[2022] ATP 21

Catchwords:

Decline to conduct proceedings – association – evidence – statutory declarations – tracing notices

Corporations Act 2001 (Cth), sections 12, 249D, 606, 657A, 671B, 672A

Dragon Mining Limited [2014] ATP 5, Mount Gibson Iron Limited [2008] ATP 4

| Interim order | IO undertaking | Conduct | Declaration | Final order | Undertaking |

|---|---|---|---|---|---|

| NO | NO | NO | NO | NO | NO |

Introduction

- The Panel, Bruce Cowley, Chelsey Drake and Richard Hunt (sitting President), declined to conduct proceedings on an application concerning an alleged association among a group of shareholders of Firetail Resources Limited, including shareholders who had provided notices under s203D and s249D, resulting in contraventions of s606 and the substantial holding provisions. The Panel considered that it was not provided with a sufficient body of material to justify the Panel making further enquiries in relation to the alleged association and accordingly, there was no reasonable prospect that it would declare the circumstances unacceptable.

- In these reasons, the following definitions apply.

- Alleged Associates

- Japan & China Holdings, Moray, HongKong Jayson Mining, Justin Haines, Warwick Smyth, certain other individuals with registered addresses in Hong Kong and the Peoples Republic of China and the beneficial owner of the shares held by Citicorp

- Citicorp

- Citicorp Nominees Pty Limited

- HongKong Jayson Mining

- HongKong Jayson Mining Co Ltd

- Japan & China Holdings

- Japan & China Holdings Australia Pty Ltd

- Moray

- Moray Holdings (QLD) Pty Ltd

- Super Cruser vendors

- has the meaning given in paragraph 18(f)

Facts

- Firetail Resources Limited is an ASX listed company (ASX code: FTL). Firetail was admitted to the official list of ASX on 11 April 2022.

- Firetail received notices under s203D and s249D, dated 18 July 2022, signed by Japan & China Holdings and Moray who collectively hold approximately 8.19% in Firetail requiring Firetail to convene a general meeting to consider resolutions to replace two of the four Firetail directors, Stephen Brockhurst and Frank Bierlein, and appoint Warwick Grigor as a director.

- On 19 July 2022, the following ASIC Forms were announced on the ASX market announcements platform for Firetail:

- an ASIC Form 604 Notice of change of interests of substantial holder stating that the relevant interest of Moray had increased from 6,000,000 shares (7.79%) to 6,305,000 shares (8.18%) because of Moray being a co-requisitioner with Japan & China Holdings. The Form 604 was signed by Paul Byrne in his capacity as a director of Moray, and

- an ASIC Form 603 Notice of initial substantial holder stating that the relevant interest of Japan & China Holdings was 6,305,000 shares (8.19%) because of Japan & China Holdings and Moray being co-requisitioners. The Form 603 was signed by Barry Shan Yin in his capacity as a director of Japan & China Holdings.

- As at 25 July 2022, the top 30 shareholders of Firetail included:

- HongKong Jayson Mining holding 10.39% of the Firetail shares

- Citicorp holding 7.84% of the Firetail shares1 and

- Moray holding 7.79% of the Firetail shares.

- On 5 August 2022, Firetail called a general meeting to be held on 16 September 2022 to consider the resolutions the subject of the s249D notice.

Application

Declaration sought

- By application dated 27 July 2022, Firetail sought a declaration of unacceptable circumstances. Firetail submitted, among other things, that:

- the Alleged Associates “understood to hold an aggregate voting power of approximately 40%..., appear to be acting in concert for the purposes of influencing the composition of the board of Firetail”

- as a result of the association, there had been an acquisition of a relevant interest in excess of 20% in contravention of s606(1)(c) and

- each of the Alleged Associates had failed to disclose their aggregate voting power as a result of the association in contravention of s671B.

- Firetail also disclosed that it had issued a tracing notice under s672A to Citicorp in order to identify the name of each person who has a relevant interest in the shares held by Citicorp. The response received by Firetail on 22 July 2022 disclosed that 5,612,464 of these shares (representing 7.29% of Firetail) are held by “CBHK - PHILLIP SEC HK LTD-CLI MR”, with an address in Hong Kong. No substantial holding disclosure had been made in relation to this holding.

- Firetail had also issued a tracing notice to BNP Paribas which is the registered holder of 3,649,523 shares (representing 4.74% of Firetail). On 26 July 2022, Firetail received a response disclosing the beneficial owner as another nominee account and issued a further tracing notice seeking further details.

- Firetail submitted that the effect of the circumstances was unacceptable under:

- “section 657A(2)(a), because of the effect of the conduct on the control of Firetail;

- section 657A(2)(b), having regard to the purposes of Chapter 6 of the Corporations Act set out in section 602, as the acquisition of control over the voting shares in Firetail has not occurred in an efficient, competitive and informed market; and

- section 657A(2)(c), because the conduct has contravened sections 606 and 671B”.

Interim orders sought

- Firetail sought interim orders that:

- Japan & China Holdings and Moray withdraw the s203D and s249D notices

- the Alleged Associates “and their respective associates must not provide a notice of intention to move a resolution to remove a director of Firetail, requisition or call a general meeting of Firetail to consider resolutions for the removal or appointment of a director, or otherwise nominate for appointment a director to the Firetail board”

- the Alleged Associates “and their respective associates must not exercise, or allow the exercise of, and Firetail must disregard, their voting rights in shares in Firetail in respect of any resolution for the appointment or removal of a director of Firetail” and

- the Alleged Associates and their respective associates be restrained from acquiring any further securities in Firetail until further order.

Final orders sought

- Firetail sought final orders in the nature of:

- disclosure orders

- divestment orders

- board requisition orders

- voting restriction orders and

- acquisition restriction orders.

Discussion

- We have considered all the material, but address specifically only those things that we consider necessary to explain our reasoning.

- The Panel’s starting point in an association matter is that it is for the applicant to demonstrate a sufficient body of evidence of association and to convince the Panel as to that association, albeit with proper inferences being drawn.2

- This test was discussed in Dragon Mining Limited [2014] ATP 5 at [59]-[60] (excluding footnotes):

We are conscious of the risk that some people may read this decision as signalling a raising of the ‘association hurdle’. This is not our intention. Our decision in this matter was based purely on the evidence that was submitted to us.

Dromana Estate Limited 01R acknowledges the difficulties that an applicant faces in gathering evidence in association matters. In deciding whether to conduct proceedings on an association case, this must be kept in mind. However, the Panel has limited investigatory powers which means, before we decide to conduct proceedings, an applicant must do more than make allegations of association and rely on us to substantiate them. An applicant must persuade us by the evidence it adduces that we should conduct proceedings.

Submissions in the application

- Firetail submitted that:

- an inference can be drawn that shareholders holding approximately 40% of the Firetail shares (being the Alleged Associates) are acting in concert for the purposes of influencing the composition of the board of Firetail and

- an inference is properly drawn from the content and timing of communications from:

- Mr Grigor, the proposed director nominated by Japan & China Holdings and Moray

- Mr Yin, a director of Japan & China Holding and

- Mr Byrne, the sole director of Moray.

- In summary, Firetail submitted that these inferences can be drawn as a result of:

- an email from Mr Grigor to Firetail’s Chairperson, Brett Grosvenor (refer to paragraph 22) and an earlier call from Mr Grigor to Firetail’s former Chairperson

- the fact that Mr Yin was and remains a key contact person who facilitated the cornerstone investment by HongKong Jayson Mining during Firetail’s initial public offering. All correspondence with HongKong Jayson Mining since Firetail’s listing on the ASX occurs through Mr Yin

- Mr Yin previously proposing the director of HongKong Jayson Mining as the nominee director under a threatened requisition

- the fact that the Citicorp shareholder has been acquiring shares since Firetail’s initial public offering and another shareholder informed Firetail that Mr Yin told him that Mr Yin and his family had been building a position in Firetail since the IPO. Firetail submitted that because the Citicorp shareholder has a HongKong address, an inference can be drawn that this shareholder is Mr Yin’s family

- in respect to certain top 30 shareholders, the fact that:

- each has a registered address (or in the case of one corporate shareholder, the places of birth of its directors are) in Hong Kong,

- Mr Yin’s business is introducing investors based in China to Firetail and

- the representations by Mr Yin and Mr Grigor (on behalf of Mr Yin) to the effect that Mr Yin controls approximately 40%

- Moray being the nominee of the vendors of an asset previously acquired by Firetail, those vendors being Paul Byrne, Justin Haines and Warwick Smyth (the Super Cruser vendors). Among other requests, shortly before the requisition, Mr Byrne requested that Mr Smyth be appointed as a non-executive director of Firetail “as a representative for our Super Cruser shareholdings”.

- Firetail submitted that the two groups – the shareholders represented by Mr Yin and the Super Cruser vendors – associated themselves through the cooperation between Mr Yin and Mr Byrne, with Japan & China Holdings (by Mr Yin) and Moray (by Mr Byrne) each signing the requisition notices and stating in their respective substantial holder notices dated 18 July 2022 that they are associates.

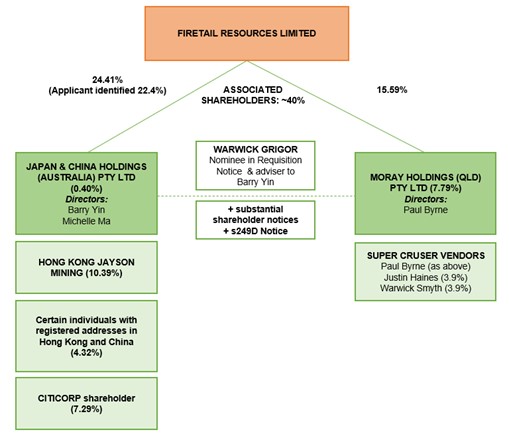

- A diagram setting out the relevant persons and associations comprising the Alleged Associates as submitted by Firetail is as follows:

Preliminary Submissions

- Japan & China Holdings and Moray provided preliminary submissions that, amongst others:

- “there is no association between [them] and the persons described as the [Alleged Associates] (or any other shareholder) (an [sic] nor do [they] and the persons described as the [Alleged Associates] hold a relevant interest in each other’s shares)”

- “there being no evidence presented by [Firetail] of an association or conspiracy amongst [them] and the persons described as the [Alleged Associates] to effect a control transaction”

- they consider that the application was made to “frustrate a lawful statutory process to determine the composition of the board of [Firetail] rather than because of genuinely held concerns that the Requisitioning Shareholders are conspiring to effect a control transaction which is not in accordance with Chapter 6 of the Corporations Act” and

- in light of the foregoing, the Panel should decline to conduct proceedings.

Additional Queries

- Following review of the application and the preliminary submissions, we were concerned with the following:

- an email from Mr Grigor to Mr Grosvenor in which Mr Grigor told Mr Grosvenor that he had been contacted by Firetail shareholders for corporate advice and stated that:

- he had “been approached by shareholders in Firetail Resources Limited regarding the substantial shareholdings they have made in that Company” who were “deeply concerned that they have been refused board representation, amongst other things”

- a “shareholder group working with Mr Yin accounts for something in the order of 40% of the company’s voting shares in Firetail. That includes shares associated with Paul Byrne, one of the vendors of projects to the Company” and

- “Mr Yin et al” require changes to the Board composition.

- emails from Mr Yin to Mr Grosvenor where he stated:

- “on behalf of my shareholders regarding your board’s poor performance”, “[o]ur people keep supporting FTL share price from 40c to 25c since April…” and throughout the correspondence used the word “we” and

- “All my shareholders worry about is FTL share price 0.205???”

- an email from Mr Grigor to Mr Grosvenor in which Mr Grigor told Mr Grosvenor that he had been contacted by Firetail shareholders for corporate advice and stated that:

- We were also concerned with the lack of transparency of the beneficial owners of the Firetail shares held by Citicorp and BNP Paribas. It is reasonable for a company to understand its register, particularly before a requisitioned meeting.

- On 9 August 2022, we requested:

- Mr Grigor to provide further details of the shareholders he was referring to in his emails to Mr Grosvenor in paragraph 22

- Mr Yin to provide further details of the shareholders he was referring to in his emails to Mr Grosvenor in paragraph 22

- Mr Yin to confirm if he, his family or any of his associates have any direct or indirect interest, beneficial interest, relevant interest or voting power in any of the shares held by Citicorp or BNP Paribas and

- Firetail to provide any details of any further requests and responses to the tracing notice requests since the date of the application.

- We directed that Mr Grigor and Mr Yin provide direct statements when answering these questions, preferably in the form of a statutory declaration.

- On 10 August 2022, Firetail advised that it had not issued any further tracing notices and the only additional information it had received was confirmation from BNP Paribas that they had no further beneficial owner details. Firetail also submitted that certain shareholders had acquired or transferred their Firetail shares since the date of the application, including HongKong Jayson Mining who had transferred 100% of its shareholding to Citicorp.

- On 11 August 2022, Mr Yin provided a statutory declaration in which he declared that:

- in his emails to Mr Grosvenor, he was referring to Japan & China Holdings and 6 other shareholders based in New South Wales and Queensland who together hold approximately 3.5% of the Firetail shares and

- “myself, my family or any of my associates do not have any direct or indirect interest, beneficial interest, relevant interest or voting power in any of the shares held by BNP Paribas or Citicorp Nominees”.

- On 11 August 2022, Mr Grigor provided a statutory declaration in which he declared that:

- in his emails to Mr Grosvenor, he was referring to Mr Yin and Japan & China Holdings and Mr Byrne and Moray and

- “I asked Mr Yin in general discussion what level of votes he could count on in the event of an Extraordinary General Meeting of Firetail being held. Mr Yin suggested 30-40%, but gave no details to me when we spoke. I did not regard that number as anything more than aspirational. I sent my email with reference to these numbers as a negotiating tactic in order that Mr Grosvenor take the request seriously. I have no evidence or proof of what the actual numbers may be”.

Association?

- We consider Firetail’s application to be well constructed, identified the issues clearly for us to consider and provided underlying materials for statements on which they relied. Nevertheless, we do not consider that Firetail provided sufficient probative material to justify us making further enquiries in relation to the alleged association.

- In relation to the inferences we were asked to make, we consider:

- Firetail’s submission that shareholders with connections to Hong Kong are members of the 40% shareholder group because Mr Yin’s business was to introduce investors based in China to Firetail as tenuous at best

- there is no material at this stage to connect the Citicorp holding to Mr Yin or the requisition generally

- there was insufficient evidence that the requisitioners were acting in concert with HongKong Jayson Mining or the Super Cruser vendors (other than Mr Byrne) and

- while it is not unreasonable for Firetail to take seriously a statement by a director nominee of the existence of a 40% voting block, without more, Mr Grigor’s explanation for his statement is equally probable.

Tracing notices

- The Panel takes compliance with the tracing notice provisions seriously. We are concerned with the lack of transparency in the responses to the tracing notices of Firetail thus far, in particular the unidentified substantial beneficial owner of the shares held by Citicorp ahead of the s249D meeting. Firetail can use the tracing notice provisions to continue to make further enquiries based on the information it has received to date or seek ASIC assistance in these matters. If the identity of these holders remains unknown after the tracing notice enquiries are exhausted, Firetail or ASIC could consider a further application to the Panel at that time. We cannot justify delaying proceedings while these further enquiries are made.

Decision

- For the reasons above, we do not consider that there is any reasonable prospect that we would make a declaration of unacceptable circumstances. Accordingly, we have decided not to conduct proceedings in relation to the application under regulation 20 of the Australian Securities and Investments Commission Regulations 2001 (Cth).

Orders

- Given that we have decided not to conduct proceedings, we do not (and do not need to) consider whether to make any interim or final orders.

Richard Hunt

President of the sitting Panel

Decision dated 16 August 2022

Reasons given to parties 29 August 2022

Reasons published 31 August 2022

Advisers

| Party | Advisers |

|---|---|

| Firetail Resources Limited | Hamilton Locke |

| Japan & China Holdings | HopgoodGanim Lawyers |

| Moray Holdings (QLD) Pty Ltd | HopgoodGanim Lawyers |

| Warwick Smyth ATF the Smyth Discretionary Trust | - |

| Justin Brent Haines ATF Haines Family Trust | - |

1 Note that this is the total number of shares held by Citicorp. The unidentified Citicorp beneficial shareholder mentioned in these reasons (refer to paragraph 9) holds 7.29%.

2 Mount Gibson Iron Limited [2008] ATP 4 at [15]