonably anticipated that it would receive acceptances in excess of the minimum acceptance condition for the BHD bid, when freeing the bid from conditions.” This submission misses the obvious point that these acceptances were based on deficient and misleading disclosure, as discussed above. We note the sensitivity analysis of the independent expert referred to above at paragraph 30. We consider this information is material to shareholders as it is relevant to their decision about when to accept the bid.

- As noted in paragraph 27, JBL lodged the Supplementary Bidder’s Statements retracting the statements regarding the recommendations of the Voting Directors and (among other things) provided further information regarding risks. It also disclosed that JBFG’s auditor had drawn attention to a material uncertainty as to JBFG’s ability to continue as a going concern.14 We do not consider that the disclosure in these statements remedied the disclosure issues relating to the various relationships and transactions between the relevant companies and their financial position, as discussed above. Also the presentation of the supplementary information that was provided was inaccessible and confusing. For example no explanation was given as to why certain statements were retracted and additional information was being provided.

- The withdrawal rights offered with the Supplementary Bidder’s Statements did not adequately protect BHD and HML shareholders who had accepted the bids prior to the release of the supplementary disclosure because the shareholders remained uninformed as to material information relating to the bids. As noted above (at paragraph 27) a significant number of BHD and HML shareholders had accepted JBL’s bids before any correction of an incorrect and misleading statement suggesting that their Voting Directors had or would recommend the bid. They also had not been informed of these other significant disclosure issues. For example, the first time shareholders were provided with a description in one document of the various transactions connecting JBL, BHD, HML, BRL, JBFG and JB Trading was in the independent expert’s reports released with the Target’s Statements on 6 December 2018. In conclusion, we consider that the additional disclosure in the Supplementary Bidder’s Statements cannot be taken to have remedied the previous defective disclosure.

- JBL submitted that it was concerned that ASIC made submissions regarding disclosure in these proceedings when it was reasonable for JBL to infer that ASIC’s concerns had been addressed when the Supplementary Bidder’s Statements had been lodged. We consider that this criticism of ASIC is unfounded given the complexity of the issues involved and that it is JBL’s responsibility to ensure the Bidder’s Statements (as supplemented) comply with the disclosure requirements in Chapter 6.

BHD Lock-up devices

- We asked for submissions on whether the Loan Conversion operates as a lock-up device for BHD shareholders given the transaction involved a significant amount of money in the context of the companies’ activities and was entered into after the bids had been announced.

- ASIC made the following submissions on the impact of the Loan Conversion on BHD shareholders:

“The effect of this transaction is that BHD has been deprived of $4.5m cash at bank which ASIC submits is a material and valuable asset in the broader context of the state of affairs of the relevant companies. Instead, BHD loaned those funds to JBL on an unsecured basis in circumstances where JBL’s ongoing financial viability appears questionable.”

“Had the performance fee been repaid to BHD, BHD shareholders would have retained an interest in that cash proportionate to their investment in BHD. This would have increased the attractiveness of retaining 100% exposure to BHD as…BHD would have been well capitalised with a significant surplus of cash. The effect of the loan arrangement was to lock-up that cash with JBL for a period of 18 months the effect of which ASIC submits conflicts with the principles in s602”

- The Applicants also submitted that the Loan Conversion operates as a lock-up device because it "deprives BHD of $4.5 million in cash (between 34.57% and 32.40% of BHD’s net asset value), which otherwise would have been available for investment in accordance with BHD’s investments mandate”.

- BHD submitted that the Loan Conversion did not devalue BHD and that “as the loan arrangement affected only cash flow, not the value of the asset itself, the rate at which JBL pays back the loan is irrelevant; the value of the performance fees, whether it occurred immediately or over time, remains fixed. There is therefore no significant difference between a lump-sum or a loan. Both are net assets.”

- JBL noted that the independent expert for BHD did not indicate that the Loan Conversion had any adverse impact on BHD. In response, ASIC submitted “the expert opined on value at a point in time when the loan arrangement had already been entered. The expert report did not address the counterfactual i.e. a situation where the funds were repaid ... or the loan arrangement had not been entered.”

- We agree with ASIC’s and the Applicants’ characterisations of the effect of the Loan Conversion. We also consider that the JBL Loan Extension and JBFG Loan Extension have a similar effect. We disagree with BHD’s submission that there is no significant difference between cash at hand and an unsecured loan, particularly in light of uncertainty regarding the financial positions of JBL and JBFG.

- The Loan Conversion, JBL Loan Extension and JBFG Loan Extension diminish the value of important assets of BHD making BHD less attractive to an acquirer and less likely to attract competing proposals (and as a result diminish the value of BHD if shareholders do not accept JBL’s bid), in effect operating as a lock up device.15 Our conclusions are supported by the following reasons given by the independent expert for determining the BHD bid is reasonable:

“BHD’s current trading suspension, JBL’s current relevant interest in BHD and BHD’s significant exposure to JBL (through existing loans and convertible instruments) are likely to act as impediments to investors realising returns through distributions or capital appreciation in the near-term” and

“Due to the significant loans made by BHD to JBL and JBFG, BHD has a dependency on JBL to be able to realise its investments in JBFG. BHD is unlikely to be able to realise the value of its loans other than in conjunction with JBL”. (emphasis added)

- The Applicants and ASIC also questioned the purpose of the loan transactions and the bids. The Applicants submitted that “it is unclear, whether the loan (and the other related party debt facilities that JBL entered into or extended in August to October 2018) where (sic) required in order for JBL to continue as a going concern. The Applicants question whether Leadenhall would have been able to value to JBL and JB Financial on a going concern basis if the loan was not agreed to”. ASIC submitted that it is “not wholly unreasonable for the Panel to consider the prospect that the JBL bid for BHD may have been contrived to avoid the need to repay the $4.5m JBL owed to BHD”. We did not consider it necessary to determine these matters in finding the circumstances in relation to BHD are unacceptable.

Overall effect

- It appears to us that:

- the acquisition of control over voting shares in BHD and HML has not taken place in an efficient, competitive and informed market

- the holders of shares in BHD and HML have not been given enough information to enable them to assess the merits of JBL’s bid and

- as a result of the Loan Conversion, JBL Loan Extension and JBFG Loan Extension, the holders of shares in BHD have been denied a reasonable and equal opportunity to participate in the benefits of JBL’s bid.

Decision

Declaration

- It appears to the Panel that the circumstances are unacceptable circumstances:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of BHD and HML or

- the acquisition, or proposed acquisition, by a person of a substantial interest in BHD and HML

- in the alternative, in relation to the effect the circumstances have had, are having, will have or are likely to have in relation to BHD and HML, having regard to the purposes of Chapter 6 set out in s602 of the Act and

- in the further alternative, because they constituted, constitute, will constitute or are likely to constitute a contravention of a provision of Chapter 6 of the Act.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- Accordingly, we made the declarations set out in Annexure B and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

- Upon review of the draft declarations, JBL offered to give undertakings to “expedite repayment of the $4.5 million in performance fees”, and provide corrective disclosure and offer withdrawal rights to BHD and HML shareholders in lieu of declarations being made. We did not accept the undertakings because they were offered at a late stage in the proceedings and we were not confident that JBL would be able to sufficiently remedy the unacceptable circumstances.

Extension of time

- Section 657C(3) says:

An application for a declaration under section 657A can be made only within:

(a) two months after the circumstances have occurred; or

(b) a longer period determined by the Panel.

- We consider the following factors are relevant in considering whether to extend time under s657C(3):

- the discretion to extend time should not be exercised lightly16

- whether the application made credible allegations of clear and serious unacceptable circumstances, the effects of which are ongoing17

- whether it would be undesirable for a matter to go unheard, because it was lodged outside the 2 month time limit, if essential matters supporting it first came to light during the 2 months preceding the application18

- whether there is an adequate explanation for any delay, and whether parties to the application or third parties will be prejudiced by the delay.19

- We are satisfied when considering the factors described above to extend the time for making the applications in this case. The applications made credible allegations of clear and serious unacceptable circumstances. The Bidder’s Statements, Supplementary Bidder’s Statements, Target’s Statements and independent expert’s reports were lodged during the 2 months preceding the applications. It was not unreasonable for the Applicants to wait until JBL shareholders had approved the bids on 24 December 2018 before making the applications.

Orders

- Following the declaration, we made the final orders set out in Annexure C. We were not asked to, and did not, make any costs orders. The Panel is empowered to make ‘any order’20 if 4 tests are met:

- it has made a declaration under s657A. This was done in relation to both BHD and HML on 25 January 2019.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons below, we are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 29 January 2019. Parties were invited to make submissions and rebuttals.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. The orders do this by (i) in relation to each bid cancelling all acceptances, requiring further disclosure by JBL in a form acceptable to ASIC (with its bid cancelled if a replacement bidder’s statement is not dispatched by the date specified in the orders) and, if the bid is not cancelled, requiring the target to dispatch a supplementary target’s statement and supplementary independent expert’s report and (ii) requiring JBL to repay of the $4.5 million Loan Conversion to BHD (with JBL’s bid for BHD cancelled if the repayment is not made).

- JBL submitted that we should accept undertakings offering withdrawal rights to BHD and HML shareholders rather than cancelling its bids, stating it “does not consider it is for the Panel (or ASIC) to make such a determination for all target shareholders, and to take such a paternalistic approach to regulation of a control transaction, by assuming that target shareholders are not able to make an independent decision (to potentially withdraw their acceptance) in their own best interests”. It also submitted that “such an outcome is inefficient (and accordingly contrary to section 602) and likely to cause confusion in the market”. The Applicants submitted that “the onus should not be placed on shareholders to exercise a withdrawal right (months after they accepted) in circumstances where (amongst other things) it is clear that they accepted on defective and incomplete disclosure”. ASIC submitted in the light of the complexities of corrective disclosure, a ‘cleaner’ disclosure outcome (at least from a shareholder’s point of view) would be fresh bids or other control transactions.

- BHD submitted that orders cancelling acceptances or the bids were inconsistent with the underlying aim of the Panel to ensure that a bid proceeds and “gets back on track”. This submission does not entirely accurately reflect Panel policy. Guidance Note 5: Specific remedies – Information deficiencies (at [16(b)]) provides that the Panel seeks to (among other things) “as far as possible, get the bid back on track and remove any advantage. For example, acquisitions while shareholders and the market were inadequately informed may need to be reversed. There is no principle that prevents orders taking away the benefit of commercial momentum obtained from unacceptable circumstances.” (footnotes omitted)

- We consider that we should provide JBL the opportunity to get both its bids on track but cancel acceptances received so far. In light of (among other things) statements made in the Bidder’s Statements regarding the recommendation of the Voting Directors of BHD and HML, the delay in correcting these statements and the other disclosure deficiencies, we do not think it is appropriate to expect accepting shareholders to reconsider their acceptances. We consider these orders protect the rights and interests of BHD and HML shareholders and ensure as far as possible that JBL’s bids proceed in a way they would have proceeded if the circumstances had not occurred.

- JBL submitted it would be unfairly prejudicial to cancel acceptances under its bids because it had waived conditions (including minimum acceptance conditions) for both bids. To deal with this, we have made orders allowing JBL to reinsert any conditions that were originally in the Bidder’s Statements, which were either waived or satisfied, if it considers it is necessary. With these additional orders, we are satisfied that the orders do not unfairly prejudice JBL.

- We have made orders that, if JBL proceeds with its bids for BHD and HML, BHD and HML must each dispatch a supplementary target’s statements with a supplementary expert’s report to take into account the additional disclosure provided by JBL and the cancellation of acceptances. We have also ordered that JBL, BHD and HML must provide all financial information in their possession to the independent expert in relation to JBL, BHD, HML, BRL, JBFG and JB Trading including, but not limited, to the effect of the repayment the $4.5 million loan resulting from the Loan Conversion on the financial position of JBL and BHD.

- We consider our orders to require repayment of the $4.5 million loan, and cancelling JBL’s bid for BHD if it is not repaid, protect the rights and interests of BHD shareholders and ensure that JBL’s bid for BHD proceeds in a way that it would have if this lock up was not entered into.

- We have decided not to reverse the JBL Loan Extension and JBFG Loan Extension. We consider that the potential benefit to BHD shareholders of such orders is outweighed by the prejudice to JBL and JBFG.

James Dickson

President of the sitting Panel

Declaration made on 25 January 2019

Final orders made on 8 February 2019

Reasons given to parties 25 February 2019

Reasons published 4 March 2019

Advisers

| Party | Advisers |

|---|---|

| Applicants | Kardos Scanlan |

| Benjamin Hornigold Limited | AJ & Co Lawyers |

| Henry Morgan Limited | AJ & Co Lawyers |

| John Bridgeman Limited | McCullough Robertson |

| JB Financial Group Pty Ltd | Thomson Geer |

1 The offer period for both bids has since been extended to 15 April 2019

2 Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

4 We understand the independent directors are the Voting Directors

5 In any case, given the importance of the directors’ recommendations it should have been made clear that they were “subject to”, not merely “following” consideration of due diligence and the independent expert’s report

6 JBL did make some of the changes requested by BHD and HML

7 We question whether the description of the BHD director recommendation in the 10 September announcement actually clarifies the statements referred to in paragraph 24 as the wording implies the BHD directors had already undertaken diligence and received the independent expert’s report and would recommend the offer in the absence of a superior proposal

8 See Benjamin Hornigold Limited and Henry Morgan Limited [2018] ATP 23

9Sydney Gas Limited 01 [2006] ATP 9 at [31]

10 On 24 October 2018, BHD announced JB Trading had given notice to BHD terminating the JB Trading Transaction

11 See BHD’s preliminary final report released on ASX on or about 3 September 2018

12 On 16 October 2018, the board of HML also agreed to extend the loan to JBL referred to in paragraph 44 for six months

13Pancontinental v Goldfields (1995) 16 ACSR 463, 472 quoted in Sydney Gas Limited 01 [2006] ATP 9 at [30]. See also Village Roadshow Limited 03 [2004] ATP 22 at [26]

14 But not in relation to the auditor’s emphasis of matter regarding material uncertainty as to JBL’s ability to continue as a going concern

15 Guidance Note 7: Lock-up devices at [7]

16Austral Coal Limited 03 [2005] ATP 14 at [18]

17 Ibid at [19] and The President’s Club Limited 02 [2016] ATP 1 at [143]

18Molopo Energy Limited 01 & 02 [2017] ATP 10 at [248]

19 Ibid at [249]

20 Including a remedial order but other than an order requiring a person to comply with a provision of Chapters 6, 6A, 6B or 6C

Annexure A

Corporations Act

Section 657E

Interim Order

Benjamin Hornigold Limited 02

Jonathan Allan Dixon, Ms Wendy Lynn Cowan, Mrs Susan Jean Dixon ATF Dixon Super Fund, GM Enterprises Australia Pty Ltd ATF GTM Super Fund and Inspired Asset Management Pty Ltd made an application to the Panel dated 28 December 2018 in relation to the affairs of Benjamin Hornigold Limited.

The Panel ORDERS:

- John Bridgeman Limited and all officers, agents or persons acting on its behalf must not take any further steps to process any acceptances received under its bid for Benjamin Hornigold Limited.

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Allan Bulman

Director

with authority of James Dickson

President of the sitting Panel

Dated 31 December 2018

Corporations Act

Section 657E

Interim Order

Henry Morgan Limited 02

Jonathan Allan Dixon, Ms Wendy Lynn Cowan, Mrs Susan Jean Dixon ATF Dixon Super Fund, GM Enterprises Australia Pty Ltd ATF GTM Super Fund and Inspired Asset Management Pty Ltd made an application to the Panel dated 28 December 2018 in relation to the affairs of Henry Morgan Limited.

The Panel ORDERS:

- John Bridgeman Limited and all officers, agents or persons acting on its behalf must not take any further steps to process any acceptances received under its bid for Henry Morgan Limited.

- These interim orders have effect until the earliest of:

- further order of the Panel

- the determination of the proceedings and

- 2 months from the date of these interim orders.

Allan Bulman

Director

with authority of James Dickson

President of the sitting Panel

Dated 31 December 2018

Annexure B

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Benjamin Hornigold Limited 02

Circumstances

- John Bridgeman Limited (JBL) is an NSX listed company.

- Benjamin Hornigold Limited (BHD) and Henry Morgan Limited (HML) are ASX listed investment companies. Trading in BHD and HML shares is suspended.

- JBL and HML have voting power of approximately 51.71% and 30.12% respectively in Bartholomew Roberts Pty Limited (BRL). JBL, HML and BRL have voting power of approximately 7.43%, 19.87% and 32.86% respectively in JB Financial Group Pty Ltd (JBFG). JBFG has a number of subsidiaries including JB Trading House Pty Ltd (JB Trading).

- JBL is the manager for BHD, HML and BRL under investment management agreements. Mr Stuart McAuliffe is the Managing Director of JBL, HML, BHD and BRL and the Group Chief Executive Officer of JBFG. Mr John McAuliffe is the Chairman and non-executive director of JBL and BRL and the Chairman of HML. Mr Peter Aardoom is a director of BHD and JBFG. Mr Ross Patane is a director of JBL, HML and BRL. JBL, HML and BHD have the same two company secretaries.

- Mr Stuart McAuliffe also has voting power of 22.58% in JBL and has an outstanding $1 million loan to JBL (as a part of a $2.5 million loan facility).

- On 4 January 2018, JBL announced that it had made an offer to all shareholders in JBFG to acquire their shares for shares and options in JBL, subject to conditions. Offers are still open but not all conditions have been fulfilled.

- On 6 June 2018, BHD announced that its board had approved in principle entering into an exclusive trading arrangement with JB Trading, with JB Trading issuing to BHD a $13.5 million convertible note as consideration for entering into the exclusive trading arrangement (JB Trading Transaction).

- On 30 June 2018, JBL issued a tax invoice to BHD of $4,169,237 (excluding GST), which included performance fees, based on the impact on net tangible assets of the issue of convertible notes under the JB Trading Transaction. The amount referred to in the invoice was paid by BHD before the date of the invoice. The JB Trading Transaction was ultimately terminated.1 BHD’s preliminary final report2 stated that:

“Due to a timing adjustment in relation to the proposed convertible note transaction with JB Trading House Pty Ltd and the subsequent exercise by the ASX of their discretion to require the Company to seek shareholder approval for the proposed convertible note transaction, fees of $4,553,773 (which had been calculated on the basis that the transaction had been implemented at that time) were paid to the Investment Manager at 30 June 2018 and are now refundable.”

- On 3 August 2018, 536,585 JBL shares held by BHD were bought back by JBL for approximately $1.1 million ($2.05 per share). Also on 3 August 2018, 1,398,573 JBL shares held by HML were bought back by JBL for approximately $2.8 million ($2.05 per share).

- On 8 August 2018, BHD and HML each made unsecured loans to JBL for a term of one year at 11.5% interest for $1,134,000 and $2,411,000 respectively.

- On 5 September 2018, the boards of BHD and HML each considered confidential non-binding letters of intent from JBL for the proposed acquisition of all of the issued share capital in BHD and HML respectively. BHD and HML’s boards each appointed a sub-committee to consider JBL’s bid.

- On 9 September 2018, BHD’s board sub-committee approved entering into a bid implementation agreement with JBL. On 10 September 2018, HML’s board sub-committee approved entering into a bid implementation agreement with JBL.

- On 10 September 2018, JBL announced its intention to make scrip off-market takeover bids to acquire:

- all of the issued shares and options in BHD that it did not currently own and

- all the issued shares of HML that it did not currently own,

attaching signed bid implementation agreements. The announcement stated:

“If appropriate, following their consideration of HML’s due diligence in relation to the HML Offer and their assessment of the independent expert report to be commissioned by them to consider the fairness and reasonableness of the offer, the HML independent directors have undertaken to recommend the HML Offer to HML shareholders in the absence of a superior proposal.”

“Following their due diligence in respect of the BHD Offer, and the advice of an independent expert engaged by them to consider the fairness and reasonableness of the BHD Offer, the independent directors have undertaken to recommend the BHD Offer to BHD shareholders in the absence of a superior proposal.”

The announcement also included a statement (towards the end) that BHD and HML shareholders should carefully consider the target’s statements before deciding whether to accept the bids.

- In the bid implementation agreements, each of BHD and HML represented that their respective voting directors3 would unanimously recommend the bids in the absence of a superior proposal and subject to consideration of due diligence, matters detailed in any independent expert’s report and the assessment of the bid by the expert. They also agreed to early dispatch of JBL’s bidder’s statements. The bid implementation agreements provided that parties would use best endeavours to comply with a timetable which included dispatch of BHD’s and HML’s target’s statements and independent expert’s reports at the same time as the bidder’s statements (which, as noted below, did not occur).

- JBL’s bids for BHD and HML were not inter-conditional. Each bid was initially subject to a waivable 50.1% minimum acceptance condition.

- On 17 September 2018, BHD’s board agreed to amend the terms of a $2.3 million convertible loan to JBFG, including extending the expiry date from 10 September 2018 to 11 March 2020.

- On 17 September 2018, BHD’s board agreed to convert the repayment of performance fees referred to in paragraph 8 into an unsecured loan of up to $4.5 million at an interest rate of 11.50% per annum repayable within 18 months. Mr Stuart McAuliffe participated in this board decision.

- On 16 October 2018, the boards of BHD and HML extended the loans to JBL (referred to in paragraph 10) for six months.

- On 31 October 2018, JBL lodged bidder’s statements in relation to its bids for BHD and HML. The bidder’s statement for BHD stated on the first page:

“BHD’S VOTING DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU ACCEPT THIS OFFER IN THE ABSENCE OF A SUPERIOR PROPOSAL”

The bidder’s statement for HML stated on the first page:

“HML’S VOTING DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU ACCEPT THIS OFFER IN THE ABSENCE OF A SUPERIOR PROPOSAL”

- The statements referred to in paragraph 19 were repeated throughout JBL’s bidder’s statements for BHD and HML. Prior to lodgement,4 BHD and HML had asked JBL to amend these statements to reflect the conditionality of the recommendation. JBL did not make the requested amendments.

- On 9 November 2018, JBL announced that it had completed dispatch of its bidder’s statements for both BHD and HML. At the time of dispatch, JBL had voting power of 0.19% in BHD and 11.07% in HML respectively. On the same day JBL also released an announcement “clarifying” (but not retracting) the statements referred to in paragraph 19 stating “these statements must be read in the context of JBL’s announcement of 10 September 2018 and other information provided in the Bidder’s Statements despatched by JBL”.

- On 22 November 2018, JBL:

- following discussions with ASIC, lodged supplementary bidder’s statements in relation to its bids for BHD and HML. These supplementary bidder’s statements, among other things, retracted the statements referred to in paragraph 19 and

- extended the offer period for its bids for BHD and HML to 14 January 2019.5 The extensions of the offer period for JBL's bids for BHD and HML triggered a right of withdrawal for BHD and HML shareholders who had accepted the bid before the date of the supplementary bidder’s statement under ss650D(1)(a)(ii) and 650E of the Corporations Act 2001 (Cth) (Act).

- As at 22 November 2018, JBL had voting power in BHD and HML of 40.69% and 57.02% respectively.

- On 26 November 2018, the same day that BHD and HML were required to lodge and dispatch their respective target’s statements, the Panel affirmed earlier decisions of ASIC to refuse relief to BHD and HML to either (a) extend time for the dispatch of their target’s statements or (b) permit them to lodge incomplete target’s statements.6

- On 27 November 2018, the voting directors of BHD and HML, in separate announcements, recommended to their shareholders for the first time that they take no action in relation to the JBL bids prior to the release of their respective target’s statements.

- On 6 December 2018, BHD and HML lodged their respective target’s statements. Each target’s statement:

- contained an independent expert’s report concluding that the relevant bid is not fair but reasonable and

- included a statement that the voting directors recommend that shareholders accept the bid in the absence of a superior proposal.

- The independent expert stated in its report on JBL’s bid for BHD, as factors in determining that the bid is reasonable, that:

- “BHD’s current trading suspension, JBL’s current relevant interest in BHD and BHD’s significant exposure to JBL (through existing loans and convertible instruments) are likely to act as impediments to investors realising returns through distributions or capital appreciation in the near-term”

- “JBL’s existing interest in BHD would likely act as a significant impediment to any third party considering a takeover offer for BHD as well as limit the ability of BHD Non-Associated shareholders who do not accept the BHD Offer to change investment manager in order to implement an alternative investment strategy”

- “JBL has a relevant interest in BHD in excess of 40% (subject to any withdrawals of acceptances) which may allow JBL to determine future investment decisions of BHD in addition to control of the management rights of BHD. JBL’s relevant interest is also likely to preclude any other takeover offers for BHD or other corporate activity from a third party” and

- “Due to the significant loans made by BHD to JBL and JBFG, BHD has a dependency on JBL to be able to realise its investments in JBFG. BHD is unlikely to be able to realise the value of its loans other than in conjunction with JBL”.

- On 24 December 2018, JBL announced that it had obtained shareholder approval for its bids for BHD and HML to proceed and declared both bids free of conditions.

- The following transactions, which occurred after the announcement of JBL’s bid, diminish the value of important assets of BHD making BHD less attractive to an acquirer and less likely to attract competing proposals (and as a result diminish the value of BHD if shareholders do not accept JBL’s bid), in effect operating as a lock up device:

- the loan provided by BHD to JBL described in paragraph 17

- the extension of the convertible loan to JBFG described in paragraph 16 and

- the extension of the loan to JBL described in paragraph 18.

- JBL’s bidder’s statement in relation to its bid for BHD (as supplemented) did not adequately disclose:

- the various relationships, and transactions, between JBL, BHD, HML, BRL, JBFG, JB Trading and their associates, noting that as the investment manager for BHD, HML and BRL, JBL had all the material information on this issue

- the risk that BHD shareholders will receive materially less value if JBL only obtains voting power of 50% or less in either or both BHD and HML

- the financial position of JBL and JBFG, including that audit opinions in both their most recent accounts refer to material uncertainty regarding going concern and

- the financial effect of the transactions referred to in paragraphs 10, 16, 17 and 18 and how they may impact on BHD shareholders’ decision whether to accept the JBL bid.

- JBL’s supplementary bidder’s statement in relation to its bid for BHD did not adequately deal with ASIC’s disclosure issues in a way that was accessible to BHD shareholders. BHD shareholders who had accepted the bid prior to the issue of JBL’s supplementary bidder’s statement were not adequately protected by the disclosure in the supplementary bidder’s statement and the ability to withdraw their acceptances.

- The above disclosure issues have not been adequately remedied by the issue of BHD’s target’s statement and independent expert’s report.

- The following in combination (among other things) indicate that BHD shareholders were denied sufficient time and information to assess the merits of JBL's bid and did not have the benefit of appropriate and sufficiently timely advice in relation to JBL’s bid:

- BHD agreeing in advance and without qualification, in the bid implementation agreement, to early dispatch of the bidder’s statement

- BHD and JBL not ensuring that the target’s statement and independent expert’s report were dispatched at the same time as the bidder’s statement, as envisaged in the bid implementation agreement timetable that each party agreed to use its best endeavours to comply with

- JBL and BHD’s directors’ failure to promptly alert BHD shareholders of their concerns regarding JBL’s bidder’s statement including the fact that statements in the bidder’s statement misrepresented the conditionality of the voting directors’ recommendation (referred to in paragraphs 19 and 20)

- BHD dispatching its target’s statement and independent expert’s report late, in contravention of items 11 and 12 of s631(1) of the Act

- BHD’s directors’ failure to clearly advise its shareholders prior to 27 November 2018 to take no action in relation to the JBL bid before considering the target's statement and independent expert’s report and

- the almost identical responses of both BHD and HML to JBL’s bids.

Effect

- It appears to the Panel that:

- the acquisition of control over voting shares in BHD has not taken place in an efficient, competitive and informed market

- the holders of shares in BHD have not been given enough information to enable them to assess the merits of JBL’s bid and

- as a result of the lock up device referred to in paragraph 29, the holders of shares in BHD have been denied a reasonable and equal opportunity to participate in the benefits of JBL’s bid.

Conclusion

- It appears to the Panel that the circumstances are unacceptable circumstances:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- in the alternative, in relation to the effect the circumstances have had, are having, will have or are likely to have in relation to BHD, having regard to the purposes of Chapter 6 set out in section 602 of the Act and

- in the further alternative, because they constituted, constitute, will constitute or are likely to constitute a contravention of a provision of Chapter 6 of the Act.

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of BHD.

Bruce Dyer

Counsel

with authority of James Dickson

President of the sitting Panel

Dated 25 January 2019

1 On 24 October 2018, BHD announced JB Trading had given notice to BHD terminating the JB Trading Transaction

2 Released on ASX on or about 3 September 2018

3 In the case of BHD – Messrs Aardoom and Cook. In the case of HML – Mr Ziegler and Ms Gunner

4 On 24 October 2018

5 The offer period has since been extended to 11 February 2019

6 See Benjamin Hornigold Limited and Henry Morgan Limited [2018] ATP 23

Corporations Act

Section 657A

Declaration of Unacceptable Circumstances

Henry Morgan Limited 02

Circumstances

- John Bridgeman Limited (JBL) is an NSX listed company.

- Benjamin Hornigold Limited (BHD) and Henry Morgan Limited (HML) are ASX listed investment companies. Trading in BHD and HML shares is suspended.

- JBL and HML have voting power of approximately 51.71% and 30.12% respectively in Bartholomew Roberts Pty Limited (BRL). JBL, HML and BRL have voting power of approximately 7.43%, 19.87% and 32.86% respectively in JB Financial Group Pty Ltd (JBFG). JBFG has a number of subsidiaries including JB Trading House Pty Ltd (JB Trading).

- JBL is the manager for BHD, HML and BRL under investment management agreements. Mr Stuart McAuliffe is the Managing Director of JBL, HML, BHD and BRL and the Group Chief Executive Officer of JBFG. Mr John McAuliffe is the Chairman and non-executive director of JBL and BRL and the Chairman of HML. Mr Peter Aardoom is a director of BHD and JBFG. Mr Ross Patane is a director of JBL, HML and BRL. JBL, HML and BHD have the same two company secretaries.

- Mr Stuart McAuliffe also has voting power of 22.58% in JBL and has an outstanding $1 million loan to JBL (as a part of a $2.5 million loan facility).

- On 4 January 2018, JBL announced that it had made an offer to all shareholders in JBFG to acquire their shares for shares and options in JBL, subject to conditions. Offers are still open but not all conditions have been fulfilled.

- On 3 August 2018, 536,585 JBL shares held by BHD were bought back by JBL for approximately $1.1 million ($2.05 per share). Also on 3 August 2018, 1,398,573 JBL shares held by HML were bought back by JBL for approximately $2.8 million ($2.05 per share).

- On 8 August 2018, BHD and HML each made unsecured loans to JBL for a term of one year at 11.5% interest for $1,134,000 and $2,411,000 respectively.

- On 5 September 2018, the boards of BHD and HML each considered confidential non-binding letters of intent from JBL for the proposed acquisition of all of the issued share capital in BHD and HML respectively. BHD and HML’s boards each appointed a sub-committee to consider JBL’s bid.

- On 9 September 2018, BHD’s board sub-committee approved entering into a bid implementation agreement with JBL. On 10 September 2018, HML’s board sub-committee approved entering into a bid implementation agreement with JBL.

- On 10 September 2018, JBL announced its intention to make scrip off-market takeover bids to acquire:

- all of the issued shares and options in BHD that it did not currently own and

- all the issued shares of HML that it did not currently own,

attaching signed bid implementation agreements. The announcement stated:

“If appropriate, following their consideration of HML’s due diligence in relation to the HML Offer and their assessment of the independent expert report to be commissioned by them to consider the fairness and reasonableness of the offer, the HML independent directors have undertaken to recommend the HML Offer to HML shareholders in the absence of a superior proposal.”

“Following their due diligence in respect of the BHD Offer, and the advice of an independent expert engaged by them to consider the fairness and reasonableness of the BHD Offer, the independent directors have undertaken to recommend the BHD Offer to BHD shareholders in the absence of a superior proposal.”

The announcement also included a statement (towards the end) that BHD and HML shareholders should carefully consider the target’s statements before deciding whether to accept the bids.

- In the bid implementation agreements, each of BHD and HML represented that their respective voting directors1 would unanimously recommend the bids in the absence of a superior proposal and subject to consideration of due diligence, matters detailed in any independent expert’s report and the assessment of the bid by the expert. They also agreed to early dispatch of JBL’s bidder’s statements. The bid implementation agreements provided that parties would use best endeavours to comply with a timetable which included dispatch of BHD’s and HML’s target’s statements and independent expert’s reports at the same time as the bidder’s statements (which, as noted below, did not occur).

- JBL’s bids for BHD and HML were not inter-conditional. Each bid was initially subject to a waivable 50.1% minimum acceptance condition.

- On 17 September 2018, BHD’s board agreed to amend the terms of a $2.3 million convertible loan to JBFG, including extending the expiry date from 10 September 2018 to 11 March 2020.

- On 17 September 2018, BHD’s board agreed to convert a receivable it was owed by JBL into an unsecured loan of up to $4.5 million at an interest rate of 11.50% per annum repayable within 18 months.

- On 16 October 2018, the boards of BHD and HML extended the loans to JBL (referred to in paragraph 8) for six months.

- On 31 October 2018, JBL lodged bidder’s statements in relation to its bids for BHD and HML. The bidder’s statement for BHD stated on the first page:

“BHD’S VOTING DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU ACCEPT THIS OFFER IN THE ABSENCE OF A SUPERIOR PROPOSAL”

The bidder’s statement for HML stated on the first page:

“HML’S VOTING DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU ACCEPT THIS OFFER IN THE ABSENCE OF A SUPERIOR PROPOSAL”

- The statements referred to in paragraph 17 were repeated throughout JBL’s bidder’s statements for BHD and HML. Prior to lodgement,2 BHD and HML had asked JBL to amend these statements to reflect the conditionality of the recommendation. JBL did not make the requested amendments.

- On 9 November 2018, JBL announced that it had completed dispatch of its bidder’s statements for both BHD and HML. At the time of dispatch, JBL had voting power of 0.19% in BHD and 11.07% in HML respectively. On the same day JBL also released an announcement “clarifying” (but not retracting) the statements referred to in paragraph 17 stating “these statements must be read in the context of JBL’s announcement of 10 September 2018 and other information provided in the Bidder’s Statements despatched by JBL”.

- On 22 November 2018, JBL:

- following discussions with ASIC, lodged supplementary bidder’s statements in relation to its bids for BHD and HML. These supplementary bidder’s statements, among other things, retracted the statements referred to in paragraph 17 and

- extended the offer period for its bids for BHD and HML to 14 January 2019.3 The extensions of the offer period for JBL's bids for BHD and HML triggered a right of withdrawal for BHD and HML shareholders who had accepted the bid before the date of the supplementary bidder’s statement under ss650D(1)(a)(ii) and 650E of the Corporations Act 2001 (Cth) (Act).

- As at 22 November 2018, JBL had voting power in BHD and HML of 40.69% and 57.02% respectively.

- On 26 November 2018, the same day that BHD and HML were required to lodge and dispatch their respective target’s statements, the Panel affirmed earlier decisions of ASIC to refuse relief to BHD and HML to either (a) extend time for the dispatch of their target’s statements or (b) permit them to lodge incomplete target’s statements.4

- On 27 November 2018, the voting directors of BHD and HML, in separate announcements, recommended to their shareholders for the first time that they take no action in relation to the JBL bids prior to the release of their respective target’s statements.

- On 6 December 2018, BHD and HML lodged their respective target’s statements. Each target’s statement:

- contained an independent expert’s report concluding that the relevant bid is not fair but reasonable and

- included a statement that the voting directors recommend that shareholders accept the bid in the absence of a superior proposal.

- The independent expert stated in its report on JBL’s bid for HML, as a factor in determining that the bid is reasonable, that:

“JBL has a relevant interest in HML in excess of 50% (subject to any withdrawals of acceptances) which may allow JBL to determine future investment decisions of HML in addition to control of the management rights of HML. JBL’s existing interest in HML is also likely to preclude any other takeover offers for HML or other corporate activity from a third party”

- On 24 December 2018, JBL announced that it had obtained shareholder approval for its bids for BHD and HML to proceed and declared both bids free of conditions.

- JBL’s bidder’s statement in relation to its bid for HML (as supplemented) does not adequately disclose:

- the various relationships, and transactions, between JBL, BHD, HML, BRL, JBFG, JB Trading and their associates, noting that as the investment manager for BHD, HML and BRL, JBL had all the material information on this issue

- the risk that HML shareholders will receive materially less value if JBL only obtains voting power of 50% or less in either or both BHD and HML

- the financial position of JBL and JBFG, including that audit opinions in both their most recent accounts refer to material uncertainty regarding going concern and

- the financial effect of the transactions referred to in paragraphs 8, 14 and 15 and how they may impact on HML shareholders’ decision whether to accept the JBL bid.

- JBL’s supplementary bidder’s statement in relation to its bid for HML did not adequately deal with ASIC’s disclosure issues in a way that was accessible to HML shareholders. HML shareholders who had accepted the bid prior to the issue of JBL’s supplementary bidder’s statement were not adequately protected by the disclosure in the supplementary bidder’s statement and the ability to withdraw their acceptances.

- The above disclosure issues have not been adequately remedied by the issue of HML’s target’s statement and independent expert’s report.

- The following in combination (among other things) indicate that HML shareholders were denied sufficient time and information to assess the merits of JBL's bid and did not have the benefit of appropriate and sufficiently timely advice in relation to JBL’s bid:

- HML agreeing in advance and without qualification, in the bid implementation agreement, to early dispatch of the bidder’s statement

- HML and JBL not ensuring that the target’s statement and independent expert’s report were dispatched at the same time as the bidder’s statement, as envisaged in the bid implementation agreement timetable that each party agreed to use its best endeavours to comply with

- JBL and HML’s directors’ failure to promptly alert HML shareholders of their concerns regarding JBL’s bidder’s statement including the fact that statements in the bidder’s statement misrepresented the conditionality of the voting directors’ recommendation (referred to in paragraphs 17 and 18)

- HML dispatching its target’s statement and independent expert’s report late, in contravention of items 11 and 12 of s631(1) of the Act

- HML’s directors’ failure to clearly advise its shareholders prior to 27 November 2018 to take no action in relation to the JBL bid before considering the target's statement and independent expert’s report and

- the almost identical responses of both BHD and HML to JBL’s bids.

Effect

- It appears to the Panel that:

- the acquisition of control over voting shares in HML has not taken place in an efficient, competitive and informed market and

- the holders of shares in HML have not been given enough information to enable them to assess the merits of JBL’s bid.

Conclusion

- It appears to the Panel that the circumstances are unacceptable circumstances:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of HML or

- the acquisition, or proposed acquisition, by a person of a substantial interest in HML

- in the alternative, in relation to the effect the circumstances have had, are having, will have or are likely to have in relation to HML, having regard to the purposes of Chapter 6 set out in section 602 of the Act and

- in the further alternative, because they constituted, constitute, will constitute or are likely to constitute a contravention of a provision of Chapter 6 of the Act.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

Declaration

The Panel declares that the circumstances constitute unacceptable circumstances in relation to the affairs of HML.

Bruce Dyer

Counsel

with authority of James Dickson

President of the sitting Panel

Dated 25 January 2019

1 In the case of BHD – Messrs Aardoom and Cook. In the case of HML – Mr Ziegler and Ms Gunner

2 On 22 October 2018

3 The offer period has since been extended to 11 February 2019

4 See Benjamin Hornigold Limited and Henry Morgan Limited [2018] ATP 23

Annexure C

Corporations Act

Section 657D

Orders

Benjamin Hornigold Limited 02

The Panel made a declaration of unacceptable circumstances in relation to the affairs of BHD on 25 January 2019 (Declaration).

The Panel Orders

- JBL, and all officers, agents or persons acting on its behalf, must not take any further steps to process any acceptances received under JBL’s bid until after the operation of Order 2.

- At the end of 5 days after the Commencement Date, all acceptances of JBL’s bid at that time are cancelled.

- After the operation of Order 2, any acceptance of JBL’s bid received before dispatch of the Further Disclosure (or on an acceptance form attached to the Bidder’s Statement whether received before or after dispatch of the Further Disclosure) is cancelled at the time it is received by JBL.

- JBL must within 5 days of the Commencement Date dispatch a supplementary bidder’s statement, in a form acceptable to ASIC, to all BHD shareholders explaining the effect of the Panel’s declaration and orders, including that any acceptances of JBL’s bid received before dispatch of the Further Disclosure are cancelled.

- BHD must within 5 days of the Commencement Date dispatch a supplementary target’s statement, in a form acceptable to ASIC, to all BHD shareholders explaining the effect of the Panel’s declaration and orders and stating that BHD shareholders should wait until they receive the Supplementary Target’s Statement and Supplementary Expert’s Report before deciding whether to accept JBL’s bid.

- Within 20 days after the Commencement Date, JBL must repay to BHD the JBL Loan (with any interest).

- Within 30 days after the Commencement Date, JBL must dispatch either of the following to BHD shareholders:

- a Replacement Bidder’s Statement complying with Order 9 (in a form acceptable to ASIC) or

- a supplementary bidder’s statement (in a form acceptable to ASIC) stating that its takeover offer for BHD is closed or has been cancelled in accordance with these orders.

- If JBL does not comply with Order 6 or dispatch the Replacement Bidder’s Statement in accordance with Order 7, and JBL’s bid remains open for acceptance, offers under JBL’s bid are cancelled and accordingly Orders 9 to 12 cease to apply.

- The Replacement Bidder’s Statement must comply with s636 of Corporations Act 2001 (Cth) and applicable ASIC regulatory guides and include the following:

- a prominent statement on the front cover that BHD shareholders should wait until they receive the Supplementary Target’s Statement and accompanying Supplementary Expert’s Report before deciding whether to accept the bid

- a description of the various relationships, and transactions, between JBL, BHD, HML, BRL, JBFG, JB Trading and their associates

- the risk that BHD shareholders will receive materially less value if JBL only obtains voting power of 50% or less in either or both BHD and HML

- most recent financial statements of JBL and BHD noting the effect of the repayment of the JBL Loan

- a prominent statement noting that the most recent audit opinions of JBL and JBFG refer to material uncertainty regarding going concern

- details of the financial effect of the transactions referred to in paragraphs 10, 16 and 18 of the Declaration and the repayment of the JBL Loan and how each may impact on BHD shareholders’ decision whether to accept the JBL bid and

- acceptance forms that are identifiably different from the acceptance forms in the Bidder’s Statement.

- JBL may reintroduce any conditions originally in the Bidder’s Statement in the Replacement Bidder’s Statement. If JBL does so in relation to a condition, its notice under s650F dated 24 December 2018 has no effect as it is stated to apply to that condition.

- Before the Replacement Bidder’s Statement is dispatched to BHD shareholders, JBL and BHD must provide to the independent expert all financial information in their possession in relation to JBL, BHD, HML, BRL, JBFG and JB Trading, including but not limited to the effect of repayment of the JBL Loan on the financial position of JBL and BHD.