[2021] ATP 17

Catchwords:

Declaration – orders – scheme of arrangement – association – relevant interest – voting power – break fee – media canvassing

Corporations Act 2001 (Cth), sections 12, 16(1), 191, 231, 411(4)(a)(ii), 602, 606, item 9 s611, 657C(1), 657D, 671B

In the matter of PM Capital Asian Opportunities Fund Limited [2021] FCA 1380; Aurora Funds Management Limited v Australian Government Takeovers Panel [2020] FCA 496; Eastern Field Developments Limited v Takeovers Panel [2019] FCA 311; Sanpoint Pty Ltd v V8 Supercars Holdings Pty Ltd [2019] NSWCA 5; Australian Securities and Investments Commission v Westpac Banking Corporation (No 2) [2018] FCA 751; Tinkerbell Enterprises Pty Limited as Trustee for The Leanne Catelan Trust v Takeovers Panel [2012] FCA 1272; AAPT Limited v Cable & Wireless Optus Limited [1999] NSWSC 509; Meridian Global Funds Management Asia Ltd v Securities Commission [1995] 2 AC 500; Adsteam Building Industries Pty Ltd & Anor v The Queensland Cement and Lime Co Ltd & Ors (1984) 14 ACLR 456; Re Rossfield Group Operations Pty Ltd [1981] Qd R 372; Re Hampshire Land Company [1896] 2 Ch 743

Guidance Note 7: Lock-up devices; Guidance Note 19: Insider Participation in Control Transactions

Thorn Group Limited 01 & 02 [2020] ATP 29; Ainsworth Game Technology Limited 01 & 02 [2016] ATP 9; World Oil Resources Limited [2013] ATP 1; CMI Limited 01R [2011] ATP 5; CMI Limited [2011] ATP 4; Viento Group Limited [2011] ATP 1; Mount Gibson Iron Limited [2008] ATP 4; Orion Telecommunications Ltd [2006] ATP 23; AMP Shopping Centre Trust 02 [2003] ATP 24; Winepros Limited [2002] ATP 18

Ford, Austin & Ramsay's Principles of Corporations Law, paragraph [16.180]

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| YES | NO | YES | YES | YES | NO |

Introduction

- The Panel, Paula Dwyer (sitting President), Christian Johnston and Neil Pathak, made a declaration of unacceptable circumstances in relation to the affairs of PM Capital Asian Opportunities Fund Limited. The Application concerned the process by which two listed investment companies (with common boards and the same investment manager) agreed a scheme implementation deed for a merger, and a direction that sought to divide the voting power of the proposed acquirer (and the investment manager and other persons associated with the investment manager) above 20% in the target company into two distinct holdings of less than 20%. The Panel considered that governance protocols were not implemented soon enough and the direction was not effective to divide voting power and end the association between relevant entities. The Panel declared the circumstances unacceptable as they constituted or gave rise to contraventions of s6061 and s671B and were not consistent with an efficient, competitive and informed market. The Panel made orders preventing voting of shares acquired in excess of the 3% creep exception and, if the proposed merger does not become effective, vesting those shares in ASIC for sale.

Background

Factual

- In these reasons, the following definitions apply.

- Term

- Meaning

- Application

- The application by WAM in relation to the affairs of PAF dated 15 October 2021

- Break Fee

- The break fee in Clause 11 of the SID

- Direction

- The instruction given by PGF to PMC pursuant to Clause 5.17 of the PGF IMA on 14 September 2021 described in paragraph 19

- Excess Shares

- Has the meaning given in paragraph 104(d)(ii)

- Governance Protocols

- The PAF Governance Protocol and the PGF Governance Protocol

- IMA

- Investment Management Agreement

- IMA Extract

- The extract from the PGF IMA attached to the notice of change of interests of substantial holder given by PGF to PAF on 1 October 2021

- LIC

- Listed Investment Company

- Moore Group

- Paul Moore and all entities, other than PMC and PGF, named as substantial holders in the notice given to PAF by Paul Moore on 7 June 2021

- PAF

- PM Capital Asian Opportunities Fund Limited

- PAF Governance Protocol

- The governance protocol adopted by the PAF Board on 6 September 2021

- PGF

- PM Capital Global Opportunities Fund Limited

- PGF Governance Protocol

- The governance protocol adopted by the PGF Board on 6 September 2021

- PMC

- PM Capital Limited

- Proposed Transaction

- The proposed merger between PGF and PAF considered by the PGF Board on 6 September 2021 and announced on 15 September 2021

- Scheme

- The scheme of arrangement between PAF and PAF shareholders in the form attached to the SID, as amended or altered

- SID

- The Scheme Implementation Deed between PGF and PAF dated 15 September 2021

- WAM

- WAM Capital Limited

- WAM bid

- WAM's takeover bid for PAF made under its bidder's statement dated 14 October 2021

- PAF (ASX code: PAF) and PGF (ASX code: PGF) are both LICs listed on ASX. Each of PAF and PGF has a separate IMA with PMC providing for PMC to:

- manage the company’s portfolio and investments in accordance with the IMA’s terms, without the approval of the directors, and

- provide administrative support services reasonably required by the company to conduct its business.

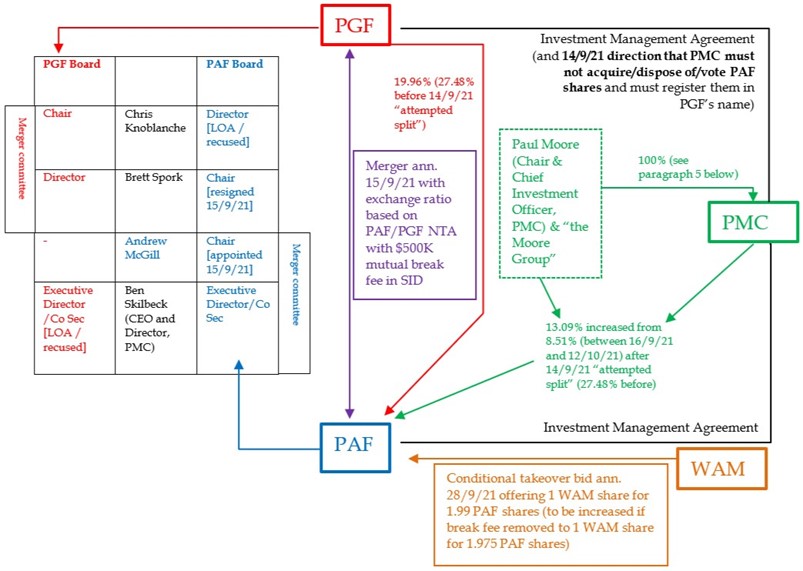

- A diagram of the relevant parties is below:

- All shares in PMC are held by an entity wholly owned by Paul Moore. Approximately 88% are held on trust for Paul Moore and his family and the remainder on trust for PMC employees.

- On 26 May 2014, after PAF was listed, the Moore Group, PMC and PGF gave an initial substantial shareholder notice to PAF disclosing voting power of 22.24% in PAF. The notice listed relevant interests in differing numbers of shares for some entities, but gave the same voting power for all, and did not name any associates. This was the case also in later substantial holding notices given by these entities to PAF up to and including the notice given on 7 June 2021 which disclosed voting power for the Moore Group, PMC and PGF of 27.48% in PAF.2

- On 10 December 2019, the PGF Board decided that a standing agenda item for consideration of potential acquisitions should be dropped, but that PGF’s executive director, Ben Skilbeck, should apprise the PGF Board of M&A opportunities as and when they were identified.

- In mid-2021, Ben Skilbeck (in his capacity as the executive director of PGF) considered various commercial aspects of a merger of PGF with PAF and provided discussion papers on this topic to PGF. Ben Skilbeck is also the executive director of PAF and Chief Executive Officer of PMC.

- On 26 August 2021, the PGF Board discussed legal advice and a Governance Protocol. The meeting was attended by all directors, Chris Knoblanche, Ben Skilbeck, and Brett Spork, who at that time also comprised the Board of PAF, and Richard Matthews (then Company Secretary of PGF and PAF and “Chief Operation Officer” [sic] of PMC3). The Board Minutes for the meeting contain a heading “Disclosure of Interests / Conflicts”, but no disclosures are recorded.4 The Minutes state:

- PGF should take the control of the voting of the PAF shares it holds if the transaction proceeds;

…

- B.Skilbeck confirmed that no one else is over the wall at [PMC]other than R.Matthews and himself. Only change at [PMC] is that R.Matthews has put both stocks into trading blackout (with no explanations being given).

- PGF should take the control of the voting of the PAF shares it holds if the transaction proceeds;

- On 6 September 2021, Ben Skilbeck provided a final discussion paper on the Proposed Transaction to a meeting of the PGF Board attended by Ben Skilbeck, Brett Spork, Chris Knoblanche (Chairman), and Richard Matthews (as Company Secretary). The Minutes indicate that the meeting commenced at 4.03pm and closed at 4.20pm, and record no disclosures under the heading “Disclosure of Interests / Conflicts”.5 The Minutes state:

- noted that the Governance Protocol had been initially drafted by JWS, and then a second opinion (review and confirmation) had been undertaken by Bakers.

…

It was RESOLVED unanimously that:

…

- The company adopt Governance Protocol – whilst noting the amendment that B.Skilbeck be appointed as a co-Company Secretary for PGF (and then go on immediate leave of absence);

- noted that the Governance Protocol had been initially drafted by JWS, and then a second opinion (review and confirmation) had been undertaken by Bakers.

- The PGF Governance Protocol states:

1 Overview

1.1 Background

The board of [PGF] is in the early stages of exploring the possibility of a potential merger of PGF and [PAF] by a scheme of arrangement …in which PGF will acquire all of the shares in PAF (Proposed Transaction).

PGF currently intends to provide a proposal to PAF concerning the Proposed Transaction. …

Due to the overlapping governance and management arrangements applying to PGF and PAF … the implementation of the Proposed Transaction has the potential to give rise to conflicts of interest for the directors of PGF and PAF as well as other difficulties.

In order to manage these potential conflicts and difficulties, the board of PGF …has adopted this Governance Protocol …

- The PGF Governance Protocol also noted, among other things, that as at the date of the protocol:

- Each of PGF and PAF had a “common board representation”, comprising Ben Skilbeck (Executive Director), Chris Knoblanche (Chairman of PGF and Chairman of the Audit Committee of PAF), and Brett Spork (Chairman of PAF and Chairman of the Audit Committee of PGF) and Richard Matthews was the Company Secretary of both PGF and PAF and the Alternate Director for Ben Skilbeck for each of PGF and PAF.

- PGF and PAF had no employees and they had separately entered into an IMA with PMC. PMC was responsible for the implementation of the investment strategy of each of PGF and PAF, and for the day-to-day administration of each company’s affairs. Also:

- the board of PMC was comprised of Paul Moore, Jarod Dawson and Ben Skilbeck;

- Paul Moore (through entities that he controlled) “currently controls 89% of the shares in [PMC]”6;

- Paul Moore was also the portfolio manager for PGF (appointed by PMC);

- PGF held approximately 19% of the shares in PAF;

- Paul Moore (through entities that he controlled) controlled approximately 8% of the shares in PAF;

- “PGF and Paul Moore jointly control approximately 27% of the shares in PAF as a consequence of the [IMA] (and which is the subject of a substantial shareholding joint disclosed interest)”; and

- Paul Moore (through entities that he controlled) controlled approximately 19% of the shares in PGF.

- The PGF Governance Protocol indicated that its purpose included ensuring that:

- the PGF Board is able to make all decisions concerning the Proposed Transaction independently of

- [PMC]

- Paul Moore; and

- PAF;

…

- to the extent practicable, the entities controlled by Paul Moore that hold shares in PAF are not associates of PGF in relation to PAF in the context of the Proposed Transaction.

- the PGF Board is able to make all decisions concerning the Proposed Transaction independently of

- In order to achieve that purpose the PGF Governance Protocol provided, among other things, for (subject to the relevant Board Committee making sensible adjustments as circumstances may require):

- Brett Spork and Chris Knoblanche to be the PGF Board Committee for the purposes of the Proposed Transaction, and

- Brett Spork to take leave of absence from the PAF Board on PGF providing a proposal to PAF, and resign on announcement of the Proposed Transaction provided PAF had appointed another director.

- Chris Knoblanche not to be involved as a director of PAF in decision making concerning the Proposed Transaction on PGF providing a proposal to PAF or as soon as reasonably practicable thereafter, and to take leave of absence from the PAF Board.

- Ben Skilbeck to:

- remain as Executive Director of PAF for the duration of the Proposed Transaction and, on PGF providing a proposal to PAF or as soon as reasonably practicable thereafter having regard to the need for PAF to put in place steps to adopt the proposal, not be involved as a director of PGF in decision making concerning the Proposed Transaction, and take leave of absence from the PGF Board;

- “continue in his executive PGF role without exercising director powers”;

- be appointed as an additional PAF Company Secretary on announcement of the Proposed Transaction or as soon as reasonably practicable thereafter.

- Andrew McGill to be appointed as a consultant to PAF and, subject to recommendations of the PAF nominations committee and resolution of the PAF Board, be “appointed a director of PAF shortly prior to entering into the Proposed Transaction”, and Andrew McGill and Ben Skilbeck to be the PAF Board Committee for the purposes of the Proposed Transaction.

- Richard Matthews to continue to act as PGF Company Secretary and, on announcement of the Proposed Transaction or as soon as reasonably practicable thereafter having regard to the need for PAF to put in place steps to adopt the proposal, not be involved as a PAF Company Secretary for the duration of the Proposed Transaction in matters concerning the Proposed Transaction.

- At the time of entry into a Scheme Implementation Agreement and the announcement of the Proposed Transaction, PGF to:

remove the PAF shares held in its portfolio from the [IMA] by giving notice to [PMC]. The effect of this will be that neither [PMC] nor Mr Moore will control the buy/sell or voting decisions relating to PGF’s shareholding in PAF. A change of substantial shareholding in relation to Mr Moore and PGF in relation to PAF.

- Brett Spork and Chris Knoblanche to be the PGF Board Committee for the purposes of the Proposed Transaction, and

- Also on 6 September 2021, PAF received a letter by email from Chris Knoblanche, as Chairman of PGF, to Brett Spork, PAF Chairman, proposing the Proposed Transaction and attaching governance protocols “likely to be appropriate should discussions advance” for both PGF (as above) and PAF for consideration, and stating that “PGF’s intent is that any scheme implementation agreement would contain customary and usual lock-up arrangements”. This proposal was considered at a PAF Board meeting attended by Ben Skilbeck, Brett Spork (Chairman), Chris Knoblanche, and Richard Matthews (as Company Secretary). The Minutes indicate that the meeting commenced at 5.07pm (47 minutes after the close of PGF’s Board meeting) and closed at 5.21pm, and record no disclosures under the heading “Disclosure of Interests / Conflicts”.7 The Minutes state, among other things, that:

B.Skilbeck provided an outline of the proposed transaction. He concluded that it would appear that a transaction could be in the interests of shareholders and deserves appropriate consideration.

…

Members considered that on face value, the proposal could be in the interests of the shareholders and of the Company, and as such the Company should enter into discussions with PGF.

After noting discussion, the Minutes state:

It was RESOLVED that:

- The Confidentiality Agreement with PGF be approved, and that Company officers be authorised to sign and return to PGF;

- Company officers be authorised to appoint Baker McKenzie as Counsel subject to Baker McKenzie not having conflict which would preclude them from acting for the Company;

- The Governance Protocol (as provided by PGF) be adopted, subject to counsel confirming its appropriateness;

- The Board considered that Mr McGill has the requisite skills, qualifications and character to be appointed as a consultant to, and/or director of, the Company;

- McGill be appointed as consultant, with intention to appoint him as a director should it become appropriate;

- Any director be authorised to formalise the appointment of Mr McGill as a director (as appropriate).

- Company officers be authorised to sign the consulting agreement with Mr McGill;

- Company officers be authorised to approach independent experts.

- Subject to B.Skilbeck consenting to the appointment, B.Skilbeck be appointed as co-Company Secretary.

- On 7 September 2021, Andrew McGill accepted appointment by PAF as a consultant to the Board. He was not appointed to the PAF Board until 15 September 2021 shortly before the SID was entered into.

- On 9 September 2021, PAF’s legal advisers sent a draft of the SID to PAF which included a break fee of $600,000.

- On 10 September 2021, after discussion with its legal advisers, PAF reduced the break fee in a draft of the SID from $600,000 to $500,000 and sent the updated SID to PGF. The SID was agreed after minor subsequent changes unrelated to the Break Fee.

- On 14 September 2021, PGF, in a letter signed by Richard Matthews as Company Secretary, instructed PMC pursuant to Clause 5.17 of the IMA:

- that it must not acquire or dispose of any securities held by PGF in PAF

- that it must not hold or exercise any rights of voting the shares on any resolutions put to a meeting of shareholders by PAF and

- to do all things necessary to facilitate moving PGF’s shares in PAF out of custody to be registered in the name of PGF (issuer sponsored) (Direction).

- On 15 September 2021, PGF gave a notice of change of interests of substantial holder to PAF stating its voting power as 19.96% and making no reference to PMC, the Moore Group, or the Direction PGF gave to PMC on 14 September 2021 (which was not attached). No associates or changes in association were disclosed.

- On 15 September 2021, PMC and the Moore Group gave a notice of change of interests of substantial holder to PAF stating its voting power had decreased from 27.48% to 8.51% and indicating in an Annexure that PGF’s relevant interest had changed and the nature of the change was “Revocation of control of shares”. No associates or changes in association were disclosed. The Direction PGF gave to PMC on 14 September 2021 was not otherwise mentioned or attached.

- Also on 15 September 2021, PGF and PAF entered into the SID to merge the entities and announced this to ASX.

- On 28 September 2021, WAM announced its intention to make the WAM bid, subject to a number of conditions, including a condition that the Proposed Transaction does not progress. The WAM bid offered 1 WAM share for every 1.99 PAF shares and WAM stated an intention to increase this to 1 WAM share for every 1.975 PAF shares if the Break Fee is removed.

- On 29 September 2021, PMC and the Moore Group gave a notice of change of interests of substantial holder to PAF stating its voting power had increased from 8.51% to 9.90%. No associates or changes in association were disclosed.

- On 1 October 2021, PGF gave a revised notice of change of interests of substantial holder to PAF which referred to and attached the Direction it had given to PMC on 14 September 2021. The Notice also attached the IMA Extract (which included Clause 5.17) and a summary of the PGF IMA taken from PGF’s prospectus. No associates or changes in association were disclosed. The IMA Extract did not include all provisions that may be relevant in determining whether the Direction was effective to achieve its intended purpose (as described in the PGF Governance Protocol).

- On 13 October 2021, PMC and the Moore Group gave a notice of change of interests of substantial holder to PAF stating its voting power had increased from 9.90% to 13.09%.

Declaration sought

- By Application dated 15 October 2021, WAM sought a declaration of unacceptable circumstances. WAM submitted that (among other things):

- PGF and PMC had failed to properly disclose the full PGF IMA, resulting in an absence of proper disclosure to explain the operation of the Direction, and consequently the WAM bid could not take place in an efficient, competitive and informed market

- the Direction did not remove either the relevant interest or the association between PGF and PMC and accordingly recent acquisitions by PGF and PMC of PAF shares represented a 6.19% increase in their combined voting power of 26.86% (disclosed in combined substantial holding notices given by PGF, PMC “and their associates”) held six months previously and constituted a breach of s606(1) and

- the Break Fee created an unreasonable and unequal opportunity for PGF to participate in benefits under the WAM bid as, due to the Break Fee, PGF would receive $1.201 per PAF share (compared to $1.157 per PAF share for other PAF shareholders) if the WAM bid succeeded. WAM submitted that this would deliver a 3.8% premium to PGF in circumstances where PGF had assumed minimal cost and effort, and no risk in proposing the Scheme, and it was unclear why PAF agreed to the Break Fee.

Interim orders sought

- WAM sought an interim order, which we made as discussed below,8 that PGF, PMC and their associates be prevented from acquiring any additional interests in PAF shares until further order of the Panel.

Final orders sought

- WAM sought final orders that:

- PAF and PGF amend the SID to remove the Break Fee

- PGF, PMC and their associates be prevented from acquiring any additional interests in PAF shares and

- All PAF shares acquired by PMC on or after 29 September 2021 be vested in ASIC.

Discussion

Decision to conduct proceedings and request provision of redacted IMA

- PGF submitted that we should decline to conduct proceedings, arguing that:

- PMC was not an associate of PGF since any relevant agreement was within s16(1)(a) and did not give rise to association.9

- Nothing in the IMA beyond the disclosures PGF had already made could possibly suggest that the Direction did not have the effect claimed by PGF. The IMA was a commercially confidential document that would only be of interest to competitors of PMC, such as WAM.

- The acquisitions referred to in the Application were made by the Moore Group, not PMC.

- The Break Fee was less than 1% and, given it was mutual, clearly had not been contrived as a means for PGF to obtain additional payments.

- PMC also submitted that we should decline to conduct proceedings, making similar points to paragraphs 30(a) and 30(c).

- PAF submitted that we should decline to conduct proceedings in relation to the Break Fee (noting that the other matters in the Application did not directly relate to PAF).

- In our view, the Application raised concerns that warranted consideration. Among other things, it was not clear to us from the material attached to PGF’s revised substantial holding notice dated 1 October 2021 how the effect of the Direction was to be reconciled with the summary of the PGF IMA in PGF’s prospectus. Furthermore, it appeared possible, if not likely, that the effect of the Direction would determine whether PAF shares acquired by the Moore Group after 28 September 202110 resulted in contraventions of s606(1). We decided to conduct proceedings.

- We requested PGF and PMC to provide an unredacted version of the PGF IMA to the Panel Executive (only) to review and advise parties and us whether the Executive considered any redacted material relevant and significant to the proceedings. That occurred and, after some correspondence with the Executive, PMC provided to us and all parties a redacted version of the PGF IMA that included (together with material previously disclosed) all material that the Executive members who reviewed the unredacted IMA considered likely to be relevant to the Application.

Interim orders sought

- It appeared to us that the Application raised a serious question as to whether the substantial holder notices of PGF and PMC/Mr Moore (who gave combined notices) complied with s671B and whether the market had sufficient information to determine the effect of the Direction. Accordingly, on 25 October 2021, after deciding to conduct proceedings,11 we invited submissions from parties and Mr Moore on interim orders we were minded to make to maintain the status quo while the Application was considered. The draft orders prevented PGF, PMC and Mr Moore acquiring shares, or increasing their voting power, in PAF without consent of any member of the sitting Panel.

- PGF and PMC submitted that we should not make interim orders. Mr Moore submitted among other things that:

- no submissions or evidence had been put before the Panel that Mr Moore is an associate of PGF or PMC (despite the Application appearing to suggest that) and

- the proposed orders did not preserve the status quo.

- We accepted that the interim orders would sufficiently maintain the status quo if directed only to PGF, PMC and their associates. On 29 October 2021 we made interim orders preventing PGF and PMCand their associates acquiring shares, or increasing their voting power, in PAF without the consent of a member of the sitting Panel.

Jurisdiction

- PGF submitted that we lack jurisdiction to consider the recent acquisitions of PAF shares because the Panel can only make a declaration and orders on an application12 and WAM’s Application made no mention of the acquisition of PAF shares by the Moore Group.

- The Application identifies as circumstances (among other things):

- substantial holder notices given by PMC and PGF on 15 September 2021 and by PGF on 1 October 2021, in which WAM submitted “defective disclosure” had “compromised the efficient, informed and competitive market in the shares of PAF”

- that “[l]odged on 29 September and 13 October 2021, [PMC’s] Substantial Holding Notices disclosed acquisitions”, which WAM submitted resulted in a breach of s606(1).

- In our view, paragraph 39(b) sufficiently identifies the acquisitions of PAF shares by members of the Moore Group to give us jurisdiction to make a declaration and orders concerning them, despite the Application assuming that the shares (or, at least, relevant interests in the shares)13 were acquired by PMC.

Association

Relevant law

- Section 12 sets out the tests for association as applied to Chapter 6, subject to exclusions in s16. There are two relevant tests here14 which provide, in essence, that B is an associate of A in relation to a body, such as a company, if (and only if):

- s12(2)(b) – B is a person with whom A has, or proposes to enter into, a relevant agreement for the purpose of controlling or influencing the composition of the company’s board or conduct of its affairs or

- s12(2)(c) – B is a person with whom A is acting, or proposing to act, in concert in relation to the company’s affairs.

- The “affairs” of a body corporate for the purposes of these tests include the matters listed in s53.15

- A relevant agreement is an agreement, arrangement or understanding:

- whether formal or informal or partly formal and partly informal and

- whether written or oral or partly written and partly oral and

- whether or not having legal or equitable force and whether or not based on legal or equitable rights.16

- Section 16(1) provides that a person is not an associate of another by virtue of s12 “merely because of one or more” specified matters, including:

- (a) one gives advice to the other, or acts on the other's behalf, in the proper performance of the functions attaching to a professional capacity or a business relationship;

…

- (a) one gives advice to the other, or acts on the other's behalf, in the proper performance of the functions attaching to a professional capacity or a business relationship;

- As stated by the Panel in CMI Limited 01R,17 the cases make it clear that there is significant overlap between the concepts of “acting in concert” and “relevant agreement” in s12.

- An understanding means an understanding – “plainly a word of wide import”18 – as to some common purpose or object in relation to the company in question.

- Often establishing an association requires the Panel “to draw inferences from patterns of behaviour, commercial logic and other evidence suggestive of association.”19

- Where a question arises regarding association involving a body corporate, it will be necessary to determine what natural person’s (or persons’) state of mind should be attributed to the body in applying the tests in s12(2)(b) or (c).20

- The Panel is a specialist, peer review tribunal. When making an assessment of all the material in this matter, we have relied on our skills and experience as practitioners (which has been made known to the parties) and as members of the sitting Panel.

- The Panel has procedural requirements to meet, which we consider have been met. We have legislated time constraints in which to make a decision.21

- In Mount Gibson Iron Limited22, the Panel said circumstances which are relevant to establishing an association include:

- a shared goal or purpose

- prior collaborative conduct

- structural links

- common investments and dealings

- common knowledge of relevant facts and

- actions which are uncommercial.

- Elements of some of these exist here and are discussed below.

Managers of Listed Investment Companies

- We do not think it necessary in this case to consider more generally when a manager will be an associate of an LIC for which it acts as manager. We assume that the exclusions in s16(1), and especially paragraph (a), may often apply. However, several factors take this case outside what, in our experience, would usually be the functions of a manager and directors of a LIC, and outside “the proper performance of [those] functions”. Those factors include, in respect of actions and decisions by PGF and PAF on 6 September 2021, before the Governance Protocols were implemented:

- The same manager, and the CEO and COO of the manager, were acting for LICs on both sides of a significant proposed transaction in which those LICs and their shareholders would inevitably have some competing interests.

- The same three individuals, including the CEO of the manager, comprised the boards of both LICs.

- The COO of the manager was company secretary of both LICs.

- Draft governance protocols before each board had expressly recognised that “implementation” of the Proposed Transaction “had the potential to give rise to conflicts of interest”. PGF properly recognised the need for Governance Protocols. However, there appeared to be no recognition of the potential for conflicts in the decision of PGF to put the proposal to PAF, and the decision of PAF as to how to respond. No governance protocols were put in place before those decisions were taken, and the board minutes record no notices given at the meeting under s191 (such as a notice that the nature and extent of a previously disclosed interest had materially increased23).

- In our view, the decision of a listed company to propose a control transaction to another, and the decision of the other company as to how to respond, are decisions where there is potential for conflict between the interests of each company, including as to:

- timing of the approach, given its potential to put the “target” into play

- the proposed process, terms of the proposal and relevant considerations in assessing the proposal and

- whether the target should engage, the manner in which it engages and if it engages, whether and when the approach should be disclosed.

- PGF submitted that “the mere signing of a [confidentiality agreement] and an agreement to engage has no great significance”. We agree that signing a confidentiality agreement may not be significant. But in our experience, a target company will usually give serious consideration to its options on receiving a proposal for a control transaction (including, for example, whether to request any change or improvement of the proposal before engaging, and whether, and if so what, lock-up arrangements may be desirable or appropriate). On one view, terms may be easier to agree in the case of a merger of LICs at an exchange ratio based on their respective net tangible assets (NTA). Even then, the target may wish to consider whether there could be other potential LIC merger partners that may be more attractive (e.g., because their investment strategy or register provide a better fit, their shares trade at a lower discount to NTA, or they are larger and offer better liquidity etc).

- We assume the individuals comprising the boards of PGF and PAF were satisfied that the decisions taken on 6 September 2021 were in the best interests of both companies. In our view, however, it is not consistent with s602(a) for PGF and PAF, being companies with common directors and the same manager and therefore with an acute risk of actual and/or perceived conflicts, to consider and make such significant decisions in the manner described above24 by the same individuals comprising each board. Rather, it should be clear to shareholders and the market that such decisions have been considered and made in the best interests of each company,25 not both together.

- We make no comment on the merits of the Proposed Transaction, which are a matter for PAF’s shareholders. Rather, our concerns relate to the inadequate disclosure of association and relationships, and the manner in which the Proposed Transaction has been proposed, negotiated and agreed by PGF and PAF.

Association through understandings pre-empting any Governance Protocols

- The Minutes of the PGF and PAF Board Meetings indicate that, within an hour of PGF sending its proposal to PAF, the PAF Board had (in a meeting lasting 14 minutes):

- accepted the Confidentiality Agreement and Governance Protocol (subject to counsel confirming its appropriateness) that PGF had prepared,

- approved the independent director PGF had proposed PAF should appoint (after having received a recommendation from PAF’s Nominations & Corporate Governance Committee for his appointment), and

- agreed to engage in discussions concerning a control transaction with PGF.

- We accept that such decisions can properly be made quickly where parties know each other well. The fact that, before the Governance Protocols were in place, the same three individuals comprised the boards of both PGF and PAF, provides the most extreme example – everything known to one was unavoidably known to the other.26 No doubt that is part of the explanation for the speed of PAF’s decision. However, it also demonstrates why the Governance Protocols needed to be implemented before significant decisions were taken. PAF’s decision to engage in discussions concerning a control transaction was not made by any directors independent of PGF. We infer that PAF’s Board Meeting was little more than a formality.

- Consistent with that inference is the indication in the Minutes of PGF’s Board Meeting that the Governance Protocol had been initially drafted by JWS (its legal advisers) and a second opinion (review and confirmation) had been undertaken by “Bakers” (which appears to refer to PAF’s legal advisers). The protocols were effectively agreed, despite the Minutes of the PAF Board Meeting, which closed an hour later, containing resolutions to:

- authorise the appointment of Baker McKenzie as Counsel, subject to them not having a conflict, and

- adopt the “Governance Protocol (as provided by PGF) …, subject to Counsel confirming its appropriateness”.

- We acknowledge PGF’s recognition of the need to implement governance protocols and its efforts to do so appropriately. It is unusual for the boards of both acquirer and target to consist only of the same individuals. This, together with the fact that both LICs shared the same manager, made the task unusually difficult, although not impossible in our view. We accept that events may not have occurred as initially intended, and the problems we discuss below may have been inadvertent and unintended.

- In our view, some elements of the PAF Governance Protocol reinforce concerns as to whether it received sufficient independent scrutiny from PAF’s perspective27 and was appropriate to achieve its stated purpose of ensuring that “the PAF Board is able to make all decisions concerning the Proposed Transaction independently of PMC, Paul Moore and PGF”. These elements include:

- Only one PAF director would be available to negotiate the terms of the SID and Proposed Transaction, albeit that he would be assisted by a consultant (Mr McGill) proposed to be appointed as a director “shortly prior to entering the Proposed Transaction”.

- The sole PAF director able to represent PAF (Mr Skilbeck) prior to the appointment of Mr McGill was also the CEO of PMC (and the only person other than Mr Matthews “over the wall” at PMC as at 26 August 2021) as well as the person who had developed the proposal for the Proposed Transaction and put it to the PGF Board.

- The Governance Protocols provided for material changes to the composition of PAF’s Board in general and particularly with respect to its negotiation of a control transaction proposed by PGF. They were only likely to achieve their stated purposes if adopted by both PGF and PAF and if PMC’s CEO and COO accepted the changes in their roles that the protocols contemplated. The Governance Protocols also provided for the separation of the substantial holding of the Moore Group and PMC in PAF from that of PGF by means of the Direction.

- We infer that, by 6 September 2021:

- there was an agreement, arrangement or understanding between PGF, PAF and PMC to progress one or more of:

- the adoption and implementation of the Governance Protocols by PAF and PGF, and PMC permitting Ben Skilbeck and Richard Matthews to act as the Governance Protocols required

- separation of the substantial holding of the Moore Group and PMC in PAF from that of PGF by means of the Direction

- the Proposed Transaction, or

- PGF, PAF and PMC were acting in concert with the common purpose of advancing one or more of paragraphs 64(a)(i), 64(a)(ii) or 64(a)(iii).

- there was an agreement, arrangement or understanding between PGF, PAF and PMC to progress one or more of:

- We infer a consensus and common purpose or relevant agreement to advance one or more of paragraphs 64(a)(i), 64(a)(ii) or 64(a)(iii) based on the matters discussed in paragraphs 53 to 63 above and:

- PMC having been manager of each of PGF and PAF for more than seven years

- the links and common knowledge resulting from the same four individuals comprising the boards and company secretary of each of PGF and PAF and including both the CEO and COO of PMC for some time

- the roles contemplated by the Governance Protocols for the CEO and COO of PMC, and especially the very significant role for PMC’s CEO

- the confirmation by PMC’s CEO on 26 August 2021 to the PGF Board, in the presence of PMC’s COO, that no one else at PMC was “over the wall” (from which we infer that PGF was entitled to assume Mr Skilbeck had authority to bind PMC in relation to matters involving PGF and PAF)

- the speed with which PAF decided, after receiving PGF’s proposal:

- that it should enter into discussions with PGF and

- adopt the PAF Governance Protocol (subject to counsel confirming its appropriateness).

- Given the purposes of Chapters 6 and 6C28 and the circumstances discussed above, we consider that the state of mind of Mr Skilbeck in relation to PAF should be attributed to PMC,29 for the purposes of sections 12, 606 and 671B, in determining whether circumstances are unacceptable. In our view this follows from, among other things, the seniority of his roles at both PAF and PMC and the overlapping significance of both roles for each of PAF and PMC. PMC submitted that Mr Skilbeck (and Mr Matthews) act for PAF and PGF pursuant to an appointment letter with PGF and PAF, and not in their capacities as employees of PMC, and that PMC has “no power to determine whether to permit Mr Skilbeck and Mr Matthews to perform roles and responsibilities pursuant to appointment letters with an unrelated entity”. We accept that PMC may have employed Mr Skilbeck and Mr Matthews on terms that give them almost unlimited discretion in performing their roles at PAF and PGF, but that does not diminish the significance of what they do in those roles for PMC, and only emphasises why attribution is necessary to ensure that the policy of Chapters 6 and 6C is not defeated.30

- PGF submitted that we would be “ignoring settled law which holds that individuals can properly act in different capacities and that their knowledge and actions should not be ascribed to another entity for whom they act in another capacity”. Similarly, PMC submitted that knowledge acquired by a director acting for company A will not be imputed to company B (in which the person is also a director) unless the common director is under a duty to disclose that information to company B.31

- We accept, of course, that directors can properly sit on several boards without knowledge acquired in one capacity being attributed to the other companies where that knowledge is not communicated and the director has no duty to do so. It is a different matter, however, where both boards consist of the same individuals and everything known to one board is in fact known to the other, as was the case for PAF and PGF on 6 September 2021. In Re Rossfield Group Operations Pty Ltd32 Connolly J said:

There may well be situations in which it would not be right to impute to one company the knowledge which one or more of its directors happen to have by reason of his or their dealings with or position on the board of another company. That is not this case. Whether the theory to be applied be the organic theory or that of principal and agent, the result must in my judgment be the same. Both AMH and the respondent have identical boards and knowledge of the affairs of AMH is an essential function of each board. I hold therefore the information was within the knowledge of the respondent offeror.

- In the case of PMC, its CEO Mr Skilbeck was the only director who was also a director of PGF and PAF (in fact, the only executive director of each of PGF and PAF). However, Mr Skilbeck and Mr Matthews appear to be the only persons who had knowledge of what PMC was doing for PGF and PAF, pursuant to the IMA it had with each company, outside of minor administrative functions. We note, for example, that in seeking to refute any relationship of association between the Moore Group and PGF, PAF or PMC in relation to PAF, Mr Moore33 submitted that he:

- had no advance warning, and was not consulted in relation to, or otherwise aware of, PGF’s proposal to issue the Direction or propose the Scheme and

- “as at the date of announcement of the Scheme on 14 September 2021 had not had a single conversation with anyone on the PGF board (other than Mr Skilbeck in his capacity as CEO of PMC) in relation to any matter in over one year”.

- Given the above matters, and in the context of the proposed merger of PGF and PAF, we consider it appropriate to attribute the state of mind of Mr Skilbeck, at least, on those matters to PMC.34

- PMC, PGF and PAF submitted that PMC, Mr Skilbeck and Mr Matthews merely gave advice or acted on behalf of PGF and/or PAF “in the proper performance of the functions attaching to a professional capacity or a business relationship” and were therefore not associates of PGF or PAF due to s16(1)(a). We accept that will often be the case for the manager of an LIC and its employees. In our view, however, given the circumstances here,35 association did not arise “merely because” of the performance of functions attaching to a professional capacity or a business relationship. Rather, it arose from what was done simultaneously in three overlapping capacities/relationships, in which PMC, PGF and PAF had at least some competing interests, in order to pursue a path considered to suit all.

- Accordingly, in our view, the actions of PMC, Mr Skilbeck and Mr Matthews, including those referred to in paragraphs 63 to 65, were not merely because of one or more of the matters in s16, and s16 does not prevent PMC being an associate of PGF or PAF.

Effect of Direction

- PMC submitted that the Direction was a valid and effective direction pursuant to Clause 5.17 of the IMA which:

had the effect of revoking PMC’s ability to control the voting and disposal of PGF’s PAF shares … , a consequence of which resulted in PMC ceasing to have a relevant interest in those shares. As PMC no longer had a relevant interest in those shares, and as PMC is not associated with PGF …, it follows that PMC ceased to have voting power in PAF relating to those shares.

- We do not agree that the Direction was effective to remove the relevant interest of PMC and/or the Moore Group, and reduce their voting power, in PGF’s shares in PAF for various reasons including the contractual interpretation of the IMA and the relationships between PGF, PAF and PMC over several years (which involve structural links, collaborative conduct, common management and directors and a shared goal) indicate that any association between them must be ongoing. These matters are discussed in further detail below.

Interpreting the PGF IMA

- As noted above,36 PMC provided to us and all parties a redacted version of the PGF IMA that included (together with material previously disclosed) all material considered likely to be relevant to the Application by members of the Panel Executive who reviewed the unredacted IMA.

- After reviewing the redacted IMA, WAM submitted, among other things, that:

- Clause 5.17 only allows PGF to give “proper and reasonable directions and instructions” and the Direction could not be considered proper and reasonable, given the breadth of absolute discretion afforded to PMC to manage PGF’s portfolio.

- The Direction can be revoked at any time.

- Without variation of the IMA, PGF’s shareholding in PAF could never be excluded from PMC’s influence, given the IMA’s broad definition of “Portfolio” and PGF’s undertakings that it will:

- “not sell, dispose or part with possession of any of the Investments…” (Clause 7.2.2) and

- “not carry on any business in relation to the Portfolio (including… dealing in the Portfolio or any part of it) other than pursuant to or as contemplated in this Agreement” (Clause 7.2.3).

- If Clause 5.17 operated in the way PGF and PMC suggested, PGF could fundamentally change management of its Portfolio, unilaterally, at odds with the requirement in Clause 23.17 that the IMA only “be altered in writing executed by all Parties”.

- ASIC submitted that, considered in isolation, PGF’s Direction pursuant to Clause 5.17 of the IMA may be sufficient to remove PGF’s PAF shares from the “Portfolio”, although depending on the purpose of the Direction, that may give rise to association. We note however that PGF had previously submitted that its shares in PAF “are still part of the “Portfolio” as that term is used in the IMA” although as a result of the Direction “PMC ceased to have the capacity to dispose of or vote the PGF shares in PAF and there is absolutely no fetter on the ability of PGF do [sic] deal with or vote its PAF shares”. Similarly, PMC had submitted that “PGF’s PAF shares no longer form part of the “Portfolio” for the purposes of PMC’s investment decision-making and voting under the IMA (but do remain part of the “Portfolio” for all other purposes)”.

- ASIC queried whether the Direction would be effective if PGF and PMC did not consider Clause 5.19 of the IMA which provides that “[PGF] cannot give [PMC] instructions that are inconsistent with the investment strategy, including any instruction or directions to acquire or dispose of an investment…”. ASIC also submitted that Clause 5.17 appeared to provide PGF with the ability to recall the Direction at will and reintroduce its PAF shares back into the portfolio managed by PMC.

- PGF submitted that nothing in the additional disclosed terms of the PGF IMA suggested that PGF’s direction under Clause 5.17 (and the subsequent transfer of PGF’s shares in PAF into an issuer sponsored holding in PGF’s name alone) was not effective to revoke any relevant interest of PMC in PGF’s shares in PAF.

- We indicated to parties we were minded to find that it is unlikely the Direction was effective to achieve its purpose as stated in the Governance Protocols of ensuring “neither [PMC] nor Mr Moore will control the buy/sell or voting decisions relating to PGF’s shareholding in PAF”. It may well be that, as a practical matter, only PGF can vote the shares given they are registered in its name. However, it appeared to us there were strong arguments that PMC could be entitled to reverse that, or prevent disposal of the shares, given:

- the breadth of the absolute discretion to manage PGF’s Portfolio conferred on PMC under the IMA

- the language of Clause 5.17, in contrast to that of Clause 5.6, which suggests it was not intended to apply notwithstanding any other provision (but subject to Clauses 5.17 to 5.22)

- Clauses 5.3, 5.6, 5.10, 7.2 and 15.5, which appear to give PMC the right to instruct PGF not to dispose of its shares in PAF and

- the Direction was not given by Authorised Persons of PGF in accordance with Clauses 5.17, 5.21, 15.3 and 23.6 and Schedule 2, which means that PMC was not obliged to take any action in response.

- PMC submitted in response that it does not retain a relevant interest in PGF’s PAF shares under the IMA because:

- Clause 5.17 applies notwithstanding any other provision (even though, unlike Clause 5.6, it does not use those words) since its purpose is obligatory and the words “subject to …” set out the limited exceptions to the strict obligation it imposes.

- The Direction limits and curtails PMC’s right to instruct PGF not to dispose of its shares in PAF under the clauses listed in paragraph 80(c).

- PMC was obliged to comply by reason of the Direction being a proper and reasonable direction given by PGF under clause 5.17 of the IMA. Clause 15 of the IMA does not prescribe the sole method for PGF to give a direction and does not prohibit PMC acting on a direction by PGF where not made by an Authorised Person.

- In our view, PMC’s interpretation of Clause 5.17 gives it an importance that is not supported by its language or context and is inconsistent with the PGF IMA’s emphasis of PMC’s absolute discretion to manage PGF’s portfolio in accordance with the “Investment Strategy”. We note that:

- With respect to PMC’s submission in paragraph 81(a), Clause 5.17 is expressed to be “Subject to Clauses 5.17 to 5.22…”, which provide among other things that PGF:

- cannot require PMC “to act contrary to this Agreement” (Clause 5.18)

- cannot give PMC “any directions or instructions that are inconsistent with the Investment Strategy, including any directions or instructions to acquire or dispose of an Investment…” (Clause 5.19)

- must be promptly notified of any directions or instructions given to PMC by an Authorised Person of PGF which have not been complied with (Clause 5.21)

- is solely responsible for the consequences of PMC acting in accordance with PGF’s directions, which will not be grounds for termination or breach of the IMA, and for which PMC is entitled to an indemnity unless such consequence is a result of its negligence, default, fraud or dishonesty (Clause 5.22).

- With respect to PMC’s submission in paragraph 81(b), Clause 5.3 provides that, within the Applicable Regulations and subject to Clauses 5.1, 5.2, and 5.6 to 5.10, PMC “has the absolute discretion to manage the Portfolio and do all things necessary or desirable in relation to the Portfolio…”. Clause 5.6 provides that “Notwithstanding any other provision of this Agreement but subject to Clause 5.10, [PMC] may only manage the Portfolio in accordance with the Investment Strategy.” Clauses 5.7 to 5.9 allow PMC to seek approval from PGF (which PGF may withhold in its absolute discretion) to undertake an investment not consistent with the Investment Strategy or amend it. Clause 5.10 provides that if by reason of specified matters the Portfolio ceases to comply with the Investment Strategy or any directions or instructions from PGF,37 PMC must use its best reasonable endeavours to remedy the non-compliance within a reasonable period or such longer period as PGF allows. If remedied within that time, the non-compliance is not a breach of the IMA and does not give rise to any right or remedy for PGF.

- With respect to PMC’s submission in paragraph 81(c), the Direction was signed only by Mr Matthews, as PGF Company Secretary, apparently under Clause 23.8, rather than under Clause 23.6 which applies when a notice is required to be “given or served upon a Party pursuant to this Agreement” (see Clauses 15 and 23.6 and the heading of Schedule 2). Under Clause 15.3, PMC must accept written instructions (unless it reasonably believes they will cause a breach of Applicable Regulations) made by Authorised Persons of PGF and is not obliged to take action if instructions are not made by an Authorised Person. PGF’s Authorised Persons are specified in Schedule 2 Clause 1, which was amended under Clause 23.17 on or about November 2013 by Amending Deed No. 1, adding in relation to PGF’s Authorised Persons: “Two persons to sign, with at least one of those persons being an Independent Director.” Previously, one Authorised Person could give notice for PGF. This amendment appears to have been intended to ensure that a notice (such as a direction or instruction under Clauses 5.17 and 15.3) would be signed by an Independent Director of PGF and not signed only on PGF’s behalf by an executive employed by PMC.

- With respect to PMC’s submission in paragraph 81(a), Clause 5.17 is expressed to be “Subject to Clauses 5.17 to 5.22…”, which provide among other things that PGF:

- PMC submitted that, as the counterparty to the PGF IMA, it is not relevant that others have differing views as to the proper construction or interpretation of the IMA in circumstances where PMC considers the Direction validly given, and that it no longer has control over the power to vote or dispose of PGF’s PAF shares.

- PGF similarly submitted that “it is irrelevant to enquire into how the terms of the IMA might be construed to suggest that perhaps PMC might be argued to retain some form of power or control over [PGF’s PAF shares]”.

Effect of the Direction and IMA in the context of this matter

- We do not agree that it is irrelevant to enquire whether the Direction has the effect claimed by PGF and PMC under the PGF IMA. We accept that purely hypothetical possibilities are unlikely to give rise to unacceptable circumstances. In the unusual circumstances of this matter, however, we are not satisfied that recall of, or departure from, the Direction is purely hypothetical. The overlap in roles between PGF, PMC and PAF has been extensive over a long period of time and the small number of individuals holding those roles is likely to have created strong relationships, common knowledge and shared views. Given that, and the factors we find gave rise to association,38 we consider that the Direction will not necessarily be effective, even if the parties currently agree on its operation under the PGF IMA.

Effect on relevant interests

- Furthermore, in our view, given the breadth of the absolute discretion to manage PGF’s portfolio conferred on PMC under the PGF IMA,39 it is unlikely that the Direction was effective to remove any relevant interest of PMC and/or the Moore Group in PGF’s shares in PAF (even if as a practical matter only PGF can vote its shares in PAF).

- We do not accept, as PGF submitted, that any relevant interest in PAF shares conferred by the PGF IMA would be purely hypothetical or theoretical. In our view, it could become relevant if, for example, PMC and PGF have differing views as to whether the shares should be accepted into WAM’s bid due to an increase in the consideration offered, or if it appears unlikely PAF shareholders will approve the Proposed Transaction. We are not suggesting that either party is likely to seek to enforce the PGF IMA, but in our view it is not impossible that uncertainty as to the PGF IMA’s legal effect could confer informal power capable of affecting the outcome.

- In these circumstances, the market should be able to assess any uncertainty as to the PGF IMA’s legal effect. We consider that PGF and PMC did not give the market the information it required to do so or the documents required by s671B(4).

Effect on association

- Even if the Direction was effective to remove any relevant interest of PMC and/or the Moore Group in PGF’s shares in PAF, we consider that it was not effective to end the associations referred to in paragraphs 64 to 65. In part, that is because:

- giving the Direction was an aim of the relevant agreement or common purpose referred to in paragraphs 64 to 65 and

- the Governance Protocols and Direction appear to be part of a broader relevant agreement or common purpose of advancing the Proposed Transaction, which has not yet been completed.

- In our view, having regard to the relationships between PGF, PAF and PMC over several years, structural links, prior collaborative conduct, common management, common directors, common knowledge of relevant facts and a shared goal or purpose, it is unlikely that the Direction could terminate the associations described above. It is even more unlikely it could do so at the precise time at which PGF and PAF agreed binding terms for the Proposed Transaction.

Contravention of s671B

- The notices given by PMC and the Moore Group to PAF of change of interests of substantial holder between 15 September 2021 and 15 October 202140 indicate that all entities have the same voting power, but list relevant interests in differing numbers of shares for some entities. That suggests either that all entities have the same relevant interests or all entities have the same voting power because they are associates (even though the notices do not name any associates). We consider that the notices contravene s671B(1) because they do not give all the information referred to in s671B(3).

- Given the associations referred to in paragraphs 58 to 65, we consider that the notices given by PGF, PMC and the Moore Group to PAF of change of interests of substantial holder between 15 September 2021 and 15 October 202141 contravene s671B(1) and:

- do not give the names of their associates who have relevant interests in PAF shares together with the details required by s671B(3) and

- are not accompanied by copies of documents (and/or any statement under s671B(4)(b)) as required by s671B(4).

- In the alternative, it was inconsistent with s602(a) and (b) for PGF, PMC, Mr Skilbeck, Mr Matthews and the Moore Group to treat the Direction as effective to divide the voting power PGF, PMC and the Moore Group had previously disclosed in their substantial holder notices, given:

- the notices of PGF, PMC and the Moore Group for over 7 years encouraged the market to conclude that they shared the same voting power because they were associates by failing to explain how the substantial holding and voting power of PGF and PMC could otherwise differ from their disclosed relevant interests in PAF shares

- the structural and contractual links between PGF, PMC and the Moore Group, prior collaborative conduct, common investments, common knowledge of relevant facts and a shared goal or purpose

- the Direction was not disclosed to the market until 1 October 2021

- PGF, PMC and the Moore Group have not provided sufficient information for the market to determine whether, or how, the Direction would be effective to divide their substantial holding.

Contravention of s606(1)

- The voting power of PGF, PMC and the Moore Group in PAF on 14 September 2021 was approximately 28.47% and an acquisition of relevant interests in PAF shares would increase voting power from a starting point that is above 20% and below 90%, resulting in a contravention of s606(1) unless an exception in s611 applied. The only relevant exception appears to be item 9 of s611 which would cease to apply once the voting power of any person resulting from an acquisition would be more than 3% higher than 6 months previously.

- The voting power of PGF, PMC and the Moore Group in PAF was approximately 26.8582% on 28 March 2021 and increased above 29.8582% (the level permitted by item 9 of s611) six months later on 28 September 2021. Accordingly, the shares acquired by members of the Moore Group between 28 September 2021 and 12 October 2021, amounting to approximately 3.1891%, were acquired in contravention of s606(1).

Break Fee

- At the time the Break Fee was negotiated,

- the same individuals comprised boards of both PGF and PAF

- the Governance Protocols had only been partly implemented (although Mr McGill was assisting PAF as a consultant and it was proposed that he be appointed as a director shortly prior to entering the Proposed Transaction) and

- the Governance Protocols raised concerns due to the matters described in paragraphs 58 to 63.

- The quantum of the Break Fee does not concern us, but in the unusual circumstances of this matter, we consider that the process by which it was negotiated and agreed gave rise to serious concerns. Nevertheless, given that the Break Fee is less than 1% of the equity value of the target42, and was reduced by PAF after discussion with its legal advisers, we are not satisfied that the Break Fee, of itself, gave rise to unacceptable circumstances.

Proposed PAF Scheme

- PGF submitted that in making our proposed declaration of unacceptable circumstances, we would act contrary to our mandate in, among other things:

implicitly criticising the Federal Court of Australia’s oversight of the [Scheme] – in the face of Mr Justice Beach’s order that the [Scheme] meeting be convened with the disclosure documents before the Court, and the Court having considered the effect of the Direction, the Panel considers instead that “the holders of shares in PAF have not been given enough information to enable them to assess the merits of the Proposed Transaction and how it may be affected by the Direction”

- We wish to make it very clear that we do not intend any such criticism, implied or otherwise, or consider that any is suggested by our findings or our declaration. The words quoted by PGF above merely apply the words of s602(b)(iii) to the “Proposed Transaction”, which is defined as “the proposed merger between PGF and PAF considered by the PGF Board on 6 September 2021 and announced on 15 September 2021”. We make no comment on the disclosure documents later put before the Court. We note also that the Court’s reasons began by outlining the well-known principles governing the limited role of the Court at the first stage of a scheme of arrangement procedure.43 We understand that the Court “considered the effect of the Direction” in accordance with those principles and its relevance to the proposed Scheme. As the Court makes clear in several places in its reasons,44 the issues we have been asked to consider are quite distinct.

- Noting the issues the Panel has been asked to consider, ASIC submitted that if the Panel found an association which was not disclosed to shareholders, it was open for us to find that PAF shareholders have not been given sufficient information to enable them to assess the merits of the Proposed Transaction. It submitted that the “fact that the Court convened a scheme meeting is not determinative of the issue. It remains open to Beach J. to take into account these matters in deciding whether to make an order at the second court hearing”. ASIC further submitted that whilst it did not dispute that the Court has jurisdiction with respect to the scheme, “it is important that the parties do not conflate the existence of the scheme as precluding the Panel from finding unacceptable circumstances or making appropriate orders to remedy those”.

Media canvassing

- PAF and PMC submitted that it appeared WAM had breached the Panel’s media canvassing rule, pointing to an article published in the AFR on 19 October 2021 which attributed statements to Mr Geoff Wilson. We expressed concern that these statements may have contravened Procedural Rule 19 and indicated we would consider making an interim order in response to similar future public statements.

Decision

Declaration

- It appears to us that the circumstances are unacceptable:

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- the control, or potential control, of PAF or

- the acquisition, or proposed acquisition, by a person of a substantial interest in PAF

- in the alternative, having regard to the purposes of Chapter 6 set out in section 602 of the Act

- in the further alternative, because they constituted, constitute, will constitute or are likely to constitute a contravention of a provision of Chapter 6 or of Chapter 6C of the Act.

- having regard to the effect that the Panel is satisfied they have had, are having, will have or are likely to have on:

- Accordingly, we made the declaration set out in Annexure A and consider that it is not against the public interest to do so. We had regard to the matters in s657A(3).

Orders

- Following the declaration, we made the final orders set out in Annexure B. We were not asked to, and did not, make any costs orders. Under s657D the Panel’s power to make orders is very wide. The Panel is empowered to make ‘any order’45 if 4 tests are met:

- it has made a declaration under s657A. This was done on 3 December 2021.

- it must not make an order if it is satisfied that the order would unfairly prejudice any person. For the reasons below, we are satisfied that our orders do not unfairly prejudice any person.

- it gives any person to whom the proposed order would be directed, the parties and ASIC an opportunity to make submissions. This was done on 29 November 2021. Each party made submissions.

- it considers the orders appropriate to either protect the rights and interests of persons affected by the unacceptable circumstances, or any other rights or interests of those persons, or ensure that a takeover or proposed takeover proceeds as it would have if the circumstances had not occurred. We are satisfied, for the reasons below, that the orders do this by:

- requiring PGF, PMC and the Moore Group to give a corrected substantial holder notice, accompanied by a copy of the IMA (redacted to no greater extent than that provided to the Panel)

- preventing the Moore Group and their associates voting, acquiring or disposing of the 3.19% of PAF shares acquired by the Moore Group in excess of the amount permitted by the 3% creep rule (Excess Shares) and

- if the Proposed Merger does not become effective (by 21 January or such later date as the Court or the Panel approves), vesting the Excess Shares in ASIC for sale.

- On 29 November 2021, we provided draft orders to the parties and ASIC. These draft orders differed from the final orders primarily in:

- requiring corrected substantial holder notices “accompanied by all documents required by s671B(4)” (potentially requiring disclosure of the unredacted IMA)

- vesting the Excess Shares in ASIC for sale within 3 business days and

- providing that the Excess Shares are taken to be sold under (b) if transferred under a scheme of arrangement or accepted into an unconditional takeover bid where the bidder has voting power above 50% (which ASIC was required to do).

Corrected substantial holder notices

- WAM and ASIC submitted that we should make orders requiring corrected substantial holder notices. ASIC submitted that we should require disclosure of the unredacted PGF IMA given “significant differences between PGF, PMC, and WAM’s interpretation of the operation of the redacted IMA”.

- PGF submitted that we should not require corrected substantial holder notices and PGF and PAF submitted that requiring disclosure of the IMA would have little utility.

- The Moore Group submitted, on the basis of our proposed findings (which they do not accept) that it would be appropriate for them to correct their voting power arising under s608(3), but objected to any requirement to disclose an association with PGF since we have not made a finding of such association.

- In our view, requiring disclosure of the IMA redacted to no greater extent than the version provided to us sufficiently protects the rights or interests of PAF shareholders and market participants.

Excess Shares - restricting voting, acquisition and disposal, and/or vesting in ASIC for sale

- ASIC submitted that:

- The Excess Shares should not be voted, including at the Scheme meeting, and “tagging” of the shares would not achieve the same objective. It is not appropriate to require ASIC to vote vested shares in favour of a scheme and it would be more appropriate for no action to be taken in relation to the Scheme.

- If the orders require Excess Shares to be transferred under a scheme or accepted into a bid by a particular date, an order preventing voting or dealing with the shares would have the same effect as a vesting order, and would reduce costs incurred by the Vendors.

- WAM agreed with ASIC that tagging the Excess Shares was not sufficient and submitted that we should make orders vesting the Excess Shares.

- PGF submitted that it was not appropriate to make the vesting order as the Moore Group’s acquisition of the Excess Shares had not had a material impact on the WAM bid or the Scheme. PGF also submitted, among other things, that the order:

- was punitive and would create an overhang depressing the PAF share price and adversely affect PAF shareholders

- would force the Vendors to accept shares as consideration (if the WAM bid was accepted) contrary to s231 and

- should require ASIC to vote the Excess Shares in favour of the Scheme, if that remains the recommendation of the PAF board supported by the independent expert.

- The Moore Group submitted that they have no culpability in relation to the asserted contraventions of s606 and s671B and we must take that into account in determining whether orders that adversely affect members of the Moore Group are reasonable and appropriate. The Moore Group submitted, among other things, that:

- The proposed vesting orders would have no bearing on whether the WAM bid proceeds as it would have, since the WAM bid is unconditional. Consequently, remedial orders should be limited to those considered necessary to protect the rights or interests of persons affected by the unacceptable circumstances.

- The proposed vesting order would prejudice members of the Moore Group, go beyond what is proportional and necessary to protect rights or interests of persons affected, and do nothing more than punish the Moore Group.

- A “far more suitable and less prejudicial order is available … to mitigate any potential control effects”, namely, an order restricting voting of the Excess Shares other than to the extent those shares would be permitted to be acquired (and voted) under the “creep” rule in item 9 of s611.

- If we are minded not to permit the Moore Group to retain the Excess Shares, any vesting orders should be conditional on the Scheme not becoming effective within 20 days of the Scheme meeting.

- We agree that our orders should be remedial, not punitive. They must be orders we think appropriate to address the effects of the unacceptable circumstances in accordance with s657D(2)(a) or (b). We consider there is potential for the manner in which the Excess Shares are voted to affect and even determine whether or not the Scheme is approved under s411(4)(a)(ii). If so, we consider that (and the acquisition of Excess Shares that enable it) would adversely affect the rights or interests of PAF shareholders who wanted the opposite result. In our view, the most appropriate way to protect those rights or interests is to prevent voting of the Excess Shares. We do not think it appropriate to require ASIC to vote the Excess Shares in favour of the Scheme. We consider that preventing voting of the Excess Shares will minimise the effect of the unacceptable circumstances on the rights or interests of PAF shareholders.

- In addition to being appropriate under s657D(2)(a), we think an order preventing voting of the Excess Shares is appropriate under s657D(2)(b) to ensure that the WAM bid proceeds (as far as possible)46 as it would have had the Excess Shares not been acquired. We do not agree with the Moore Group’s submission that given the WAM bid is unconditional, our orders will have no bearing on how it proceeds. The WAM bid will not continue to receive acceptances if the Scheme becomes effective, but it may otherwise. To the extent that our orders reduce the likelihood of the acquisition and voting of Excess Shares affecting whether the Scheme is approved under s411(4)(a)(ii), we consider that they also ensure that the WAM bid proceeds (as far as possible) in a way that it would have proceeded if the Excess Shares had not been acquired.

Unfair prejudice

- We must not make any of the orders discussed above if satisfied that it would unfairly prejudice any person.

- PMC submitted that the IMA is commercially sensitive and requiring its disclosure would be unfairly prejudicial to PMC. Given the process adopted regarding the IMA, we are not in a position to assess the commercial sensitivity of redacted provisions. We are satisfied, however, that Order 1 requiring disclosure of the IMA redacted to no greater extent than the version provided to us is not unfairly prejudicial to PMC or any person.

- We are also satisfied that Order 1 is not unfairly prejudicial to those it requires to give corrected substantial holder notices. In our view, any prejudice to them is not unfair, given our findings of contraventions of s671B.

- We accept that Orders 2 to 4 restricting voting, acquisition and disposal of the Excess Shares, and Orders 5 to 9 vesting the Excess Shares in ASIC for sale, may be prejudicial, especially to members of the Moore Group. However, we are not satisfied that those orders unfairly prejudice members of the Moore Group or any person. We agree that our decision does not establish that members of the Moore Group are necessarily “culpable” for the contraventions we have found of s671B and s606. We have not found it necessary, or desirable given the urgency of the matter, to reach a view on that. However, we find that they participated and were sufficiently involved in the circumstances.47 That is enough to satisfy us that the prejudice to them, when weighed against the objective of protecting rights and interests as described above, is not unfair. The Moore Group’s involvement in the circumstances included the fact that they were aware of the Direction,48 had previously given combined substantial holder notices with PGF for over 7 years,49 and should have been aware that any acquisitions would need to fall within an exception to s606(1) if the Direction was not effective to separate their voting power from that of PGF. We note that Mr Moore (as Chairman of PMC) responded on 4 October 2021 to a letter from WAM dated 30 September 2021 raising queries regarding the Direction and PMC’s Form 604 dated 15 September 2021. Mr Moore indicated in his submissions that it was “his decision as the ultimate controller of the [Moore Group] to acquire further shares in PAF following the termination of the discretionary mandate” by means of the Direction.

- We altered our draft orders to make them less prejudicial by adopting submissions of the Moore Group50 and ASIC51 and providing that the Excess Shares are only vested if the Scheme will not become effective within a specified period (which can be extended). We are satisfied that Orders 2 to 12 are not unfairly prejudicial to the Moore Group or any person.

Other disclosure orders

- We asked parties whether we should consider any other disclosure orders.

- ASIC submitted that it expected that PAF would, in the ordinary course of its obligations to the Court, bring all relevant matters including any declaration or orders we make to the Court’s attention, subject to PAF’s confidentiality obligations. PAF responded by undertaking to promptly provide the Court with a copy of all public information issued by the Panel (including any declaration and orders and reasons for decision). We accepted PAF’s undertaking.

- PAF noted that all such public information issued by the Panel would appear on ASX and that it did not think either the Panel or the Court would need to make any additional disclosure orders. Given that, we do not consider that any other disclosure orders are appropriate.

Paula Dwyer

President of the sitting Panel

Decision dated 3 December 2021

Reasons given to parties 17 December 2021

Reasons published 5 January 2022

Advisers

| Party | Advisers |

|---|---|

| Moore Group | MinterEllison |

| PM Capital Asian Opportunities Fund Ltd | Baker McKenzie |

| PM Capital Global Opportunities Fund Ltd | Johnson Winter & Slattery |

| PM Capital Ltd | DLA Piper Australia |

| WAM Capital Limited | Mills Oakley |

Annexure A

CORPORATIONS ACT

SECTION 657A

DECLARATION OF UNACCEPTABLE CIRCUMSTANCES

PM CAPITAL ASIAN OPPORTUNITIES FUND LIMITED 01

Definitions

- In this Declaration, the following definitions apply.

- Break Fee

- The break fee in clause 11 of the SID

- Direction

- The instruction given by PGF to PMC pursuant to Clause 5.17 of the PGF IMA on 14 September 2021 described in paragraph 14

- Governance Protocols

- The PAF Governance Protocol and the PGF Governance Protocol

- IMA

- Investment Management Agreement

- IMA Extract

- The extract from the PGF IMA attached to the notice of change of interests of substantial holder given by PGF to PAF on 1 October 2021

- LIC

- Listed Investment Company

- Moore Group

- Mr Paul Moore and all entities, other than PMC and PGF, named as substantial holders in the notice given to PAF by Mr Moore on 7 June 2021