[2020] ATP 19

Catchwords:

Decline to conduct proceedings – association – takeover bid – defensive act – board control – unsolicited offers to purchase financial products off-market

Corporations Act 2001 (Cth), Division 5A of Part 7.9 and sections 602, 657A(3), 657C(3), 671B, 1019D(1)

ASX Listing Rule 10.1

Aurora Funds Management Limited v Australian Government Takeovers Panel (Judicial Review) [2020] FCA 496, Brierley Investments Ltd v Australian Securities Commission (1997) 24 ACSR 629

Ford, Austin & Ramsay's Principles of Corporations Law (Lexis Advance online)

Guidance Note 12: Frustrating Action

Keybridge Capital Limited 08R, 09R and 10R [2020] ATP 9, Keybridge Capital Limited 04, 05 & 06 [2020] ATP 6, Keybridge Capital Limited 02 [2019] ATP 19, Aurora Absolute Return Fund [2019] ATP 14, Tribune Resources Limited [2018] ATP 18, Auris Minerals Limited [2018] ATP 7, Molopo Energy Limited 03R 04R and 05R [2017] ATP 12, Jervois Mining Limited [2016] ATP 16, Brisbane Markets Limited [2016] ATP 3, Resource Generation Limited [2015] ATP 12, Dragon Mining Limited [2014] ATP 5, Brockman Resources Limited [2011] ATP 3, Mt Gibson Limited [2008] ATP 4, Dromana Estate Limited 01R [2006] ATP 8, Village Roadshow Limited 02 [2004] ATP 12, Winepros Limited [2002] ATP 18

Procedural Rule 3.1.1(c)

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Bruce Cowley, Richard Hunt (sitting President) and Tracey Horton declined to conduct proceedings on an application by WAM Active Limited in relation to the affairs of Keybridge Capital Limited. WAM Active submitted that Keybridge and Aurora Funds Management Limited had an understanding or were acting in concert in relation to Keybridge to concentrate ownership of ordinary shares in Keybridge in entities associated with Keybridge board members and Aurora for the purpose of stymieing WAM Active’s bid for Keybridge, with the shared goal of ensuring that WAM Active was not able to obtain sufficient voting shares to remove the current Keybridge board. The Panel considered that there was not sufficient material to justify making further enquiries as to whether Keybridge and Aurora were associated and there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- ADIT

- Aurora Dividend Income Trust

- AIB

- Aurora Global Income Trust

- ASG

- Australian Style Group Pty Ltd

- ASH

- Australian Style Group Holdings Pty Ltd

- Aurora

- Aurora Funds Management Limited

- Catalano Entities

- Catalano Super Investments Pty Limited ATF Catalano Superannuation Fund and Antstef Pty Limited ATF Antstef Trust

- CRPN

- Has the meaning given in paragraph 8

- Keybridge or KBC

- Keybridge Capital Limited

- Processed Holders

- Former holders of Keybridge shares who had accepted a bid from WAM Active that were given reversal rights under the Panel’s orders in Keybridge Capital Limited 04, 05 & 061

- RNY

- RNY Property Trust

- WAM Active

- WAM Active Limited

Facts

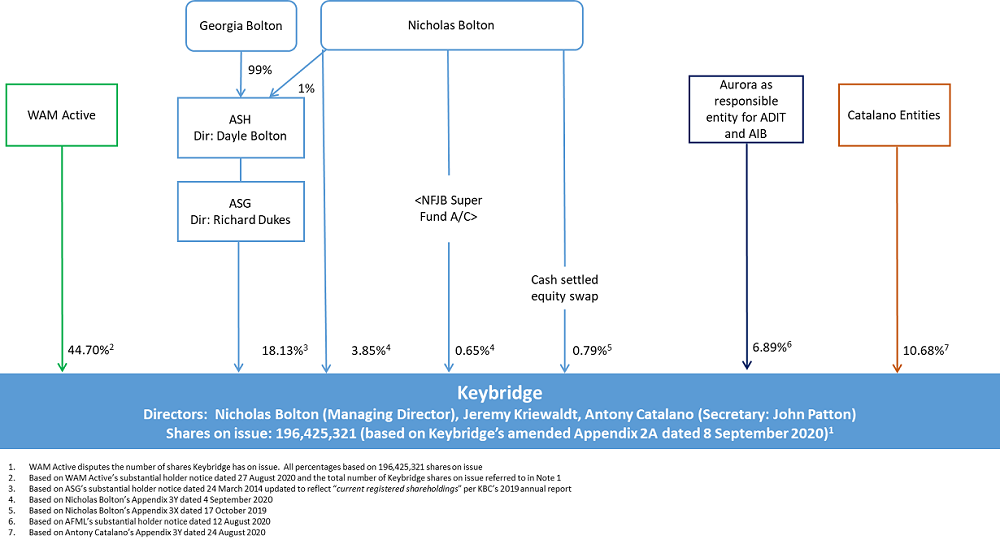

- Keybridge is an ASX listed company (ASX code: KBC). A diagram setting out the officers and major shareholders of Keybridge is below.

- On 28 April 2020, WAM Active announced an unconditional takeover bid for Keybridge.

- On 1 June 2020, Keybridge announced an offer by the Catalano Entities to acquire Keybridge shares from Processed Holders2 at 7.0 cents per share.

- On 29 June 2020, Keybridge announced an intention to undertake a scrip takeover bid for RNY (ASX: RNY), conditional on Keybridge obtaining all necessary approvals. Aurora had voting power in 80.96% of RNY’s units and held an economic interest in a further 3.0% of RNY. Aurora is the responsible entity for a variety of substantial unitholders in RNY.

- On 10 July 2020, the offer by the Catalano Entities was increased to 7.1 cents per share.

- On 4 August 2020, Keybridge announced, among other things, that Keybridge convertible redeemable promissory note (CRPN) elections had been accepted and that 513,800 CPRNs had converted to 7,457,165 Keybridge shares (with accrued interest paid in cash), 169,022 CRPNs had elected to have their maturity date extended to 31 July 2021 and 4,861,932 CRPNs had been redeemed for cash.

- On 12 August 2020, Keybridge announced a response to various queries from ASX in relation to its bid for RNY, including regarding ASX Listing Rule approvals. Attached to that response was a letter from Aurora, stating that:

“Aurora advises that it has not yet made a decision whether to accept the Keybridge offer. In the event it does, Aurora reaffirms its earlier comment that it will not do anything that causes third parties, including Keybridge, to be in contravention of applicable laws or regulations. In the event Listing Rule 10.1 is an issue, Aurora confirms that it will abide by the limitations that flow from that, namely it would not accept into the offer more than 41,450,000 RNY units. Accordingly, Listing Rule 10.1 would not be triggered by Aurora’s acceptance into the Keybridge offer.”

- On 13 August 2020, Aurora filed a substantial holder notice advising that Aurora (as the responsible entity of ADIT and AIB) and Aurora Corporate Pty Limited had a relevant interest in 13,541,437 Keybridge shares, of which 5,355,268 were issued on conversion of 368,978 CRPNs.

- On 14 August 2020, Keybridge issued a bidder’s statement for its bid for RNY on an unconditional basis. On 31 August 2020, Keybridge announced that it had sent its bidder’s statement and offers dated 28 August 2020 to RNY unitholders.

- On 15 September 2020, WAM Active’s bid for Keybridge closed.

Application

Interim orders

- On 31 August 2020, WAM Active sought urgent interim orders “prohibiting Keybridge from processing any acceptances in the RNY bid” and gave an undertaking that it would make an application. WAM Active submitted, among other things, that:

- it was “aware that individuals associated with KBC, particularly Mr Bolton, contacted CRPN holders and invited them to sell their notes in breach of Division 5A of Part 7.9 of the Corporations Act”

- “the RNY bid is not a legitimate bid; rather it is a mechanism to procure the issue [of] new KBC shares to an associated entity in order to further dilute WAM Active’s holding, preventing control of voting shares in KBC taking place in an efficient, competitive and informed market, at the cost of KBC’s shareholders” and

- “KBC’s register is very tightly held. Even very small changes in relevant interests can have material control implications… Further, given KBC is the subject of a live takeover bid by WAM Active, these defensive acts are such that the control over the voting shares in KBC is not taking place in an efficient, competitive and informed market in contravention of the principles in Section 602(a), (b) and (c) of the Corporations Act”.

- The substantive President considered WAM Active’s request for interim orders, after seeking submissions from interested parties. Keybridge submitted, among other things, that:

- WAM Active’s application for interim orders was not timely, noting that Keybridge announced its takeover bid for RNY on 29 June 2020 and the “ASX disclosed the Aurora “Truth in Takeovers” statement when it released the Keybridge response to its Query Letter on 12 August 2020”

- in effect, any unacceptable circumstances could be remedied by final orders

- it had not breached Division 5A of Part 7.93 and in any event “WAM Active has not established a basis on which Division 5A of Part 7.9 is relevant for the purposes of Chapter 6”

- “WAM Active appears to be complaining that the bid is uncommercial for RNY unitholders. This is a matter for those unitholders to assess having regard to the Bidder’s Statement and the forthcoming RNY Target’s Statement” and

- “WAM Active’s offer for Keybridge is unconditional. Hence, the act of Keybridge making its own takeover offer does not cause WAM Active’s offer to be withdrawn or lapse or to be not proceeded with as described in Guidance Note 12. WAM Active has accepted the possibility that Keybridge could make a takeover bid for RNY Property Trust, and cannot complain that it has been frustrated. Accordingly, there is no basis for a declaration of unacceptable circumstances.”

- The substantive President decided not to make any interim orders. He considered that:

- the application was not timely as Keybridge’s takeover bid for RNY was announced on 29 June 2020 and Aurora’s ‘truth in takeovers’ statement was publicly released on 12 August 2020

- insufficient material was provided to support the allegations in the application, in particular there was no material provided to support WAM Active’s submission regarding the acquisition of CRPNs

- it would be unusual and arguably uncommercial for a major shareholder such as Aurora to accept Keybridge’s bid so early in the bid period and

- once an application for a declaration of unacceptable circumstances is made, the Panel when convened likely can (if appropriate) make orders that remedy any unacceptable circumstances (if found).

Declaration sought

- By application dated 11 September 2020, WAM Active sought a declaration of unacceptable circumstances. WAM Active submitted that Keybridge and Aurora had an understanding or were acting in concert in relation to Keybridge to concentrate ownership of Keybridge’s ordinary shares in entities associated with Keybridge’s board members (including Aurora) to stymie WAM Active’s bid by (among other things):

- diluting WAM Active’s shareholding through the issue of Keybridge shares to Aurora as a result of conversion of CRPNs, “apparently acquired in breach of Division 5A of Part 7.9” and

- Keybridge undertaking an uncommercial scrip bid for RNY.

- WAM Active also submitted that Keybridge and Aurora ultimately had “the shared goal of ensuring that WAM Active and its associates are unable to obtain sufficient voting shares to remove the current Keybridge board”.

- WAM Active submitted that the effect of the circumstances (among other things) was that control of Keybridge had been purchased “without shareholders (sic) knowledge contrary to the policy of section 602”, in particular:

“The actions of Mr Bolton and Mr Patton, combined with the material financial interests each has in Keybridge and Aurora, and the influence that they exerted over Aurora and KBC, gives rise to a control effect in KBC that is otherwise unacceptable by causing the control of KBC to be concentrated in the entities associated with the KBC board members and Aurora, to the detriment of shareholders”.4

Final orders sought

- WAM Active did not seek interim orders as part of its application.

- WAM Active sought final orders to the effect that all the shares acquired by Aurora in the period since 31 July 2020 be vested in ASIC for sale and corrective disclosure, “as to [Keybridge’s] issued capital, the voting power of its directors and their associates and [Keybridge] to issue a supplementary target statement in relation to the WAM Active bid”.

Discussion

- We have considered all the material, but address specifically only that part of the material we consider necessary to explain our reasoning. References to submissions from WAM Active are to submissions in its application. References to submissions from Keybridge and Aurora (unless otherwise stated) are respectively to their preliminary submissions.

Association

- In Dragon Mining Limited, the Panel stated that:

“It is a well-established principle of the Panel that before it will conduct proceedings on the issue of association, there must be a sufficient body of material demonstrated by the applicant, which together with inferences (for example from partial evidence, patterns of behaviour and a lack of a commercially viable explanation) support the Panel conducting proceedings.” 5

- In the circumstances of that case the Panel was conscious that some people may read its decision as raising the ‘association hurdle’ and stated that:

“Dromana Estate Limited 01R acknowledges the difficulties that an applicant faces in gathering evidence in association matters. In deciding whether to conduct proceedings on an association case, this must be kept in mind. However, the Panel has limited investigatory powers which means, before we decide to conduct proceedings, an applicant must do more than make allegations of association and rely on us to substantiate them. An applicant must persuade us by the evidence it adduces that we should conduct proceedings.”6

- The Panel has now considered numerous applications relating to Keybridge, Aurora, WAM Active and other entities that these companies have invested in. A number of these matters alleged that many of the Keybridge shareholders referred to in the diagram in paragraph 3 are associated with each other or other parties.

- In Molopo Energy Limited 03R, 04R and 05R7, the review Panel found that by no later than 26 October 2016, Keybridge and Aurora (i) had, or proposed to enter into, a relevant agreement for the purpose of controlling the composition of the board of Molopo Energy Limited or the conduct of Molopo’s affairs and (ii) were acting, or proposed to act, in concert in relation to the affairs of Molopo. The review Panel also considered that Mr Bolton “has at least substantial influence over the relevant affairs of ASG”.8

- In Keybridge Capital Limited 029, the applicants (who were at the time shareholders and directors of Keybridge) submitted (among other things) that Mr Bolton had “a relevant interest in the Keybridge shares held by ASG under s608(3)(b), and/or Mr Bolton and ASG are associates, referring to previous findings of the Panel as to the relationship between Mr Bolton and ASG”.10 While the Panel considered that it would be concerning if it were established that the finding of the Panel in previous matters as to the relationship between Mr Bolton and ASG reflected their current relationship11, it was not satisfied that even if the matters raised in the application were established it would be in the public interest to make a declaration and declined to conduct proceedings.12

- In Keybridge Capital Limited 04, 05 & 0613, WAM Active alleged a number of associations, including between:

- Mr Catalano and Mr Bolton and Aurora

- Mr Catalano, Keybridge and Aurora (and their respective associates)

- Mr Bolton and Aurora, ADIT and the entities funding ADIT’s bid for Keybridge and

- Mr Bolton and ASG.14

- In Keybridge Capital Limited 04, 05 & 06, the Panel did not consider that findings of association were available to it15 and noted as a factor that weighed against accepting WAM Active’s submissions that:

“…in relation to ASG, Mr Bolton submitted that “an independent director with no personal or professional relationship with me” is the sole director of ASG and that director “makes all decisions on behalf of the company for all matters, including in relation to Keybridge””.16

- The Panel in Keybridge Capital Limited 04, 05 & 06 noted that the Panel’s observations in Auris Minerals Limited may be apt.17 Those observations were that, if there was an association between parties and it continued, it may become easier over time to demonstrate patterns of conduct or other material that demonstrated that parties were acting in concert. In such a case, shareholders or ASIC could apply to the Panel again.18

- WAM Active submitted that Keybridge and Aurora have an understanding or are acting in concert in relation to Keybridge. WAM Active submitted the purpose of the association was to concentrate ownership of ordinary shares in Keybridge in entities associated with Keybridge board members, including Aurora, “to stymie WAM Active’s bid”, “ultimately with the shared goal of ensuring that WAM Active and its associates are unable to obtain sufficient voting shares to remove the current Keybridge board”.

- While WAM Active submitted there was an association between Keybridge and Aurora, it provided a considerable amount of historical material suggesting other associations, including between Mr Bolton, ASG and ASH. We consider that WAM Active’s application did not adequately explain the relevance of this material to its alleged association between Keybridge and Aurora. Further, a proportion of the material provided by WAM Active related to the conclusions of the review Panel in Molopo Energy Limited 03R, 04R and 05R relating to Keybridge and Aurora (as well as the findings of the Panel relating to Mr Bolton and ASG), without noting that there has been a number changes to the board of Keybridge and Aurora and a change of directors of ASG and ASH since that decision.19 We also agree with the statement made by the Panel in Keybridge Capital Limited 04, 05 & 06 quoted in paragraph 28.

- While prior collaborative conduct may be a relevant consideration, WAM Active neither explained how Mr Bolton and Mr Patton ‘exerted influence’ over Keybridge and Aurora nor provided any material to support such an inference.20

- We now turn to the more recent material that WAM Active submitted supports an inference that Keybridge and Aurora are associated.

Allegations of contraventions of Division 5A of Part 7.9

- WAM Active submitted that its shareholding in Keybridge was diluted through the issue of new shares to Aurora as a result of the conversion of CRPNs, “apparently acquired in breach of Division 5A of Part 7.9”. The purpose behind Division 5A of Part 7.9 is to protect holders of financial products from being misled into selling their interests at less than market value.21

- As noted in paragraph 15(b), the substantive President noted in considering WAM Active’s request for interim orders that he was provided with no material to support WAM Active’s submission regarding the acquisition of Keybridge CRPNs. In its application for unacceptable circumstances, WAM Active provided three examples which it either explicitly or impliedly submitted were a contravention of Division 5A of Part 7.9. However as discussed further below, WAM Active did not identify a particular section that had allegedly been contravened, nor did the application explicitly engage with the elements of any such section.

- Firstly, WAM Active submitted that individuals “associated with KBC (notably Mr Bolton) approached former holders of KBC shares encouraging them to exercise [the] reversal right ordered by the Panel in order to sell to another party for 7.0 cents per share”. In support of this proposition, WAM Active produced an email from Mr Bolton to a former director of Keybridge stating that:

“I have been approached by a party who is interested in buying your KBC shares at 7.0c cash with immediate settlement.

Given you were prepared to accept into the failed Wilson bid at 6.9c, do you want me to show this premium offer in to you? As you know, the shares remain yours to sell.”

- WAM Active submitted that Mr Bolton’s actions, including sending this email, constituted a breach of Division 5A of Part 7.9. However we query the relevance of the email. It does not relate to the acquisition of CPRNs, it may have been a preliminary discussion leading to the Catalano offer that on its face complied with Division 5A of Part 7.9 and was sent to someone who may well have a business or personal relationship with Mr Bolton.22

- Secondly, WAM Active submitted that Mr Bolton “emailed different Processed Holders regarding the Catalano Offer, using his position at KBC to influence acceptances into that offer”. We also query the relevance of this submission. The Catalano offer on its face complied with Division 5A of Part 7.9 and was at a price higher than the WAM Active bid at the time. We consider it is not inappropriate for Mr Bolton to bring that to the attention of Processed Holders.

- Thirdly, WAM Active submitted that:

“In the period ending on 31 July 2020, individuals associated with KBC (notably Mr Bolton) approached a number CRPN holders (but not all), actively and repeatedly encouraging them to sell their CRPNs. Annexure B provides examples of the types of emails sent by Mr Bolton from his KBC email (suggesting that he was acting in his capacity as a KBC representative). WAM Active understands that CRPN holders were not treated on the same basis (not all holders received offers) and, amongst those that were contacted, different CRPN holders were offered different prices.”

- To support this submission, WAM Active produced an email chain disclosing a discussion between Mr Bolton and a representative of a holder of CPRNs. This included an email from Mr Bolton to the holder of CPRNs stating, among other things:

“As for your KBCPA. I note your preference to redeem for cash. I’m aware of a party wishing to buy CRPN for a 2% premium to par, which would be a $50,000 windfall for your fund over and above your redemption request. Commercially, it is obviously in your interests.”

“Are you able to have your board consider whether you would sell your notes for such a premium?”

- WAM Active did not explain how this email would attract the operation of Division 5A of Part 7.9. In our view, it is unlikely that it would apply. In particular it is conceivable that Mr Bolton had a business or personal relationship with that holder.23

- We consider that WAM Active has not provided any probative material to satisfy us that there has been a contravention of Division 5A of Part 7.9.

- We agree with Keybridge’s submission that “WAM Active has not established a basis on which Division 5A of Part 7.9 is relevant for the purposes of Chapter 6.” Further, irrespective of whether there is a breach, we do not consider the actions of Mr Bolton discussed above provide sufficient material for us to consider conducting proceedings on the question of association.

Keybridge's bid for RNY

- We consider that while Keybridge’s bid for RNY, in circumstances where Aurora has a large proportion of RNY units, is unusual, that is not in isolation a strong indicator of association.24

- WAM Active submitted that there was no commercial rationale for Keybridge undertaking the RNY bid, “but to procure the issue of new KBC Shares to an associate”, that is supported by (among other things) an alleged potential for the RNY bid, if successful, to be detrimental to KBC’s financial condition. WAM Active referred to an ASX query letter to Keybridge dated 5 August 2020, that (among other things) noted that RNY’s auditors stated in the RNY annual report for the financial year ended 31 December 2019 that:

“Based on the information available to us, we have not been able to obtain sufficient appropriate audit evidence to conclude on the appropriateness of the use of the going concern assumption to prepare the financial statements as the validity of the going concern assumption is dependent on the successful renegotiation of the Group’s loan facilities, the continued support from tenants and financial institutions, in the uncertain economic environment, as well as any United States Government stimulus measures to support the economy.”

- WAM Active also submitted that any acceptance by Aurora of the RNY bid “would clearly be inconsistent with Aurora merely following its own interests”, noting that “the implied value of the consideration offered by KBC in the RNY bid is one quarter of the carrying fair value for RNY units determined by Aurora, any acceptance by Aurora will call into question Aurora’s decision to increase the carrying value for RNY from 1.4 cents to 4.4 cents in September 2019”.

- As noted below, Aurora has stated that it has not made any decision in relation to accepting Keybridge’s bid for RNY. In any event, if the bid was at such a low price, then surely it would be in the interests of Keybridge shareholders if Aurora were to accept the offer.

- WAM Active submitted that Aurora “offered to accept up to 41,450,000 RNY units into the bid”. WAM Active also submitted that Aurora offering to limit acceptances into the RNY bid had no commercial rationale and supported an inference that “Aurora’s board knew and agreed to, or at least acquiesced to, the strategies for Aurora’s investment in KBC, as influenced by Mr Bolton. Aurora’s board knew that those strategies would be aligned with Mr Bolton, the KBC board and their shared goal”.

- As noted in paragraph 9, Aurora’s letter was made on the basis that “it has not yet made a decision whether to accept the Keybridge offer”. We therefore do not agree with WAM Active’s characterisation of what was said in Aurora’s letter. Aurora submitted (among other things) that:

“Aurora has a relevant interest of 80.96% in RNY, so in providing its undertaking to Keybridge it enabled the remaining 19.04% of RNY unitholders to receive a takeover offer for their securities. Aurora notes that WAM Active does not appear to be concerned with acceptances from those parties, but rather only has concerns with any acceptances by Aurora.”

- We accept Aurora’s explanation.

- Finally, in support of an inference of association, WAM Active submitted that (footnotes omitted):

“KBC’s initial announcement regarding the RNY bid states that, due to Mr Bolton’s material economic interest in Aurora, Mr Bolton did not approve the bid. The announcement also alludes to KBC establishing procedures to ensure Mr Bolton “continues to recuse himself from the making of strategic decisions by Keybridge in relation to this bid”. KBC’s bidder’s statement makes no reference to an independent committee, procedures established by KBC or Mr Bolton recusing himself from any decisions. In fact KBC’s bidder’s statement includes recommendations from all KBC directors (including Mr Bolton). Mr Bolton also appears to have approved and released all announcements made by KBC in relation to RNY after the initial announcement (rather than the board as a whole).”

- We do not consider it is open to us to draw any inference on this basis, noting Keybridge’s submission that:

“Mr Bolton has recused himself from the approval process at Keybridge in relation to the RNY Property Trust bid, noting that he holds a material economic interest in Aurora. Keybridge continues to ensure that Mr Bolton recuses himself from the making of decisions by Keybridge in relation to the bid. These arrangements were prominently disclosed when the Keybridge bid was announced on 29 June 2020.”

Materiality

- Keybridge submitted that:

“From the substantial shareholder notice lodged by Aurora since 31 July 2020, (on 13 August 2020) it appears that Aurora has increased its substantial shareholding by 5,355,268 shares at a price of $368,978 being the cost of CRPNs. This increased Aurora's relevant interest to a total of 13,542,437 shares being a 6.91% relevant interest. The substantial shareholder notice indicates that (by way of calculation) this represents a 2.73% increase in Aurora's relevant interest. It is clear that this increase is of a minimal nature. It is clear that Aurora's relevant interest is well under the 20% threshold. It is clear that this increase does not represent unacceptable circumstances. It is clear that a divestment order in relation to this increase in interest is not appropriate.”…

“Keybridge notes that WAM Active appears to have a relevant interest in more than 40% of Keybridge shares. WAM Active is the largest relevant interest holder on the Keybridge register. It is difficult identifying a Panel precedent where a successful assertion of unacceptable circumstances is made against a party where it is not the largest relevant interest holder in a company by a more than 40% shareholder…”

- WAM Active submitted that the amount of voting power acquired by Aurora was sufficiently large to entrench the Keybridge board, noting that the Keybridge register was tightly held.

- A relatively small acquisition of shares can in context be an acquisition of a substantial interest as it may be “a step along the way to a change in control”.25 In this case however we were not satisfied that the acquisition by Aurora was material. We consider that WAM Active’s submission may be arguable if all of the parties referred to in the diagram in paragraph 3 (other than WAM Active) are associates in relation to the affairs of Keybridge. This is not supported by the material WAM Active has provided.

Other matters

- It is possible that WAM Active’s characterisation of what constituted unacceptable circumstances (see paragraph 16) could be read as suggesting that Keybridge and Aurora’s actions were a defensive act which were unacceptable pursuant to s602(c) and s657A(3).26 We consider it is unlikely that this could amount to unacceptable circumstances given WAM Active’s unconditional bid closed shortly after WAM Active made its application (noting the bid had been open for a reasonable period of time, had previously been extended, and had received a number of acceptances27).

- As discussed in note 1 to the diagram in paragraph 3, WAM Active disputes Keybridge’s calculation as to the number of shares Keybridge has on issue. WAM Active submitted that Mr Bolton and ASG had contravened s671B and that:

“At the very least, KBC’s failure to provide clear disclosure regarding its capital structure is preventing the acquisition of control of KBC from taking place in an efficient, competitive and informed market in contravention of the principles in Section 602(a), (b) and (c) of the Corporations Act.”

- Even if it could be established that Keybridge’s statement as to the number of its issued shares is wrong (and we are not satisfied WAM Active has provided sufficient material in that regard), we consider that any potential contraventions of the substantial holder provisions that may result are not likely to result in unacceptable circumstances.28

- Keybridge submitted that WAM Active’s application was out of time under s657(3)(a)29 and there was no basis for the Panel to extend this period. Aurora made a similar submission. WAM Active did not seek an extension of time in its application. If we had been minded to conduct proceedings, we would have sought submissions on this issue.

- Aurora submitted that WAM Active’s application was “far reaching and adopts a scatter gun approach”. We agree. The Panel expects applicants to present a clear case as to why circumstances are unacceptable and not put forward a number of unsubstantiated allegations in the hope that some ‘mud’ might stick. We are concerned that WAM Active’s application, which exceeded the 10 page limit required by the Procedural Rules30, was not clear as to what was alleged to be unacceptable. It also made what turned out to be unsubstantiated allegations of contraventions of Division 5A of Part 7.9.31

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any final orders.

Richard Hunt

President of the sitting Panel

Decision dated 23 September 2020

Reasons given to parties 8 October 2020

Reasons published 13 October 2020

| Party | Advisers |

|---|---|

| Keybridge | Baker McKenzie |

| WAM Active | Mont Lawyers |

| Aurora Funds Management Limited as responsible entity for each of Aurora Dividend Income Trust, Aurora Global Income Trust, Aurora Fortitude, Absolute Return Fund and Aurora Property Buy-Write Income Trust | - |

1 - [2020] ATP 6

2 - Involving Processed Holders exercising their reversal rights

3 - Unless otherwise indicated, all statutory references are to the Corporations Act 2001 (Cth), and all terms used in Chapter 6 or 6C have the meaning given in the relevant Chapter (as modified by ASIC)

4 - WAM Active submitted that, further and in the alternative, Aurora had acquired a substantial holding in Keybridge such that “the acquisition of control of KBC is not taking place in an efficient, competitive and informed market in contravention of the principles in Section 602(a), (b) and (c)”

5 - [2014] ATP 5 at [27], referring to Mt Gibson Iron Limited [2008] ATP 4 at [15]

6 - [2014] ATP 5 at [59] and [60] (footnotes omitted), referring to Dromana Estate Limited 01R [2006] ATP 8 at [25]

7 - [2017] ATP 12. A judicial review of this decision was dismissed, see Aurora Funds Management Limited v Australian Government Takeovers Panel (Judicial Review) [2020] FCA 496

8 - [2017] ATP 12 at [256]

9 - [2019] ATP 19

10 - [2019] ATP 19 at [9(d)]

11 - [2019] ATP 19 at [15(a)]

12 - [2019] ATP 19 at [16]

13 - [2020] ATP 6

14 - [2020] ATP 6 at [104]

15 - [2020] ATP 6 at [109]. The review Panel agreed with the initial Panel’s findings on the question of association – see Keybridge Capital Limited 08R, 09R and 10R [2020] ATP 9 at [90] to [93]

16 - [2020] ATP 6 at [107(d)]

17 - [2020] ATP 6 at [110]

18 - [2020] ATP 6 at [110] citing Auris Minerals Limited [2018] ATP 7 at [20]

19 - Accordingly, unlike the Panel in Dragon Mining Limited [2014] ATP 5 at [48], we do not consider that we can presume that the relationship between Keybridge and Aurora, and Mr Bolton and ASG, had not changed since Molopo Energy Limited 03R, 04R and 05R. However, similar to the Panel’s observation in Dragon Mining Limited, the allegation here is in relation to Keybridge not Molopo Energy Limited

20 - See Winepros Limited [2002] ATP 18 at [27]

21 - See Ford, Austin & Ramsay's Principles of Corporations Law (Lexis Advance online) at [22.195]

22 - See s1019D(1)(c)(ii)

23 - The holder was a party to the Keybridge Capital Limited 04, 05 & 06 proceedings and the recipient of the email was alleged to be an associate of, among others, Mr Bolton in the Keybridge Capital Limited 02 proceedings

24 - The Panel has previously considered that parties that are like-minded in relation to voting at a company meeting does not in isolation suggest association. See Aurora Absolute Return Fund [2019] ATP 14 at [100], Jervois Mining Limited [2016] ATP 16 at [28] and Resource Generation Limited [2015] ATP 12 at [97]

25 - Village Roadshow Limited 02 [2004] ATP 12 at [36], quoting Brierley Investments Ltd v Australian Securities Commission (1997) 24 ACSR 629 at 638-639

26 - The last paragraph of s657A(3) provides that “In having regard to the purpose set out in paragraph 602(c) in relation to an acquisition, or proposed acquisition, of a substantial interest in a company, body or scheme, the Panel must take into account the actions of the directors of the company or body or the responsible entity for a scheme (including actions that caused the acquisition or proposed acquisition not to proceed or contributed to it not proceeding).”

27 - See paragraph 12(a) of Guidance Note 12: Frustrating Action

28 - See Auris Minerals Limited [2018] ATP 7 at [23] and Tribune Resources Limited [2018] ATP 18 at [67] to [68]

29 - Noting that Keybridge announced its bid for RNY on 29 June 2020

30 - Procedural rule 3.1.1(c) requires an application not to exceed 10 A4 pages in 12 point for the details of the application. See also Brisbane Markets Limited [2016] ATP 3 at [20], quoting Brockman Resources Limited [2011] ATP 3 at [131], where the Panel in that case stated that “[i]t is usually the case that brevity serves parties better.”

31 - Noting that the substantive President referred to the lack of material on this point when he considered interim orders, see paragraph 15(b)